The Daily Dive #137 - Bitcoin Below $40,000

What's Next For Bitcoin After Break Of $40,000?

The price of bitcoin at the time of writing is $38,700, as the risk-off across asset classes continues, with big names in equity markets getting pummeled, especially the high multiple tech sector.

So what does this mean for bitcoin, which is touted by many as an “uncorrelated asset” or a store of value? What good is a store of value that drops in tandem with everything else?

While the answer is quite nuanced, we’ll do our best to break it down today and use historical precedent to lay out possible future scenarios.

The Workings Of A Credit-Based Monetary System

All fiat money is created through lending. To repeat, every dollar in circulation was lent into existence, and thus as a prerequisite, that debt must be repaid (plus interest). This means that when debt is repaid or defaulted upon, that money is “destroyed” - often called credit contraction. While it is healthy to have an economic system where malinvestment gets liquidated and eradicated from the system, a contracting money supply can have spiraling negative effects on the entire economic system, as deflationary pressures on one person's balance sheet lead to the weakening of their counterparty's.

With this in mind, when looking at the past 40 years of monetary policy, it becomes evident that every deflationary event where credit began to contract was met with stimulative monetary easing in the form of lower interest rates.

This has the effect of lowering interest expenses and lowering real debt burdens across the economic system, which stems the deflationary forces (for the time being).

But today we find ourselves in an environment where real yields (yields after inflation) are deeply negative, and the typical playbook of counteracting deflationary forces is no longer an option (due to reaching the lower zero bound of the Fed’s funds rate).

Thus, central banks have turned to quantitative easing, the act of buying bonds with printed money, as a stimulative policy. This policy boosts asset prices by lowering yields further. The Fed knows that deflation cannot be allowed to take hold with a record amount of debt across the global economic system. To make a long story short, without ever increasing credit expansion, a deflationary event would take hold and the entire global economic system would collapse upon itself.

If we look to the last event where credit markets began to seriously unwind, how did bitcoin react? During March of 2020, with global markets tanking across the board, bitcoin dropped in price by 60% in a matter of a month.

Many declared bitcoin a failure as it failed to serve as a “store of value” during an economic crisis. Interesting enough however, was that bitcoin bottomed first compared to equity markets, and had increased by 40% from the lows by the time that equities ultimately bottomed.

What To Watch For

If things continue to get ugly in equity markets, keep an eye on the VIX, which is a volatility index for the S&P 500.

If stocks continue to drop, it will likely lead to continued weakness in bitcoin. The real question is what is the threshold where bitcoin derivatives markets face cascading liquidations, which is what worsened the sell-off in March of 2020.

A look at the perpetual futures funding rate, which is positive or negative depending on where the contract is trading relative to the spot bitcoin market, displays this dynamic:

Cascading liquidation events drive bitcoin derivative contracts far below the spot price, which is why funding goes negative following large long liquidations.

It needs to be reiterated that everything is probabilistic in nature, and nothing is a sure thing to occur, but if the stock market sell-off worsens, a framework similar to the March 2020 event will likely do you well.

Max opportunity lies if a mass liquidation event occurs, as this would likely be viewed after the fact as a generational buying opportunity.

While the market is less leveraged today than it was going into March 2020 (given the roughly 40% drawdown that has already occurred), there is still a long bias that is present.

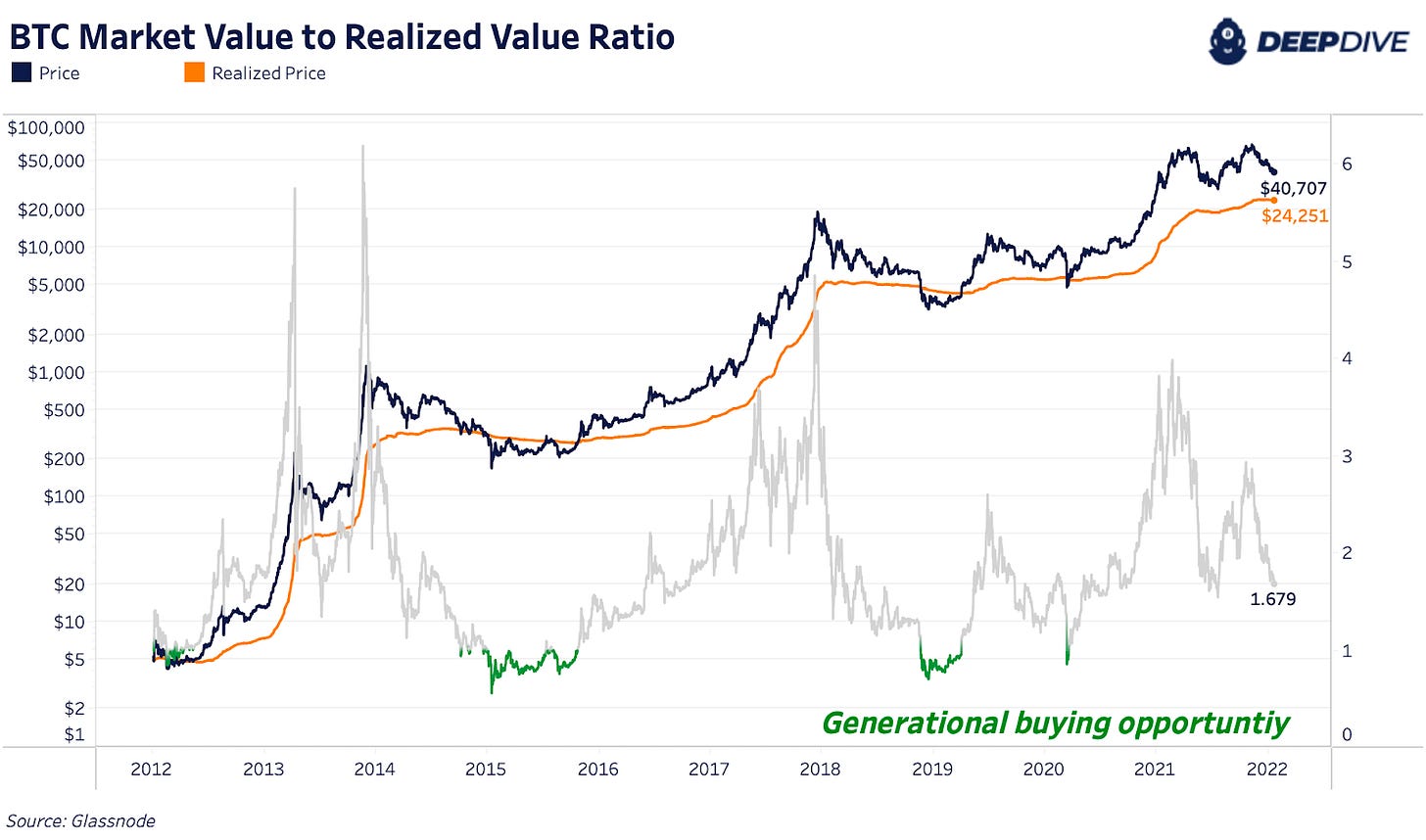

From an on-chain perspective, the cost basis of investors is approximately $25,000, and the opportunity to buy bitcoin at its realized price has previously served as a generational buying opportunity.

The reality of the current situation is that all assets are driven by the central bank liquidity spigot, but one must extrapolate out and focus on the end game.

How can one maintain (and grow) their capital’s purchasing power in a world of perpetual credit expansion?

An absolutely scarce monetary asset, with a production cost engineered to trend towards infinite, with its own native property rights built in is your answer.

Short term macro correlations present an opportunity to convicted long-term investors with a fundamental understanding of the asset’s monetary properties and assurances.

Buy the dip.

36.7K now...give me 29-30K BTC and 15$ MARA and my ongoing accumulation will be complete, at which point im heading off into the wilderness for about 6 months with no electronics or internet -- upon return ill find either millions or destruction but ill be too zenned out to care.

alexa play get rich or die trying. yes alexa, the whole album

ok f**k it im back on here with a paid sub despite you fudding my MARA bags (im still accumulating. catching the falling knives.gif). i gotta give it up to yung Dylan for the clearheadedness youve shown these 2 months. if you were paying attention to this kid, you wouldve taken measures when he started giving DXY based warnings back in late November ....