Soft CPI Sparks Rate Cut Speculation, And Its Effect on Bitcoin

Examining the Implications of Negative CPI on the FOMC policy, Economic Outlook, and Bitcoin

This morning, the CPI came in soft for June, ramping up speculation about a rate cut from the Federal Reserve. In this post, I walk through the important parts of the CPI, give insight on Chairman Powell and the FOMC’s thought process, and lastly, discuss what are the likely outcomes for the Bitcoin price.

I live streamed the CPI release here. Follow me at bitcoinandmarkets.com.

CPI Negative in June

In June 2024, the Consumer Price Index (CPI) for All Urban Consumers fell by 0.1%, following no change in May. The YoY CPI dropped to 3.0% from 3.3%. Gasoline prices fell significantly by 3.8% in June, contributing to a 2.0% decrease in the overall energy index, while food prices edged up slightly by 0.2%. Excluding food and energy, the index increased by 0.1%, with notable softening in shelter, motor vehicle insurance, household furnishings, and medical care, though airline fares and used car prices declined.

I've maintained my position that high CPI readings were transitory, facing much criticism, especially in Bitcoin. Yet, it was the correct position and is being validated by this negative CPI print in June following a 0.0% in May. This was the first negative print since May 2020, and likely to be the first of several such prints this year. In an election year, Biden will release more oil from the Strategic Petroleum Reserve (SPR) which will compound the disinflationary effects in the economy already, further lowering CPI. This now gives Fed Chair Powell room to cut rates and combat unemployment and recession, potentially delaying a recession until after the election.

The high CPI of the last few years was driven by COVID-related fiscal spending, supply chain issues, and suffocating energy regulations, sanctions and trade wars. My stance is based on the understanding that our debt-based financial system is destined for a deflationary end, the economy simply cannot sustain the level of economic activity necessary to maintain a high CPI. This was a predictable path in a return to low growth and low inflation – the fate of every debt bubble in history. CPI falling does signal recession, especially when paired with rising unemployment, however, it doesn't mean it will be immediate. They can try to kick the can down the road, but diminishing marginal returns on new debt locks in the deflationary dynamic.

A large influence this month was Owners Equivalent Rent (OER), which is finally starting to come down. The overall shelter number was slashed in half this month, from 0.4% to 0.2%. This should not be a surprise, since we’ve discussed on this substack that shelter is a lagging indicator. It lagged on the way up and is lagging on the way down.

Federal Reserve to Cut Rates?

The Fed’s dual mandate is stable prices and maximum employment. With prices stabilizing they can shift to fighting rising unemployment. Their thought process is by lowering rates, they can stimulate the economy and perhaps guide it to the elusive soft landing. That is the current school of thought for the FOMC and that is what they’ll do. The only reason they wouldn’t cut rates with unemployment rising is because they don’t want prices to reaccelerate to the upside, but after the last two months, that is very unlikely.

Rate cut odds for the Fed have skyrocketed for the September meeting, not so much for July. However, I believe the market is underestimating the chances for a July cut. Jobs data is deteriorating fast and the inflation fight will take care of itself in a recessionary environment. The risk of being late outweighs the risk of being too early. We’ll have to see what the FOMC members say over the next week, before their blackout period prior to meetings.

Source: Investing.com, Fed Rate Monitor Tool

Powell’s modus operandi was formed back in 2019, when he cut rates 3 times that summer in what he labeled a mid-cycle adjustment. These were early cuts which I think Powell will repeat, cutting sooner rather than later, especially if other central banks are already cutting. Back in June, I wrote about several major central banks starting to cut rates, while the Fed held firm.

Source: Nova Scotia Bank

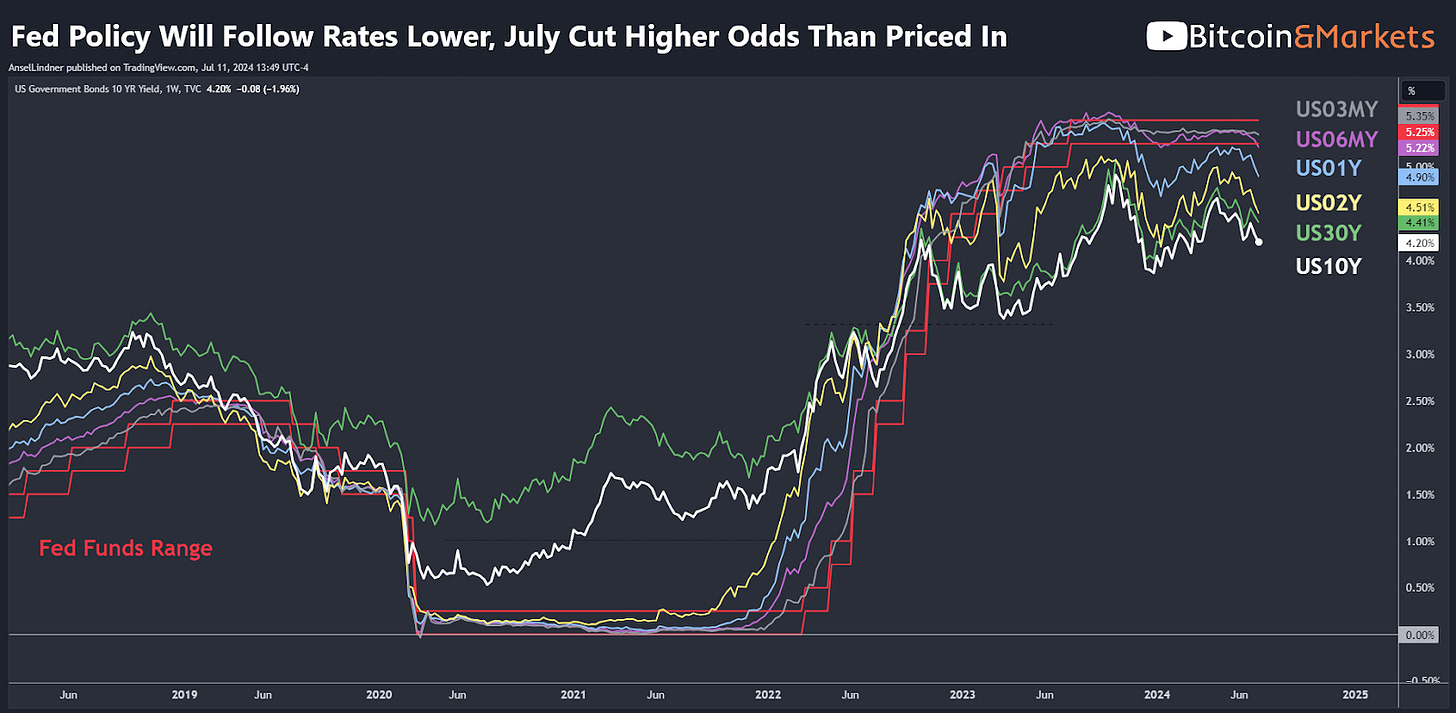

Below, is a chart of several US Treasury yields alongside the Fed Funds policy range. On the far left, you can see nicely behaving yields in proper order, however, starting in mid-2022 the curve went nuts, inverting with longer maturities below the shorter ones. The Fed has failed to influence these longer rates, and will look very foolish if they break to new lows without a response.

Again, in the chart above, we can also plainly see that the Fed follows the market. In 2019, the last time Powell was cutting rates, all but the 30Y was already below the policy range. You can find that same pattern time and time again as you go back to other recessions. It is yields that drop and the Fed follows. Applied to the situation today, the Fed has stubbornly held their policy rate high but the longer rates are calling their bluff. It is my forecast that if the 10Y continues to fall into the July 31 FOMC meeting, perhaps breaking below 4%, Powell will cut.

Effect on Bitcoin

With rate cuts commonly believed to be stimulatory, the cut should be bullish for Bitcoin. Despite some other analysts predicting a stock market crash to coincide with a rate cut, which would imply a crash in Bitcoin as well due to their correlation, I believe stocks have further to rally this year.

Below, you can plainly see that only twice in 40 years have cuts coincided with stock market crashes, the Dotcom bubble and the Great Financial Crisis. Even the 2019 cuts were followed by 6 months of stellar stock market performance before COVID. Powell will try to engineer something like Greenspan in the 90’s, where he cut early and moved the rate around yet stocks kept climbing.

This brings us back to the below chart from earlier this week (which I’ll revisit once more). As the German bitcoin selling winds down (they have less than 5,000 BTC remaining as of this morning), it is likely that Bitcoin’s price will start to catch up with the ongoing rally in the stock market. With the first rate cut likely to occur sooner rather than later—enabled by a soft CPI that shows progress on the inflation side of the Fed's mandate and Powell’s tendency for early cuts—Bitcoin should experience a significant rally over the next quarter.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!