Regional Banks Underwater, Big Banks Consolidating As Confidence Falters

Regional banks are feeling the heat as stocks tumble across the sector. Depositors flee to big banks and money market funds for protection, but bitcoin is the only asset without counterparty risk.

Relevant Past Articles:

Regional Banks Underwater

Regional bank market capitalizations are being wiped out again this week after J.P. Morgan Chase’s takeover of First Republic Bank. Looking at the KRE U.S. regional banking ETF, the index is down over 50% over the last few months. PacWest, First Horizon and Western Alliance are some of the latest names to drive index losses this week, but this has been a broader market selloff with short speculators piling in across the entire sector.

There’s a few factors up for debate that are driving the failures of regional banks and the continued speculation in the market of who may be next. At a high level, banks are in a fundamentally different market environment than they have been over the last 10 years and some are failing to manage this regime change.

To name a few factors, the reversal from quantitative easing to quantitative tightening has put increased pressure on shrinking commercial deposits. There’s been increased incentives to keep money in various money market funds over banks as interest rates are much more lucrative. There’s also been mismanagement from banks to navigate the inverted yield curves from one of the fastest rate hiking cycles in history, which has had a significant impact on their business. Higher rates have now put pressure on new economic activity and credit growth, which has been turning over since August 2022. Add in the new speed at which bank runs and insolvency speculation can take shape and we have a simple, crude way of understanding why this is happening.

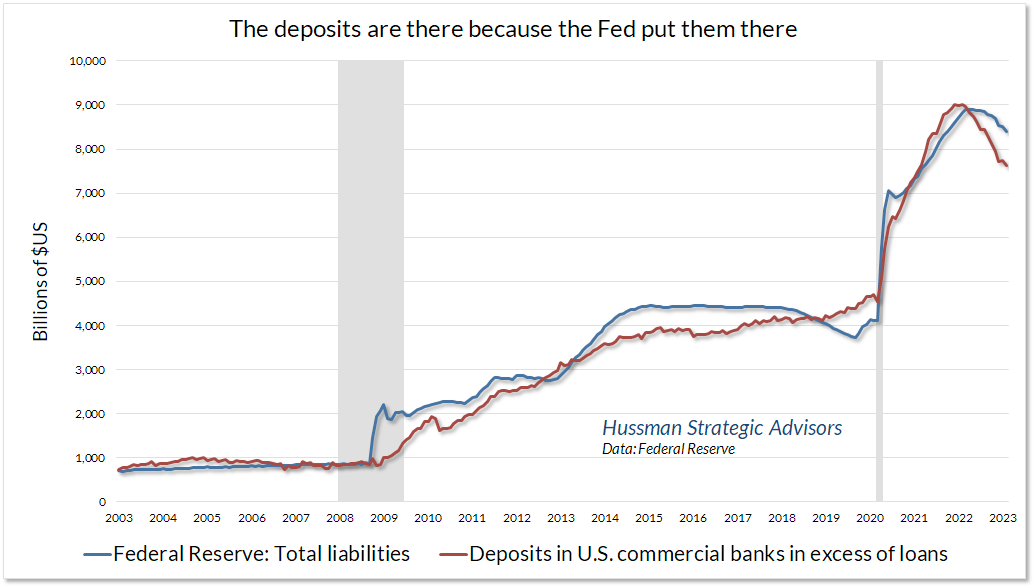

The below chart shows that banks’ deposit base and overall health has been strengthened over the last decade with the help of the Federal Reserve but now that trend is reversing.

Source: Hussman Strategic Advisors

The below chart shows the annual change in commercial bank credit which has been turning over since August 2022.

During the month of April this year, and at the height of the first few banking failures, a Gallup poll shows that Americans haven’t been this concerned about the safety of their money deposits since the Great Financial Crisis in 2008.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

The reasons bank runs seems to be increasing. 🏃♂️

Why bank stocks have rebounded today. 📈

How FDIC insurance isn’t enough to protect depositors. 🕳️

There is a new precedent of FDIC insurance covering beyond the $250,000 limit after the Silicon Valley Bank (SVB) failure, but there is also uncertainty that other regional banks will receive the same treatment. With customers feeling the precariousness of the situation at their regional banks, we’ve seen a wave of inflows to larger banks in order to limit these seemingly new counterparty risks of not being able to access your money.

Without diving into the operations of specific banks, it’s harder to predict the next regional bank to fall or to anticipate when the bleeding will end. But the growing trend of the banking sector becoming more consolidated into the hands of a few players is clear. The sheer number of regional banks and the rise in shadow banking activity has proven to overwhelm regulators. Smaller banks are also more vulnerable to economic shocks despite being economic engines for increasing credit in localized areas.

This is not necessarily a new trend but a continuation of what’s been happening over the last decade. The latest failures have shed a major spotlight on the problem.

Role Of Fintech In Digital Bank Runs

One element of this crisis that is relatively new is the speed at which rumors, worries and fear have spread and been aided by posts on social media platforms such as Twitter. This and the frictionless nature of mobile banking and fintech platforms gives depositors the ability to flee with their money on a moment's notice, further exacerbating any problems the banks had on their balance sheet that were masked by hold-to-maturity accounting practices.

Source: ZeroHedge

However, deposits aren’t just leaving banks due to fears of bank runs. With the Fed’s latest interest rate hike to 5.25% this past Wednesday, deposits are pouring into money market mutual funds, smashing historic records at an astounding $5.31 trillion, a figure that has increased by $100 billion over the last two weeks. It is entirely logical that depositors are leaving banks that are paying below market rates to park their capital in money market funds, which are essentially just vehicles that invest in short-dated U.S. Treasury bonds.

If you compare the interest rate on short-duration Treasury bonds to what many regional banks were paying on deposits, it’s no wonder that deposits have fled. As the Fed’s rate hike cycle developed, the small leak in regional banks’ deposits turned into a flood, all while holding long-duration assets that had massive unrealized losses (relative to historical norms) along with a mix of toxic commercial real estate exposure.

Make no mistake, the Fed knows the effects that these rate hikes will have on the system. If you want proof that they fully understand the consequences of their actions, look no further than a quote from none other than Jerome Powell in 2012, then on the Board of Governors at the Fed.

“Second, I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk,and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.” — Jerome Powell, 2012, FOMC Meeting Transcript

In this case, the investors are the very banks that underpin the American economy.

In February, the Fed published an internal report “Board Briefing on Impact of Rising Interest Rates and Supervisory Approach” that was released to the public in April. The report showed that banks suffered a historic amount of unrealized losses as a percentage of tier 1 capital as a result of the rise in interest rates on the long end of the yield curve, with over 700 banks having suffered unrealized losses exceeding 50% of their capital by the third quarter of 2022.

Just maybe, these banks that suffered massive unrealized losses were misled by the very same institution that is currently decapitating them one by one.

“The Federal Reserve foresees the economy accelerating quickly this year yet still expects to keep its benchmark interest rate pinned near zero through 2023, despite concerns in financial markets about potentially higher inflation.” — Fed expects to keep its key rate near zero through 2023, AP News, March 17 2021

Friday Short Squeeze

Turning our attention back to the action in the market, the very same regional banks that faced immense pressure for much of the week have seen quite an impressive move higher today.

As a rumor of a ban on short-selling bank stocks began to spread, it induced a massive short-squeeze rally among the most beaten up names in recent days, as much of the market activity was driven in part by speculators looking to find the next dead body in the banking sector.

Despite being down more than 35% year-to-date, regional banks are more than 10% off yesterday’s lows as a result of the squeeze.

Similarly, amid the panic on Wall Street this week, rumors began about the possibility and plausibility of officially increasing FDIC insurance, with the government already showing their willingness to cover uninsured depositor losses in the SVB debacle.

The result of the weakness in regional banks is further consolidation of the sector into the main banking conglomerates, increasing centralization while also creating a de facto nationalization of the sector.

What this shows is that banking is now a system where risks are rewarded with profit while any losses are implicitly backed by the use of the money printer. Under a system where deposits are fully backed by the money printer, banking is a practice where profits are privatized, while the losses are socialized in the form of currency debasement.

Final Note

Peel back the onion and analyze the situation for what it is:

There are approximately $200 billion of funds insuring approximately $10 trillion of “insured deposits.” With the recent calls to insure all funds in the banking system, the number moves to $17 trillion.

Now consider that the Treasury General Account has a mere $188 billion in its coffers and bipartisan politics keep the U.S. from issuing more debt while the national debt is pinned at its ceiling (at least temporarily).

It’s simply a confidence game. The bank’s don’t have enough liquid capital to fulfill everyone’s withdrawal request if they asked, which is why regulators and public officials are going to great lengths to signal strength and issue reassurance on the resiliency of the system, when in reality it is anything but.

This is fractional reserve banking at its finest. It works until confidence is broken, and once that happens, things can unravel quickly. Do not be fooled by such notions such as “guaranteed deposits” or “deposit insurance”, as all this means is that if push comes to shove, money will be printed to plug the gap. It is that simple. You do not need a PhD in economics to comprehend the fragility of such a system.

Counterparty risk and debasement.

Both are inevitabilities of the incumbent fiat monetary experiment, and it is quite literally the very thing that bitcoin was engineered to solve.

Follow the signal.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Great!

Great piece. Makes sense as to why the US needs to shut down the crypto fiat on/off ramps as well, just like they did with banning gold in the past.. now it’s just a ban on digital gold.