The Bigger They Are…

Potential capitulation from public bitcoin miners. Digging into Alameda's balance sheet which may be showing signs of financial distress.

Relevant Past Articles:

Latest Public Miner Developments

After writing last week on the potential for public miner capitulation and covering Core Scientific’s possible bankruptcy route, there’s been a wave of miner announcements and developments that show industry-wide risks taking more shape. The major risk is miners' accumulated debt and lack of cash flow to afford the interest rate on that debt as profit margins are squeezed. The other risk is hash rate (ASIC mining machines) that has been used as collateral to secure this debt financing.

As miners face increased pressure to pay off debts, there’s another risk of a significant drawdown in hash rate and ASIC machines hitting the market which can drive depressed rig prices even lower. It’s a fire sale for those who can afford it and a balance sheet risk across collateralized ASICs for others. This doesn’t just affect public miners but also the firms and lenders who hold the debt on their balance sheets as well.

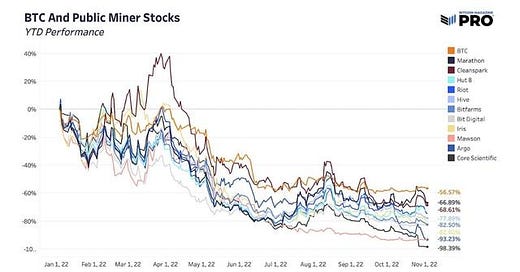

Public miners across the board continue to heavily underperform bitcoin in year-to-date performance. That’s not a new trend but now, as miners start to fall and the survivors emerge, the performance gap starts to widen in a big way. Miners on the edge of going under are down over 90% while the market’s chosen “stronger” miners are more in the 60-70% drawdown range.

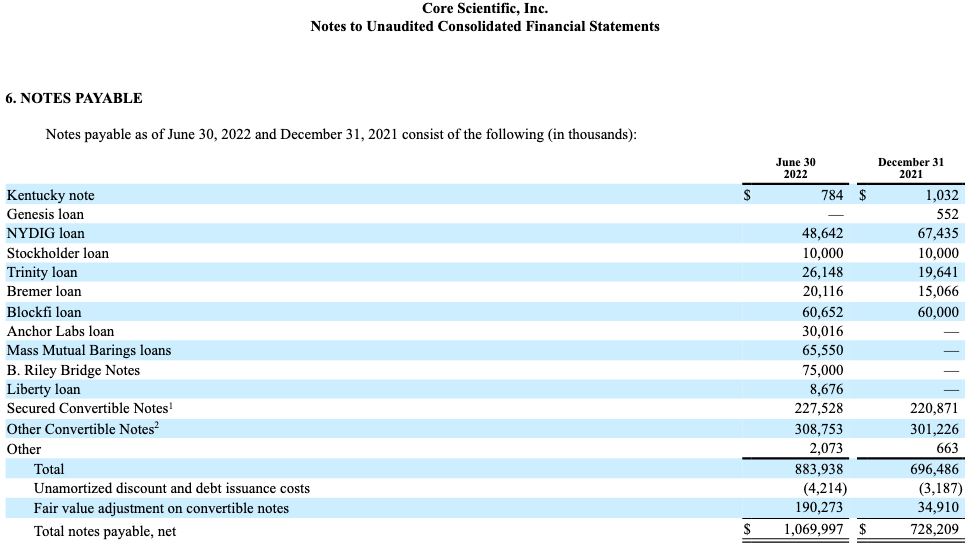

Starting with Core Scientific, there’s a laundry list of firms that are owed money, including BlockFi, NYDIG and Anchor Labs. In total, creditors are owed around $1 billion and even MassMutual Barings (an investment firm owned by Mutual Life Insurance Co.) is on the short list.

Source: Core Scientific Quarterly Filing

In case you missed it: Bitcoin Magazine PRO hosted two Twitter Spaces events this week. The first on Monday 10/31 with guest Greg Foss discussing systemic financial risk.

The second occurred today 11/3 with guest TXMC for a recap of the recent FOMC meeting and discussion of the macroeconomic dynamics at play, including the tail risks of both inflation and deflation taking shape throughout the next decade.

Argo Blockchain is one of those at the bottom, now down 93.23% this year. They released the biggest mining news of the week after announcing that a planned $27 million fundraise didn’t go through. Earlier this year, NYDIG agreed to a $70.6 million loan with Argo. Argo also used some of its bitcoin holdings in August to reduce their BTC-backed loan obligations from Galaxy Digital as well.

Iris Energy highlighted in a financing update this week that the company is “currently capable of generating an indicative $2 million of Bitcoin mining monthly gross profit, compared to aggregate required monthly principal and interest payment obligations of $7 million.” After borrowing $71 million from NYDIG which was secured by ASIC machines for one of their outstanding loans and at risk of needing a debt restructuring, Iris has nearly 36,000 machines that may change hands fairly quickly. The company would default on these loans unless they can find a new agreement by November 8.

Stronghold Digital Mining just this week closed on their debt restructuring deal with NYDIG, delivering a fleet of 26,200 miners in exchange for the wipeout of $67.4 million in debt. Stronghold also extended another tranche of debt to be repaid over 36 months instead of 13 to buy more cash runway. The moves have been a strategic action to “rapidly de-lever our balance sheet and enhance liquidity”.

CleanSpark, who’s been in a place of growth and able to buy ASICs at lower prices recently, ended up selling more of their bitcoin holdings (mined 532 BTC and spent 836) last month to support growth and operations. Although many major miners are still maintaining their HODL strategies and bitcoin balances, strong miners will tap into those holdings for growth opportunities or funding operations when absolutely needed.

TeraWulf, another bitcoin miner down 92.38% year-to-date, runs a relatively high debt-to-equity ratio compared to other miners (86%) and has $120 million in debt to start being paid back in spring 2023 at an 11.5% interest rate.

There will be a bit of a scramble for miners to find additional fundraising and debt restructuring opportunities in the market. Even DeFi platform Maple Finance has a long waiting list of miners who want access to a pool of $300 million in potential liquidity. These are publicly traded mining companies and private firms who are willing to pay 18-20% interest rates. Binance is also starting to make a play in the market with a $500 million total pool of capital to offer 5-10% interest rates to miners who need it. Everyone is looking for capital to keep their business afloat in this bear market and others are taking advantage of the opportunity.

As larger private lenders like BlockFi and NYDIG don’t disclose how much mining debt is on their balance sheets, it’s impossible to know for sure how exposed some of these lenders are to broader mining industry bankruptcy risk on the horizon. These loans may be a reasonable portion of broader financing activities and well equipped to handle the default risk, but it’s a dynamic worth highlighting and to better understand as we expect more miners to face pressure of debt default and/or restructuring over the next few months.

One opinion from Marathon Digital Holdings CEO Fred Thiel, ballparks that 20 or so public miners could be at risk of going bankrupt in what he deems a perfect storm for the industry. There’s no doubt that larger, better-positioned miners are looking for potential, favorable acquisition deals to arise fairly soon. Like every other industry before it, major industry consolidation is inevitable and public bitcoin mining looks primed to go through that next phase of its lifecycle. It’s likely we move to a world where there are only a few major bitcoin miner giants with a handful of much smaller miners behind them.

Similarly, it’s entirely possible that as this cycle moves from the bottom right quadrant to the bottom left, cash rich energy producers at both the public and private level start scooping up ASICs to deploy in preparation for the next bull phase.

Source: Alkimiya

Details Emerge on Alameda Research Balance Sheet

Yesterday afternoon in an article published by CoinDesk, details surfaced regarding the balance sheet of crypto trading firm Alameda Research. The fund, which is tightly intertwined with exchange FTX, was one of the few dominant players to seemingly come out unscathed from the crypto contagion, displaying several signs of strength during its supposed “bail out”.

Throwback - Bitcoin Magazine Pro coverage on this summer’s Crypto Contagion

“The financials make concrete what industry-watchers already suspect: Alameda is big. As of June 30, the company’s assets amounted to $14.6 billion. Its single biggest asset: $3.66 billion of ‘unlocked FTT.’ The third-largest entry on the assets side of the accounting ledger? A $2.16 billion pile of ‘FTT collateral.’

“There are more FTX tokens among its $8 billion of liabilities: $292 million of ‘locked FTT.’ (The liabilities are dominated by $7.4 billion of loans)” — CoinDesk

The glaring problem with Alameda’s stash of assets is that it’s dominated by extremely illiquid altcoins, with its exchange token FTT being by far its largest holding.

FTT Token Use Cases, per CoinMarketCap:

1/3 of the commissions received from transactions on FTX are utilized to buy back FTT. Tokens redeemed in this way are burned;

FTT tokens are used to reduce trading fees and to secure futures positions;

Profits from massive market movements are distributed among the holders;

By purchasing a white label version of FTX’s OTC portal and futures market, institutions and investors pay expenses in FTT tokens.

The balance sheet leak was from the second quarter, up to date through Q2, but it can still provide some insight into Alameda.

The biggest problem with the balance sheet is that it’s reported Alameda was holding $5.82 billion of FTT on June 30th, while the market cap of FTT at the time of the report was $4.2 billion. This is a result of some of their asset allocation being held in locked altcoins, which, similar to VC investments and employee stock compensation programs, has a locked/vesting period, only this time it’s using smart contracts. It should be noted that Alameda apparently applied a 50% haircut to all “locked” assets, but one could make the case that this is still generous accounting.

Regardless of the locked tokens, the concentration of their holdings is in their own extremely illiquid exchange token, which they are the majority owner of. In a scenario where a large part of their reported $8 billion in liabilities is denominated in dollars, Alameda could become a forced seller of an exchange token that they are the primary market maker and indirect issuer of.

One should note that during the collapse of crypto lender/yield service Voyager, Alameda had an open credit line of $376 million.

We do not have insight into the actual makeup of their liabilities, so nothing can be known for certain. We are simply asking questions that we think deserve to be asked.

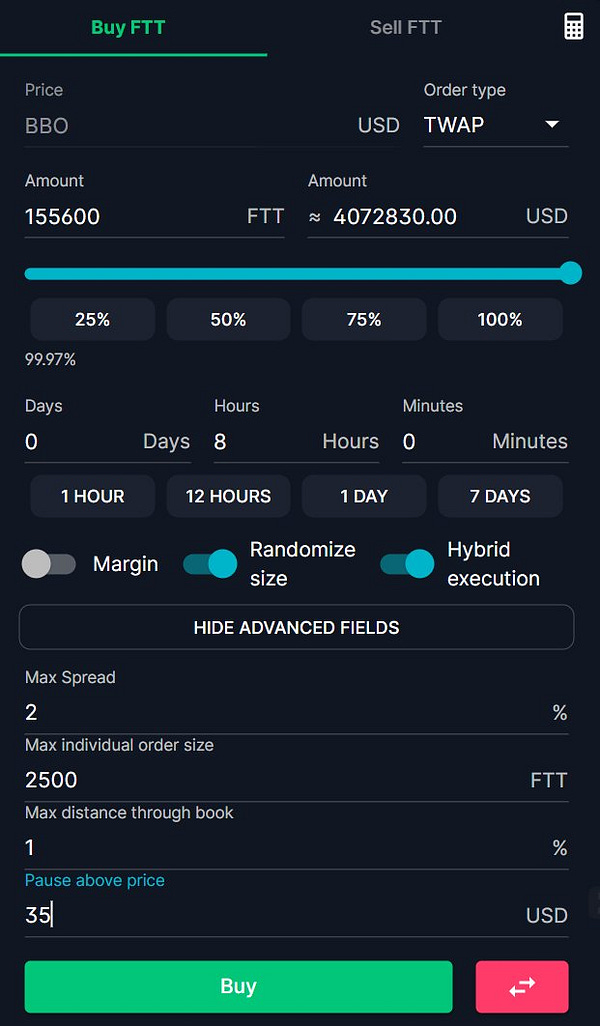

With all of this in mind, the actions of FTX/Alameda co-founder to promote buying FTT token — a token he also co-founded — in TWAP (time weighted average price) orders on FTX quite obviously looks like a ploy to lure in buy-side liquidity to support the illiquid FTT market.

With the FTT market still extremely bloated relative to 2020 valuations, it’s possible that the concentration and liquidity risk will lead to some forced deleveraging.

We covered and tracked similar dynamics in regard to Celsius and LUNA. While those were completely different and tangential to the bitcoin market, this speculative excess and balance sheet leverage/concentration in general can lead to market-wide sell pressure native to crypto markets.

Final Note

The biggest risk inherent to the bitcoin market today remains the weak players hanging by a thread underneath the surface. The lack of meaningful price volatility in this $20,000 range is certainly encouraging from the standpoint of buyers and sellers finding a temporary equilibrium. But as the frequency of miner troubles continues to rise, along with the possibility of more fund-based leverage still in the market, max pain unequivocally is lower for industry participants. The brunt of the selling has taken place with bitcoin now at $20,000, but one has to question whether the marginal buyer is of sufficient size to stem the potential selling pressure on the horizon.

We suspect that the pressure is beginning to ramp up on the crypto lenders that did survive the summer contagion, due to the increasing headwinds certain miners are facing in this environment.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Who I need to talk to about getting this deposit into my account