Bitcoin Magazine PRO Contagion Report

This special edition report will be focused on the contagion that has spread amongst counterparties in the cryptocurrency industry.

We’re releasing the “Contagion Report” across both PDF and Substack options. Click the “Read Now” button below to access the full report PDF.

PREPARED BY:

Dylan LeClair, Head of Market Research

Sam Rule, Lead Analyst

Intro

This special edition Bitcoin Magazine Pro report will be focused on the contagion that has spread amongst counterparties in the cryptocurrency industry. The report will begin with a detailed explanation of what transpired leading up to the crises, including a thorough evaluation of the actors, services, and investment vehicles in particular that contributed to the industry-wide liquidity/solvency crisis.

The 2020/2021 Bull Market

Following the blow-off top of 2017, where the price of bitcoin appreciated by a factor of 100 in a mere 28 months, a sharp drawdown and period of consolidation occurred over the next two and a half years. As price traded between $3,000 and $14,000 throughout 2018/2019, the massive fiscal and monetary stimulus that occurred due to the COVID-19 economic lockdowns had investors around the world scrambling to find a hedge against inflation, and there stood nascent yet absolutely scarce bitcoin.

What followed was a raging bull market, fueled first by natural demand, and later powered by layers of opaque leverage, excess liquidity and arbitrage strategies. In this report, we’ll detail how many of the dynamics that stoked the flame of the raging bull market contributed to the ultimate crash and unfavorable market conditions seen today.

The Reach For Yield

The fundamental cause of the contagion crises that has plagued the cryptocurrency industry over the last six weeks has been an unwind of leverage brought about due to massive reach for “yield” by various industry players and platforms. This dynamic, and the reach for “risk-free” yield in an industry built around a yieldless bearer asset was doomed from the start. Its widespread growth following the 2020 bull run introduced systemic risk that few if any truly fully understood, leading to crashing exchange rates, mounting insolvencies, and future regulatory intervention.

The concept of “yield” in the cryptocurrency space is entirely misunderstood, which has led to the large amount of pain felt by participants in recent weeks. Yield refers to the earnings generated and realized on an investment over a period of time on a percentage basis. The most common example of yield in the investment world today would be the coupon payment one receives for buying sovereign bonds.

Example:

You, the investor, lend a nation your capital for a defined period of time, and they agree to pay you back the face value of the loan on a specific date. Due to the time value and opportunity cost of your capital, the debtor will also pay you periodic interest payments along the way. This excess return on capital is defined as the yield.

This is quite different from how “yield” is/has been generated in the bitcoin/crypto industry, which necessitates a closer look. The following passages will be an overview of the dominant “yield” generating strategies that arose since 2020, and the current state of those strategies and the second order effects of their proliferation.

GBTC Arbitrage

The GBTC arbitrage trade was one of the largest drivers of the bitcoin bull market of 2020, and ironically it has since shown to be one of the biggest bear market tailwinds. Let us explain.

The Grayscale Bitcoin Trust was the first company to launch a publicly-traded Bitcoin fund in the U.S., and given the product’s first-mover advantage, steadily grew in size and notoriety since its launch in May of 2015. Shares of the trust, which trade in OTC markets (over the counter), represent a fixed amount of BTC (currently: 0.00092242 BTC), with an annual fee of 2%.

The trust did not (and still does not) operate like an ETF, where institutions can exchange shares of the product for the underlying and back again. Shares of GBTC have a one way redemption mechanism, the Hotel California of bitcoin if you will. The trust worked by converting accredited investors’ bitcoin or dollars into shares of GBTC, with a six-month lockup period following the creation of shares.

Because of bitcoin’s nascency, shares of GBTC trading on OTC markets were the only way to gain exposure to bitcoin for individuals/firms operating within the walls of the legacy financial system. Due to the lack of other available options for the U.S. market, shares of the product long traded at a premium to net asset value.

Due to shares of the trust trading at a premium, an arbitrage opportunity arose where investors could bring dollars or bitcoin to Grayscale and receive shares (that were locked for six months).

Many funds pummeled capital into the strategy, with some shorting bitcoin futures or bitcoin-like exposure (although few accessible products yet existed) to remain market-neutral, while some funds just used the premium to simply mark up their books for 2020 year’s end (i.e., send $100 to Grayscale and receive $120 in locked GBTC assuming 20% premium), what wasn’t to like?

It is worth noting that firms could short bitcoin equivalent exposure upon the creation of shares to remain USD market neutral (in theory), or sell GBTC upon the conclusion of the 6-month lockup and buy bitcoin to harvest bitcoin native alpha (if there was still a premium).

Three Arrows Capital (3AC) entered this trade in massive size in 2020, becoming the largest holder of the trust with 38,888,888 shares of exposure (approximately 35,871 BTC) in its December 2020 filing.

A staggering 394,398 bitcoin was purchased and locked in the trust from the start of 2020 until February 18, when the trust first began to trade at a discount to NAV (net asset value). For context this figure was 79.26% of new total supply mined over the same time period, coming from just one buyer.

However, problems arose when the historical premium flipped to a discount, as a large amount of GBTC unlocks began to occur, flooding the market with available shares. This dynamic, coupled with the lack of redeemability, had large impacts on the market:

One of the largest buyers in the bull market was now sidelined, with there being no incentive to create additional shares of GBTC with shares trading in secondary markets at a discount to NAV.

Market participants who had purchased large amounts of shares were stuck with relatively illiquid shares of GBTC (average daily trading volume of 6.142 million shares/day ($199M/day) over the last year) compared to bitcoin itself.

The discount to NAV on such a massive amount of BTC-equivalent exposure dissuaded institutional investors from buying spot bitcoin itself, due to the existence of a bitcoin-like derivative that was trading below net asset value. This dynamic is still very much in play, with bitcoin trading at $21,000 at the time of writing with GBTC shares trading at a cost equivalent exchange rate of $14,639 (30.3% discount to NAV).

One of the primary “yield-generating” arbitrage strategies for institutional custody providers (such as BlockFi) was no longer available.

Due to the six-month lockup period for shares, many participants attempting the “market neutral” arbitrage took large losses as the premium flipped.

The first point is the one that is still to this day not widely understood. Due to the premium flipping to a discount on shares of GBTC, the bull run’s largest indiscriminate buyer was no longer in the game.

Futures Premium

Another yield-generating strategy that arose during the bull market for 2020/2021 was the futures arbitrage, where traders could acquire market-neutral exposure to bitcoin (and other cryptocurrency assets as well, with bitcoin being by far the most liquid) by selling futures contracts while holding spot.

Due to the speculative nature of a bull market, where market participants are bullish and the demand for leverage is extremely high, futures trade at a significant premium to spot markets. This occurred both in the perpetual and quarterly futures markets. Perpetual futures contracts never expire, and maintain their tether to spot markets via a variable funding rate, with longs and shorts paying each other directly based on the contract’s price relative to the reference price (a spot market index) over a period of time. When perpetual futures are leading above spot markets, longs pay short positions to hold positions at the variable rate, and vice versa.

Similarly, futures contracts with an expiration date are just promises to buy and sell at a set date. If prices of a futures contract are above the current spot market rate, the market is in contango and traders/arbitrageurs can capture a spread by selling the futures contract to capture the spread, which can be annualized into a yield.

Shown below are the annualized rates of the perpetual and quarterly futures contracts throughout the bull run:

Broadly, the futures basis can collapse for mainly two reasons:

Arbitrageurs sell futures and buy spot exposure, leading to a closure of the spread.

Spot demand dries up, and the over extended nature of the long-biased leverage in the market leads to forced selling and a cascade of leverage exposure.

Given that all exposure is marked-to-market with sufficient collateral, even a rapid collapse in exchange rates doesn't lead to systemic risk or broad-based “contagion.” The biggest impact of forced long liquidations is often a collapse in futures premium, and subsequently the yield-generating strategies dependent on the market conditions.

Moving Up The Risk Curve

As arbitrage opportunities dried up in the later months of 2021 as the futures basis once again collapsed, a “yield” generating opportunity in the form of staking UST on the Anchor protocol arose. Readers very likely know how this ends, but for the sake of this issue we will once again summarize.

UST was an algorithmic stablecoin that attempted to be pegged to $1. The peg was in theory maintained as UST was always redeemable for $1 of LUNA, a cryptocurrency backing the system on the Terra blockchain. Users could mint UST by burning $1 of LUNA, which would decrease the supply of LUNA in circulation. In the case of the exchange rate of UST falling below $1, the supply of LUNA would algorithmically expand to fulfill the $1 obligation.

Both UST and LUNA grew in spectacular fashion over the course of 2021, with the market cap of UST and LUNA growing from a combined figure of approximately $8 billion in May 2021 to as high as $59 billion merely one year later.

The growth and interest in both UST and subsequently LUNA (which was needed to acquire UST) due to the Anchor protocol, which was a DeFi platform that paid a sky-high interest rate of 20% for UST depositors. This rate was partially paid for by depositors who would borrow UST against collateralized cryptocurrency assets such as ETH and LUNA. However, the rate was subsidized by Terraform Labs, the creators of the LUNA blockchain.

This subsidization, paid for with funds acquired from the premined allocation of LUNA that Terraform labs had for itself, incentivized an increasing number of entities to utilize the protocol for yield-generating strategies.

What Went Wrong For UST And LUNA?

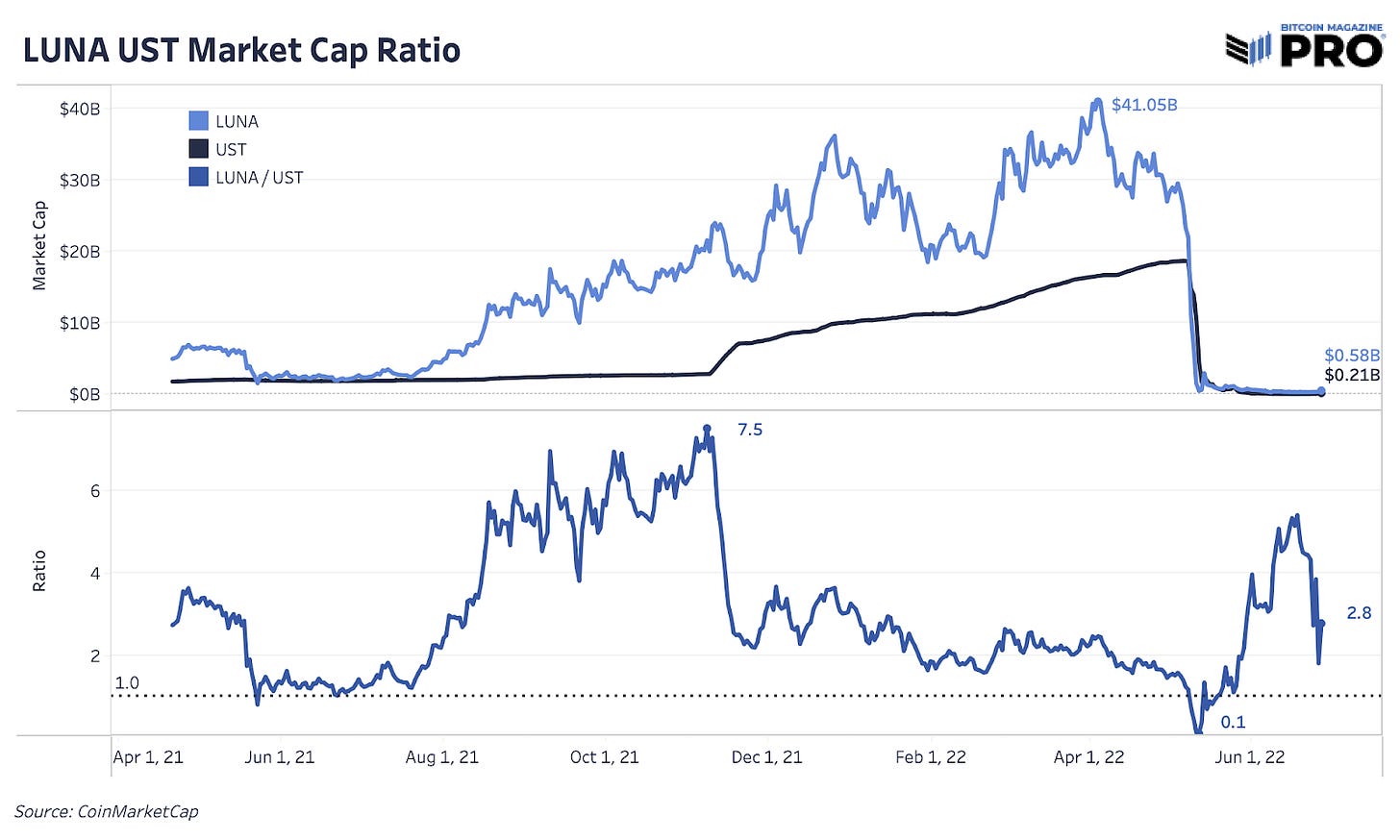

One can look at the ratio of market cap between LUNA and UST as a measure of the solvency of the system. Remember, since the supply of LUNA would increase in the case of redemption of UST, it was critical for the solvency of the system that LUNA remained larger than UST in market cap.

As soon as the market cap of UST became greater than LUNA’s, the system was functionally insolvent, and as investors ran for the exits to redeem their UST, the supply of LUNA would hyperinflate in an attempt to maintain the peg, collapsing the exchange rate to $0. As this was occurring in real time, we warned holders of UST of the impending doom-loop-style digital bank run.

Below is the ratio of the two assets’ market caps:

As LUNA and UST death-spiraled to zero in tandem, it became clear that many industry players faced significant losses, not just due to the collapsing exchange rates of crypto assets, but also the overnight blowup of an $18 billion “stablecoin” that many considered to be a risk-off asset.

Spillover Effects

Rumors began to fly as major players such as 3AC were known to have large exposure to both LUNA and UST, with the firm purchasing $500 million worth of locked LUNA exposure a mere three days before the collapse.

Similarly, on-chain forensics in April showed that Celsius, a major yield/lending custodian, was depositing hundreds of millions into the Anchor protocol in the weeks leading up to the collapse.

With the GBTC arbitrage and futures premium no longer available, and the collapse of LUNA/UST comparing the balance sheets of major industry players, it became apparent to many that the risk/reward of depositing on centralized yield platforms was increasingly unfavorable.

As this sentiment became increasingly shared by market participants, withdrawals increased, further exacerbating any liquidity/solvency issues that would face a lending institution engaging in fractional reserve/rehypothecation practices. This became an increasingly high risk for institutions that had capital locked up in higher duration “yield” strategies.

Unsecured Lending, Rehypothecation, And Layers Of Leverage

What turned the collapse of UST and the run on centralized yield institutions such as Celsius was the massive amount of unsecured lending that firms engaged in, specifically with 3AC. From what we now know about 3AC, the firm engaged in the following trades/practices:

Borrowed money unsecured from multiple counterparties due to reputation, including $350 million of USDC and 15,250 BTC from Voyager.

Trading on derivatives/options on Deribit (a portfolio company) without any underlying collateral.

Promising portfolio companies/protocols 8-10% “yield” on treasuries, used this to bolster the size of assets under management with rehypothecation. Likely was using Anchor to pay yield and capture the spread.

Pitched “opportunity” in waning moments for investors to buy BTC and get 15% return on that BTC in one year - was an attempt to get liquidity due to illiquid GBTC bags.

Collateralized (fully or under-collateralized is not entirely known) lending with multiple firms such as Genesis and BlockFi.

Buying ETH, staking ETH in Lido to receive stETH, pledging stETH as collateral in DeFi to receive yield, borrowing ETH against stETH, repeat (graphic below).

The layers of leverage, specifically of the unsecured fashion, is what helped to create the daisy chain of impairment across industry, with assets on the balance sheet of lenders secured by nothing but IOUs disappearing in an instant.

Don’t Trust, Verify

The unique circumstances that accompanied this bitcoin bull market cycle led to a boom in unsustainable arbitrage strategies, opaque systemic leverage and unsecured lending that has been in the process of violently unwinding since the November 2021 all-time high.

Yield-generating consumer retail products like BlockFi, Celsius and others that promised lucrative yield were not sustainable in their past (and current) form, due to the yieldless and absolute scace nature of bitcoin, and the fact that many of the risks that were being taken were unquantifiable and veiled in a lack of transparency (DeFi hacks and collapses, counterparty risk, and illiquidity and duration risks such as GBTC and stETH).

The proliferation of unsecured and under-collateralized lending across the crypto industry in particular should serve industry participants a tough lesson on the ills of counterparty risk and systemic leverage, which is something that bitcoin was quite literally invented to fix.

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” - Satoshi Nakamoto

Lessons Learned

“Your yield is not yield” - D̶o̶ ̶K̶w̶o̶n̶ The authors of this piece

First:

Yield products offered in native bitcoin terms are unsustainable. There is no way to natively generate yield on your bitcoin, without engaging in risk to do so. Therefore, the term “yield” is an incorrect or rather improper term. A more correct term would be “risk premium,” which is defined as the return in excess of the risk-free rate of return that an investment is expected to yield.

Given that the risk-free rate of return on bitcoin in bitcoin terms is 0%, any platform/service offering yield by definition is taking excess risk.

Second:

Bitcoin is here to stay, and despite recent events, is among the best collateral the world has ever seen. Transparent ownership on a global ledger, 24/7/365 liquidity in most every jurisdiction across the world, and fungible.

As bitcoin continues to entrench itself amidst the legacy financial system, it will increasingly be used as collateral as it has been over the last two years in the broader cryptocurrency ecosystem.

This is a welcomed development, but only if utilized properly.

Bitcoin is notoriously volatile. Over-collateralization with proof of reserves should be the standard going forward. Given the transparent nature of the Bitcoin UTXO set, this should be trivial for all lenders to implement. Firms such as Unchained Capital already have implemented such strategies, where users receive one of three keys to a multisig quorum and can transparently see that their loan collateral is dormant.

Proof of reserves should become the standard for every crypto/bitcoin exchange with custody solutions.

Final Note

The bitcoin/crypto market has been left reeling following the events that have transpired over the previous six weeks. It will likely take many months, quarters, or even years for all of the second and third order effects of the recent events to be worked out, with the most obvious impact being future regulatory standards.

It is also unlikely, even today, that the full extent of the credit impairment and losses have been uncovered across the market. For these reasons, our outlook on the market over the short/medium term remains quite cautious, as broader risk-off conditions in legacy markets have led to a reduction of risk exposure across the board, with bitcoin/crypto being among the riskiest from a volatility and regulatory perspective.

However, our long-term outlook on bitcoin is extremely bullish, and the recent forced liquidations and cascade of off balance sheet leverage has created extremely lucrative conditions for long-term oriented value investors looking to secure a slice of the world’s largest and most secure decentralized monetary network.

With time, this too shall pass, and bitcoin will continue its ascent as unstoppable global money built on a system of rules, and not rulers.

“A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system.” - Satoshi Nakamoto

Timeline

The timeline below does not capture every event that’s unfolded over the last two months but does aim to capture important events from the beginning of this contagion period to where we stand today.

Below we have also included previous Bitcoin Magazine PRO issues that covered events in detail as they have unfolded.

Celsius Exchange Halts Withdrawals: What Went Wrong?

Celsius and stETH - A Lesson on (il)Liquidity

Three Arrows Capital Faces Liquidation

3AC And The Leaning Tower Of Babel

4/2 DeFi total market cap peaks, falling 73.81% since then.

4/5 LUNA total market cap peaks at roughly $41 billion.

5/3 Celsius sends $275M into the Anchor protocol.

5/5 LUNA and UST depegging starts. Market collapse begins this week through May 12 with DeFI total market cap falling to roughly $50 billion from $120 billion.

5/6 Anchor Protocol deposits start to turn over and collapse for UST from over $14 billion to 1.76 billion by May 13.

5/8 Luna Foundation Guard (LFG) starts loaning out bitcoin to OTC desk to help defend UST peg.

5/9 UST trades down to $0.85 and LFG starts draining more bitcoin to stabilize peg.

5/10 Do Kwon announces a recovery plan is underway.

5/24 Voyager raises financing from private placement shares for $60M and builds up cash positions from Alameda, DCG, 3AC and others.

6/7 3AC starts circulating deck to pitch investors on a new GBTC arbitrage play. This is a last ditch effort to recover funds from LUNA losses of $200M.

6/10 stETH trades to 0.95 just two days before Celsisus withdrawals are halted.

6/11 Alex Mashinksy poses a question on Twitter if you know anyone who has a problem with withdrawing from Celisus. Mashinksy says it's all just FUD one day before Celsius halts withdrawals.

6/12 Celsius announces halting withdrawals, swaps and transfers. Mashinsky stops tweeting.

6/13 Celsius liquidation levels surface and start falling as they add collateral across 17k wBTC.

6/14 Su Zhu and 3AC announce they are working things out and go dark as they were liquidated by lenders and face insolvency.

6/14 Voyager tells customers they have no exposure to Celsius or stETH and have never engaged in DeFI lending activities.

6/16 Finblox announces 3AC exposure, pauses reward distributions and restricts withdrawal limits.

6/16 Derebit announces 3AC exposure and losses.

6/16 BlockFi’s CEO came out with a statement saying the firm had liquidated an overcollateralized margin loan of a client who had failed to meet debt obligations, with no mention of client name or underlying collateral used.

6/17 Genesis CEO announces losses with large counterparty who failed to meet margin call.

6/17 GBTC discount hits lowest level all-time at 36.45%.

6/17 Babel suspends withdrawals and redemptions under liquidity pressure.

6/17 Bitmex and Derebit liquidate 3AC positions.

6/19 Celsisus posts to community that they are trying to find a resolution.

6/19 Bancor pauses impairment loss protection and limits deposits likely as a result of large Celsisus withdrawals from liquidity.

6/20 Maple Finance announces lack of pool liquidity and that lenders will have to wait for borrower repayments.

6/20 Babel announces new structural agreements to repay debt to alleviate the liquidity situation.

6/21 BlockFi announces $250 million credit line from FTX.

6/22 Voyager announces $200 million cash and 15,000 BTC credit lines from Alameda and announces 3AC exposure of $350 million and 15,250 BTC.

6/23 Voyager limits daily withdrawals to $10,000.

6/23 BlockFi announces higher interest rate with tier 3 BTC from 0.01% to 2%, a 20X increase citing increased institutional demand and lower lender liquidity.

6/23 CoinFlex Exchange halts withdrawals.

6/24 Celsius hires advisors to prepare for bankruptcy.

6/24 News surfaces that Goldman Sachs may broker a deal with investors to buy distressed Celsius assets for $2 billion.

6/24 BlockFi On The Brink (OTB) podcast released with CEO Zac Prince saying 3AC’s loans were collateralized while BlockFi faced 10% of asset withdrawals in a “massive stress test”.

6/25 Investor call leaked that Morgan Creek is trying to raise $250 million to counter the BlockFi FTX offer to avoid wiping out equity holders.

6/27 CoinFlex Exchange issues $47 million worth of recovery tokens to cover an uncollateralized loan with a single individual counterparty, Roger Ver.

6/27 Voyager issues default notice to 3AC.