Grayscale’s SEC Hearing Gives New Hope For GBTC Investors

The SEC was in the hot seat on Tuesday as the Grayscale Bitcoin Trust brought their arguments for a spot bitcoin exchange-traded fund in front of U.S. judges. GBTC shares jumped during the hearing.

Relevant Past Articles:

The State Of GBTC: Discount Shrinks For The First Time In Over A Year

Genesis Files For Chapter 11 Bankruptcy, Owes More Than $3.5 Billion To Creditors

The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

Grayscale’s SEC Hearing Gives New Hope For GBTC Investors

Yesterday, the debacle over a spot bitcoin exchange-traded fund (ETF) reached U.S. courts, as the SEC was questioned by judges over the rejection of Grayscale’s application to convert its closed-end bitcoin trust, GBTC, into an open-ended ETF. During the hearing, the SEC cited concerns regarding manipulation in spot bitcoin markets, while Grayscale refuted the SEC’s reasoning, given the SEC’s prior approval of a futures bitcoin ETF in the fall of 2021.

This led to court judges questioning the SEC’s understanding of the relationship between the spot market and the futures market, with a court judge saying, “We haven’t seen any evidence that Grayscale's argument is flawed.”

In our view, the key point in the hearing was when the judges asked the SEC to explain why the Grayscale offer was rejected and followed up with a question as to whether manipulation of a futures-based ETF was possible. The SEC’s answer was that Grayscale did not provide enough data, which led to a response from judges suggesting that the data provided by futures-based bitcoin ETFs should be equally sufficient for spot ETF applicants.

The contents of the hearing were enough for the Senior Litigation Analysts at Bloomberg to change their probability of a successful Grayscale suit from 40% to 70% — an extremely noteworthy swing.

What’s next?

The expected timeline for a ruling on the case is expected to drag on into the later months of 2023, with Bloomberg Intelligence estimating a ruling somewhere in Q2 or Q3.

GBTC Price Action

Although the volume for GBTC was still relatively illiquid compared to historical numbers, yesterday was one of the highest trading volume days we’ve seen for GBTC in many months. As we’ve observed with many of bitcoin’s explosive market rallies in this bear market, it doesn't take much to push price in either direction with a major news story.

The court hearing served as a catalyst for the GBTC discount to shoot from -45% at the weekly opening to -34.5% today, an impressive move that saw shares of GBTC move +18.4%, while the price of spot bitcoin fell by 1.6% during the same time period.

Bitcoin 2023 ticket prices increase FRIDAY at midnight! Lock in your ticket & join the Bitcoin Magazine PRO team at the Bitcoin event of the year. Paid subscribers get 15% off tickets and everyone can use code “BMPRO” for 10% OFF.

Limited-time offer: Industry Passes come with a 6-month PRO subscription!

This massive outperformance while bitcoin traded lower is different from previous times when the discount closed due to market beta, as the illiquid nature of the over-the-counter GBTC market relative to the spot BTC market, often causes GBTC to serve as a more volatile derivative of bitcoin intra-day.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

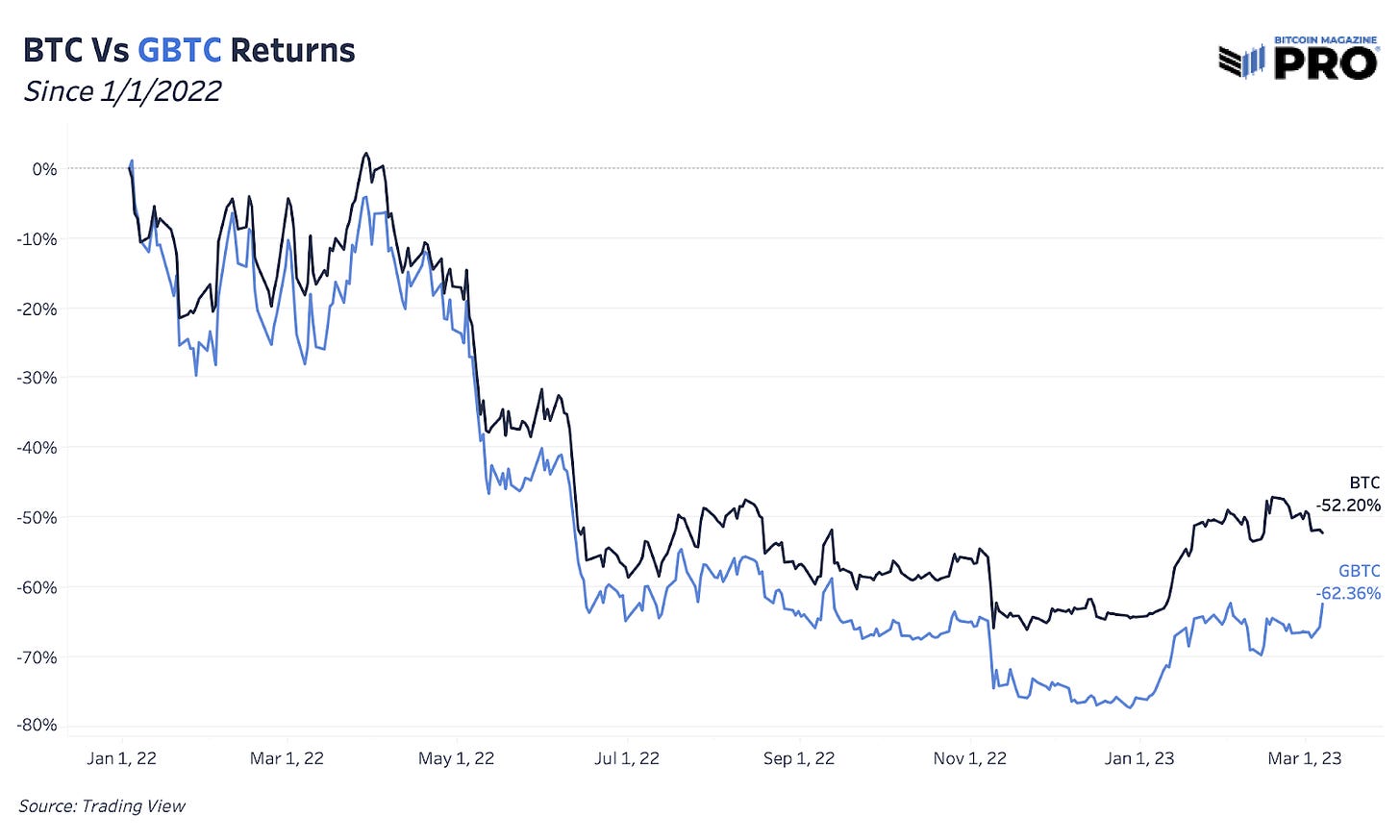

How bitcoin returns compare to GBTC returns. ⚖️

The effect a spot bitcoin ETF approval might have on the bitcoin price. 🏷️

A potential timeline for a spot bitcoin ETF approval. ⏳

Since the start of 2022, GBTC has returned -62.36% versus bitcoin performance of -52.50%. The divergence and outperformance for 2023 YTD — GBTC up 57.32% versus bitcoin’s 33.17% — has come from this one market event alone, with a major swing in market pricing and the probability of a redemption looking more likely.

Typically, you could think of the GBTC discount or premium as having an implied bitcoin price where institutional capital can allocate to bitcoin via another vehicle with more potential upside. The current GBTC discount implies a bitcoin price of around $14,000, up from GBTC-implied lows of $8,500. This implied discount became increasingly dislocated during the forced liquidation events in 2022.

Although a long way away from the discount closing, this can be an appealing play for investors to acquire cheaper bitcoin allocations or for arbitraging the spread between the two. Both options likely siphon away demand for spot bitcoin though and could even be more bearish for bitcoin in the short-term despite the strong bitcoin/GBTC correlation we’ve seen throughout the history of the Grayscale Bitcoin Trust.

With the recent GBTC move, some of the juice has already been squeezed from the arbitrage/speculation strategy of acquiring shares at near a near 50% discount to net asset value (NAV). While the timeline is unclear, with the increased momentum around Grayscale’s case against the SEC, the ultimate fate of Grayscale’s 629,759 BTC closed-end fund remains to be seen. One could imagine the scenario where the approval of a spot bitcoin ETF could simultaneously serve as a short-term bearish but long-term bull catalyst, given the unlocking of over 3% of the circulating bitcoin supply to the open market. The bitcoin is unlocked due to the change from a closed-end trust to an ETF structure, where buying and selling of the underlying asset dynamically influences the net asset value of the fund itself.

While many of the holders of GBTC are fundamentally bullish on bitcoin itself, there is also likely a cohort of speculators who are purely looking to capitalize on the discount to net asset value and would become sellers of GBTC in the case of a spot ETF approval, causing spot bitcoin to hit the open market.

Something else to watch in regards to a potential Grayscale spot ETF approval would be the impending competitor applications from legacy incumbents such as BlackRock, who could look to undercut Grayscale’s exceptionally high fee structure. For context, the average fee of a BlackRock ETF is 0.25%, which is 87.5% lower than the current fee structure of products in the Grayscale family suite of trusts.

Final Note

We are months away from a ruling on the SEC versus Grayscale court case, and likely much further away from the approval of a spot bitcoin ETF, given the recent SEC hostility toward much of the crypto industry. Over the following quarters, the GBTC discount to NAV will likely serve as a quasi-probabilities market for a Grayscale victory over the SEC, which would then greatly increase the probability of the passing of a spot bitcoin ETF.

Our general base case is that a spot bitcoin ETF does not come to market in 2023, with 2024 or 2025 being a much more likely timeframe for such an approval.

In the meantime, speculators and arbitrageurs alike will continue to place their bets on the inevitable outcome, in the form of market positions in GBTC and bitcoin itself.

For Grayscale, it is in their best interests for this process to drag out as long as possible, given the massive size of the trust (629.7k BTC) and the incumbent 2% fee to NAV. As stated earlier, with any ETF approval, market forces would likely force Grayscale to substantially lower the annual fee for their product or lose a massive amount of market share to eventual competing products. In either case, Grayscale revenues would be greatly depleted during a time when parent company Digital Currency Group is under a large amount of financial duress.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!