PRO Market Keys Of The Week: Market Anxiously Awaits Fed Meeting

The collapse of banking institutions continues, with Credit Suisse marking a systemic risk to the global economy. The Federal Reserve announces global swap lines to increase liquidity. Bitcoin pumps.

Relevant Past Articles:

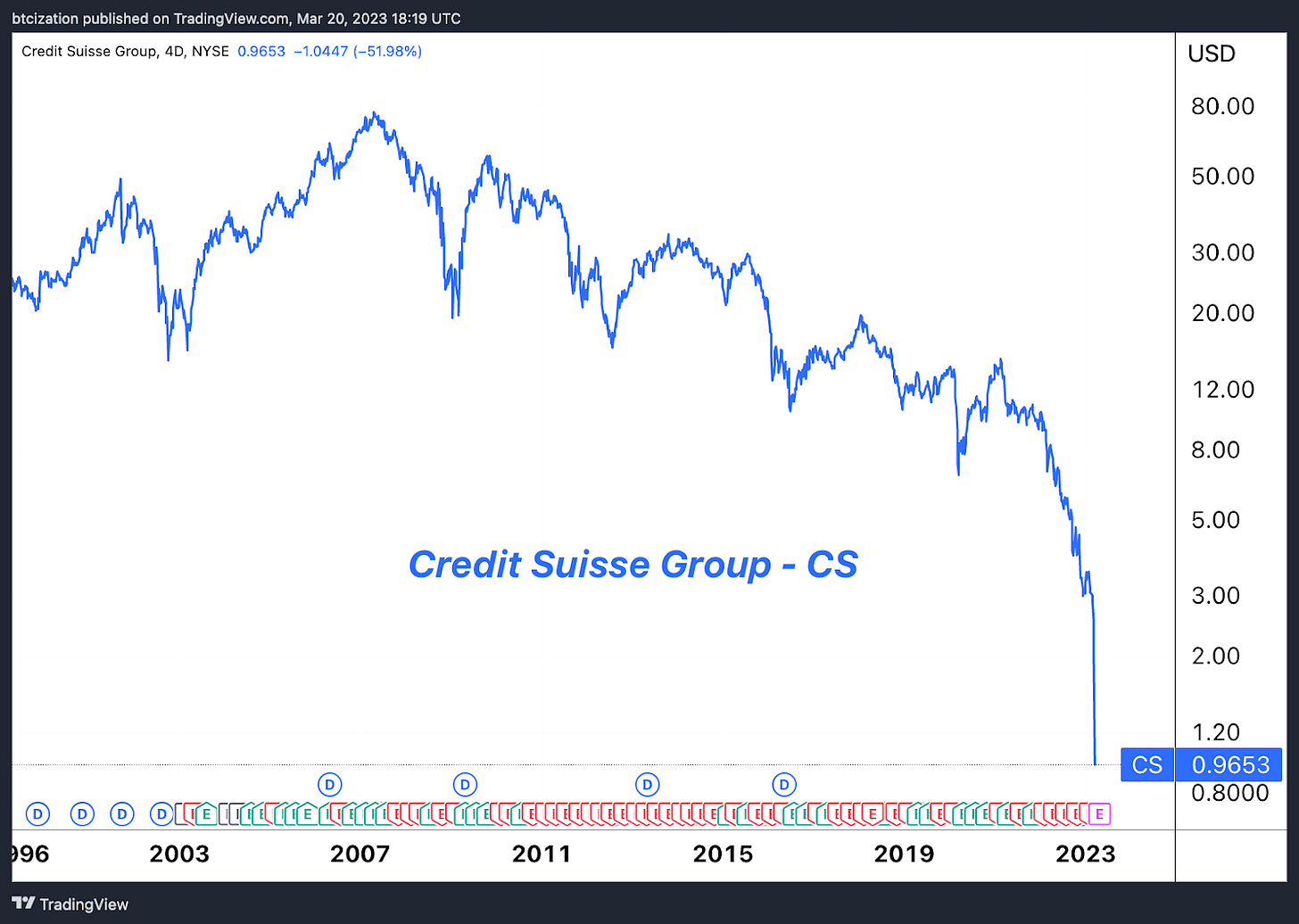

Credit Suisse Gets Acquired For Pennies On The Dollar

Credit Suisse was officially acquired for $3.25 billion, with shareholders receiving one share of UBS for every 22.48 shares of Credit Suisse. As part of the deal, the Swiss National Bank (SNB) is offering liquidity assistance of 100 billion francs to UBS, while the government is granting a 9 billion franc guarantee for potential losses from assets UBS is taking over — essentially, this is a taxpayer-backed bailout.

Regarding the acquisition, the U.S. Treasury and Federal Reserve had this to say about the support from the SNB:

“We welcome the announcements by the Swiss authorities today to support financial stability. The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient. We have been in close contact with our international counterparts to support their implementation.”

More importantly, however, the bank's entire AT1 bond tranche — some 16 billion CHF of Additional Tier 1 (AT1) bonds — will be written down to zero. According to the press release, “FINMA has determined that Credit Suisse’s Additional Tier 1 Capital (deriving from the issuance of Tier 1 Capital Notes) in the aggregate nominal amount of approximately CHF 16 billion will be written off to zero.”

This has enraged many creditors of Credit Suisse because investors mistakenly assumed that they were ahead of equity holders in terms of the capital structure.

The most interesting tidbit around this news is the potential spillover effects regarding the writedown, with other European banking bond tranches facing pressure due to the decision.

Source: Joachim Dressler

“The wipeout of 16 billion francs ($17.2 billion) of Credit Suisse’s so-called AT1 bonds is the biggest loss yet for Europe’s $275 billion market in these securities, which were created after the financial crisis to ensure losses would be borne by investors not taxpayers.” — ZeroHedge

Equally noteworthy was how credit default swaps reacted to the move, with 5-year default swaps for UBS soaring to highs not seen since the European debt crisis in the early 2010s.

Source: ZeroHedge

Bitcoin 2023 ticket prices increase FRIDAY at midnight! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Paid subscribers get 15% off tickets and everyone can use code “BMPRO” for 10% OFF.

Limited-time offer: Industry Passes come with a 2-month PRO subscription!

Federal Reserve Announces “Coordinated” Swap Lines

Steady Lads!

On Sunday evening, after a weekend of swirling rumors around the acquisition of Switzerland-based Credit Suisse, global central banks came out with a coordinated announcement to ease market tensions as worries of banking system stability intensified.

This is following a week which saw funding stress in the banking system rapidly blow out to crisis levels. Weak banks have been falling like dominoes since the fall of Silicon Valley Bank.

The graphic below shows the FRA-OIS spread, a measure of funding stress in the banking sector by measuring the gap between the U.S. three-month forward rate agreement and the overnight index swap rate.

The FRA-OIS spread is the rate that banks charge each other for overnight lending in addition to the expected forward risk-free rate set by the Federal reserve, and its widening as a proxy for risks in the banking sector.

A more technical breakdown of FRA and OIS from Bloomberg is as follows:

“What is FRA?

“A forward rate agreement is a deal to swap future fixed interest payments for variable ones, or vice versa. The key rate for U.S. markets is the three-month London interbank offered rate, or Libor, in U.S. dollars. The benchmark is derived by major banks submitting rates based on transactions that are compiled to establish benchmark for five different currencies across seven different loan periods. Those benchmarks underpin interest rates on trillions of dollars of financial instruments and products from student and car loans to mortgages and credit cards.

“What is OIS?

“The Overnight Index Swap rate is calculated from contracts in which investors swap fixed- and floating-rate cash flows. Some of the most commonly used swap rates relate to the Federal Reserve’s main interest-rate target, and those are regarded as proxies for where markets see U.S. central bank policy headed at various points in the future.

As interbank lending tightens, access to credit in the banking system also tightens, particularly for international banks without direct access to dollar liquidity from the Fed.

For history buffs, yesterday’s press release served as déjà vu, as it reads nearly identical to one that came in December 2007 before the peak of the Great Financial Crisis.

In future issues, we will go into more detail about the various forms of liquidity provisions being put forth by the Fed and other global central banks to help readers understand and differentiate the tools being put forth by the world’s leading central bank.

State Of The Tightening Cycle

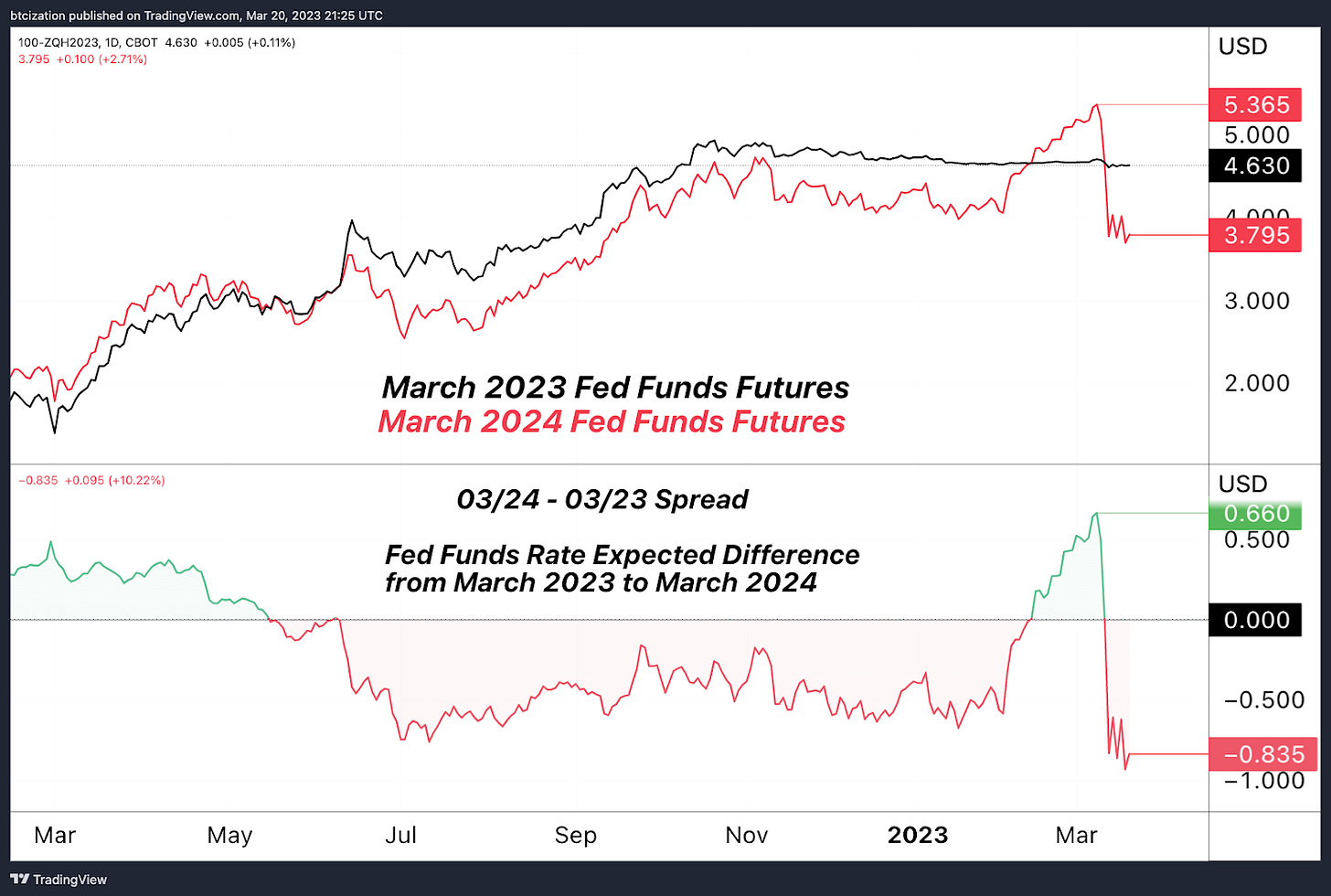

Short-term rates are saying this tightening cycle is over. The market has priced in over three rate cuts (-0.83%) from the upcoming FOMC meeting on Wednesday through the next 12 months — a shocking change from the +0.66% of cuts that the market expected from March 2022 through March 2023 before the collapse of Silicon Valley Bank earlier this month.

Anecdotally, many investors noted that the weekend support from the SNB to aid the acquisition of Credit Suisse along with the coordinated nature of the swap line announcement from major global central banks showed that monetary authorities are fearful and the banking sector faces continued weakness. With these worries, many market participants have concluded that this tightening cycle will conclude after the likely addition of one more hike this coming Wednesday, which the market assigns a 76.8% probability of occuring and a 23.2% chance of no hike.

Source: FOMC Tracker

Download the FREE “Banking Crisis Survival Guide” today! Get your copy of the full report here.

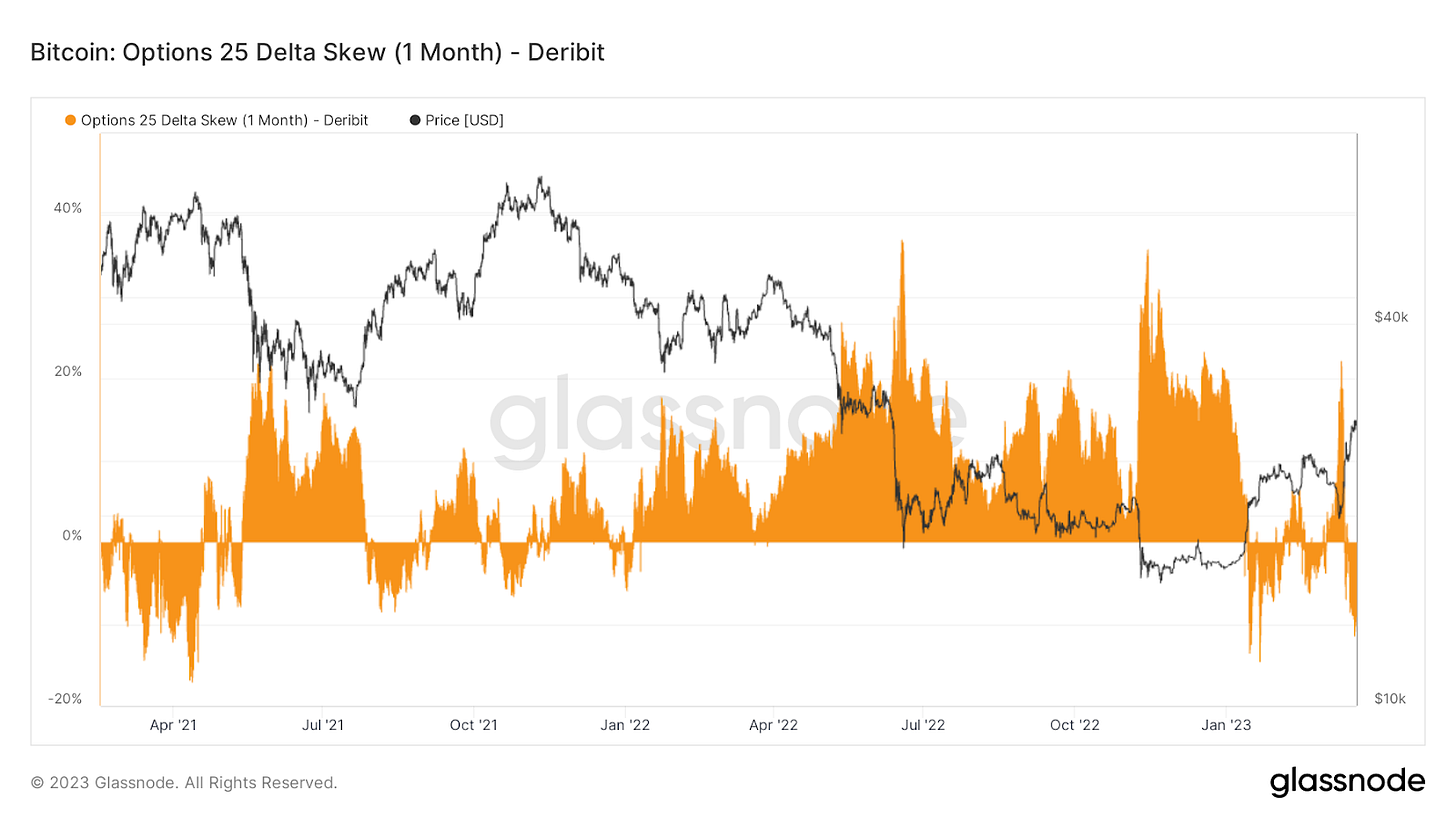

Bitcoin Options Market Skewed Extremely Bullish

Following the recent bitcoin price move to the upside, delta skew in the bitcoin options market is at its lowest levels since the fall of 2021, breaking multi-month resistance on the way above $28,000. Said simply, delta skew shows the relative level of “richness” of puts relative to calls, with negative readings showing a volatility premium being assigned to calls. Upside relief following an extended market downturn and selling exhaustion is healthy, participants should keep an eye on whether premiums for calls relative to puts continue, as historically sustained periods of negative delta skew are signs of bullish derivative traders getting a bit over their skis.

Shown below is the skew for 1-month options, with periods in red displaying when the skew for 1-month options was negative.

For additional context, here is the skew for the 3-month and 6-month options maturities.

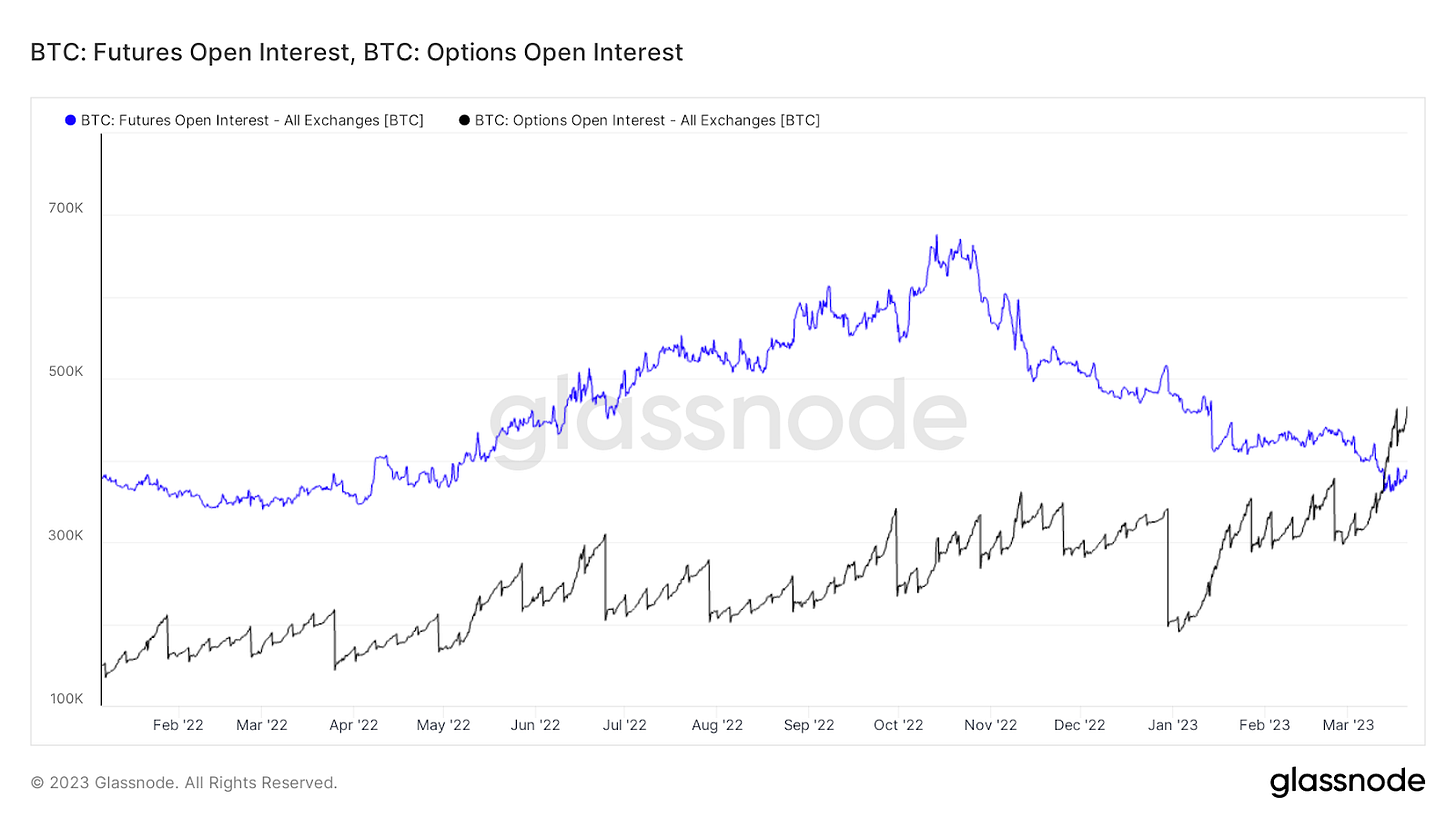

This comes at a time when the options market has become a larger share of the market than ever before when compared to futures. Over the last week, open interest in bitcoin terms surpassed futures open interest for the first time ever. As a result, options flow is more relevant than ever in terms of driving price action, and as such, we will monitor and update readers frequently with updates on the latest options data.

Final Note

Over the last two weeks, the developments around weakness in the banking system happening in tandem with the price appreciation of bitcoin — and despite the attempt to derail crypto firms from dollar rails — has presented the strongest narrative reinforcement for the bitcoin thesis in years.

A bearer asset with neither counterparty risk nor debasement risk is the golden goose, and it looks as if the market is just beginning to realize this. At the moment, liquidity is slim in both directions. In terms of market structure, the $28,000-$32,000 level is the next significant resistance level to chew through.

A perfect storm of bitcoin outperformance in the face of banking system failures across the Western World highlights the very reason why bitcoin was created in the first place.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Fire report gents.stay steady.