In today’s issue we will again focus on the ever-changing dynamic occuring with the company Celsius, who has halted all activity on its platform in the name of being in a “better position to honor, over time, withdrawal obligations.”

If you missed yesterday’s writeup detailing the situation, you can find that below.

Celsius Exchange Halts Withdrawals: What Went Wrong?

Since yesterday’s issue was released, Celsius has topped off their loan vault with additional collateral and paid down $37 million of debt, pushing the liquidation price to

Readers can track the status of the collateralized loan here.

With this status of the collateralized loan vault looking safer, we shall turn our attention to what may be the bigger worry: Celsius’ massive stETH position. stETH is a token issued by Lido which provides users a service where they are able to lock any amount of ETH in exchange for the stETH token, which can be rehypothecated in DeFi to earn yield, serve as collateral, etc. This contrasts to other forms of ETH staking where your assets are not liquid.

To read more about this dynamic and how it functions, read here.

You may be wondering, as a Bitcoin-focused publication, why cover Ethereum staking derivatives, and the answer lies in the fact that there is a large Bitcoin-related market player in an extremely vulnerable position (Celsius), that could potentially become a forced seller (of both ETH and BTC) at the most undesirable moment. For this reason, we cover the situation.

It’s critical to understand that the ETH to stETH redemption mechanism is a one-way street. This means that once ETH are staked, it is not possible to “unstake” the funds until after the merge to PoS (proof-of-stake) is successful. Ethereum developers expect the event to occur by the end of 2022, but history shows these timelines are notoriously over-optimistic.

This means that any large holder of stETH must wait until the merge to get back to liquid ETH, or exchange it on the open market, with a variable exchange rate. One can think of this dynamic similar to the free-floating premium/discount carried by shares of the Grayscale Bitcoin Trust.

Okay, so back to Celsius. Celsius currently is holding a massive 409,260 stETH, equivalent to $475 million at the time of writing. The problem with their position was that Celsius was promoting very high ETH-denominated yield to their users, where they would then take their customers’ ETH, and stake it with Lido to receive stETH, which would then be further pledged as collateral to receive more yield in DeFi protocols.

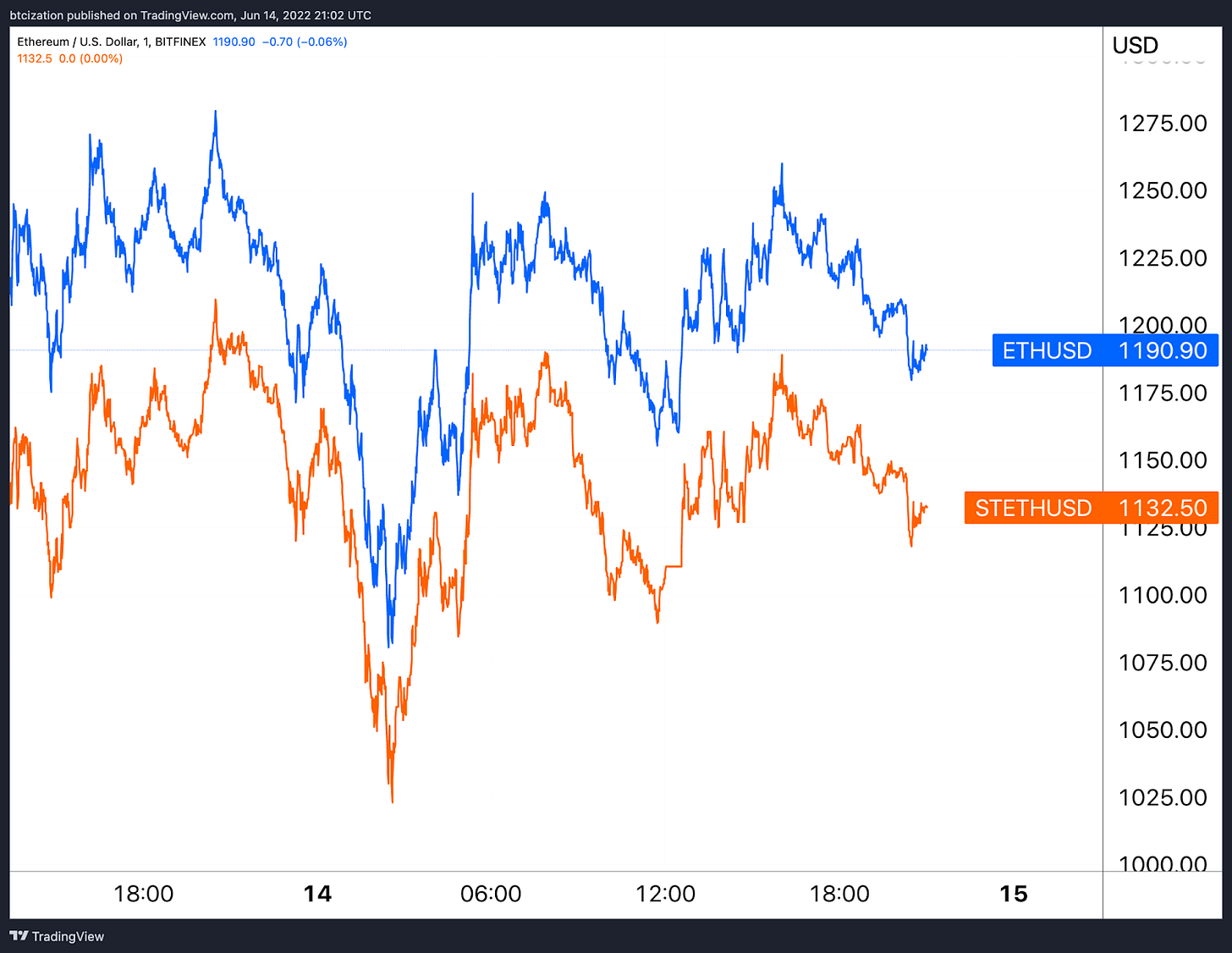

A large problem emerged for Celsius when market participants for whatever reason began to withdraw liquidity from pools on the stETH to ETH trading pairs, causing the exchange rate to break below 1.0.

At the time of writing, the current exchange rate for stETH/ETH is 0.949, which means that stETH positions are not redeemable for liquid ETH until a successful merge occurs. But this is just the start of the company's worries.

Aside from just a falling exchange rate, a larger problem is the lack of liquidity currently available for the trading pair, meaning that the exchange rate (even at 0.949) is much better in theory than it would be in practice. The main source of liquidity for the trading pair is the Curve stETH pool, which currently is 21.83% ETH and 78.17% stETH, meaning it would be impossible for Celsius to liquidate their position at once during a time of need.

Source: Curve stETH pool

Visuals of the balance of stETH and ETH in the Curve pool are shown below.

stETH balance visual - Source: Dune.com

ETH balance visual - Source: Dune.com

stETH and ETH balance visual - Source: Dune.com

The problem with this dynamic is that the 409,260 of stETH ($475 million at time of writing) is pledged as collateral in an Aave vault borrowing $308 million worth of stablecoins.

This is just the company’s total borrow amount on Aave; including assets on Compound, the company has pledged $1 billion worth of collateral to borrow $500 million of stablecoins, with stETH being the largest piece of collateral.

Readers can track the status of these positions here.

Given the trivial amount of liquidity that exists for the trading pair of stETH/ETH, as well as the persistent (and growing) discount that stETH has been trading with, Celsius has found itself in quite the liquidity crunch.

If the price of bitcoin and ether continue their fall in the face of an increasingly uncertain and volatile macroeconomic backdrop, Celsius is facing margin calls totaling upwards of $750 million. To cover these margin debts, a fire sale of pledged assets would need to take place, into an already relatively illiquid market for wBTC and ETH, and into the ether (pun intended) for stETH, given the state of the stETH Curve pool liquidity.

This all is occurring while major players such as Three Arrows Capital are dumping their stETH positions (at a discounted exchange rate) presumably for the liquidity preference.

Final Note

While nothing is for certain, a large industry player looks to be cornered and at the whims of the market. Given the cutthroat nature of financial markets, there is quite a large chance that we haven’t seen the end of this, and given the sheer size of Celsius’ positions, an event where they became forced sellers would have a tremendous short-term impact on market prices.

We will continue to update readers on these dynamics in future issues.

what a riveting turn of events let me see if i got this right, we got $hitcoin staking derivatives used as collateral to magically generate yield while the real $hitcoin lies locked away until the advent of a phenomenon the prophecies refer to as "merge"... only issue is...wen merge...and will any of this still be around by then

I think Celsius is working with Alameda on this. Sould be a good news even if they don't redeem them exactly 1:1 at least we see some cooperation in the crypto because the mentality of each for themselves depress me a bit lately.