The Bond Market Meltdown Continues: Where Are The Buyers For ‘Risk-Free’ Government Debt?

Sovereign debt is under pressure and it’s not clear who the marginal buyer is. Central banks are intervening to keep yields from exploding higher while they hike rates to fight inflation.

Relevant Past Articles

Looking For The Marginal Bond Buyer

Where are the bond buyers? As central banks around the world continue their attempts to wind down balance sheets, there is declining demand for sovereign debt everywhere you look. In fact, the Bank of England (BoE) was forced to buy more bonds this week, a continued expansion that is a clear sign that right now central banks have been (have to be) the only marginal buyer in the room.

Every day we check sovereign debt yields; every day they are going higher. The only dynamics that have taken yields lower or kept them flat in the short term is the announcement of interventions from the BoE, BoJ and the ECB. So far, these efforts have shown to provide only temporary relief. We’re likely to see all “temporary” liquidity injections become more long-staying policies as larger-scale issues (like the insolvency risk to United Kingdom pension funds) come to the surface. Central banks still seem adamant on using rate hikes until inflation is much closer to their 2% targets, so we could easily see restrictive rates continue while at the same time see central banks abruptly purchase bonds as various liquidity crises arise.

For example, the BoE is still expected to raise rates 75 to 100 basis points in their November meeting considering the rampant inflation in the U.K., risk of further currency devaluation, record-low unemployment and despite the latest bond market intervention. It’s a similar story that many countries and regions are now facing. Although it can change with the day — especially Thursday’s CPI data — the market is now pricing in an 88% chance of a 75 basis point hike for the Federal Reserve during the November meeting. Until inflation comes down further, central bank pivots look further away.

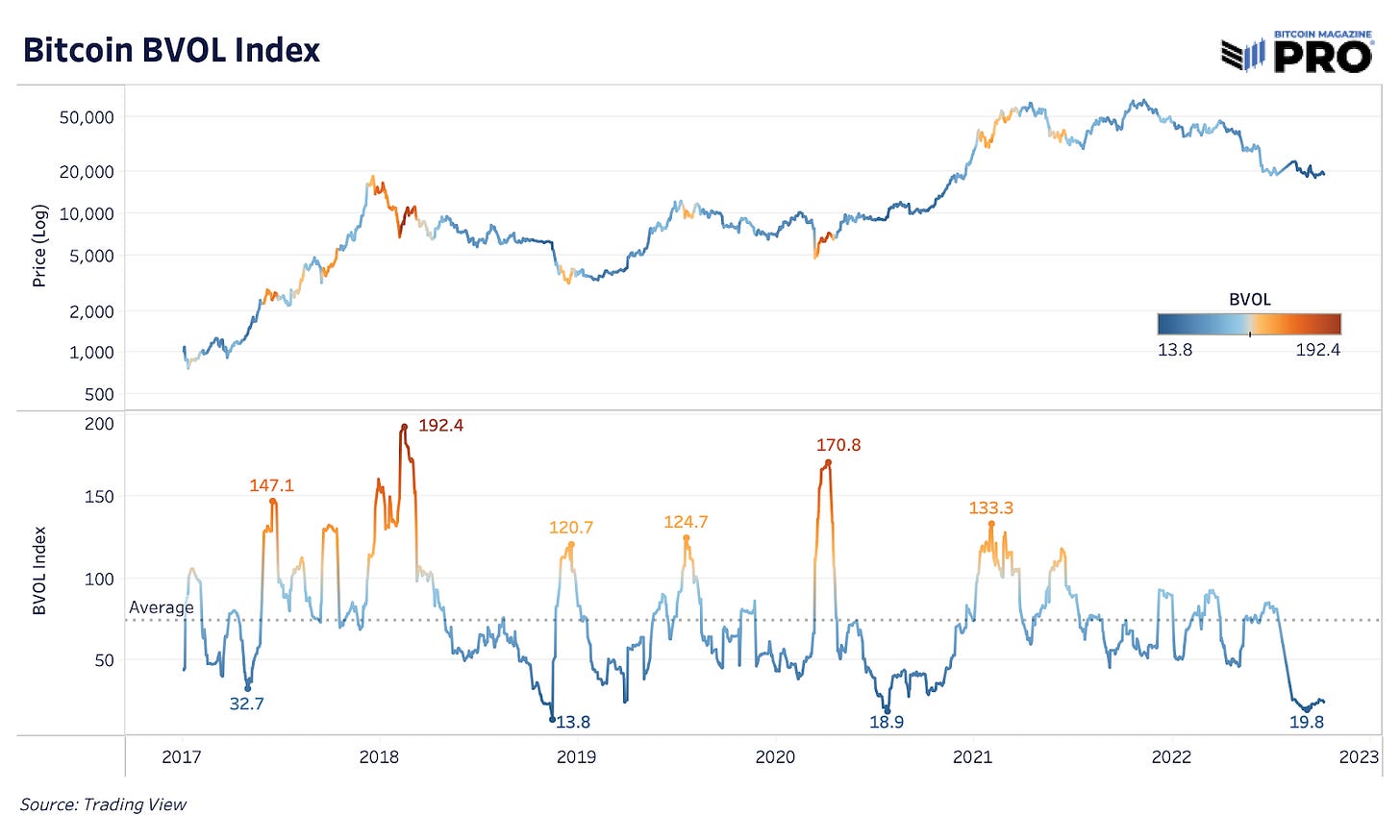

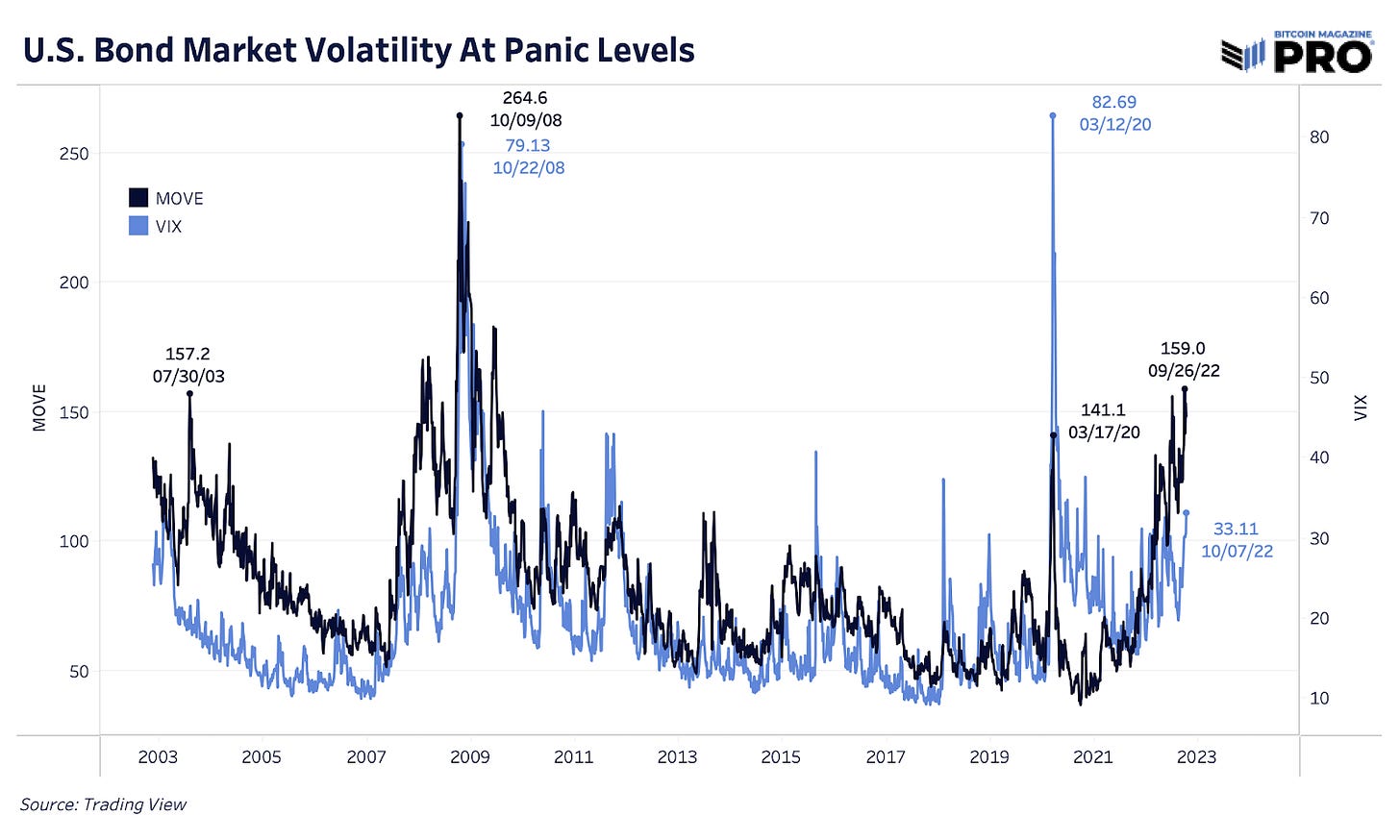

The easiest way to see that the broader sovereign debt market is breaking or close to breaking is to look at the MOVE index, which tracks interest rate volatility across U.S. Treasuries. The MOVE index at current levels is extremely abnormal; these are unsustainable, volatile, panic-like levels for the market. Volatility can be a measure of market liquidity as prices whip around more than participants are comfortable with, which can limit normal buying and selling behavior.

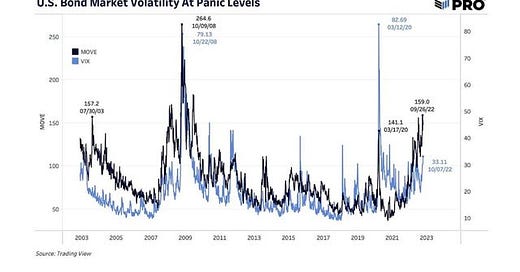

Realized volatility in U.K. government bonds is now even higher than for bitcoin. That said, bitcoin volatility is at one of its lowest historical levels (suggesting a big move coming) while bond volatility everywhere continues to rise. Created by Bitmex, BVOL is the rolling 30-day annualized volatility of bitcoin.

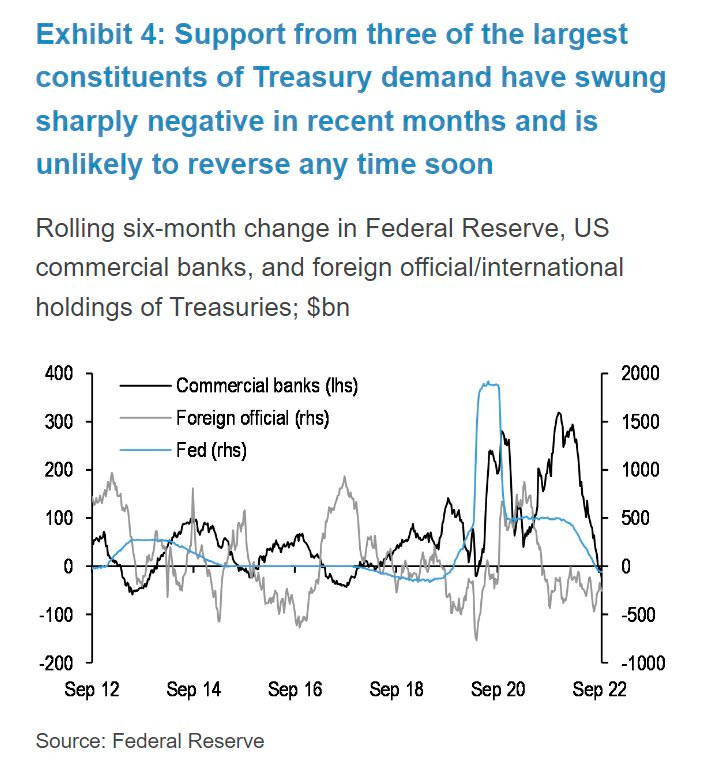

What is most concerning is the decline in buying for U.S. Treasuries across major groups: commercial banks, foreign institutions and the Fed. Many don’t want to step in and buy until we see the Fed’s next policy move in fears that rates haven’t reached their peak. Many can’t buy as a strong dollar and subsequent decline in other major currencies have also forced foreign buyers out of the market. Countries have been running down their foreign exchange reserves to defend their own currency’s purchasing power instead.

One of those key countries is Japan, where despite intervention efforts, the Japanese yen is still trading above a critical 145 level. For the first time in history, the Japanese 10-year government bond market has gone un-traded for three consecutive sessions as the yield curve control policy to pin rates at 0.25% carries on. Basically, the market doesn’t even exist anymore: there are no external buyers and yields will continue to stay capped as the government drives their share of the market higher and higher. Japan’s economic path has been used as a foreshadowing example many times for what’s to come for other Western economies.

Ultimately what we need to see to reverse this explosion and unprecedented rise in yields globally is a wave of marginal buying in sovereign debt outside of domestic governments. Otherwise, the market is telling us that bond prices need to be lower (and interest rates higher) for bonds to be seen as an attractive investment and allocation right now. As shown by the chart below, we’re coming off one of the worst performance years for returns in history — a once-in-a-century regime shift.

The other argument against the lack of bond buying right now is that very soon, there will be. Either via a deflationary bust that makes inflation much lower, a shortage of U.S. Treasury collateral in the market during a margin call or new regulations that force new buyers — like commercial banks or pension funds — to hold more U.S. debt against their will.

But right now, many are asking what to do with these “safe” or “risk-free” assets when they no longer seem to be safe, seem to carry more risk and are imploding with volatility.

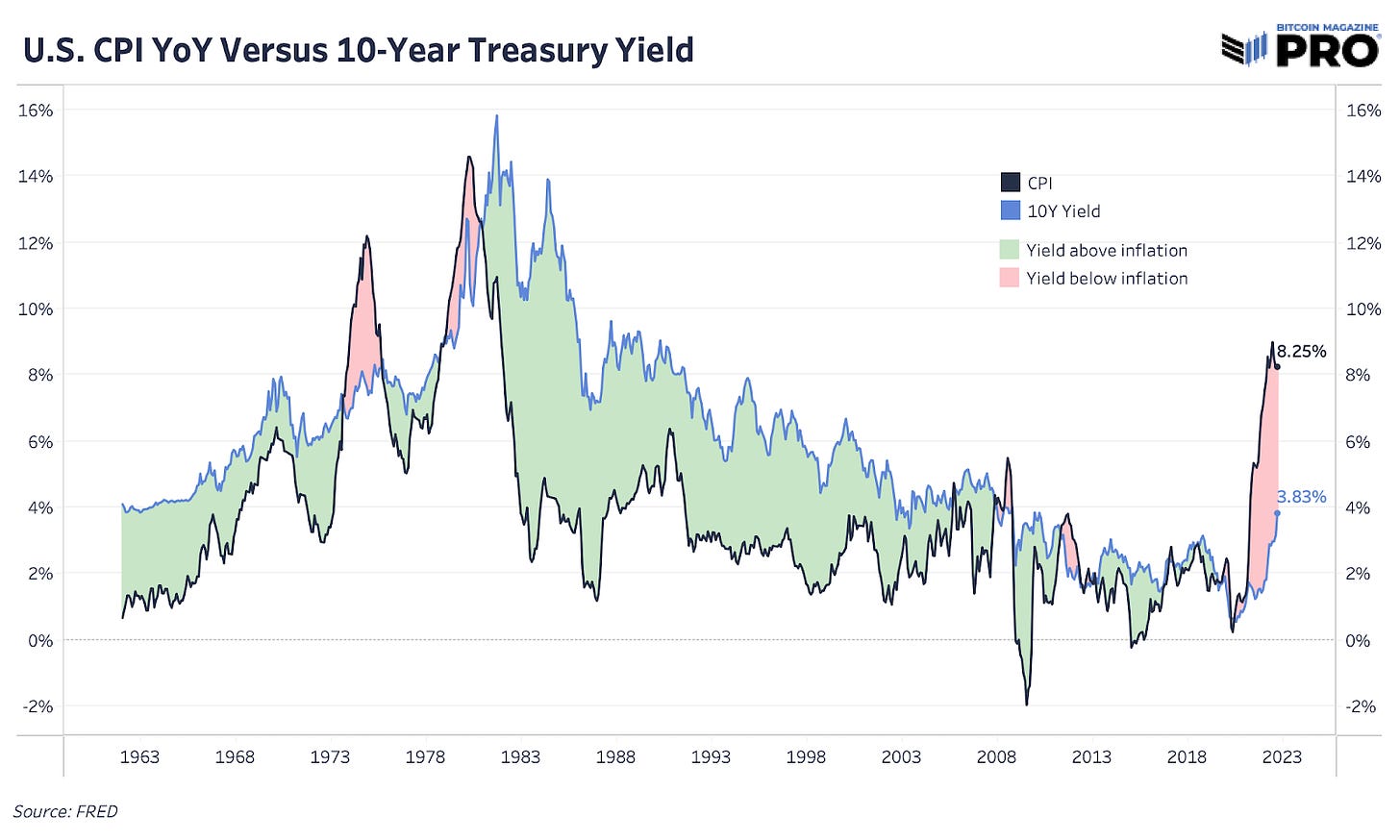

The challenge today is that 10-year yields are still well below CPI inflation even if the gap continues to close. Although 10-year expectations of inflation are much lower and have come down, the market didn’t predict this round of what looks to be more structural inflation that we have to deal with now. Historically, we’ve never defeated inflation over 5% until the federal funds rate is above CPI. That’s the problem before us today.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!