PRO Market Keys Of The Week: 5/8/2023

Large mining pools have consolidated after Poolin suspended withdrawals last September. Transaction fees have recently exceeded the block subsidy, leading to misguided calls for bigger blocks.

Relevant Past Articles:

Brc-20 Brings Tokenomics To Bitcoin, Spiking Transaction Fees

State Of The Mining Industry: Public Miners Outperform Bitcoin

What We’re Watching

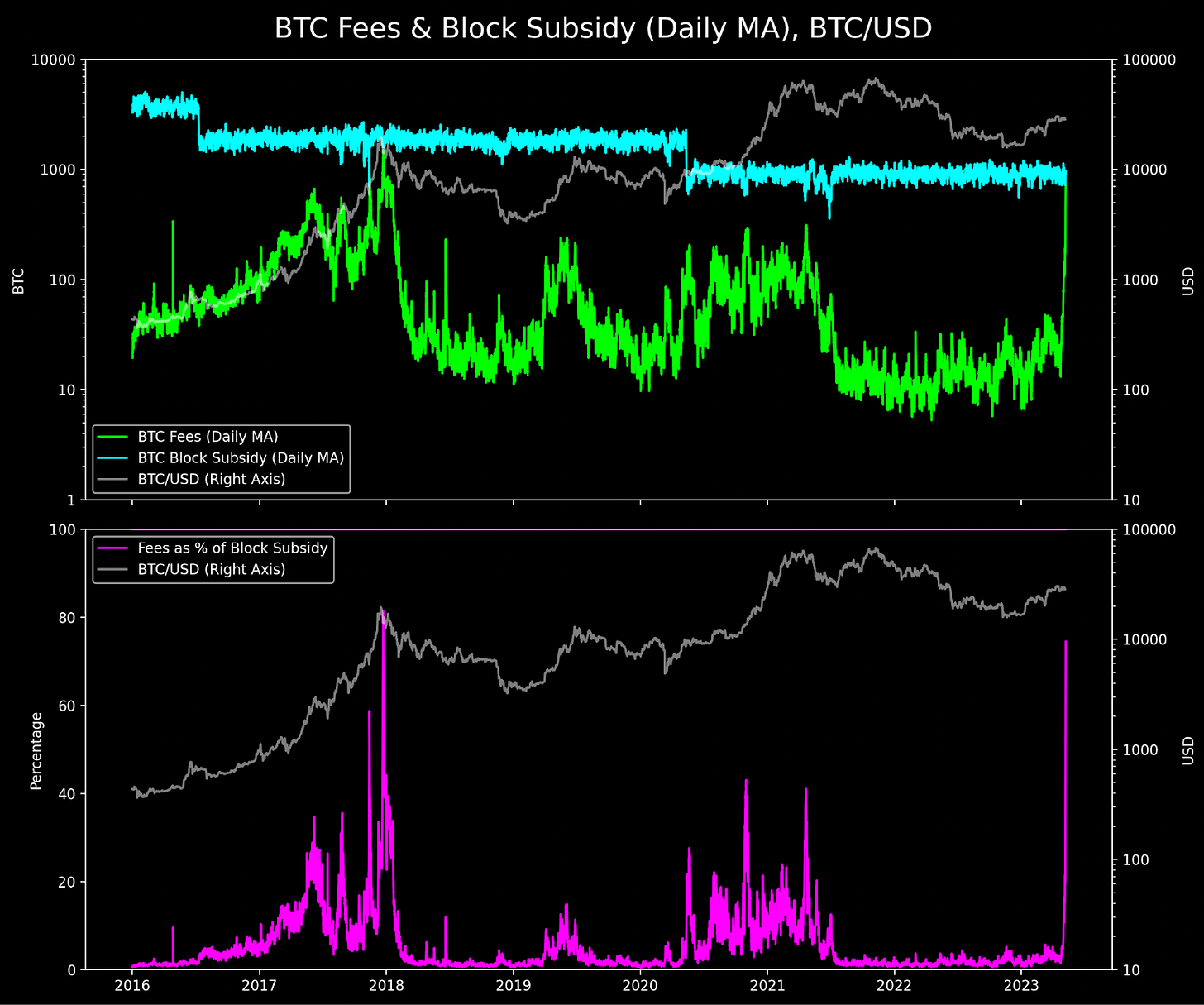

Transaction Fees Higher Than Block Subsidy

There’s been few periods in Bitcoin history where the total network transaction fees are higher than the block subsidy. This past weekend, in a welcome trend for miners, we saw the first block reward since 2017 to have higher fees than the subsidy. Over the last week, daily fees have been climbing closer to daily block subsidy levels with the explosion of speculation on brc-20 tokens. The only other two times in recent history to compare this level of block demand have been at retail-fueled tops in the market.

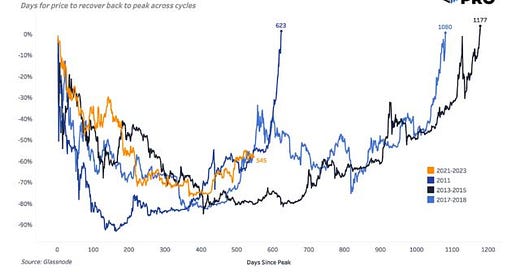

Price Action Across Cycles

Because the sample size is so small, we should take any bitcoin cycle comparison with a grain of salt. It took the last two bitcoin cycles around three years each to return to their previous all-time high. Currently, we’re halfway through that period. Both previous cycles also saw price action that retested market bottoms. It’s best to prepare for a similar scenario playing out, especially considering current macro headwinds. At the least, history would show us that it’s a good time to have patience at this part in the cycle.

Largest Mining Pools Grow Larger

Who are the mining pool winners over the last year? Foundry USA and AntPool have become the dominant players, collectively taking up approximately 50% market share. That’s grown from a total of around 31% over the last year. A significant portion of that market share has come from the fall of Poolin, which suspended withdrawals in September 2022.

We know from the Poolin example that Bitcoin miners can and will switch mining pool operators at any moment, but for now the consolidation of mining pools carry on. Digital Currency Group (DCG) subsidiary Foundry USA stopped offering free mining pool services last month. The DCG saga has been quiet for a few months, but is far from being concluded, which leaves their future and the future of their portfolio companies still hanging in the balance.

Historic Bitcoin Transaction Fees

We have delivered multiple updates over the past weeks on the development of Ordinals on Bitcoin’s base layer. Our most recent piece from Wednesday covered this in detail.

However, Bitcoin never sleeps and transactions from the weekend have resulted in even larger fee revenue for bitcoin miners to start the week — a wild development considering that mempool backlogs often ease over the weekend as commercial transaction frequency temporarily dissipates.

As fees skyrocket and the mempool builds a fortress of low time preference transactions in its queue, this will serve as a boon to miner revenues, who get a much needed boost after a brutal 2022 environment with declining hash price and a drop in exchange rate.

While the mempool weight is less than it was around the march timeframe, the fees being paid to get into the next block are at a much higher level than the time-agnostic backlog that was built earlier in the year.

The top-heavy nature of the mempool, with high priority transaction fees currently costing on average of approximately $20 (500 sat/vB) is indicative of the ordinals brc-20 craze, but simultaneously reiterating that long-term worries about bitcoin’s security budget in a world with a low or nonexistent block subsidy are misguided because fees have outperformed the subsidy in an environment of high-demand for block space.

We have seen a Bitcoin narrative in crypto circles go back and forth. At times of low fees, we’ll hear, “Bitcoin doesn't have a security model strong enough to sustain itself over the long term so inflationary tail emissions are needed to compensate miners.” Then, during high fee environments, the story is “Bitcoin needs bigger blocks to allow for more transactional throughput.”

These narratives are always misguided, for multiple reasons:

Bitcoin’s decentralized network consensus makes any changes to its consensus via hard fork extremely difficult to the point that bringing up a change like this is a non sequitur.

There are no “solutions” regarding the scaling “issue”, only trade offs. Tail emissions were never a serious discussion point because they directly conflict with the sacred nature of bitcoin’s 21,000,000 hard cap supply. Second, in regards to transactional throughput, the market already decided its thoughts on this matter. Just check the BCH/BTC exchange rate for confirmation…

Hal Finney predicted the use of additional layers built on top of Bitcoin in 2010. It’s likely that there will need to be more development of the Lightning Network or other solutions, like Cashu or Fedimint that can support faster and cheaper transactions.

Final Note

This week, we will dive into the details on what a sustained fee market environment would mean for the settlement efficiency of bitcoin and cover the big winners of this current fee environment: miners. Make sure to subscribe to get notified as soon as we release the next article.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!