The Daily Dive - What The Hell Is Going On With Financial Markets?

The Larger Macro Picture

Last night, Dylan shared an extensive thread on Twitter covering the current macro picture across stocks, bonds and volatility in the market. In today’s Deep Dive, we’re expanding on some of those ideas and charts more in-depth as these are some of the more important market dynamics that will affect all markets in 2022, bitcoin included. Check out the Twitter thread below:

The overall ethos of the thread and a thesis we’ve discussed many times in the Deep Dive is that we’re in unprecedented times with over a decade of negative real rates contributing to the everything bubble we’re in today. The market now has to face the second order effects.

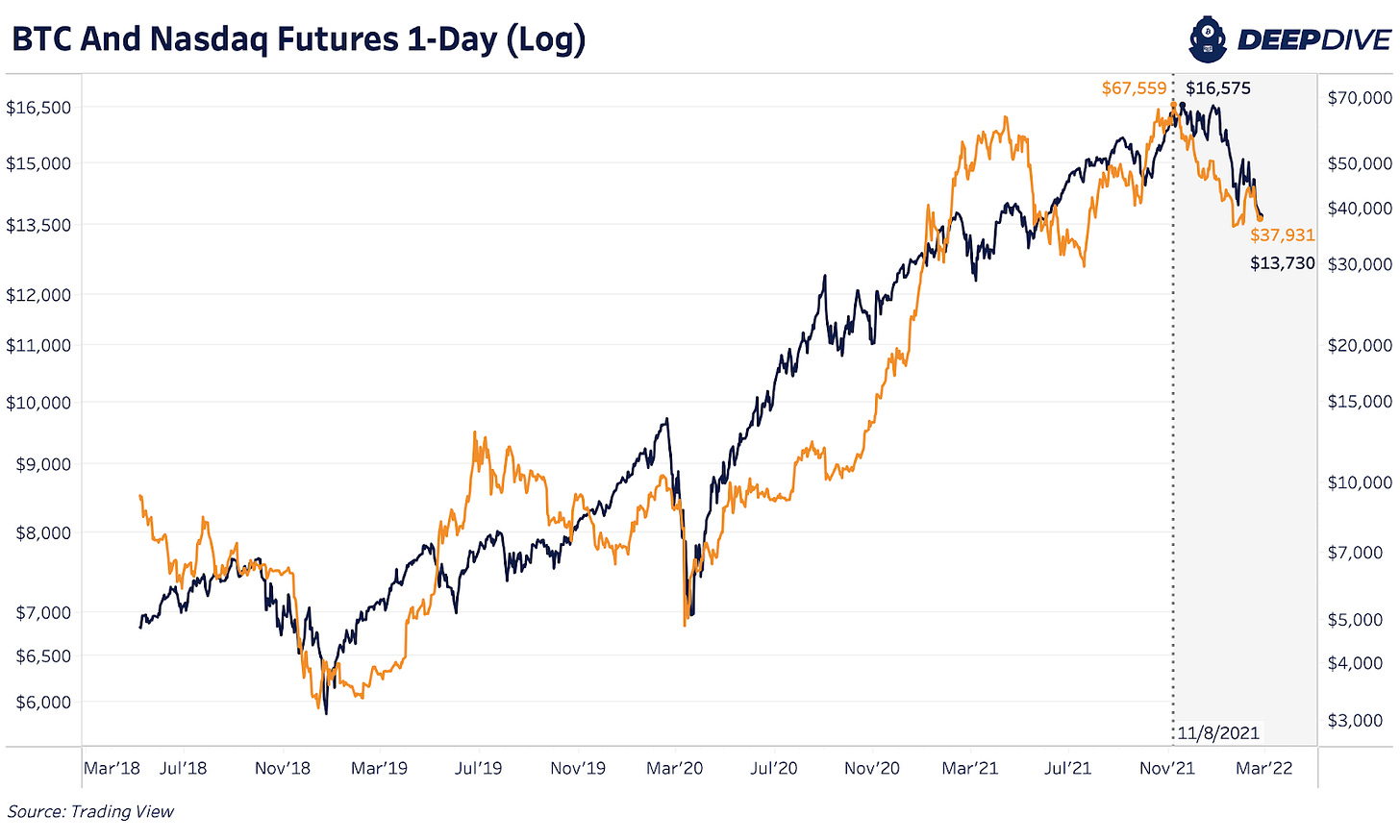

Since November 2021, risk assets have been selling off in tandem. We covered some of the specific major tech stock drawdowns in yesterday’s Daily Dive. But largely the story can be told through the lens of the Nasdaq. Bitcoin peaked approximately 10 days before the Nasdaq all-time high, falling nearly 44% to yesterday’s price. The Nasdaq has fallen over 17% during the same time frame.

The S&P 500 Index shows the same dynamic with now over an 11% correction from all-time highs which is the largest correction since spring 2020. All risk assets are largely trading the same way. Today, we wait to see if any relief rallies are to come for risk assets over the next one to two months (a probable scenario), but the level of macroeconomic uncertainty and conditions aren’t promising for 2022.

Risk assets only tell one side of the market with the more important market being credit. Since November 2021, United States Treasury bond yields have been rising across all durations. With inflation running so hot, U.S. Treasurys yielded their worst returns in over 40 years. Even with rates still negative, rising rates are having a profound effect on earnings multiples and financing costs across corporate debt.

Since 2010, there’s been a continued decline in high-yield corporate bonds as shown by the Bloomberg High Yield Bond ETF (JNK). High-yield bonds selling off result in higher financing costs for corporations which result in lower earnings and greater insolvency risk. We’re yet again going through another period of high-yield bonds selling off since November 2021.

What a lot of this results in is higher periods of volatility, which have been more frequent over the last few months. Higher volatility is a direct result of lower credit market liquidity. Looking back at an extreme period of volatility during March 2020, markets violently sell-off in the face of a credit unwinding. Like most risk assets, bitcoin is severely affected in these higher periods of market volatility and rising U.S. dollar strength as told through the VIX relationship. We’re likely due for more market volatility going forward.

Yet in the aftermath, this is the opportunity for bitcoin. Is bitcoin a beneficiary of the massive credit bubble around the world? Undoubtedly. If credit markets continue to unwind will the price of bitcoin face headwinds? Almost assuredly.

But here is the kicker:

"In the end, policy makers always print. That is because austerity causes more pain than benefit, big restructurings wipe out too much wealth too fast, and transfers of wealth from haves to have-nots don’t happen in sufficient size without revolutions." - Ray Dalio

Bitcoin is the answer to the conclusion of the long-term debt cycle.

Unless the monetary policy of fiat currency is miraculously fixed to actually benefit savers, bitcoin will rebound, and we'll soon reach another all-time high.