BM Pro Daily - Charts Update 5/5

BM Pro Charts Update

All charts are updated as of today, including the most recent daily value for May 4. This is a format and premium subscription feature we’re looking to deliver every week on Wednesdays if subscribers continue to find it valuable. Today’s release is Thursday instead with the April Monthly Report released yesterday. Previous write-ups analyzing the metrics more in-depth are linked below.

For these updates, let us know if there are other charts or iterations you would like to see included on a regular basis.

On-Chain/Cyclical Indicators

Mayer Multiple

The Mayer Multiple, named after bitcoin pioneer Trace Mayer, is an oscillator that calculates the ratio between current price and the 200-day moving average. While one of the most simple cyclical indicators, it is one of the most effective at displaying how cheap/expensive bitcoin is relatively.

Reserve Risk

When Reserve Risk is high, confidence is low (HODLers dumping) and price is high, risk/reward is skewed to downside. When Reserve Risk is low, confidence is high (HODLers not selling) and price is low — risk/reward is very attractive. Read Reserve Risk Overview.

Market Value To Realized Value (MVRV) Ratio

The MVRV Ratio is a ratio between the price of bitcoin and the average cost basis of all coins on-chain, called the realized price. MVRV Z-Score calculates the standard deviation of this metric for a cleaner signal.

R-HODL Ratio

The R-HODL Ratio (short for Realized HODL Ratio), takes the ratio between the 1-week and 1-2 year Realized HODL bands. In layman’s terms, it takes a ratio of the market cap of coins that have moved within the last week against those that haven’t moved in over one year but less than two. While this may seem like somewhat of an arbitrary indicator, during market tops, many old coins change hands at a very inflated price, vastly skewing the metric to the upside. Read Realized HODL Ratio.

90-Day CDD Entity Adjusted

Coin days destroyed (CDD) is calculated by taking the number of coins in a given transaction and multiplying it by the number of days it has been since those coins were last spent. By aggregating CDD over a daily time period, we can see how old the coins being spent were. By applying a moving average or rolling sum to the figure, you can display whether bitcoin is in a relative accumulation or distribution phase. Read Coin Days Destroyed Overview.

Dormancy-Flow Entity Adjusted

Dormancy flow is a ratio of market capitalization and an annualized dormancy value measured in USD created by David Puell. Dormancy, on its own, is measured as the ratio of the number of coin days destroyed over total transfer volume (change-adjusted). More on dormancy-flow here.

STH LTH Ratio

Ratio of the cost basis of short-term holders (STHs) vs long-term holders (LTHs). When trending upwards, the cost basis of STHs is appreciating relative to that of LTHs, a bullish market dynamic. When trending downwards, the cost basis of STHs is falling relative to that of LTHs, a bearish market dynamic. The STH LTH Ratio is historically one of the most accurate signals in a bitcoin market cycle. Read Short-Term:Long-Term Cost Basis Ratio.

STH MVRV

Short-term market value to realized value. A key dynamic of a bull/bear market is whether short-term holders are above/below their average cost basis. When above, new money has to competitively bid up price to secure an allocation; when below, underwater positions capitulate and redistribute. Read Short-Term Holder Analysis.

30-Day Percentage Change of Long-Term Holder Supply

30-Day Percentage Change of Supply Held by Whale and Retail Entities

Read Whale Accumulation.

Derivatives Markets

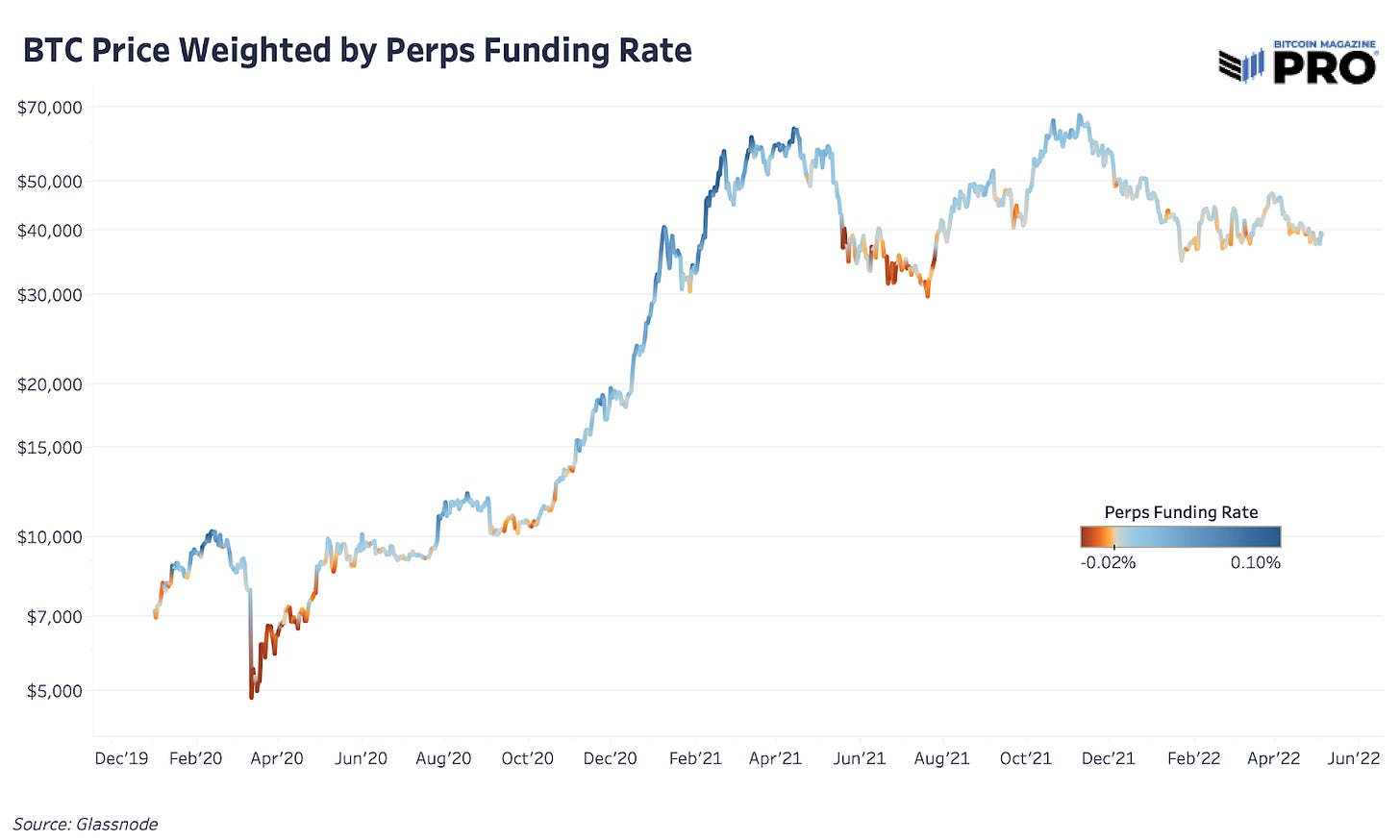

Perpetual Swaps

A futures contract that never expires but just rolls over every eight hours. Created by Arthur Hayes, founder of BitMex. The perpetual swaps funding rate is a periodic rate that is paid between longs and shorts based on the relative positioning of the perpetual swap market relative to a spot index price. Positive funding rates mean longs pay shorts, and vice versa. Funding payments are paid every eight hours. Read Derivatives Market Breakdown.

Open Interest

The amount of bitcoin in contracts outstanding (always an equal amount of longs and shorts).

Percent Futures Open Interest Crypto-Margined

The collateral makeup of the bitcoin derivatives market. Mostly collateralized with bitcoin and stablecoins, though some derivatives exchanges allow for the use of less liquid altcoins as collateral, but increasingly stablecoins are the most dominant use of collateral in derivatives open interest, followed by bitcoin.

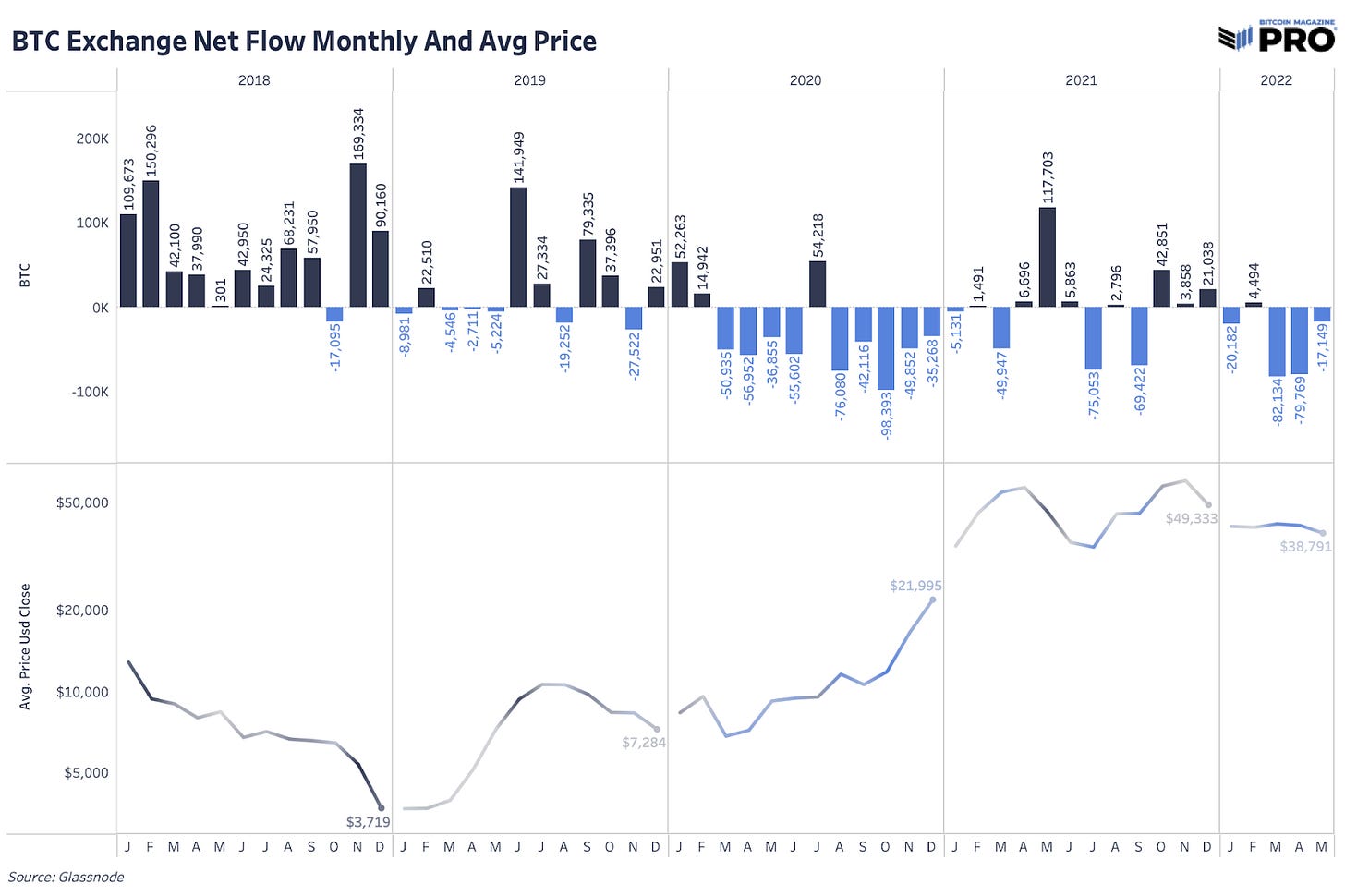

Exchange Flows

Rolling 30-Day Sum of Exchange Inflows/Outflows

Illiquid Supply

HODL Waves > 3 Months

Read HODLer Sentiment.

Bitcoin Mining

Hash Rate

Mining Difficulty

Hash Price

Calculated as miner revenue over hash rate, a key measure of relative miner profitability. Hash price is in a long-term downtrend as mining continues to become increasingly competitive.

Puell Multiple

The daily issuance value of bitcoin (in USD) divided by the 365-day moving average of daily issuance value.

Miners Transfer Volume To Exchanges

Total Miner Revenue 30-Day Cumulative