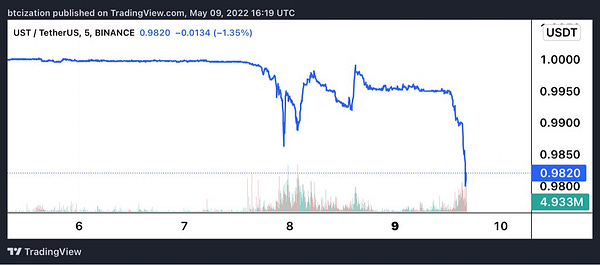

UST Dollar Peg Collapses

What’s been developing over the weekend and has been amplified today is the depegging of the Terra stablecoin (UST) to the U.S. dollar now with Terra currently trading at $0.85. Many of these market dynamics have been playing out in near real time today as the situation worsens and will likely change again over the next 24 hours. It started with billions of dollars in UST leaving the high-yielding Anchor Protocol over the weekend and turned into a full-on digital bank run.

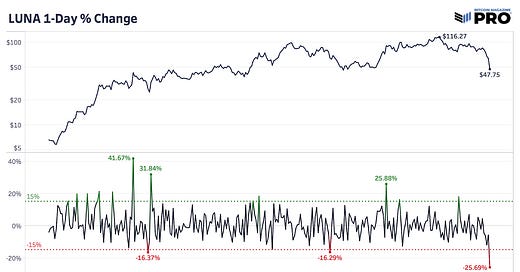

UST relies on the LUNA token to maintain its price through algorithmic minting and burning mechanics. Through this method, an arbitrage opportunity is created when UST is off its $1 peg. Traders can burn LUNA and create new UST when UST is priced over $1 and profit. When UST is below $1, UST gets burned and LUNA is minted to help stabilize the peg. Yet, as UST has suffered a blow to demand and liquidity, LUNA has fallen nearly 26% in just one day while BTC is down nearly 8%.

Why this matters for bitcoin is because the centralized Luna Foundation Guard (LFG) has accumulated 42,530 bitcoin ($1.275 billion at a $30,000 price) as reserves to be used in these exact situations, to defend the UST peg when it sustains below the $1. And currently, that is exactly what they are attempting to do.

As a response, the LFG voted earlier today to loan out $750 million of bitcoin and $750 million of UST to OTC trading firms in efforts to help sustain the UST peg. Later in the day, the LFG announced a withdrawal of nearly 37,000 BTC to loan out to market makers highlighting that it is currently being used to buy UST.

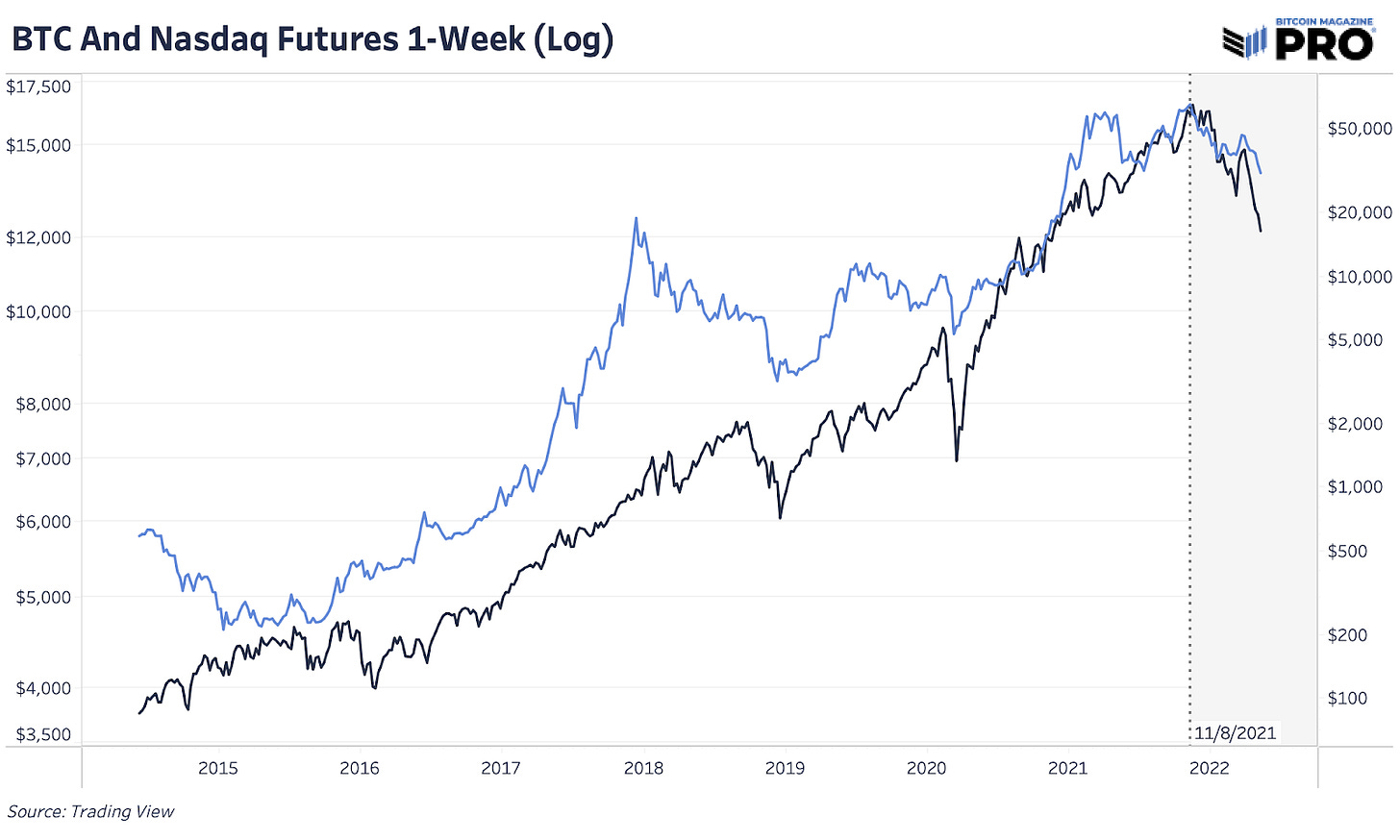

Now the main risk to the market is that the biggest buyer of bitcoin over the last couple months will now become the market’s biggest forced seller. The market expectations and potential selling have certainly played a role in bitcoin’s historic selloff today, but it comes at the same time that broader equity markets have been selling off in tandem. Bitcoin’s correlation to broader equity indexes and tech stocks is at historic highs and is following the same market dynamics since November 2021.

As a result of the rise in global interest rates, 40-year high inflation, deteriorating growth and a macro credit sell-off and unwinding unfolding, we’ve been highlighting these dynamics and the larger market risks at hand for months.

Final Note

As these dynamics continue to play out, the forced selling of the LFG’s bitcoin reserves could be the spark to send the market into a capitulation event with demand and liquidity already fleeting over the last few months. As the bitcoin price is now below MicroStrategy’s cost basis of $30,700, the next key levels of interest for bitcoin are a key technical analysis level of $28,000 and the realized price (cost basis) of around $24,000.

We’ll continue to cover the impact of the Terra stablecoin experiment as it relates to the impact on bitcoin supply and demand.

Do you think the PEG is coming back??