The Daily Dive - Negative Derivatives Sentiment

Derivatives Market Update

Today we’ll cover the latest in the bitcoin derivatives market. At the time of writing, the price of bitcoin is up approximately 8% over the previous day’s time. When analyzing the derivatives data, the previous two months have brought about a regime of periodically negative funding, showing the caution shown by market participants during a period of macroeconomic uncertainty.

Shown below is the funding rates annualized, with approximately 10% annualized being the market neutral rate to go long. As we stand today, funding rate sentiment emphasizes a skewed, below-neutral sentiment to the downside since late January.

For additional context, here is the daily average of perpetual swap funding rates since the start of 2020:

It is noteworthy that previous regimes of derivative bearishness saw funding rates go much deeper into negative territory, which could speak to the maturation and institutionalization of the asset class.

Similarly, quarterly futures annualized basis continues to fall, while price notably caught a bid.

Equities indices are also trading up by approximately 3% today, which is likely to have contributed to the positive price action seen in the bitcoin market.

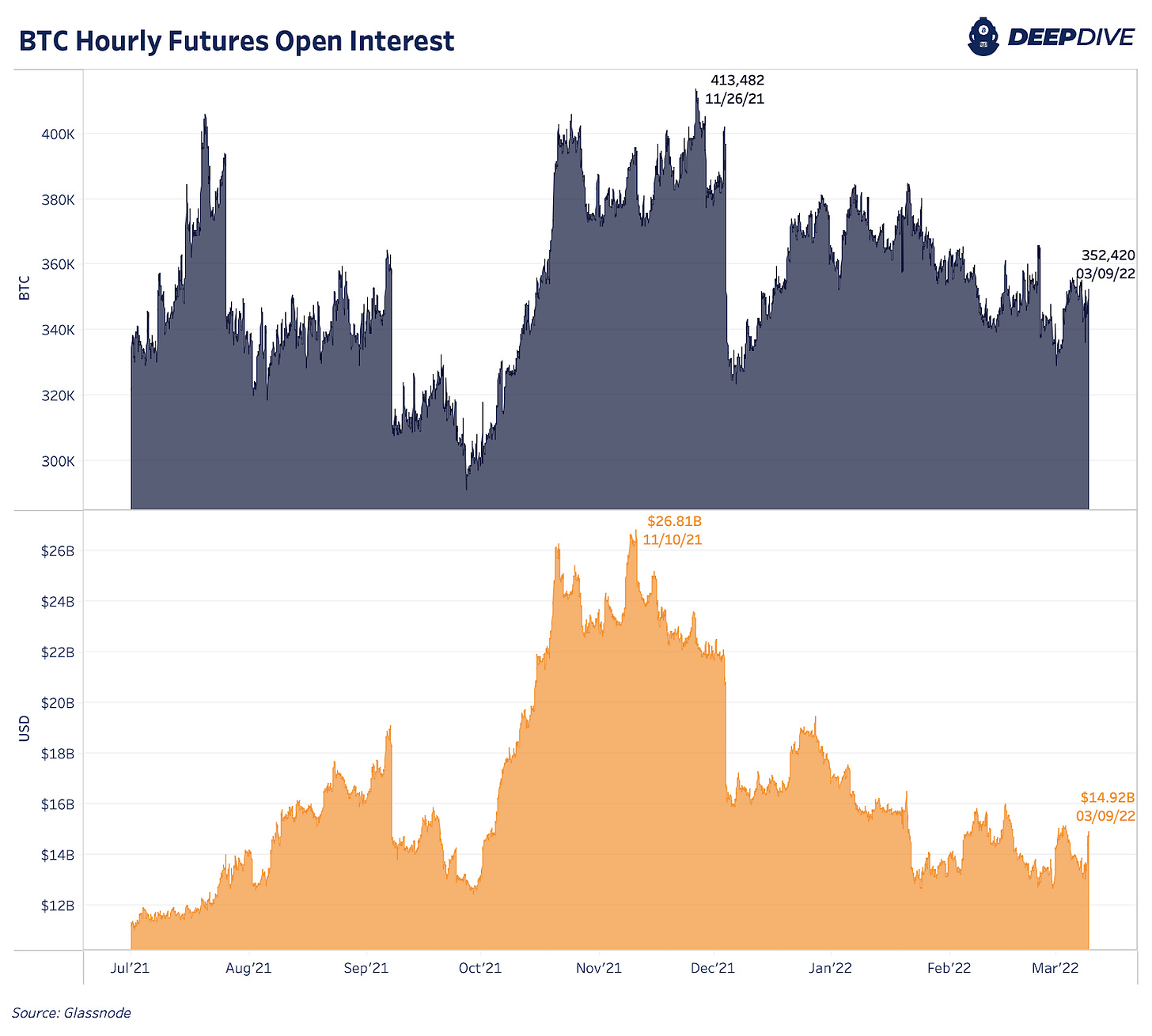

As for the level of open interest in the derivatives market, it continues its downtrend since November in both BTC and USD terms. Open interest is down 14.76% and 44.34% respectively. With the falling annualized rolling basis, this is another way to view the structural decline of the risk appetite demand for bitcoin over the last five months.

We see the same trend looking at just the perpetual futures open interest which accounts for nearly 67% of the total futures market, BTC-denominated open interest:

Aggregate futures open interest has been in decline since November in dollar terms and since January in BTC terms, as investors' appetite for risk has diminished with the increased macro uncertainty.

Continued outperformance in the bitcoin market could be seen as an inflection point for asset allocators and their treatment of bitcoin as a risk-off/risk-on asset. As for now, bitcoin continues to trade as a risk-on asset while many macro indicators continue to signal a risk-off environment.