Using Bitcoin Derivatives To Discern Speculation From True Momentum

We unpack recent developments in the bitcoin derivatives market, as well the dynamic between bitcoin and the legacy financial system and the potential for "decoupling" between the two systems.

Relevant Past Articles:

State Of The Derivatives Market

Today’s issue will cover some of the recent action in the bitcoin derivatives market, as well as touch on the evolving relationship between bitcoin and the legacy financial system.

The action in global capital markets has been intense over the last week, with massive volatility across currencies, more selling in bonds, and a brief bullish deviation for bitcoin, which excited the bulls.

As bitcoin pushed back above $20,000, there was some chatter of a potential decoupling, as bitcoin was up over 7% while U.S. equity markets were down approximately 4% over the last week. While we would certainly love to see a moment where bitcoin finds relief during an increasingly tumultuous environment in the legacy financial system, we remain skeptical on this outcome over the near future, as the data just doesn’t support it.

We cannot emphasize enough that the current trading environment for bitcoin is less about bitcoin itself and more about the dollar. As yields across maturities and currencies are soaring higher, the value of global assets is collapsing in tandem, which will subsequently lead to a day of reckoning where everything sells in tandem.

As we like to say it, the everything bubble is unwinding, as the asset sitting at the base of it all, the U.S. Treasury bond, continues to bleed.

Let’s return back to bitcoin for a moment. What was the period of outperformance from, and can we expect more of it soon?

The simple answer is that the type of buying that was occurring — long positions in the bitcoin futures market — is never one of sustainable nature.

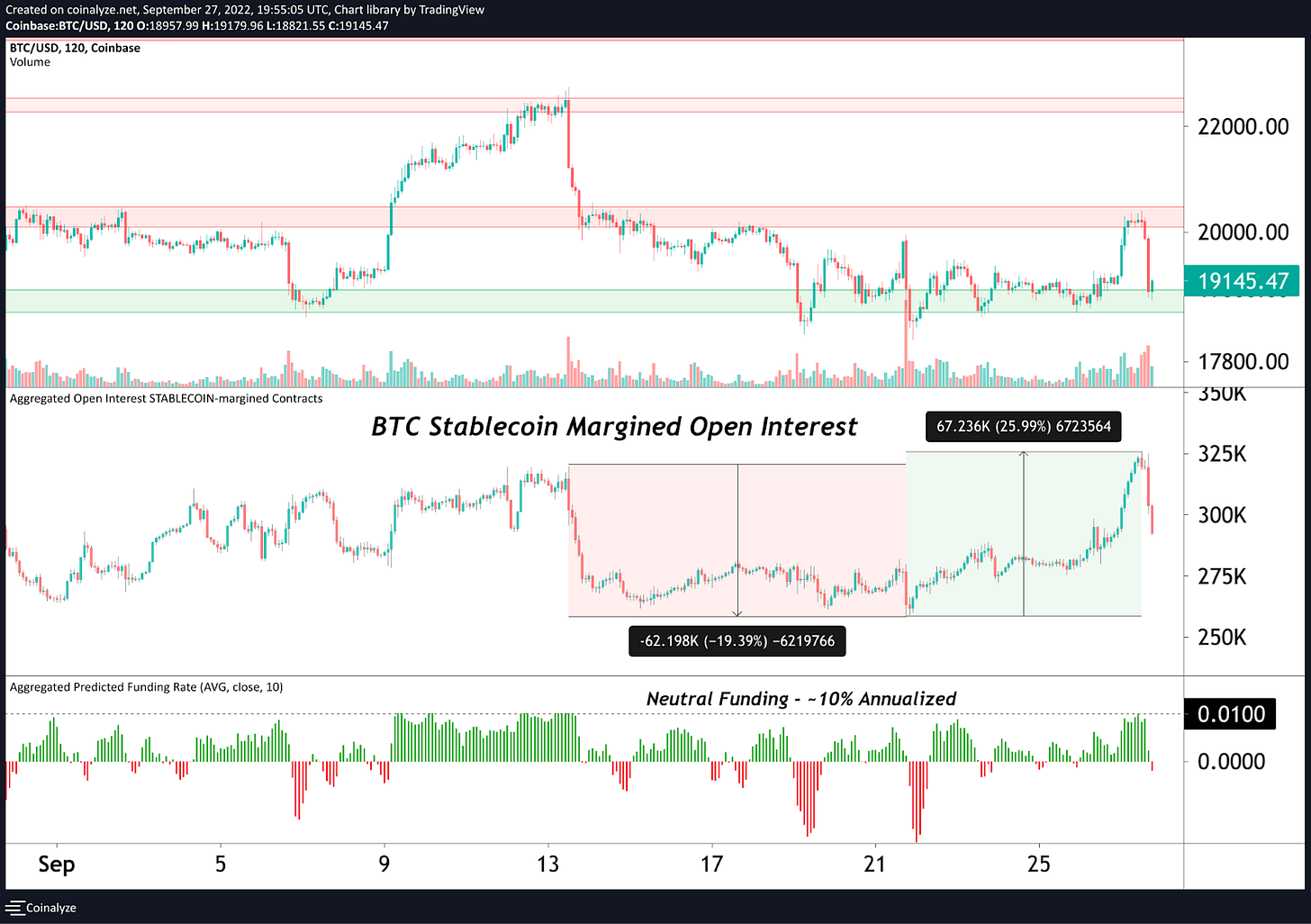

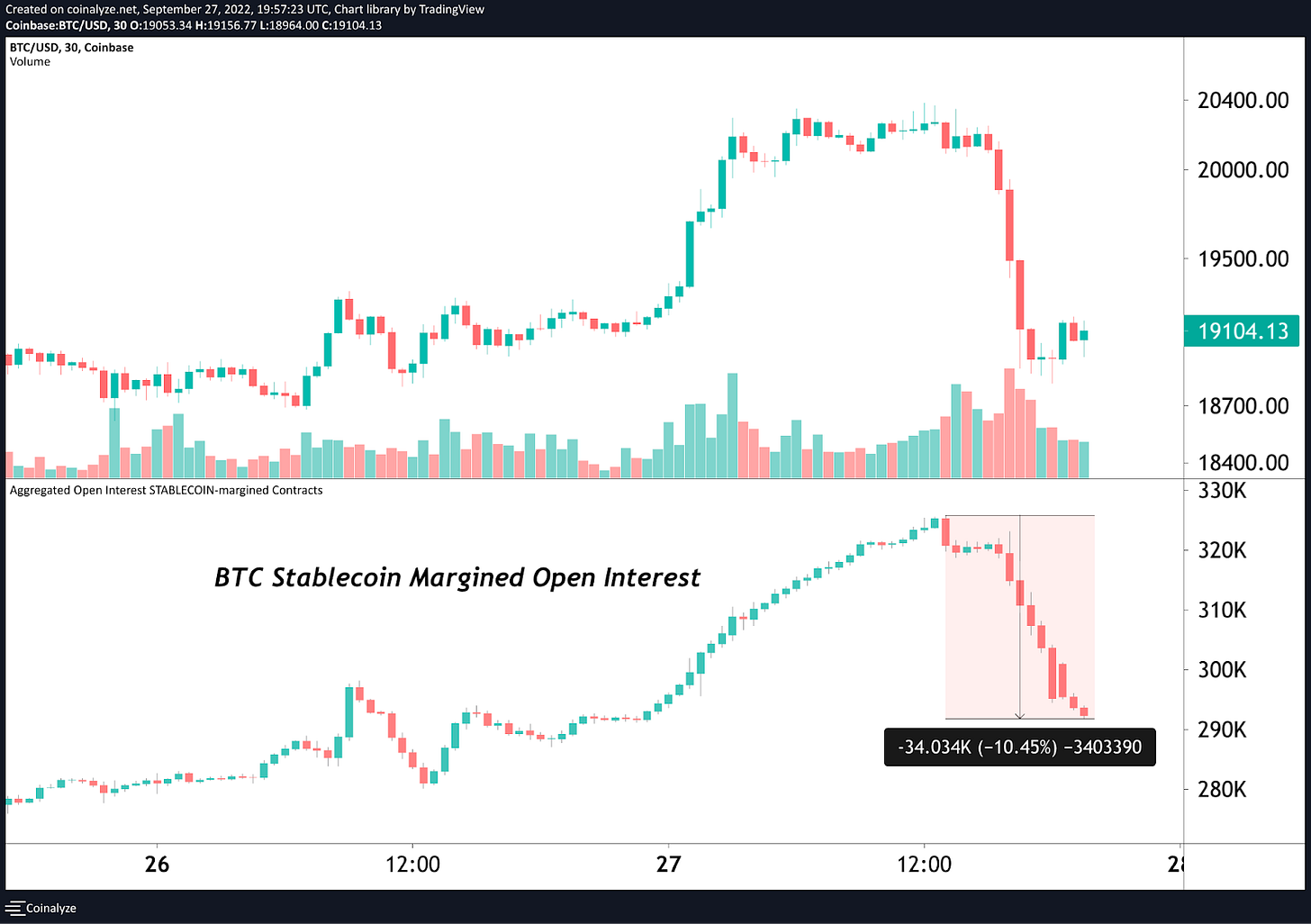

The above post, referring to the surge of open interest in tandem with price action yesterday evening, was a plea to the celebratory bulls, that the spot market better start buying, or the bears will rear their ugly head.

Tens of thousands of bitcoin worth of net buying became net sellers in hours, as the surge in open interest that led to the increase in market price quickly fell underwater.

Our belief in regards to the bitcoin derivatives market and its insight into the state of the market cycle is the following:

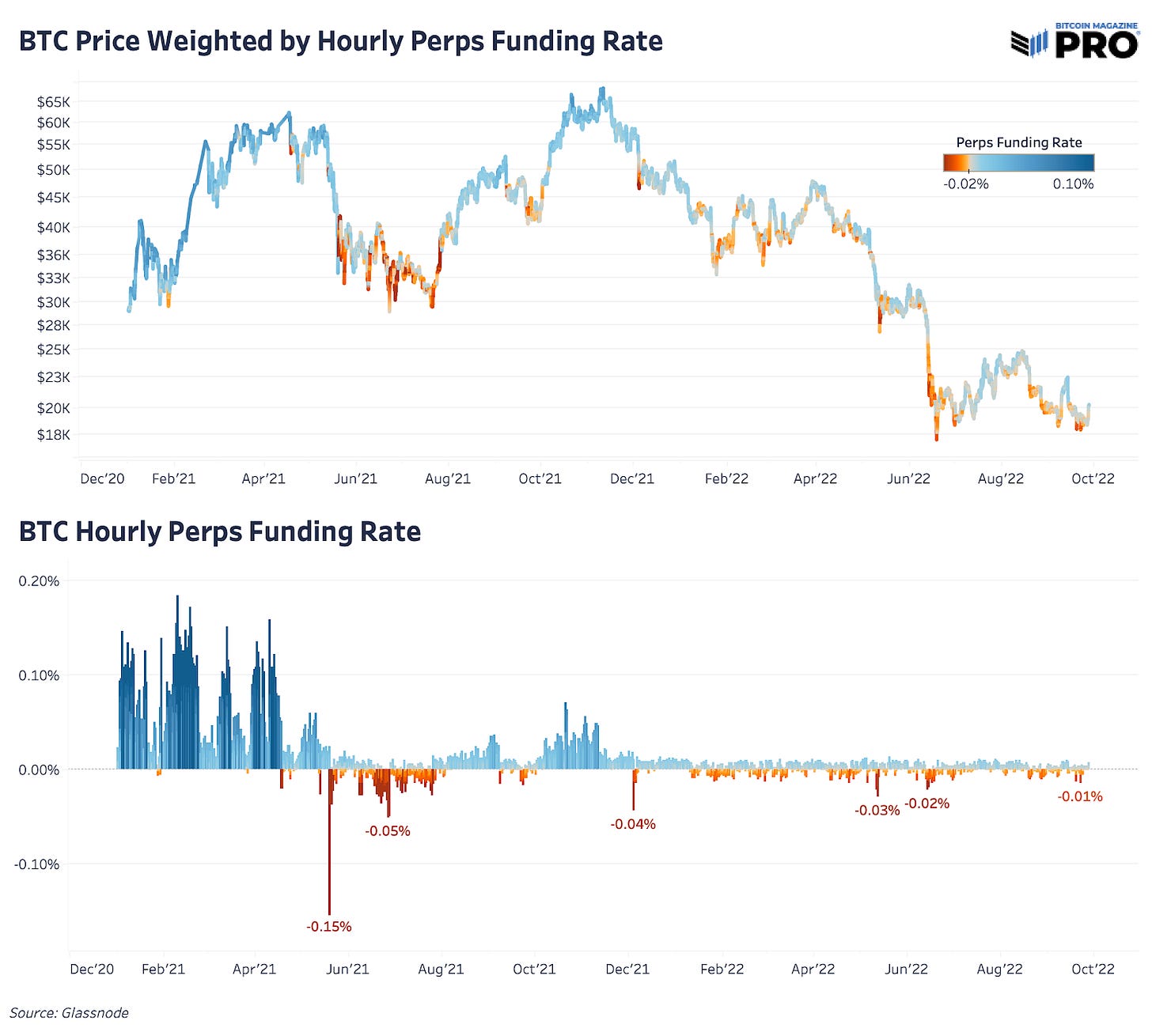

When the variable interest rate is significantly negative, the brunt of the spot selling and leverage unwinding has occurred. The variable interest rate across the perpetual futures complex can give us insight as to whether the bulls or bears are overaggressive.

When the funding rate is significantly negative, it can be because of both closing long positions driving the price below the spot market or due to aggressive short positions pushing the price lower. The funding rates in today's market environment are much more muted than the craziness seen in 2021.

Our expectation is that a volatility in legacy markets would lead to a large liquidation in bitcoin derivatives, driving the price below spot markets, while short traders piled on. This would be seen by a drastically negative perpetual futures funding rate (variable interest rate that incentivizes traders to settle prices close to the spot market rate).

We haven’t seen that, in terms of the level where the 2020 and 2021 markets bottomed. Bitcoin typically finds an absolute bottom when the following happens:

The marginal spot seller is completely exhausted as derivative traders (both longs closing and new short positions opening) drive prices into the ground. This is what the data tells us.

Given our increasing conviction in a volatile ending to the current conditions developing in legacy markets, that opportunity is likely to arise over the coming months/quarters. Similarly, due to deteriorating global economic conditions, spot sellers of various sizes are likely to arise in the coming months.

One can only imagine the market calamity that would arise from a run at previous lows with a near record amount of bitcoin-denominated open interest in the liquid futures market.

We will make sure to update readers on the evolving nature of the bitcoin derivatives market and its positioning frequently as the elements develop and change. Our analysis leads us to believe that bitcoin will bottom during a time when futures prices are significantly skewed to the downside relative to spot, and short positions are paying large amounts to their long counterparts to take on positions.

The market isn’t there today, in our estimation.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section.