Dollar Go Up: Global Macro Headwinds Intensify

The Federal Reserve is conducting monetary policy for the global economy. Is Plaza Accord 2.0 on its way? The eurodollar futures curve says rate cuts.

Dollar Strength Or Foreign Currency Problems?

Read previous U.S. dollar strength issues and updates here:

July 12 Brewing Emerging Market Debt Crisis

Jun 23 Growth Deceleration And The Dollar Wrecking Ball

April 28 Dollar Soars While GDP Contracts

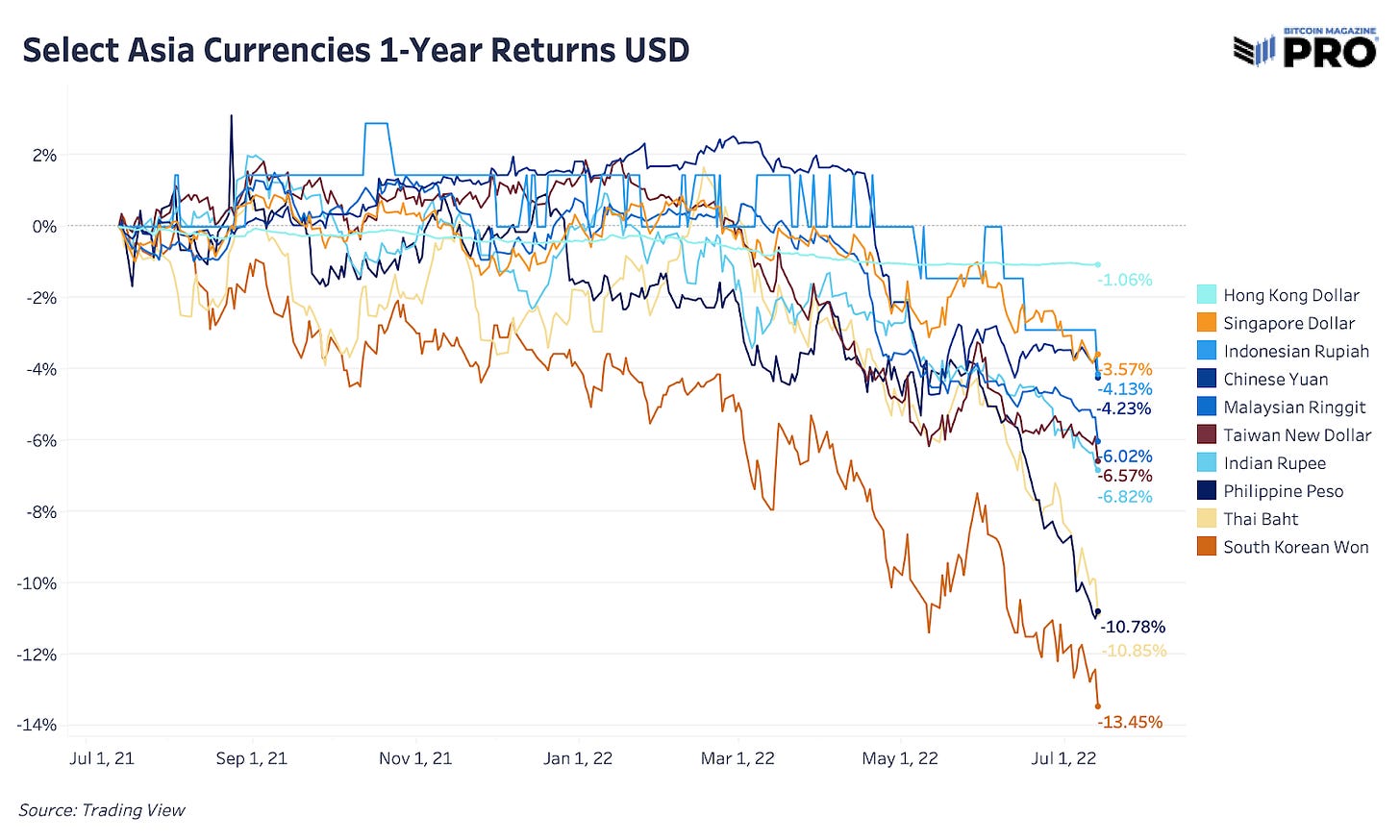

Previously we highlighted the recent, continued U.S. dollar strength with the euro in freefall and Japanese yen devaluation from Bank of Japan yield curve control measures (both facing significant rises in energy import expenses) being significant drivers of U.S. dollar index (DXY) strength. Yet, it’s not just major currencies losing value against the U.S. dollar. A look at key currencies across Asia shows the same dynamic: over the last year nearly every other currency is bleeding purchasing power.

Bonus Content: Head of Market Research Dylan LeClair appeared as a guest on the AssetDash Podcast to discuss CPI data, the Dollar Milkshake Theory and the Triffin Dilemma as they relate to Bitcoin.

The Korean won is the worst of the group and has breached the 1,300 per dollar level. That has only happened during times of major economic crisis during the 2008-2009 Global Financial Crisis and the 1997-1998 Asian financial crisis.

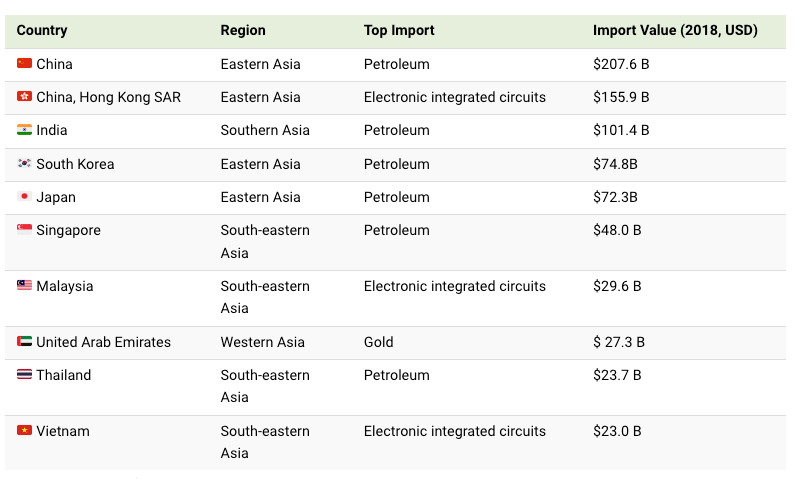

The story is similar in many areas of the world. As a result of the energy crises, net importers of energy are seeing their currencies rapidly depreciate against the dollar, which is still the dominant unit of account in commodities and energy trade. Below are the largest imports of Asian countries, with energy being the key import for obvious reasons. When looking at the largest net importers of energy, a clear trend of currency weakness against the dollar can be seen.

Source: Visual Capitalist

What is the resolution of an increasingly strong dollar? A look to history can reveal a possible playbook.

Plaza Accord 2.0 Incoming

In 1985, following the tight monetary policy of Federal Reserve Chair Paul Volcker in the late 70s / early 80s, the U.S. dollar had appreciated by approximately 50% against a basket of foreign currencies (most notably the Japanese yen, Deutsche mark, French franc, and British pound, which were the currencies of the four largest economies besides the U.S. at the time).

Monetary policy under the watch of Fed Chair Volcker successfully halted the stagflation crisis of the 1970s through the use of interest rate policy (sound familiar?), but the impacts had significant second-order effects.

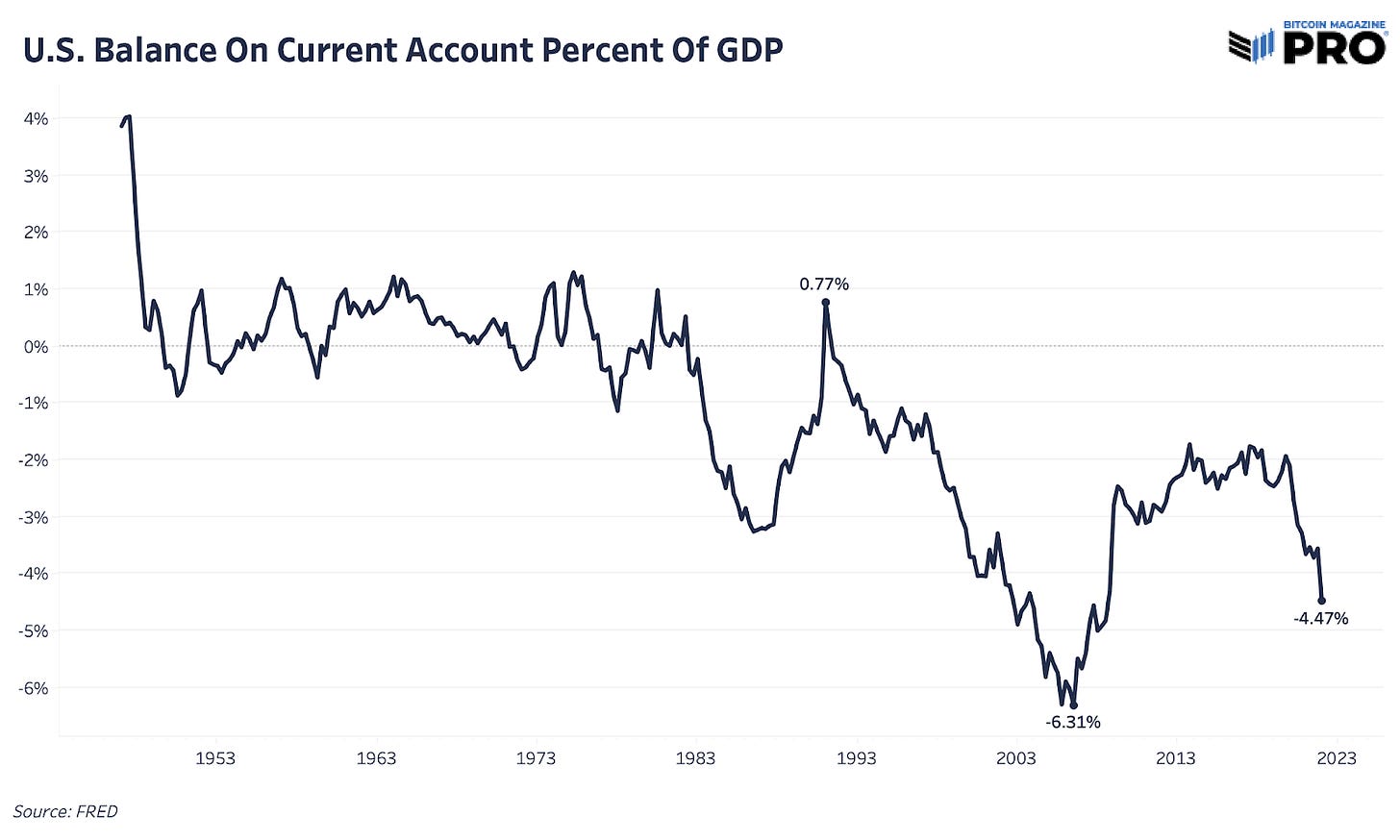

By raising interest rates by such a large degree, capital flowed into the U.S. domestic economy from other countries across the world, leading to a surging USD. However, this relative dollar strength against other currencies led to significant weakness in the U.S. manufacturing and agriculture industries compared to its foreign counterparts, who were selling goods and services at cheaper prices into the global market. As a result of the historically strong dollar, the U.S. trade deficit significantly increased, which was foreseen by economist Robert Triffin back in 1960. Triffin saw that whatever country held the status of the world reserve currency would have to run increasingly large balance of payment deficits in order to keep the global economy functioning smoothly.

Speaking to Congress back in 1960, Triffin said the following,

“If the United States stopped running balance of payments deficits, the international community would lose its largest source of additions to reserves. The resulting shortage of liquidity could pull the world economy into a contractionary spiral, leading to instability.”

“If U.S. deficits continued, a steady stream of dollars would continue to fuel world economic growth. However, excessive U.S. deficits (dollar glut) would erode confidence in the value of the U.S. dollar. Without confidence in the dollar, it would no longer be accepted as the world's reserve currency. The fixed exchange rate system could break down, leading to instability.” - IMF

So what is happening today?

A strong dollar is in the process of completely upending the global economy. While there are certainly exogenous factors that are causing the economic pain points such as shattered supply chains following COVID-19 economic lockdowns (which were incredibly strained following unprecedented levels of monetary and fiscal stimulus in 2020/2021) and the Russia/Ukraine conflict which has thrown global energy and commodity markets in flux, a strong dollar only increases pressure on foreign nations in terms of meeting their dollar-denominated liabilities, while increasingly harming U.S. domestic industry.

Due to the dollar’s position as the world reserve currency, the Federal Reserve is not just conducting monetary policy for the U.S. domestic economy, The Federal Reserve is conducting monetary policy for the global economy.

For these reasons (among many others), we view the Federal Reserve's stated intent to significantly tighten financial conditions as futile. Every tick of increased USD strength increases the probability of global economic armageddon. This is not just our view, the bond market knows it too. Shown below is the eurodollar futures curve, which maps out the bond market’s expectation for the future fed funds rate. The inversion in the curve tells us that investors are hedging their bets that something will break down significantly.

The market has already begun to price in a Fed monetary policy pivot, with an expectation of 0.73% worth of interest rate cuts during 2023. The bond market knows that the Fed is embarking on an impossible task of raising rates into a global recession.

The scary thing for investors is that they just might try until something breaks in spectacular (read: disastrous) fashion.

We know the Fed’s current goal is to crush inflationary pressures. The biggest drivers in the inflationary pressures have been commodity prices, with energy being the largest contributor.

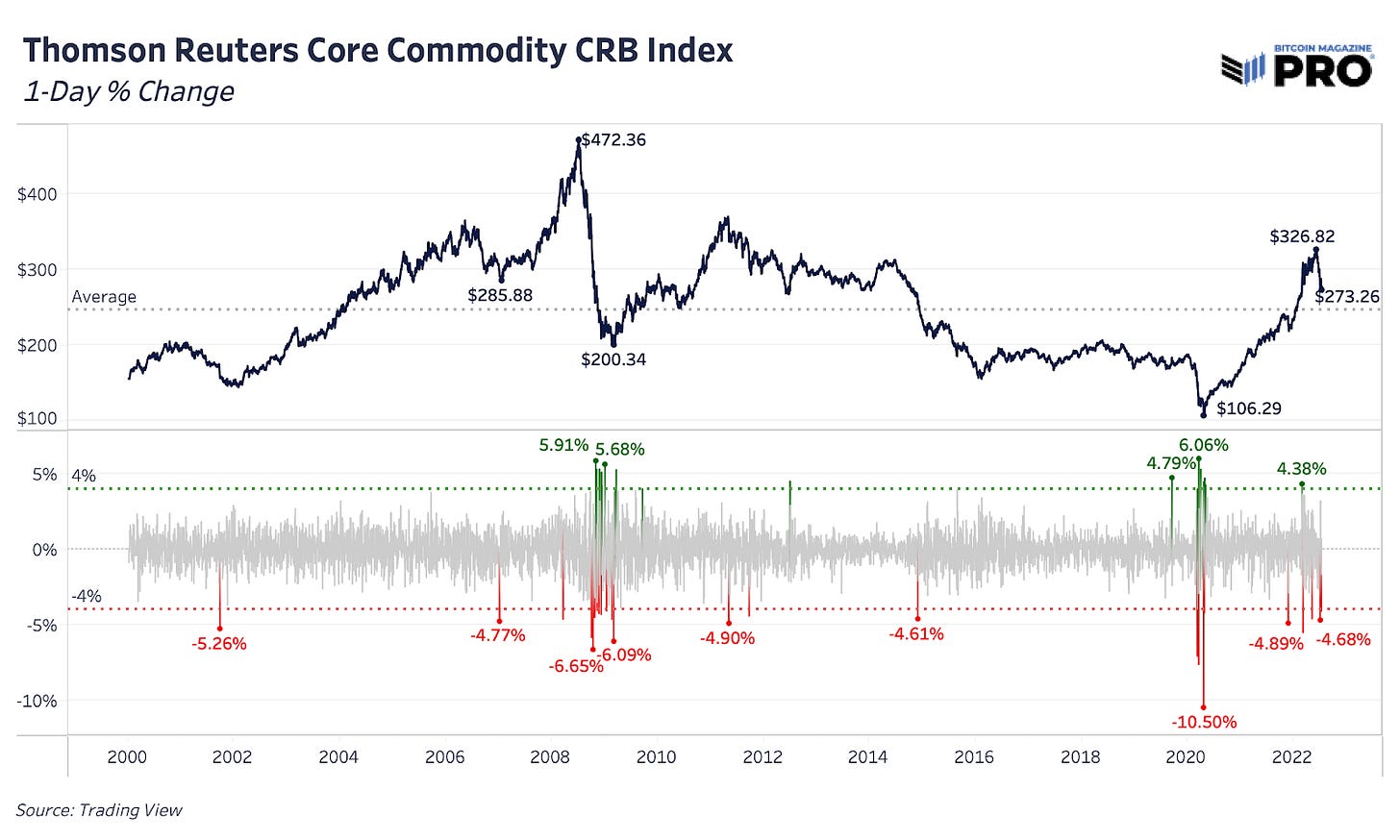

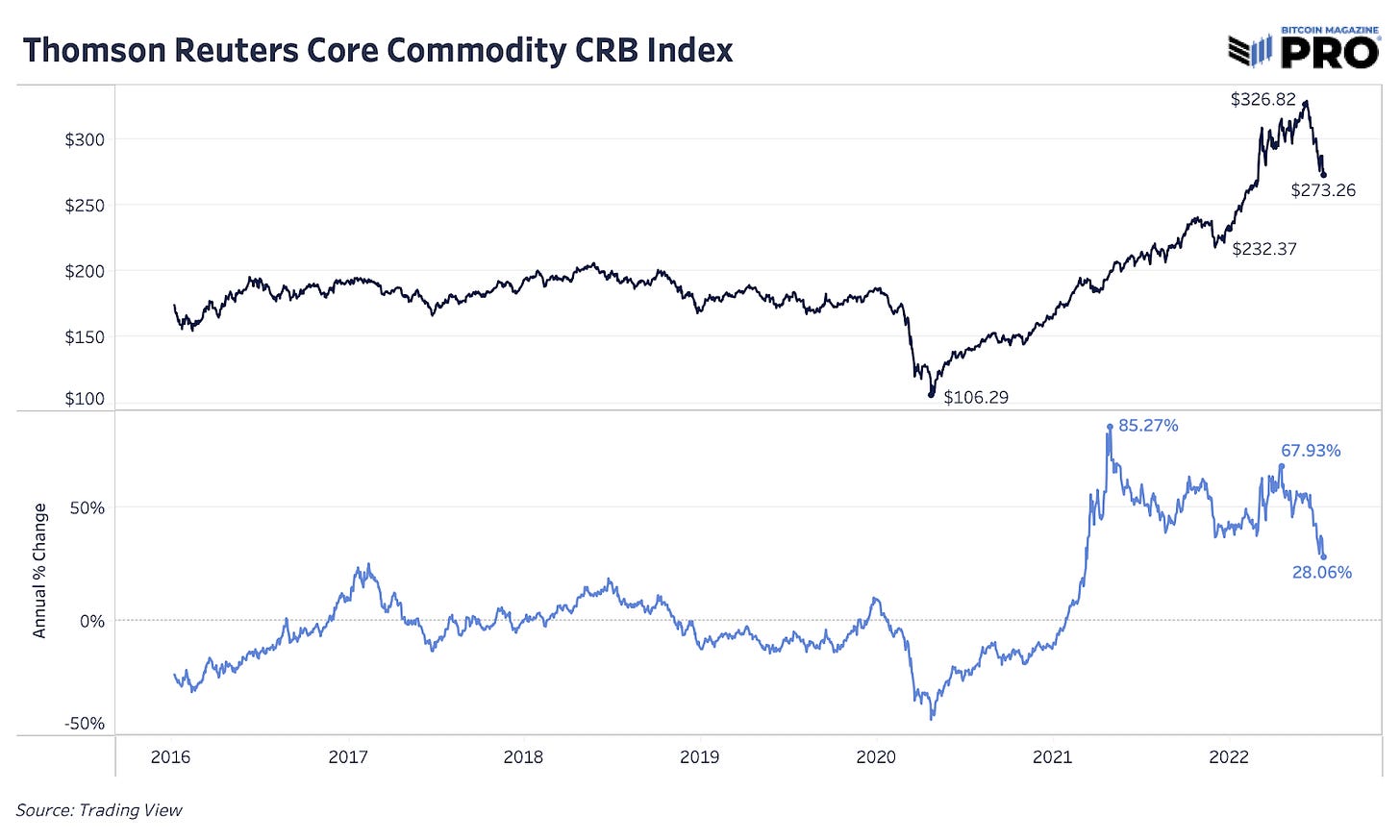

The question now for commodities is are we to see a 2008-style deflationary bust, or are prices just oversold from the incredible recent inflationary rise? The core commodity index below is now 16.4% down from all-time highs in early June with nearly every major commodity (oil, copper, aluminum, wheat, cotton, soybeans, coffee, etc.) turning over.

A broad basket of commodities as shown by the Thomson Reuters/CoreCommmodity Index is still up 28.06% year over year.

Among the most interesting data points is the relationship between copper, economic vitality, and inflation expectations. Copper has earned the nickname “Dr. Copper” among traders in commodities markets for its ability to predict turning points in economic cycles.

Specifically, copper has traded in line with inflation expectations for much of the last decade.

With this being said, both copper and 10-year inflation expectations are falling off a cliff, which favors the possibility that the economy is in the early stages of transitioning from inflationary bear market to economic recession and subsequent bust.

Final Note

Bank of America has recently revised their projections for the Fed’s announced quantitative tightening program that is expected to occur over the coming years.

All one has to do to gauge the likelihood of sustained balance sheet reduction (otherwise known as QT, or “quantitative tightening”) is look at previous Federal Reserve balance sheet reduction projections of the past.

Further monetary debasement is an inevitability.

In regards to bitcoin:

Bitcoin is not a consumer price index inflation hedge. Bitcoin offers a technological solution to escape from the perpetual monetary debasement of fiat currency regimes.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section.

more of this !!!