Whale Supply Accelerates

In the The Daily Dive #132 - Retail And Whale Accumulation Trends, we highlighted some of the recent buying and selling behavior across whale and retail groups. Over the last week, we’ve seen some increased whale accumulation that’s worth highlighting today.

Before we dive into the charts, it’s key to note that there’s many ways to define and estimate whales. In this analysis, we’re defining whales as estimated entities holding more than 1,000 BTC, less exchange balances. We rely on Glassnode heuristics to estimate both of these.

To track behavior, we look at the rate of change in the supply held by these entities. These entities, whales, can be a wide mix of individuals or institutions. We don’t leave any of these entities out so for example, the Canadian Purpose Bitcoin Spot ETF and MicroStrategy holdings would be included here. By doing so, we can get a broad overview of what larger, market movers are doing in aggregate.

In our analysis, the 30-day rate of change in supply produces the best signal. Yesterday we saw some of the strongest accumulation by whales since September 2021. Since we’re relying on estimates and heuristics, it’s best to see how this trend plays out over the next week but overall it’s a positive sign for the market that bigger players are showing demand here.

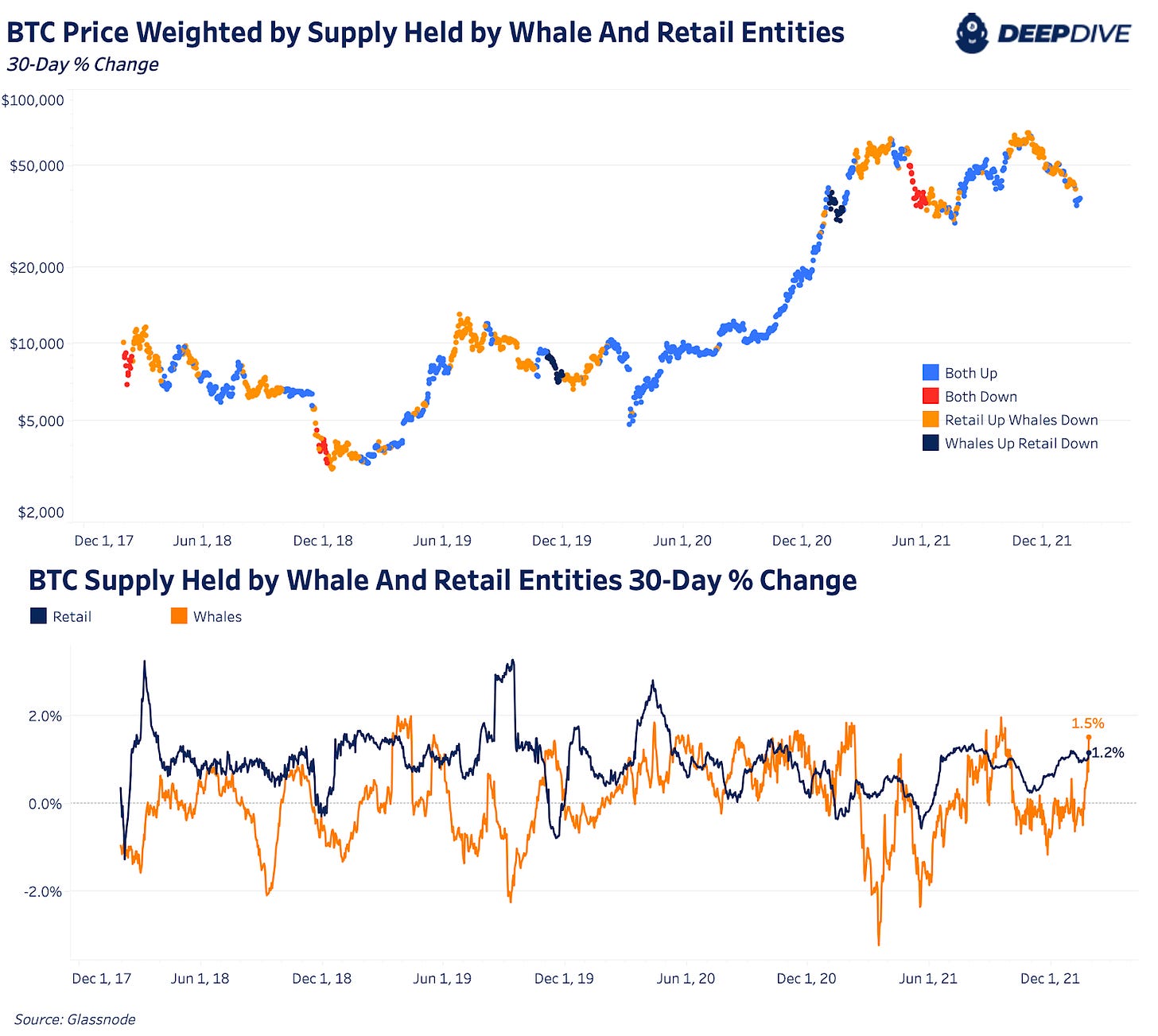

The below chart shows the same dynamic with the 30-day percentage change for whale supply accelerating to 1.5%. This high of a change is similar to the price dips we saw back in September and February 2021. Whale supply has been decelerating to market neutral over the last few months so the data is starting to show a pretty significant change in aggregate buying behavior and sentiment. We’re monitoring to see if this is a one-off event or a continued accumulation period unfolding.

This accumulation seems reasonable as the price of bitcoin just saw its lowest 30-day percentage change since the June 2021 liquidations cascade. There may be more downside to the bottom to come as we highlighted in recent Daily Dives, but drawdowns like these are historically great long-term accumulation opportunities when bitcoin looks heavily oversold.

The below chart highlights some extreme periods when the 30-day percentage change in price is above 40% and below 15% with a rolling 90-day average of 7.86%:

Bitcoin Liveliness And HODLer Net Position Change

Liveliness is calculated as a ratio: the sum of all Coin Days Destroyed and the sum of all coin days ever created. Liveliness increases as long-term holders distribute more coins, creating more coin days destroyed relative to coin days created.

Liveliness decreases as long-term holders accumulate more coins, creating less coin days destroyed relative to coin days created.

Throughout bitcoin’s history, we see clear patterns of long-term holder distribution and accumulation that drive bull and bear market cycles that can be easily tracked with liveliness.

Currently bitcoin is in a heavy accumulation phase, with supply-side conditions continuing to tighten. It is important to remember that with metrics like bitcoin liveliness and many on-chain indicators that only quantify supply-side dynamics, and considering the current macroeconomic uncertainty, marginal selling has driven the price as of late.

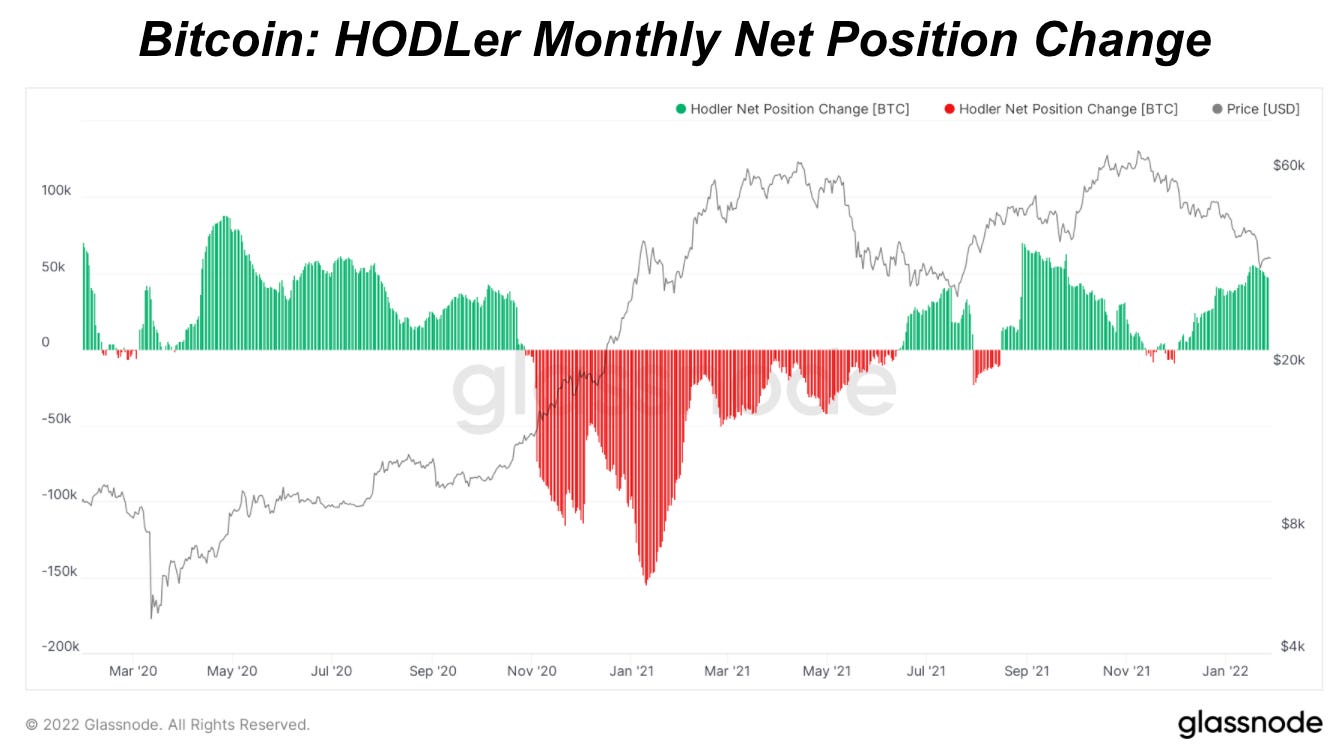

We can also look at HODLer Monthly Net Position Change, which is bitcoin liveliness in terms of circulating supply over a 30-day period. Net accumulation is currently in effect.

However, with the increasingly tight supply-side conditions, when marginal selling turns to marginal buying, the wall of money must compete to acquire a small proportion of the world's first absolutely scarce monetary asset.

In our Deep Dive Monthly Report being released next week, we will cover these dynamics in more detail.

Check out the recent attack on bitcoin from the proof of stake dweebs. "Cointelegraph" article is spreading the usual environmental FUD on bitcoin mining and that "regulation is coming". then u click on the author and see that its the co-founder of IOTA, another proof of stake shitcoin that has premined and issued its own coin like the 3rd rate penny stock that it is...bitcoin magazine should do a retort and explain that yes regulation is coming but that its likely coming for PoS and the other penny stock shitcoin securities. The environmental FUD is the biggest con when you realize that bitcoin mining is driving/incentivizing more renewable energy and solving grid problems

🔥🔥