PRO Market Keys Of The Week: 4/3/2023

Binance close to finishing the conversion of $1 billion of BUSD into bitcoin and other crypto. More contraction in important economic data. Stablecoin supply continues to decline after USDC concerns.

Relevant Past Articles:

PRO Market Keys Of The Week: Market Anxiously Awaits Fed Meeting

State Of The Mining Industry: Public Miners Outperform Bitcoin

Binance Recovery Fund Running Low

Weeks ago, Binance announced a full conversion of the remainder of their $1 billion Industry Recovery Initiative funds into bitcoin, ether and BNB. As of the latest flows, the funds are now down to the last $113 million as Binance’s buying spree and move away from BUSD is now reaching its end. Coincidentally, the original announcement and soon to be conclusion of the buying have come alongside bitcoin’s explosive rally from a $20,000 retest.

“Given the changes in stable coins and banks, #Binance will convert the remaining of the $1 billion Industry Recovery Initiative funds from BUSD to native crypto, including #BTC, #BNB and ETH. Some fund movements will occur on-chain. Transparency.” — CZ, March 13

Despite the bitcoin move, we’ve seen a lack of outperformance in ether, BNB and other tokens. Binance has also discontinued their zero-fee trading for bitcoin and other pairs, which led to a subsequent collapse in their overall bitcoin spot exchange volume, falling 86%.

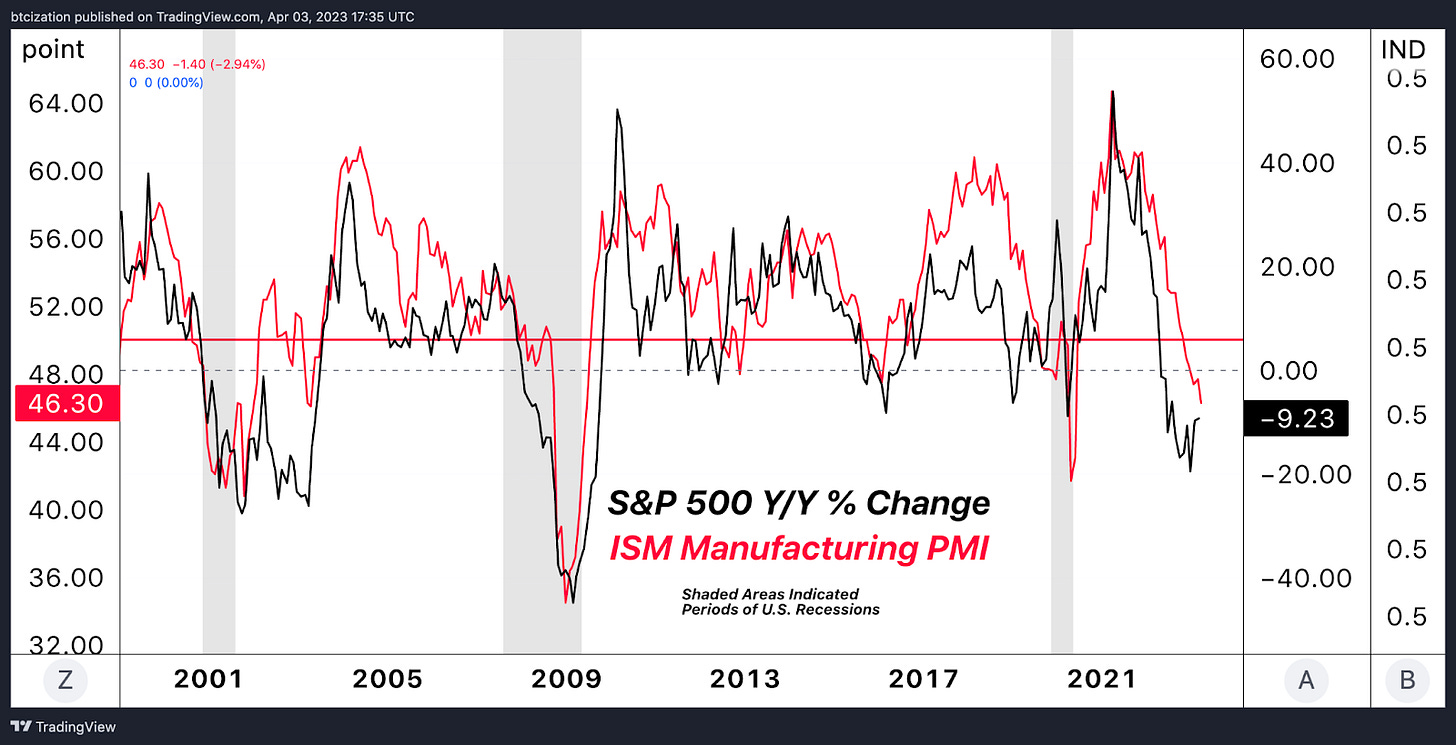

ISM PMI Shows More Contraction

We saw yet another concerning and contractionary print for the ISM PMI that was below market expectations. Apart from the pandemic, this is the weakest economic print since 2009.

The U.S. Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) is a monthly economic indicator that measures the health of the manufacturing sector in the United States. It is a survey-based index that tracks the sentiment of purchasing managers in the manufacturing industry, who are responsible for procuring raw materials, components and supplies for their companies.

The ISM Manufacturing PMI is significant for several reasons:

Timeliness: The report is released on the first business day of each month, making it one of the earliest indicators of economic activity for the previous month.

Forward-looking: As it’s based on purchasing managers’ sentiment, it provides insights into their expectations for future business conditions, which can help predict future economic trends.

Representation: The manufacturing sector is a crucial part of the U.S. economy, and changes in this sector can have a significant impact on overall economic growth.

To interpret the data, you should consider the following:

Index value: The PMI is reported as a number between 0 and 100. A value above 50 indicates expansion in the manufacturing sector, while a value below 50 indicates contraction. The farther the index value is from 50, the more significant the expansion or contraction.

Trend: Pay attention to the changes in the index over time. A rising trend suggests improving conditions in the manufacturing sector, while a falling trend may signal a slowdown or deterioration.

Components: The PMI is made up of five sub-indices: new orders, production, employment, supplier deliveries and inventories.

It’s worth pointing out the historical correlation between ISM PMI and SPX year-over-year performance (another leading indicator of economic recession). Historically, traditional markets have bottomed after the ISM PMI has bottomed out.

Bitcoin 2023 ticket prices increase FRIDAY at midnight! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Paid subscribers get 15% off tickets and everyone can use code “BMPRO” for 10% OFF.

GDP Forecast Follows ISM Print

The Atlanta Fed’s mathematical model for GDP estimates takes a hit on the back of ISM PMI print with the latest Q1 estimate coming in at 1.7% down from 2.5% a week and 3.5% at peak. The latest rounds of data are bringing down market growth expectations quickly after recessionary fears are coming back into view after a more bullish first quarter.

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 1.7 percent on April 3, down from 2.5 percent on March 31. After this morning’s construction spending release from the US Census Bureau and the Manufacturing ISM Report On Business from the Institute for Supply Management, decreases in the nowcasts of first-quarter real personal consumption expenditures growth and first-quarter real gross private domestic investment growth from 4.6 percent and -7.3 percent, respectively, to 3.7 percent and -8.5 percent were slightly offset by an increase in the nowcast of first-quarter real government spending growth from 1.7 percent to 2.1 percent. — GDPNow

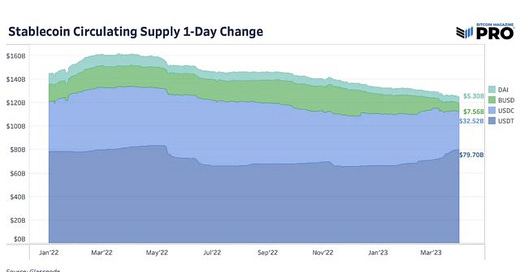

Stablecoin Supply Remains In Decline

After the recent banking crisis and concerns around USDC backing, overall stablecoin supply continues to fall, now at around $125 billion aggregate supply. USDC supply is just over $32 billion, down from approximately $44 billion. BUSD is at $7.5 billion, down from approximately $23 billion. Tether has taken in a sizable chunk of that demand now near $80 billion in supply after hitting approximately $65 billion at recent market lows. Even with Tether inflows, we’ve yet to see demand come back in size for stablecoins.

What does that mean for bitcoin? Obviously, with the direct Binance buying announcement, some of those BUSD stablecoins have been making their way into bitcoin over the last few weeks. At a higher level view, bitcoin has thrived off of growth in the stablecoin supply during bull cycles, as it’s a clear indicator of new capital coming into the market. Currently, that larger trend is still in decline.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!