The Debt Ceiling: It’s Going Up Forever

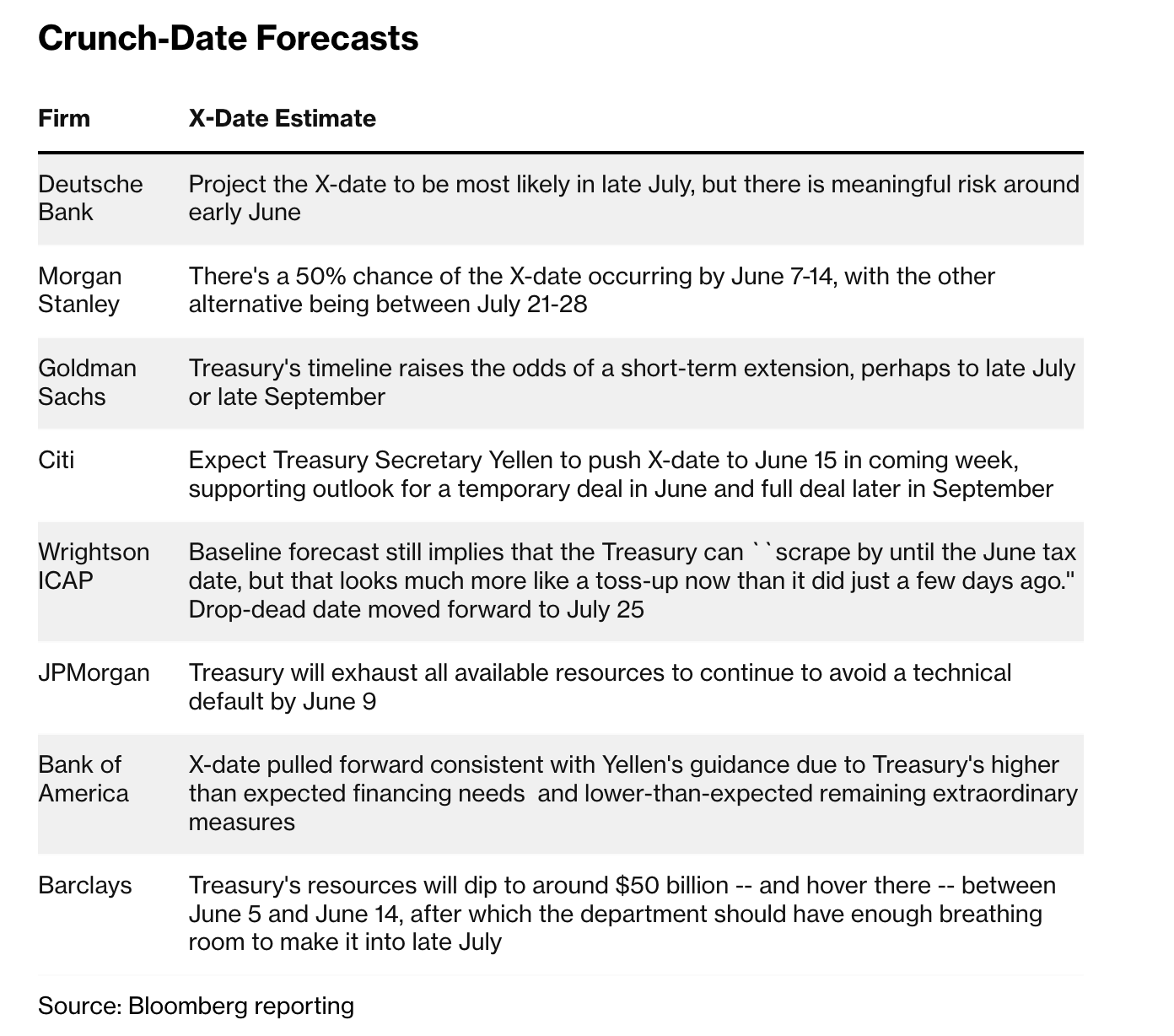

Debt ceiling dynamics are back as the X-date approaches in the United States. We break down the potential market impacts of various resolutions and what might happen to the bitcoin price as a result.

Relevant Past Articles:

Quantitative Easing Or Not? A Primer On The Fed’s Shiny New Tool

The Bond Market Meltdown Continues: Where Are The Buyers For ‘Risk-Free’ Government Debt?

Debt Ceiling Resolution Approaches

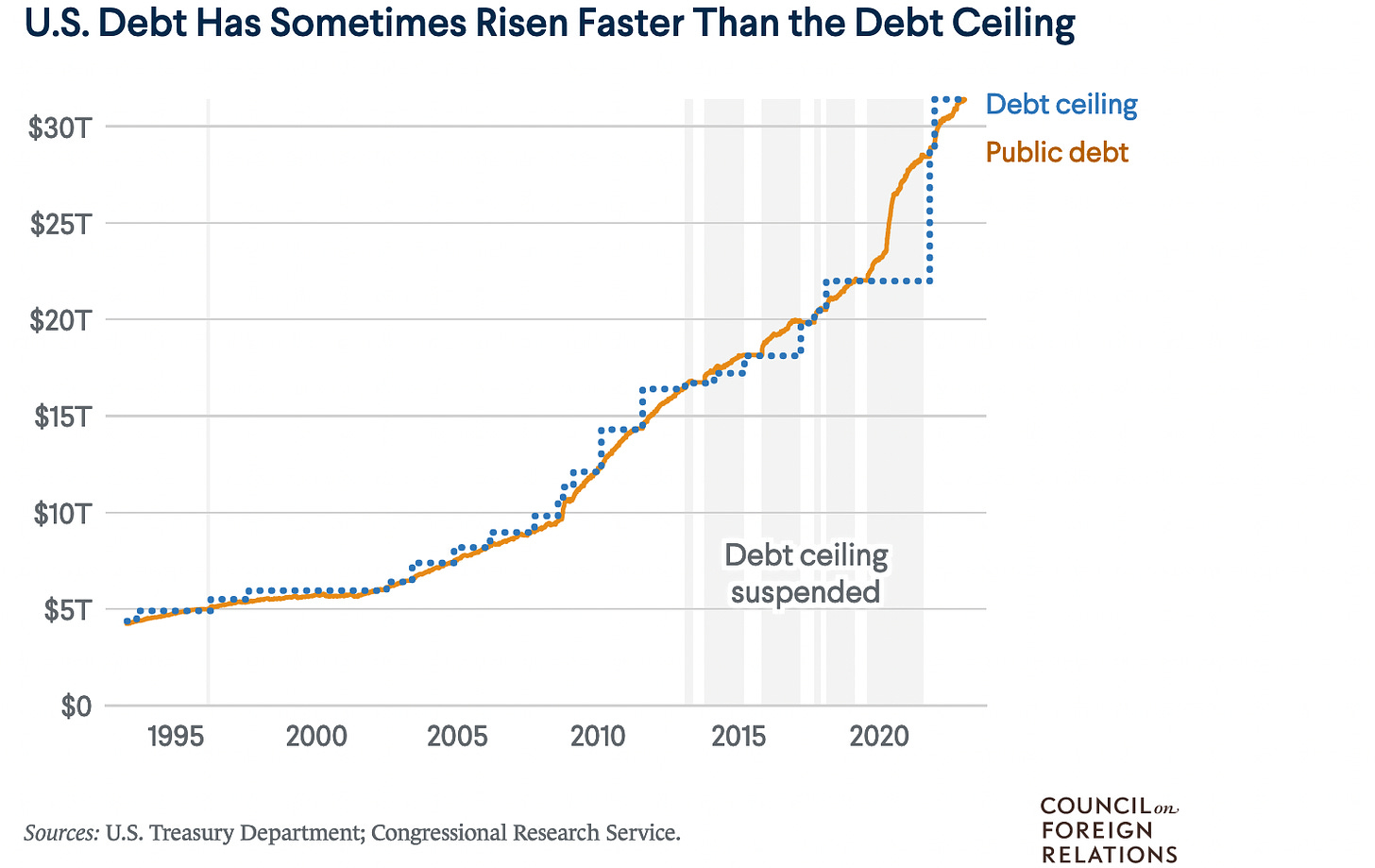

As with most years, the grandstanding and charade of approving the United States debt ceiling limit is back once again. Through its archaic mechanism and legal hoops, the U.S. has always found a way to “uphold the full faith and credit of the United States” by changing the limit for new debt issuance that’s already been previously approved by Congress. There’s always a small chance that the U.S. government doesn’t approve the debt ceiling and defaults on its debt but that path is extremely unlikely. Either way, there are concerns and ensuing market developments that are worth analyzing to see how different scenarios may play out.

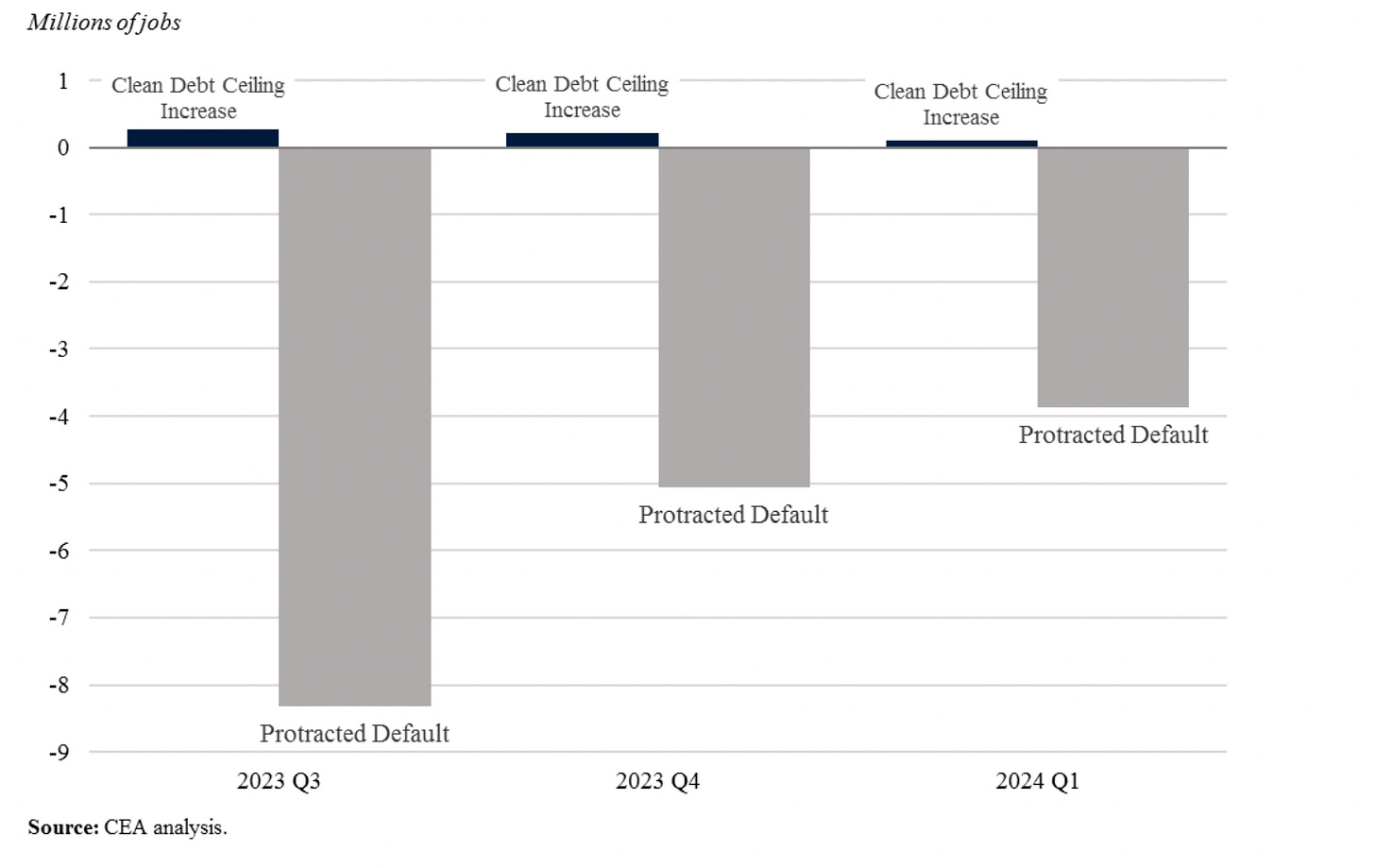

Let’s start off with the worst case projections highlighting why the debt ceiling must be resolved. The White House released analyses earlier this month from the Congressional Budget Office, Department of the Treasury and the Council of Economic Advisors which highlights the economic severity of a potential U.S. protracted debt default. The key takeaways in their worst case are:

Immediate, sharp recession on the order of the Great Recession, GDP will fall 6.1% in Q3.

Unemployment will increase by 5% with over 8 million job losses in Q3 alone.

Widening CDS spreads which will lead to increased volatility in equity and corporate bond markets and inhibiting firms’ ability to finance themselves.

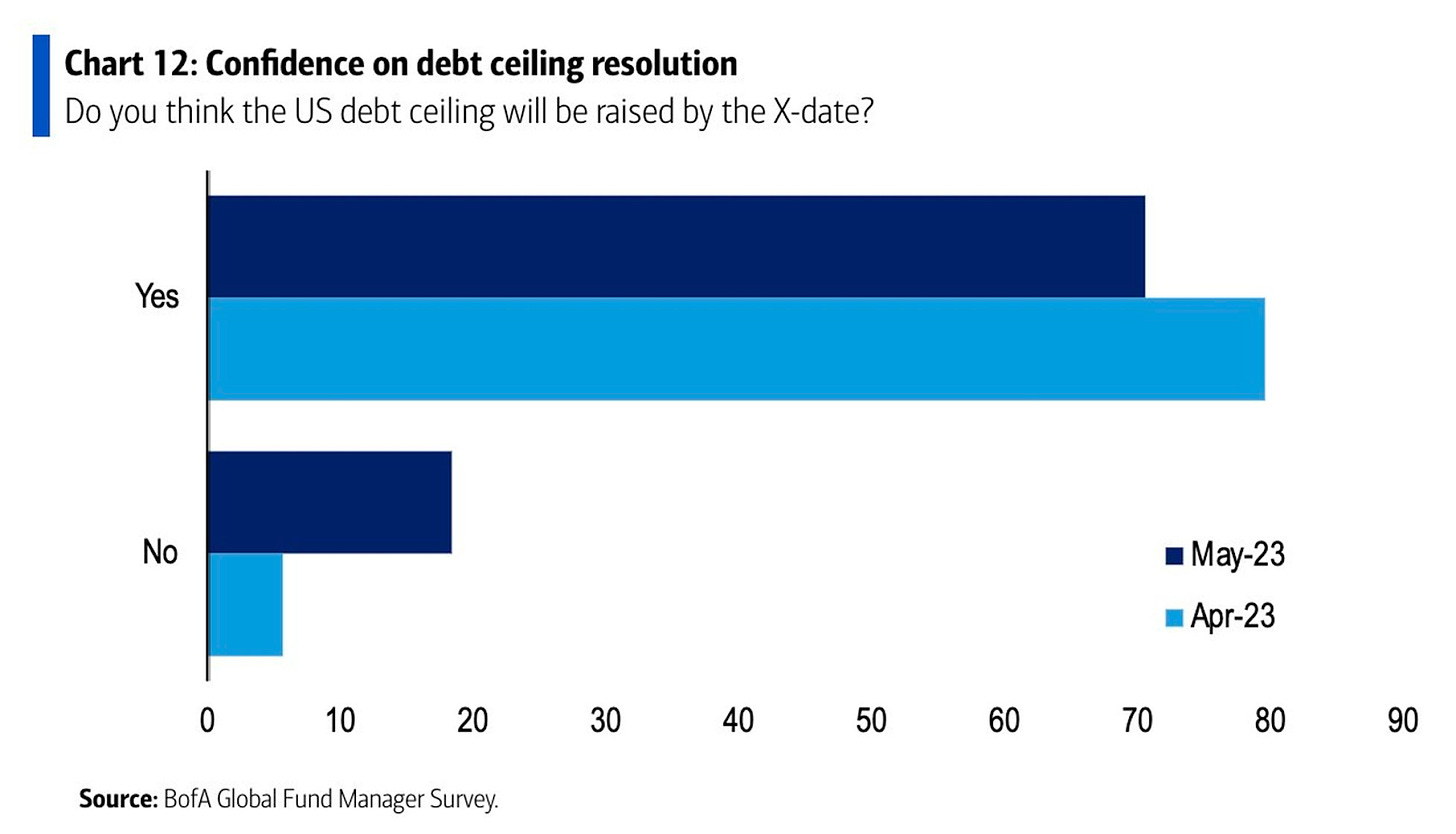

There’s widespread consensus among economists that a debt default would be catastrophic for the economy and this is the exact reason why Congress always approves the limit. This is the same sentiment across investors right now with nearly 70% of them saying they think the U.S. debt ceiling will be raised by the X-date. That sentiment has severely decreased compared to nearly 80% in April.

Passing debt ceiling limits and then subsequently increasing them at the last minute has become a more politicized process in the last decade. Doing so leads to more even volatility in financial markets as the potential for downgrades of U.S. credit rating and large shifts in interest rates can play out. This is what happened in 2011 when the S&P downgraded U.S. sovereign debt for the first time.

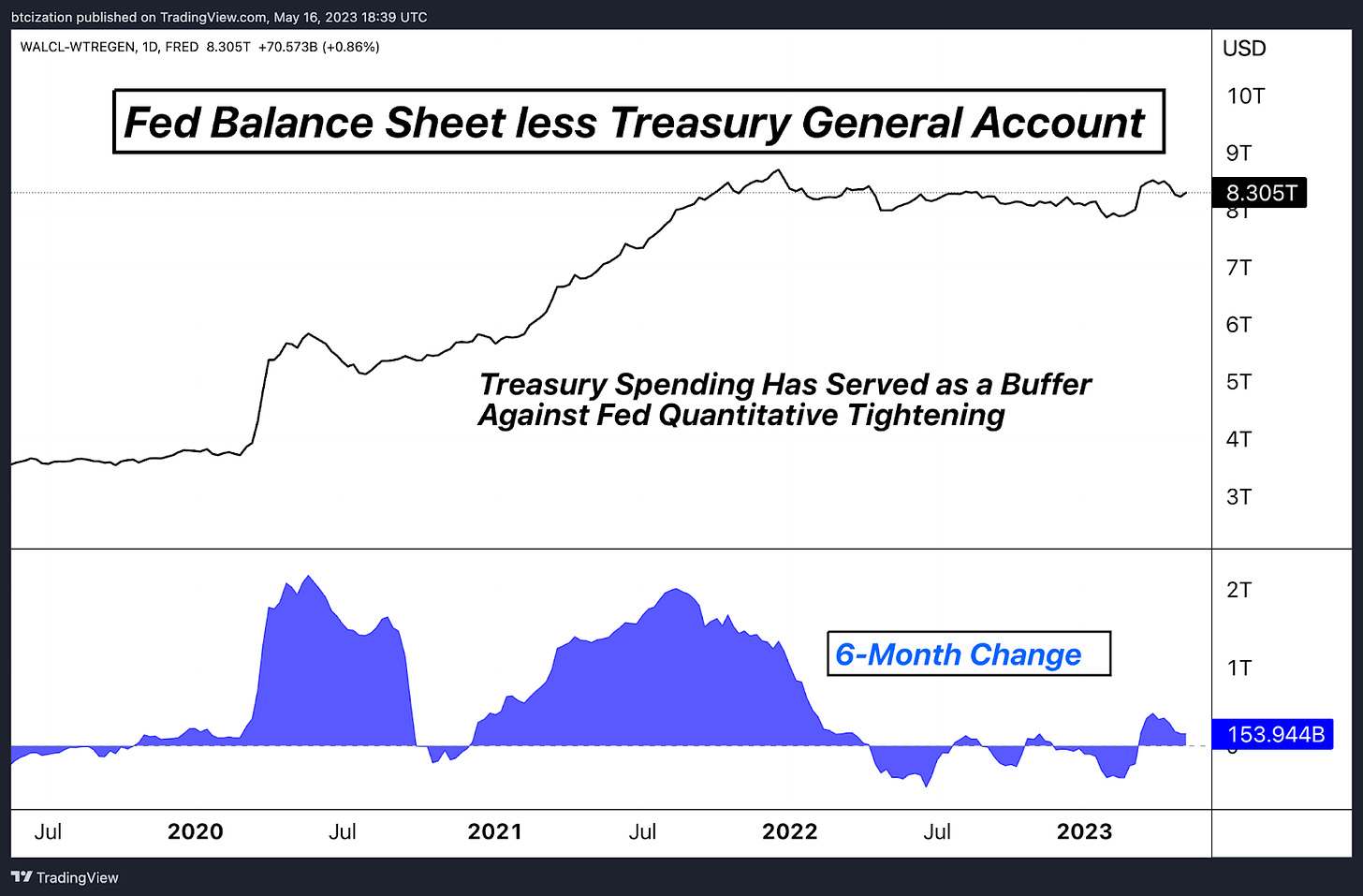

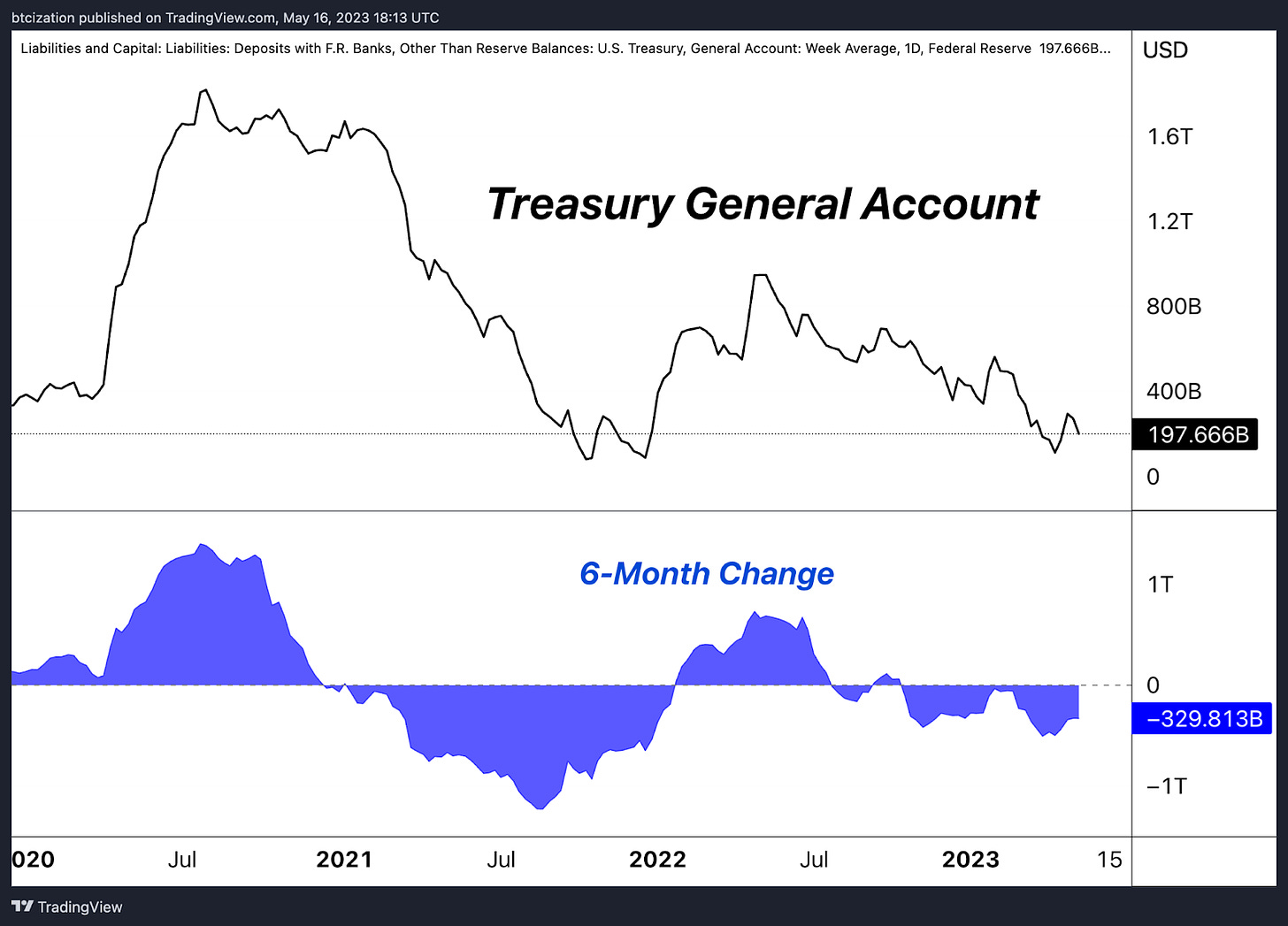

New debt issuance to fund and replenish the Treasury General Account can be either neutral or a net negative for overall liquidity depending on where the issuance comes from. In short, issuance can either come from bank reserves or the reverse repo account. Generally, reverse repo funds are ones that cannot take on longer-term duration risk, so it’s more likely to see new debt issuance be covered by existing bank reserves which would reduce overall liquidity. This depends on the duration of bills that the Treasury decides to issue.

Using the framework of net liquidity — the Federal Reserve balance sheet less the Treasury General Account and funds parked in the Reverse Repo Facility at the Federal Reserve — leading the trend for risk assets, a reduction in overall liquidity is not likely a boon to bitcoin’s valuation in the short-term. That being said, there are hints of changing sentiment among investors who are looking for a safe haven in uncertain times.

Surveys suggest professional investors most favor gold in this case, with some suggesting bitcoin over other major currencies. It’s still a long shot given the projections of the worst case scenario mentioned above. Bitcoin has certainly shown more of a correlation with gold this year, more so than equities so far, but there is a reasonable bear case for its performance in a deep recession.

What’s the probability of a U.S. debt default and what are the possible paths forward? Let’s dig in…

So far, the diminishing balance in the Treasury General Account has served as a buffer against the Federal Reserve’s quantitative tightening program. As mentioned above, an inevitable resolution to the debt ceiling would lead to a refill in the Treasury General Account in the form of additional Treasury bill and bond issuance, which would be negative for liquidity in financial markets on a net basis, unless the funds came from funds parked in the overnight repo facility. However, it is unlikely that this is the outcome, as funds parked in the reverse repo facility only have a duration of one day, essentially being an alternative form of cash earning a yield, whereas bills or bonds come with additional duration risk that investors may not want to take.

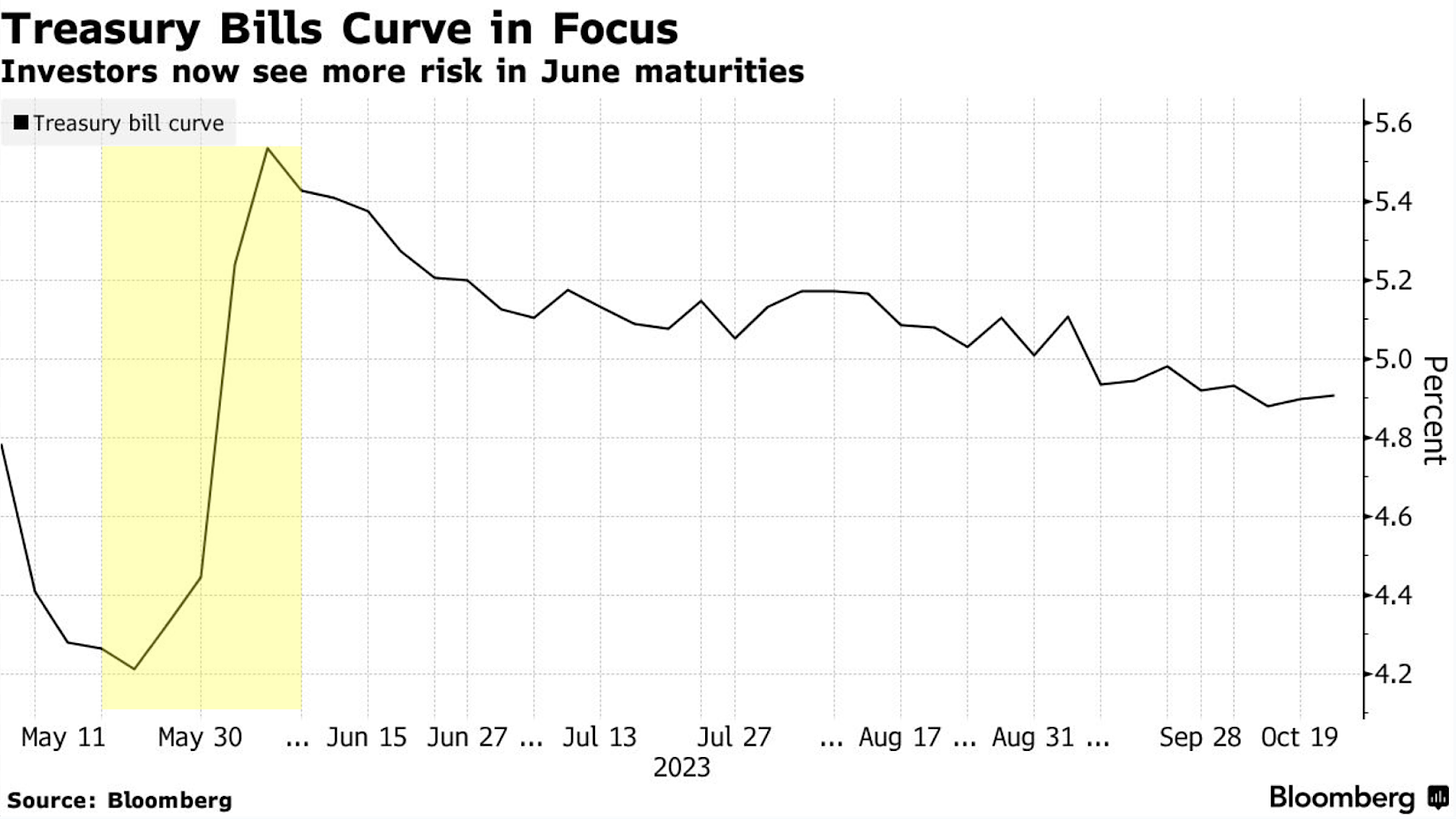

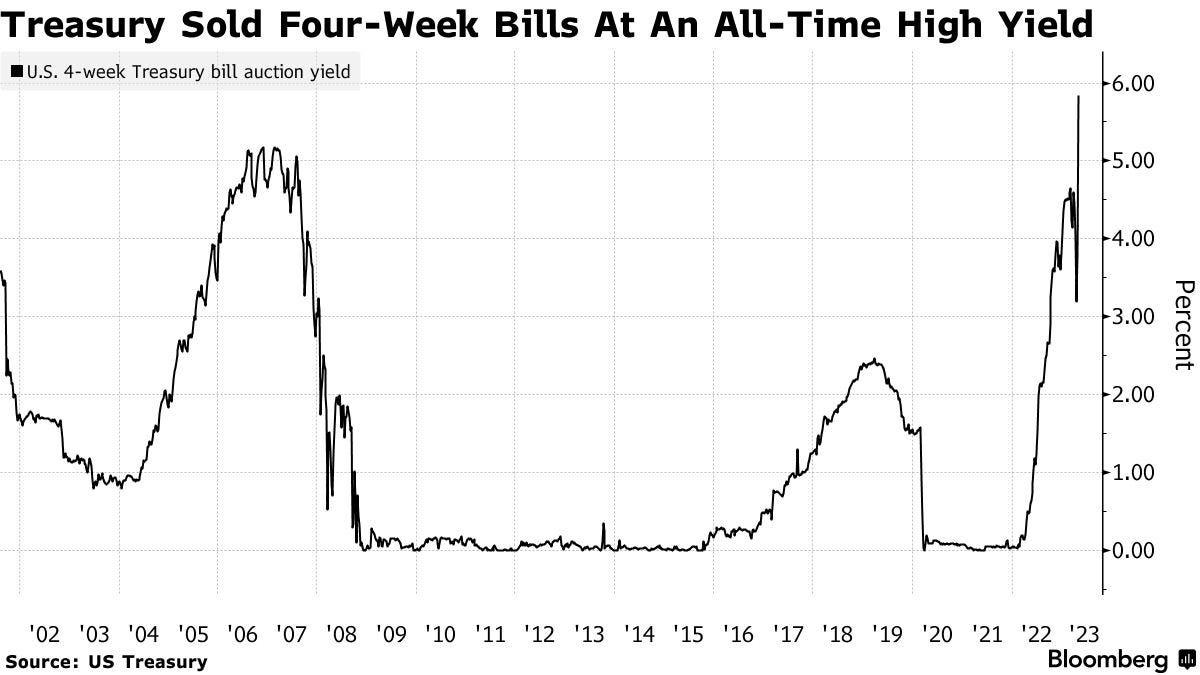

As markets brace for the small probability of a technical U.S. default, investors have skirted away from bills maturing after the debt default and piled into shorter duration instruments, creating quite an odd Treasury bill curve into the month of June, with 4-month T-bill yields hitting an all-time high.

Potential Short-Term Resolutions

The U.S. Treasury has recently leaned on one strategy which is an accounting gimmick in the form of “extraordinary measures." Extraordinary measures refer to a set of strategies that can be used by the Treasury Department to continue funding the government and avoid breaching the debt ceiling when the legal borrowing limit has been reached, essentially through the use of accounting loopholes. When the U.S. hits the debt limit set by Congress), the Treasury Department can't issue any more Treasury securities, which are the primary means of funding the government's activities. However, the Treasury can utilize "extraordinary measures" to create additional headroom under the debt limit.

These measures include:

Declaring a "debt issuance suspension period" for specific funds.

Suspending reinvestment in certain government funds.

Halting daily reinvestment of the Exchange Stabilization Fund.

Stopping the issuance of certain Treasury securities.

These measures are not designed to provide a long-term solution to the debt limit issue, but rather buy time for Congress to act by raising or suspending the debt limit. The length of time that these measures can stave off a default varies depending on a number of factors, including the government's cash flow and spending obligations. Once these measures are exhausted, the U.S. would potentially be in a position where it could not meet all of its financial obligations, which could lead to a technical debt default.

Final Note

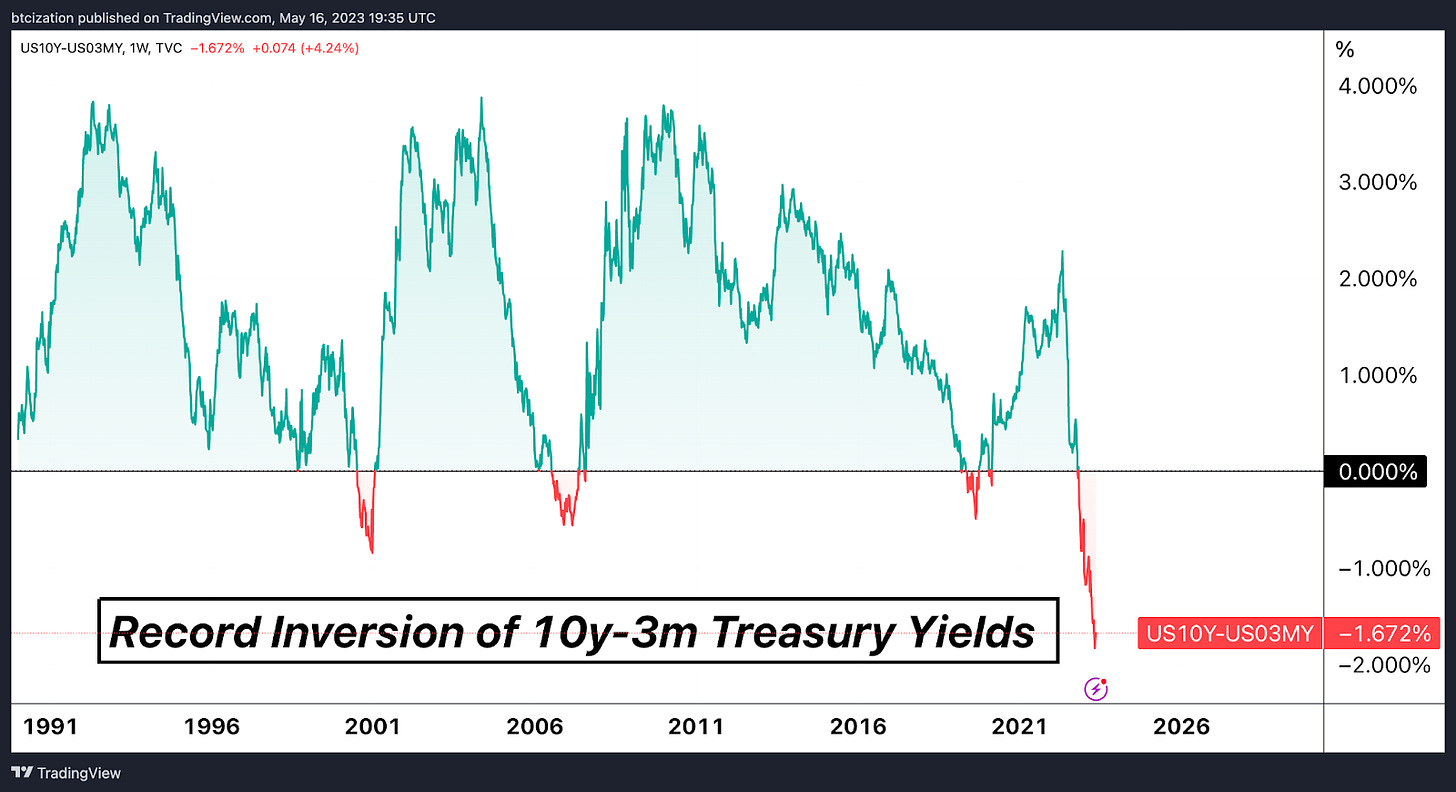

In the short-term, many short- to intermediate-term risks remain on the horizon for financial markets, regardless of the explicit path taken by Congress to address the debt ceiling. Contrary to many investors’ expectations, liquidity risks could escalate after the debt ceiling is increased, as opposed to before its raise because markets transition to an environment characterized by decelerated growth with decreasing liquidity when the debt limit is lifted due to new Treasury bill issuance. A solid assumption is that some degree of austerity is implemented as part of the agreement process. Looking at historical parallels, most of the equity market downturn in 2011 occurred post the debt ceiling agreement between President Barack Obama and Speaker John Boehner, accompanied by a flattening yield curve and declining growth expectations. A parallel situation might arise today, with liquidity constraints hitting markets at the same time as growth expectations dwindle while consumer savings diminish.

With respect to bitcoin, the short-term implications in the markets are uneasy, with a resolution for the debt ceiling likely taking net liquidity lower, and the unlikely scenario of a technical default likely leading to short-term panic in financial markets across the board.

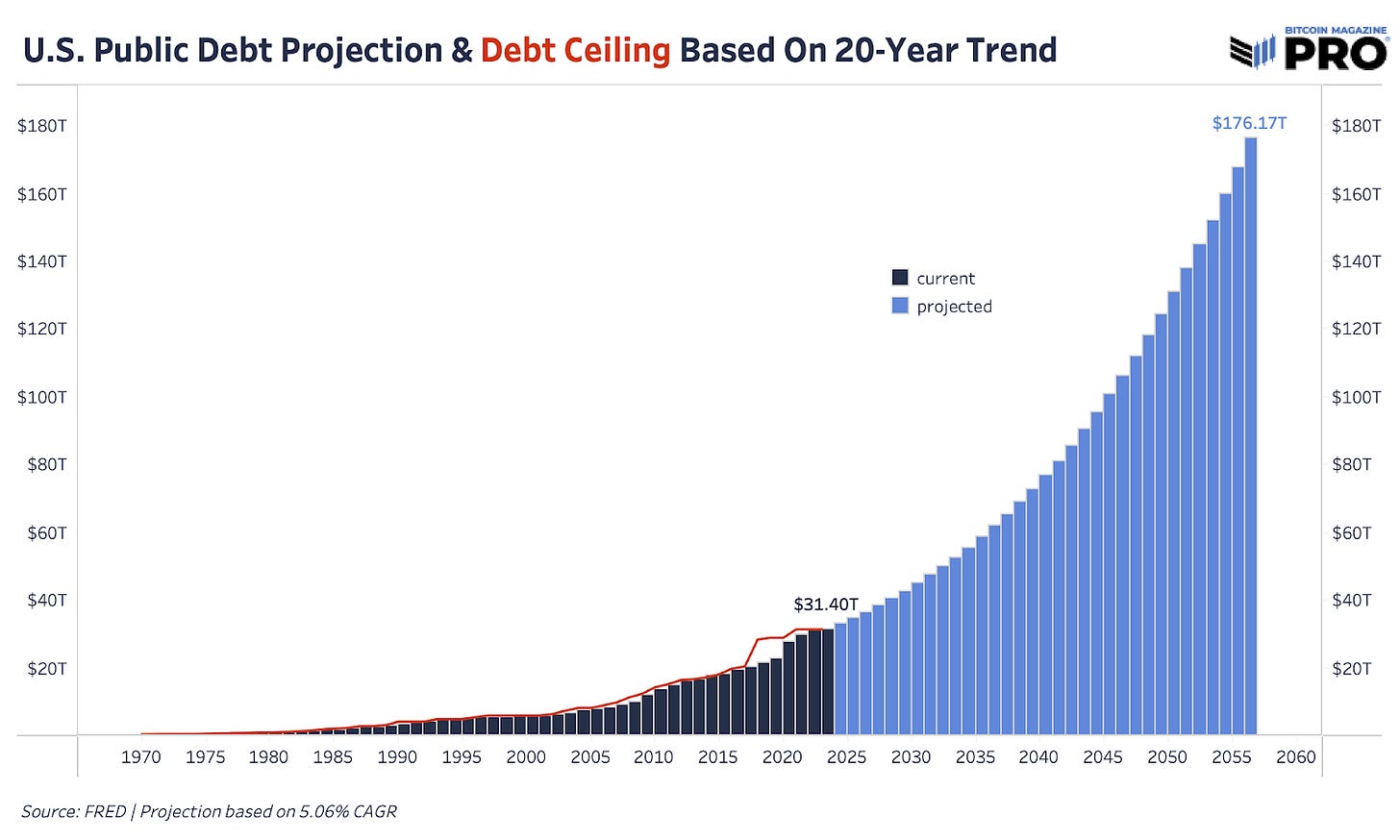

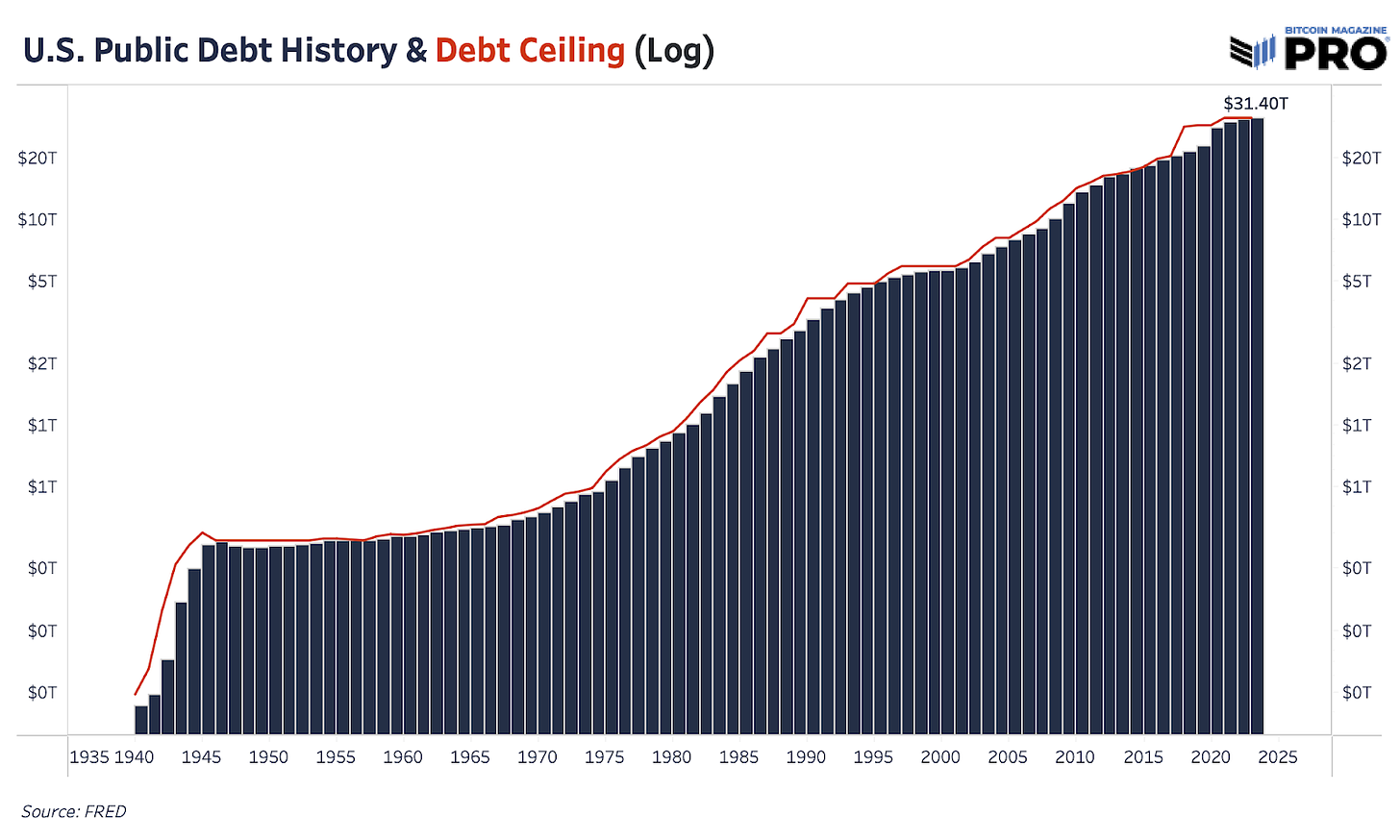

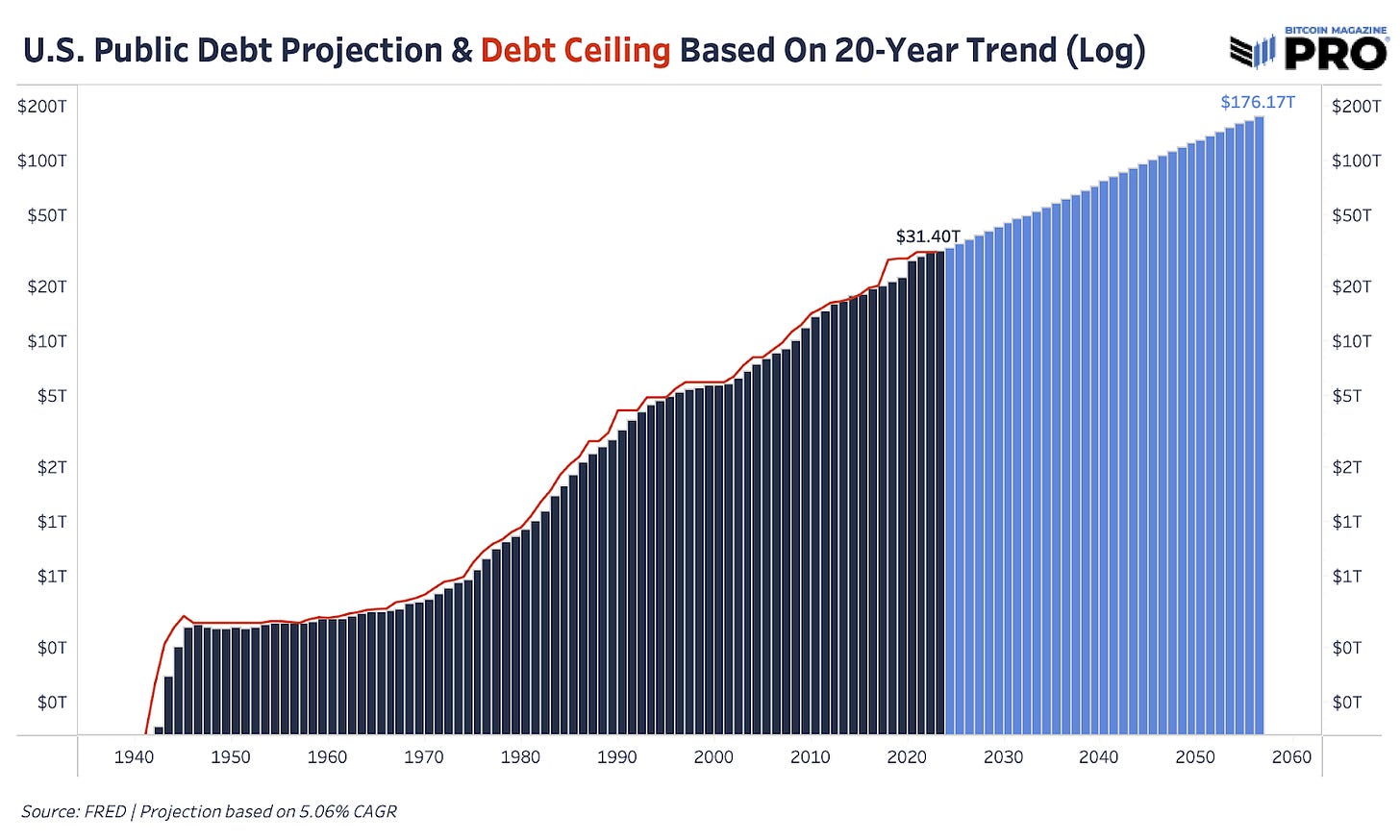

However, over the longer term, the entire debacle and political charade further ingrains the inevitability of perpetually increasing national debt limits and deficit spending into the minds of investors as they think about the allocation of their capital.

The national debt will continue to increase over any medium-to-longer-term time horizon and the compounding effects of the debt increase, especially with the debt-to-GDP ratio at such historically elevated levels, does not lead to good outcomes for the purchasing power of the dollar.

Political theatrics around a nonexistent debt “ceiling” only reiterate the value proposition of a non-sovereign, apolitical, monetary bearer asset with a fixed-cap supply. Short-term uncertainty is likely to bring volatility to the exchange rate across various asset classes, bitcoin included. Investors with long time horizons will happily capitalize on the opportunity.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

What's the percentage of bitcoin falling below $20k again?