PRO Market Keys Of The Week: Dropping Consumer Confidence Amid Debt Ceiling Debate

Consumer confidence fell in May as uncertainties about the labor market and business outlook began to surface during ongoing debt ceiling negotiations. Bitcoin network difficulty nears all-time highs.

Relevant Past Articles:

PRO Market Keys Of The Week: Tether’s Massive Treasury Portfolio

Not Your Average Recession: Unwinding The Largest Financial Bubble In History

What We’re Watching

Upcoming Economic Calendar:

May 31, 2023

U.S. Job Openings report.

Federal Reserve's Beige Book release.

Speeches by Fed's Patrick Harker, Susan Collins and Michelle Bowman.

June 1, 2023

China manufacturing PMI and Non-Manufacturing PMI.

Eurozone HCOB Eurozone Manufacturing PMI, CPI, and Unemployment data.

US construction spending, initial jobless claims, and ISM Manufacturing report.

ECB President Christine Lagarde speaks at a conference.

Speech by Fed's Patrick Harker at a webinar.

June 2, 2023

U.S. Unemployment and Nonfarm Payrolls report.

Falling U.S. Consumer Confidence

U.S. consumer confidence numbers came in today, with the May results declining to 102.3 from a revised figure 103.7 in the prior month. As uncertainties about the labor market and the outlook for business decisions began to surface amidst debt ceiling negotiations, consumer confidence is dropping. The Conference Board’s business expectations index has sunk to its lowest point since 2011. Despite these concerns, plans for major purchases including homes, cars and appliances have risen, indicating a resilient consumer in the face of higher interest rates and a potential looming fiscal fiasco.

Some key data points from the release:

The Present Situation Index, indicating consumers' views of current business and labor conditions, decreased to 148.6 from 151.8 in April.

The Expectations Index, reflecting the short-term outlook for income, business and labor market conditions, fell slightly to 71.5 from 71.7 in April, showing a continuation of pessimistic sentiment.

There was a significant deterioration in current employment conditions, with the proportion of consumers claiming jobs are “plentiful” dropping from 47.5% in April to 43.5% in May.

Consumer confidence decreased across all age and income categories over the past three months, but the decline was especially marked among consumers aged over 55.

Inflation expectations for the next 12 months remained high but stable at an average of 6.1%, demonstrating the significant influence of inflation on consumer perception of the economy.

Plans to purchase homes held steady at 5.6%, while intentions to purchase automobiles and big-ticket appliances saw a small rise compared to April.

Final Hurdles For Debt Ceiling Deal

President Joe Biden and House Speaker Kevin McCarthy’s debt-limit agreement approaches a decisive congressional test, with the default deadline of June 5. Both leaders spent Memorial Day attempting to rally partisan support. The catch is that a mere single addition or rejection of the contents of the bill in the Senate has the potential to delay proceedings and risk a technical U.S. debt default.

Here are some of the contents of the new proposed bill:

Suspend the $31.4 trillion debt limit through January 1, 2025.

Capping Non-defense Spending: Non-defense spending would remain relatively flat in fiscal 2024 and increase by 1% in fiscal 2025. After fiscal 2025, there would be no budget caps. Specific amounts and allocations are detailed in the source, including the repurposing of certain funds.

Protecting Veterans' Medical Care: Full funding for veterans' health care would be maintained.

Expanding Work Requirements: The deal calls for a temporary broadening of work requirements for certain adults receiving food stamps. The age limit would increase and some exemptions would be expanded, with these changes ending in 2030.

Clawing Back Some COVID-19 Relief Funds: Approximately $28 billion in unobligated funds from the COVID-19 relief packages would be rescinded.

Cutting Internal Revenue Service (IRS) Funding: The deal would repurpose a significant amount of IRS funding for non-defense areas and rescind some IRS funding from the act.

Restarting Student Loan Repayments: Borrowers would have to begin paying back their student loans at the end of the summer.

Maintaining Climate and Clean Energy Measures.

Expediting a Pipeline in West Virginia: The agreement would speed the creation of the Mountain Valley Pipeline, a natural gas pipeline in West Virginia.

However, hardline conservatives have been outwardly dismissive of the proposed bill. “No matter what happens, there is going to be a reckoning,” said Representative Chip Roy of Texas, with Representative Ralph Norman of South Carolina adding, “McCarthy has lost some trust,” and Scott Perry of Pennsylvania claiming “I am focused on defeating this bill.”

The partisan political game of chicken is underway, with short-term political theatrics taking front and center to distract from the long-term consequences of decades of malinvestment and back-breaking deficit spending.

You can analogize the discussion regarding the debt-ceiling as an argument between a husband and wife who both carry rock-bottom credit scores, combined with a propensity to spend more than their income to showcase their “wealth”. Neither is keen on addressing or even acknowledging the long-term structural issues facing their budgeting skills, or lack thereof.

Goldman Forecasts Liquidity Drain During Summer

As the negotiations about the U.S. debt ceiling near a conclusion, market analysts turn their attention to the banking sector due to the impending liquidity drain that will be created when the Treasury General Account (TGA) gets refilled. The Treasury’s plan to increase its cash balance from $50 billion to $600 billion will initiate a reserve drop equivalent to several rate hikes, negatively impacting risk assets and stressing regional banks as deposits get rapidly transferred to money market funds at large banks.

While not an apples-to-apples comparison, it can be useful to look at what happened to markets the last time the Treasury had to refill its coffers, and the subsequent effect it had on various asset classes.

Both Morgan Stanley and Goldman Sachs agree on the market impact of a looming liquidity drain. The former warns of amplified banking system risks and adverse impacts on market liquidity due to the Treasury’s fund replenishment. Meanwhile, Goldman Sachs’ strategists voice concerns about significant liquidity tightening between June and July due to the build up of the TGA, Targeted Long-Term Refinancing Operations (TLTRO) repayments in Europe and further quantitative tightening from the Federal Reserve.

Key points from Goldman Sachs’ note include:

The TGA rebuild may reduce U.S. reserves by around 7%-8% over June and July.

June's TLTRO repayments could decrease European Central Bank reserves by nearly 12%.

This may result in a G4 liquidity drop of approximately 5% over the next two months, which could be exacerbated by a stronger dollar.

Historically, the largest monthly decrease in G4 reserves was a -6.6% drop in April 2022, causing the Nasdaq and S&P 500 to fall by 9% and 8% respectively, while DXY strengthened by almost 3%.

The TGA balance currently stands at $49 billion and is expected to draw down to nearly zero over the next two weeks and then rebuild to around $550 billion over June and July. The actual liquidity withdrawal will depend on the TGA rebuild funding and shifts out of the reverse repurchase agreement.

While Goldman Sachs recommends NASDAQ put spreads as the best way to hedge against the anticipated liquidity withdrawal, we remain on the lookout for any potential liquidity dynamics due to the potential buying opportunity it might create in the bitcoin market.

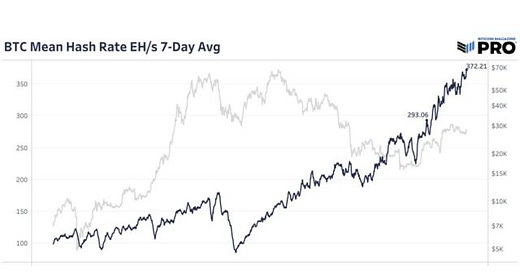

Bitcoin Difficulty Poised For All-Time High

Amidst the macro noise, the Bitcoin network keeps on chugging. Network hash rate is at all-time highs and within the next 24 hours, network difficulty is poised for an upward adjustment to all-time highs.

Even in the middle of short-term macro worries, political theatrics around the debt ceiling and bubble valuations for the stock market, bitcoin is the signal cutting through the noise.

Bitcoin’s monetary assurances and value proposition has never been stronger. The fact that the network is reaching historic metrics at the same time as the news has forgotten about its 2021 darling only reiterates this reality.

Tick tock, next block.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!