BM Pro Daily - Equities Bear Market Unfolding

Bear Market Rallies

In today’s issue, we will revisit the ever-changing dynamics in legacy markets, with a focus on the history of U.S. equity bear markets.

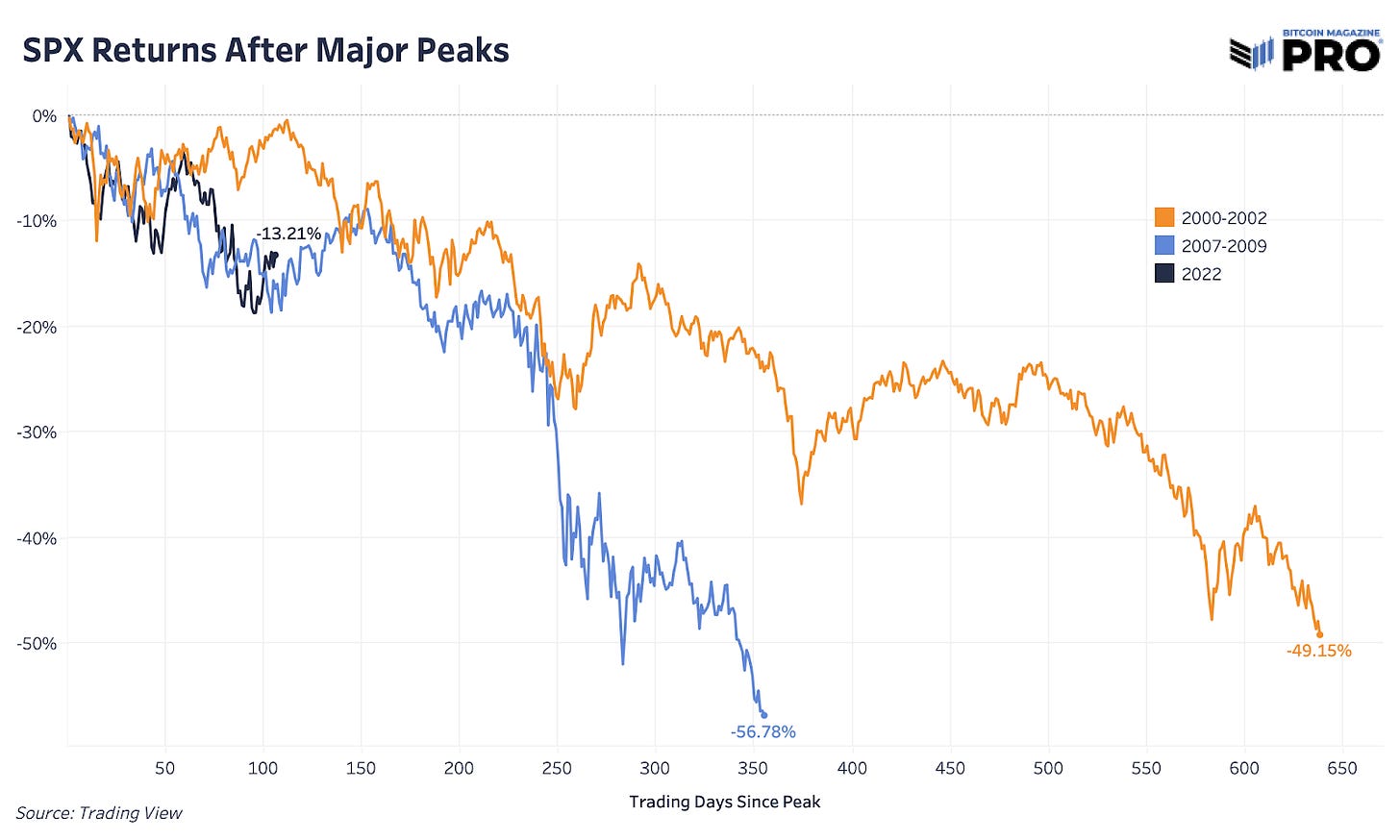

At the time of writing, the S&P 500 equity index is 8.5% off the lows while still being 13.2% below its all-time high peak. While nothing is for certain, our base case is that the equity market is in the midst of a bear market relief rally. Shown below is today’s market overlaid with previous sustained bear markets of the past during the Great Recession and 2000s Dot-Com Bubble.

While this isn’t meant to spark fear, it is meant to give readers context as to what is in the realm of possibility. When referring to history, and given today’s environment, the Federal Reserve has publicly stated it is attempting to reverse engineer a wealth effect to stomp out consumer price inflation with monetary policy. With this in mind, it's probable that the worst has yet to come for the U.S. equity market.

In particular, one should understand that historical bear markets have witnessed multiple rallies throughout that convinced many that the worst was over, only before turning over for the next leg lower.

Displayed below are the bear markets in the S&P 500 during the Dot-Com bust and the Global Financial Crisis.

U.S. Treasuries Continue To Face Downside Pressure

Despite the recent rally in equities, the bond market has meaningfully reversed and resumed its sell-off as treasury yields across the duration curve continue to rise in the face of inflationary pressures.

For investors, this is very meaningful, as it shows that investors believe that inflation is stronger than many expect at this stage still, and bonds are falling as a result. At the time of writing, the 10-year treasury is trading with 3.03% yield, just short of its 2022 high of 3.20%.

With yields continuing to rise (meaning bonds are continuing to sell off) in the face of inflation, markets will need to continue to adjust to the reality of a significantly higher discount rate and cost of capital.

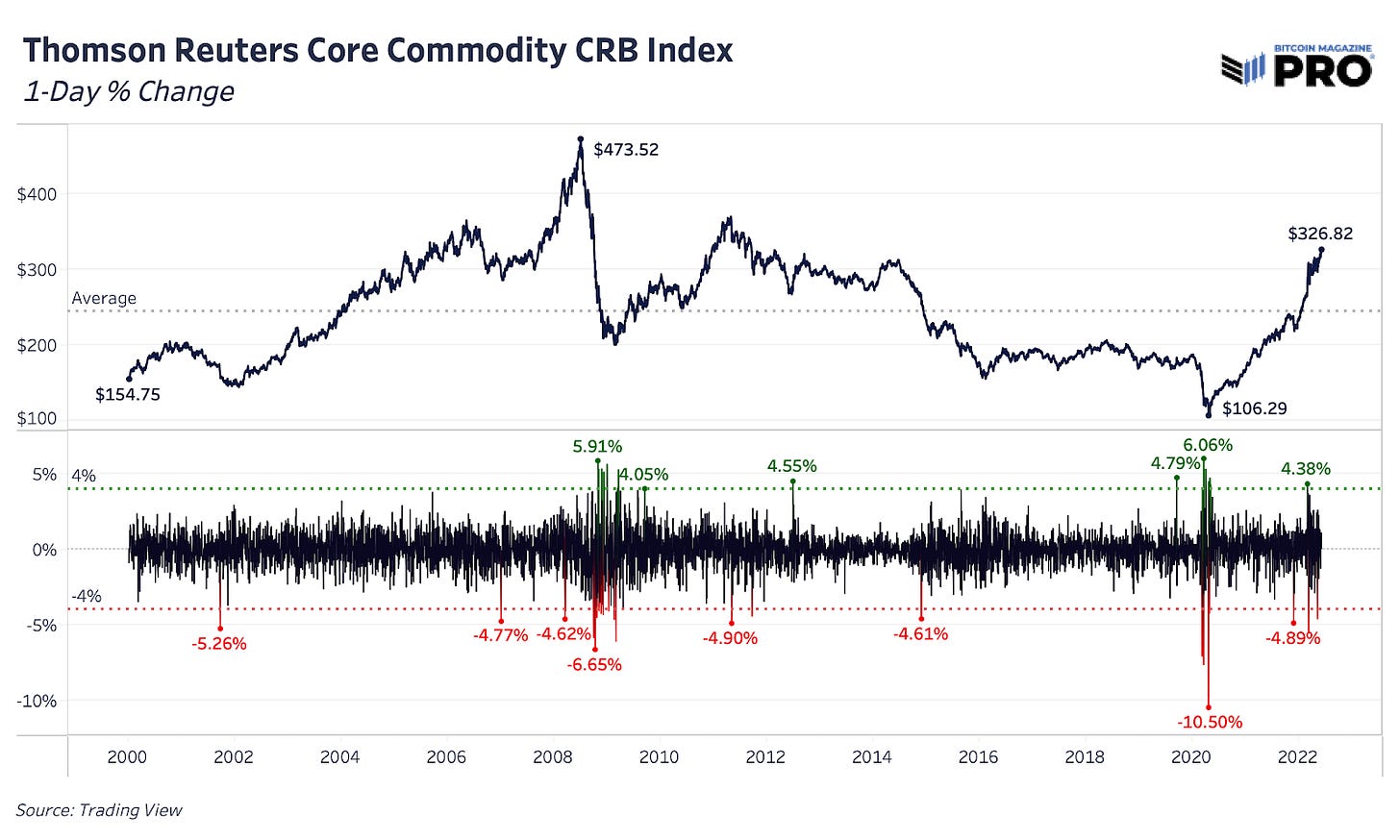

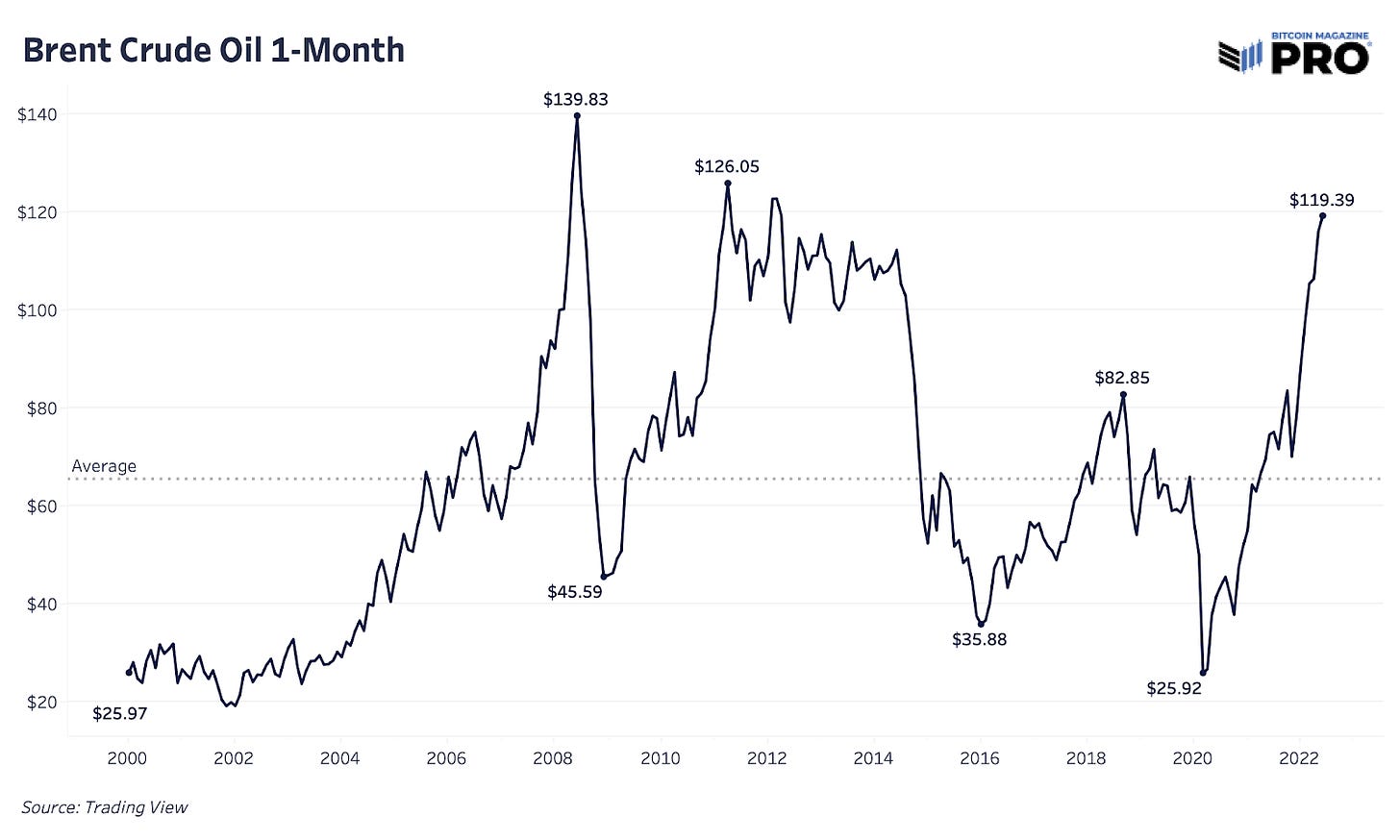

Many signs point to a further pullback of the "liquidity tide," as oil continues to march toward new highs and a broader basket of commodities continues its epic march upward. Soaring energy prices severely impact consumer spending as well as corporate margins, which leads us to believe that the next leg down in equity markets will be due to downgrades in corporate earnings and increasing credit risk due to monetary tightening.

While bitcoin is still subject to its own native market dynamics and forces (as highlighted in our latest monthly report), the strong correlation between bitcoin and U.S. equities is likely to remain elevated for the foreseeable future, with all global assets subject to the ebbs and flows of the global liquidity tide, to both the upside and downside.