Who Has The Bitcoin? A Closer Look At The Bitcoin Supply

As evidenced by increasing retail ownership and historically high levels of long-term holders, it’s clear that bitcoin's supply is getting distributed more evenly across this vast array of adopters.

Relevant Past Articles:

PRO Market Keys Of The Week: Tether’s Massive Treasury Portfolio

Earlier Than You Think: An Objective Look At Bitcoin Adoption

One Year Until The Bitcoin Halving: Analyzing Holder Dynamics

Read until the end for exclusive footage from Bitcoin 2023!

For Paid Subscribers Only.

Who Holds The Bitcoin?

Bitcoin’s public ledger comes with a unique level of transparency that includes significant information detailing where the bitcoin supply lives. With the help of address tracking, public announcements and some estimation across data sources, we can get a sense of where nearly 47% of total bitcoin supply is today. A considerable portion of bitcoin’s 21-million supply is estimated to be lost, which includes Satoshi Nakamoto’s coins. There’s useful data from both Glassnode and Chainalysis to suggest that nearly 4 million bitcoin has been lost.

Other large amounts of bitcoin are on exchanges, in the Grayscale trust, or in bitcoin miners’ wallets. Swaths of bitcoin have been accumulated by the likes of MicroStrategy, and more recently Tether. Some 5,500 bitcoin are locked up on the Lightning Network, while other sums exist as wrapped bitcoin (WBTC) on blockchains besides Bitcoin.

Most bitcoin estimates can be tracked on a routine basis when looking at examples, like known U.S. government-associated on-chain addresses from various bitcoin seizures, or when analyzing monthly production updates from public bitcoin miners, while other holding details can be much harder to come by. A private institution may have indicated bitcoin holdings years ago, but isn’t required to publicly announce updates of their stash. For example, in 2019, Block.one said they had 164,000 bitcoin, but this figure could be outdated since we don’t know all their addresses and it’s easy to assume they directed some of that capital into a new venture. Other instances include uncertainty around government holdings. China may have 194,000 bitcoin from seizure, but it’s difficult to verify if this number is current.

All that said, the below chart is a rough cut of available data that can be expanded upon and improved for better accuracy across different groups. These figures come from on-chain forensics, public SEC filings and balance sheet attestations.

Of the 2.3 million of bitcoin on exchanges, the majority resides on Binance and Coinbase. This wouldn’t include bitcoin in investment custody products like Grayscale and Coinbase Custody, for example. Binance’s share of bitcoin on exchanges has risen from under 10% in 2019 up to 30% today. The company is estimated to have nearly 700,000 bitcoin on their platform, which can predominantly be attributed to their derivatives marketplace dominance and their international presence, whereas Coinbase is mainly a spot exchange with a heavy U.S. presence.

Over time, the amount of circulating bitcoin supply on exchanges has reached 17.5% of circulating supply, reaching its peak in March 2020 before declining to just 11.89% today. We suspect that the trend of declining bitcoin on exchanges as a percentage of circulating supply will continue as bitcoin distributes across an increased amount of global adopters, thanks to sophisticated personal custody solutions becoming more mainstream and robust as time goes on.

Additionally, we can break the bitcoin supply down into cohorts of long-term and short-term holders. The long- and short-term holder heuristic filters out balances on exchanges from calculations and quantifies long-term holdings as coins that have not been moved in over 155 days. Shown below is a visual of the holder cohorts and the cutoff date for short-term holders to age into the long-term classification.

How do the current levels of long-term holders compare to previous times in Bitcoin’s history? Let’s take a closer look…

In absolute terms, there has never been this level of long-term holders in bitcoin. In relative terms, the only two times in history with a larger share of long-term holder coins is in 2009 before bitcoin had an exchange rate, and in the depths of the 2015 bear market. With nearly 75% of supply held by holders unbothered by short-term volatility, bitcoin’s exchange rate is a turbocharged rocket ship waiting on a mere spark of demand to take off. Concurrently, with so much of the supply off the market, sell-side pressure in the interim can result in large price adjustments to the downside, since many market participants are partaking in more of a passive role.

We can also look at bitcoin’s illiquid supply to quantify holder dynamics. The term “illiquid supply” refers to bitcoin that are held by entities that rarely sell, meaning these coins are not readily available for trading. To quantify this, an entity's bitcoin holdings are deemed illiquid if less than 25% of its received bitcoins have been spent, liquid if 25% to 75% have been spent, and highly liquid if over 75% have been spent.

In the post-2016 halving era, bitcoin’s illiquid supply as a percentage of circulating supply is at its highest level, with holder accumulation taking coins off the market faster than miner issuance can distribute them.

As of this April 2023, bitcoin’s illiquid supply surpassed 15,000,000 coins.

Supply Distribution By Entity

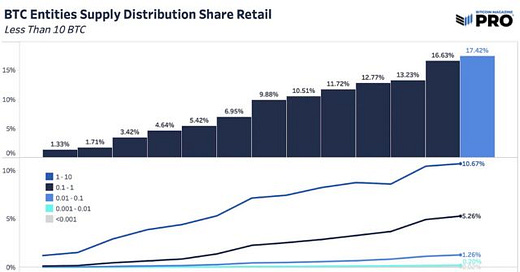

The below charts show Glasssnode’s estimates for bitcoin supply held across different entities. Entities are estimated from data science techniques to group multiple addresses together. Specifically, we’ve highlighted the retail share of entities that hold less than 10 BTC. The rising share of retail’s share of supply has been one of the significant trends in Bitcoin over the last decade. Retail’s supply share now accounts for 3.38 million bitcoin or 17.42% of the circulating bitcoin supply and 16.1% of the total 21 million supply hard cap.

The trend is clear: Bitcoin continues to distribute into more hands, with a greater concentration of supply shifting from entities holding large amounts of bitcoin — balances of 1,000-10,000 BTC, 10,000-100,000 BTC, and greater than 100,000 BTC — to entities holding balances of 10 BTC or less.

It’s important to note that entities holding large amounts of bitcoin, particularly those with 10,000-plus BTC, are likely managing keys for thousands or even millions of users, exchanges being an obvious example. This is often a classic source of mischaracterization and misinformation when people make claims regarding a lack of wealth distribution of bitcoin. Yes, there are clumps of addresses with large holdings of bitcoin. (Glassnode uses proprietary heuristics to label these clumps of addresses as unique entities.) But this is like claiming that one corporation owns 14% of all U.S. dollars in the commercial banking system. While JPMorgan Chase has $2.4 trillion out of $17.1 trillion of deposits in domestic banks and the deposits are a liability of JPMorgan, in actuality, they are custodied for millions of unique individuals and businesses.

The key difference — aside from the legal versus cryptographic ownership structure — is the fact that bitcoin’s ownership structure, the UTXO set, is much more transparent and easily auditable. This makes it easy for anyone to look at the data and make informed claims about bitcoin’s supply concentration.

Final Note

Bitcoin has been successful in attracting a broad spectrum of holders, from individuals to corporations, private entities and even nation-states. As evidenced by increasing retail ownership and historically high levels of long-term holders, it’s clear that bitcoin's supply is getting distributed more evenly across this vast array of adopters. This trend is further reinforced by a declining amount of bitcoin held on exchanges and an increasing illiquid supply, pointing to a strong conviction among bitcoin holders to HODL their stash.

The trend of Bitcoin adoption by corporations and nation states appears to just scratch the surface of potential growth. As these entities increasingly recognize and engage with bitcoin as a viable asset, we can expect this cohort of bitcoin's holder base to expand significantly.

Moving forward, we anticipate these trends of increased distribution and declining concentration to continue, as bitcoin’s 21,000,000 hard capped supply is divided up between the world’s individuals, institutions, corporations and nation states.

Check out Dylan LeClair's Exclusive Panel In The Deep From Bitcoin 2023!

Password: icDgx*WunwhQmF4YgA

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!