Revisiting The Dollar Bitcoin Relationship

In more recent issues, we’ve highlighted that over the last few months, bitcoin’s price has been a function of larger macroeconomic conditions of rising yields and credit unwinding leading to increased equity market volatility and rising U.S. dollar strength. You can read more on that analysis and thesis in previous issues: Bitcoin Falls As Rates Rise, Rising Commodities And Flattening Yield Curve, What The Hell Is Going On With Financial Markets? and Volatility, Tech Stock Drawdowns And Credit Markets.

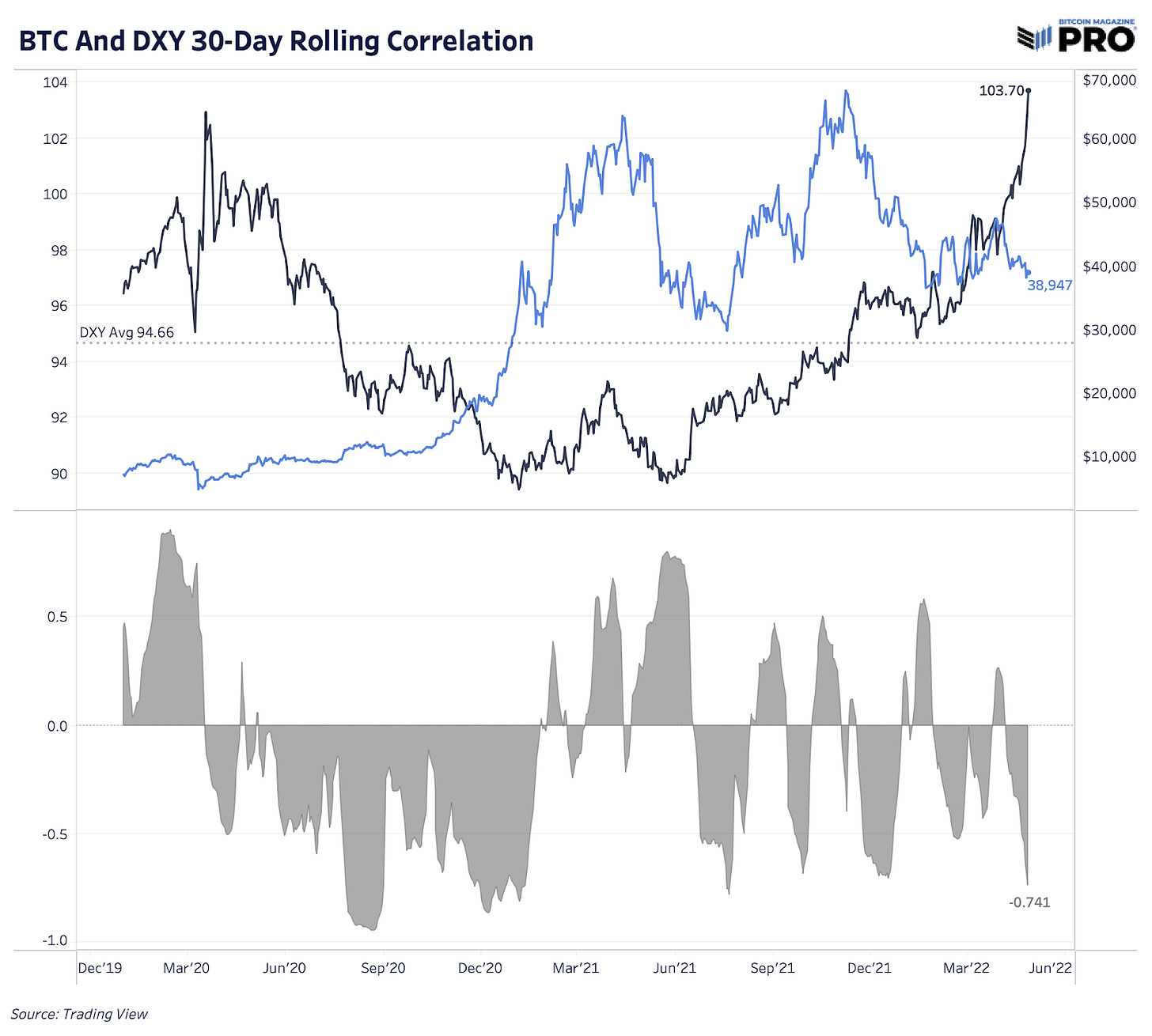

As of late, the Dollar Currency Index (DXY) which tracks the relative strength of the U.S. dollar measured against other key global currencies, is hitting new 20-year highs as major currencies like the euro, Japanese yen, and British pound continue to weaken. The latest rise comes as the Bank of Japan triples down on their yield curve control efforts, purchasing an unlimited amount of 10-year bonds every business day to cap yields at 0.25%.

So what does a rising DXY mean for bitcoin and other assets? We’ve highlighted in previous issues, Rising U.S. Dollar Index And Exchange Balances as an example, that the rising trend since 2021 is a result of financial risk-off conditions because of the global dollar-denominated debt financial system we have today. Even with the dollar devaluing against real goods, services and financial assets, all debtors are forced to sell USD-denominated assets to cover liabilities during deleveraging events.

Throughout much of 2020, there was a close inverse correlation relationship between the DXY and bitcoin as bitcoin rose to an all-time high during a period of relative dollar weakness. There’s been more of a mixed correlation since, but as DXY has risen to 103.70 index value, the negative correlation has risen to 0.74 over the last 30-days while bitcoin has fallen from $47,000.

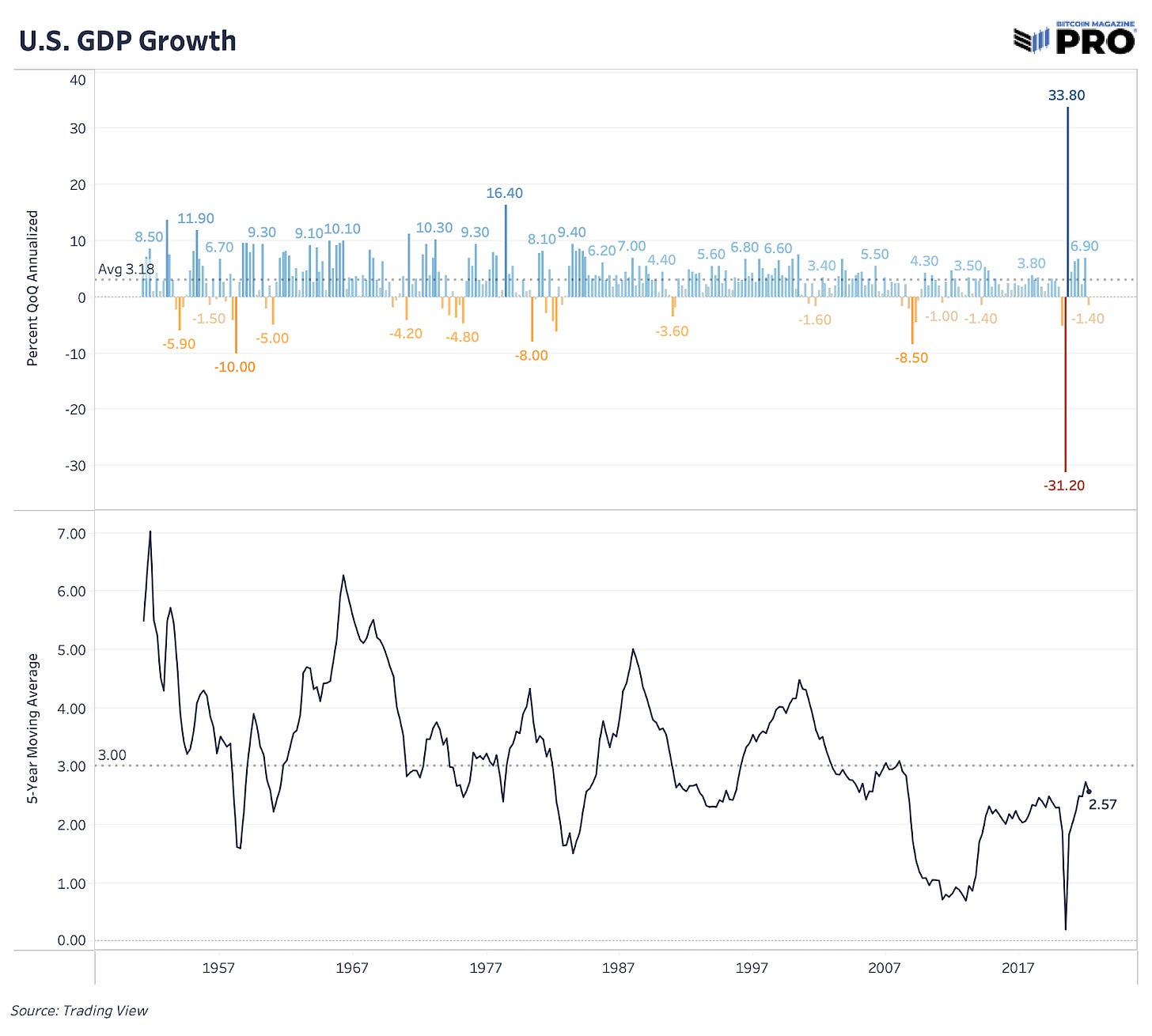

Today, we also get the latest U.S. Q1 2022 gross domestic product (GDP) data showing that the economy contracted by 1.4% compared to 1.1% expansion consensus. The growth deterioration across major global economies that will usher in a market regime shift to a more deflationary environment later this year has been a key assumption in our base case to expect more downside for risk assets in 2022.

In Q1, we already saw consensus expectations cuts to both U.S. and Eurozone GDP forecasts for 2022. Many consensus estimates still expect 3% annual growth in the United States to play out this year. The Organisation for Economic Co-operation and Development (OECD) was projecting 3.7% in December 2021. The below chart shows annualized quarterly growth for GDP with a five-year moving average trend of GDP growth. We haven’t sustained a trend of 3% growth since 2006 with a current moving average of 2.57%.

If we’re to see broader market expectations for growth cut further this year then that change is likely more downside for risk assets.

Final Note

In our view, the worst is yet to play out for markets and bitcoin. That said, the type of credit unwinding and deleveraging we’re facing today is one of the key reasons that we expect the case for bitcoin to grow in the market as these events unfold. Quoting a previous issue,

“The world is in dire need of neutral, apolitical, programmatic money. The negative real-yield environment the economic system finds itself in today is an inescapable reality that comes in the late stages of a long-term debt cycle. Financial repression (negative real yields) is a way to (attempt to) erode the real value of the debts, at creditors’ (bond holders’) expense.

“This is among the biggest reasons for our persistent uber-bullishness on bitcoin. The total addressable market for something like bitcoin (of which bitcoin is the only viable option because of node decentralization, immutability, hard-capped supply, immaculate conception and proof-of-work mining) is above $100 trillion ($100,000,000,000,000).”

How are you Sam! Great report! Im following the DXY and starting to think that a nice pullback is coming. Don`t you think this will give a nice move in Tech and BTC that can change the plans of a huge bear flag forming? Or you think your view will continue to stand despite of this posible correction in the DXY.

Great overview, Sam. Keep up the great work. George the artist