Pt 2: What To Expect When You’re Expecting Volatility

Volatility thrives in uncertainty and historically, it proliferates in bear markets. We examine the volatility conditions of Bitcoin, S&P 500, and Nasdaq for insights into today's market environment.

Relevant Past Articles

Below is Part 2 of Tuesday’s article: “What To Expect When You’re Expecting Volatility”. Become a paid subscriber to receive all of our articles in full as they are released and to access our archive of 200+ research articles.

Part 2

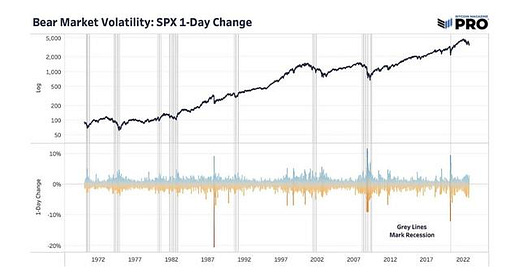

Even taking a more historical view back to 1970, we see more extreme periods of realized volatility and larger swings in 1-day changes playing out during bear market or recession-like conditions. The Nasdaq’s largest 1-day rallies in history have nearly all come in bear markets and are well over 7% moves.

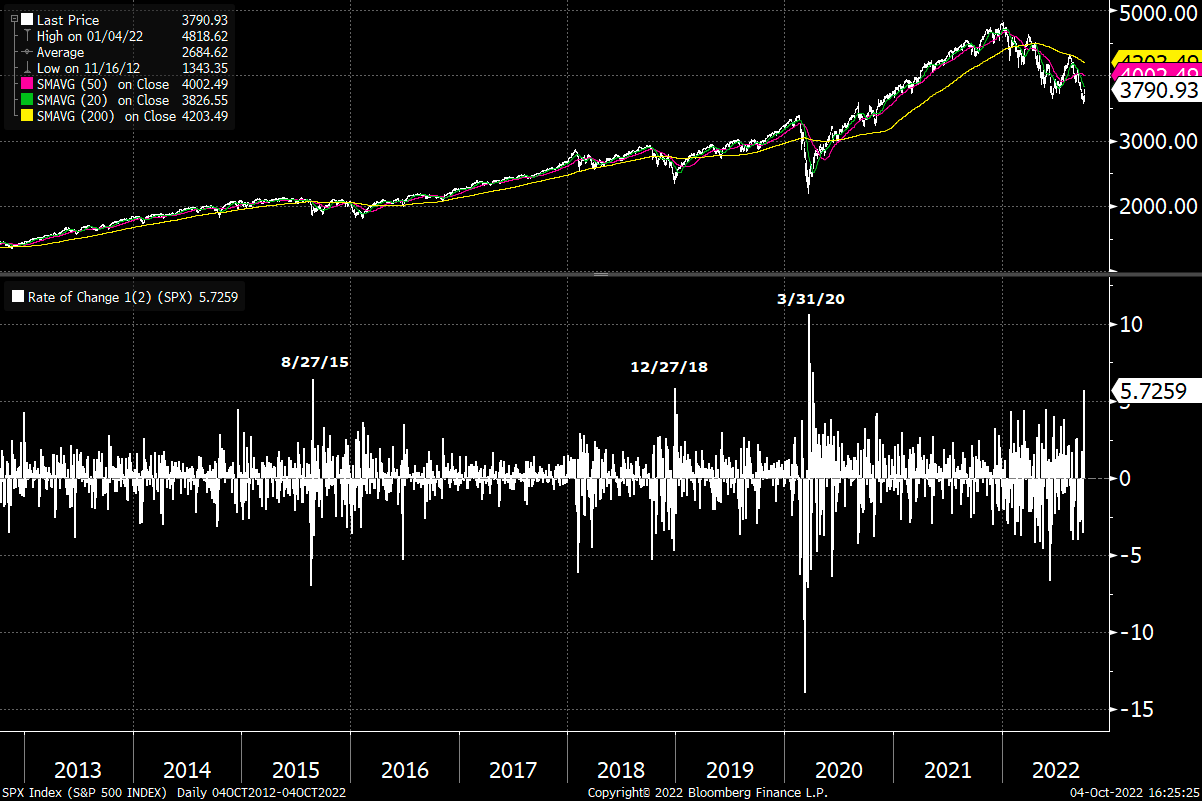

On a two-day timeframe, the combined move to the upside for the S&P 500 Index was among its largest of the last decade.

Source: @MrBlonde_macro

Another interesting point to note is that bear markets are typically short, lasting 10 months on average. That 10-month benchmark would roughly put us to where we are today. Yet, there’s a useful idea and thesis to be made that the current destruction we’ve seen so far has been about the readjustment to a unique and historic time for rates, bonds and credit. We’ve barely even arrived at what is the classic and cyclical earnings bear market.

As we approach the bulk and most significant announcements of Q3 earnings season this month, be prepared for scenarios where earnings continue to deteriorate and surprise to the downside that would continue this bear market.

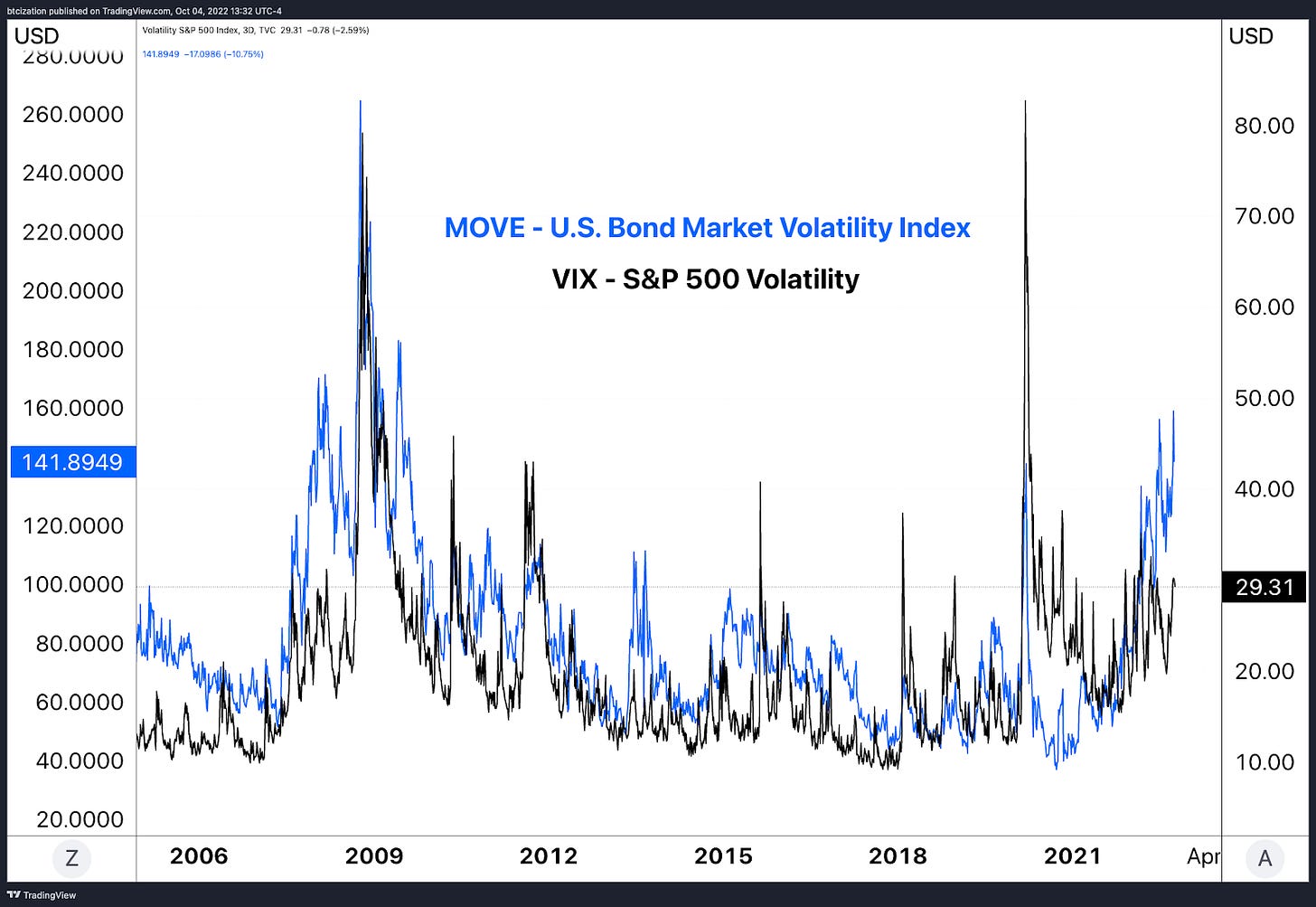

What’s been a useful marker to signal that the bottom is closer is actually an explosion in volatility playing out. These events don’t necessarily equate to market bottoms, but can be precursors. An easy way to see this is through the S&P 500 Index bottoms and the VIX looking at a small sample size since 2000. Although forward volatility has been elevated in the market, it hasn’t reached the type of levels most, including us, have been expecting.

The VIX lagging behind the MOVE index (Merrill Lynch Option Volatility Estimate, a forward measure of U.S. Treasury volatility) has been one of the more interesting trends over the last year.

Just today, The Wall Street Journal cited a new report from the International Monetary Fund, highlighting “the issues open-end funds present to the financial system, including potentially tightening financial conditions and adding to market volatility during times of stress.”

Source: Bloomberg

As bonds, currencies, and global equities all have continued trading with increasing levels of volatility, the recent historical and implied volatility of bitcoin is eerily muted compared to historical standards.

While the lack of recent volatility in bitcoin could be a sign that much of the leverage and speculative mania of the bull market has been almost entirely washed out, our eyes remain on the outsized legacy markets for signs of fragility and volatility, which could serve as a short/intermediate-term headwind. To cite a piece of ours released in February,

“What a lot of this results in is higher periods of volatility, which have been more frequent over the last few months. Higher volatility is a direct result of lower credit market liquidity. Looking back at an extreme period of volatility during March 2020, markets violently sell-off in the face of a credit unwinding. Like most risk assets, bitcoin is severely affected in these higher periods of market volatility and rising U.S. dollar strength as told through the VIX relationship. We’re due for more market volatility going forward.

“Yet in the aftermath, this is the opportunity for bitcoin. Is bitcoin a beneficiary of the massive credit bubble around the world? Undoubtedly. If credit markets continue to unwind will the price of bitcoin face headwinds? Almost assuredly.”

What The Hell Is Going On With Financial Markets? - February 23, 2022

While the world around bitcoin’s price action looks to be becoming increasingly uncertain, the Bitcoin network remains completely unaffected at the protocol level, continuing to do its job as a neutral monetary asset/settlement layer, despite its exchange rate volatility.

Ultimately, we expect that the increased volatility and fragility in the legacy system will result in further interventions, bailouts, and central planning. We believe this will push more market participants and asset allocators to seek possible alternatives.

Bitcoin stands to gain, but first, has to withstand the volatile economic storm brought about by macroeconomic conditions.

Tick tock, next block.

This concludes Part 2 of “What To Expect When You’re Expecting Volatility”. You can access the original article published Tuesday 10/4/22 by clicking the button below. Try a 30-day free trial of Bitcoin Magazine PRO’s paid tier to receive all of our articles in full as they go live.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!