Bitcoin's Path to Recovery Amidst Market Volatility

Examining the resilience of Bitcoin in the face of government sell-offs, institutional inflows, and potential recessionary pressures

Bitcoin sentiment has been very bearish over the last couple of weeks, and many analysts are calling for the possibility for even lower lows down to $48,000. While that is possible, it is unlikely at this point.

Follow me at BitcoinandMarkets.com!

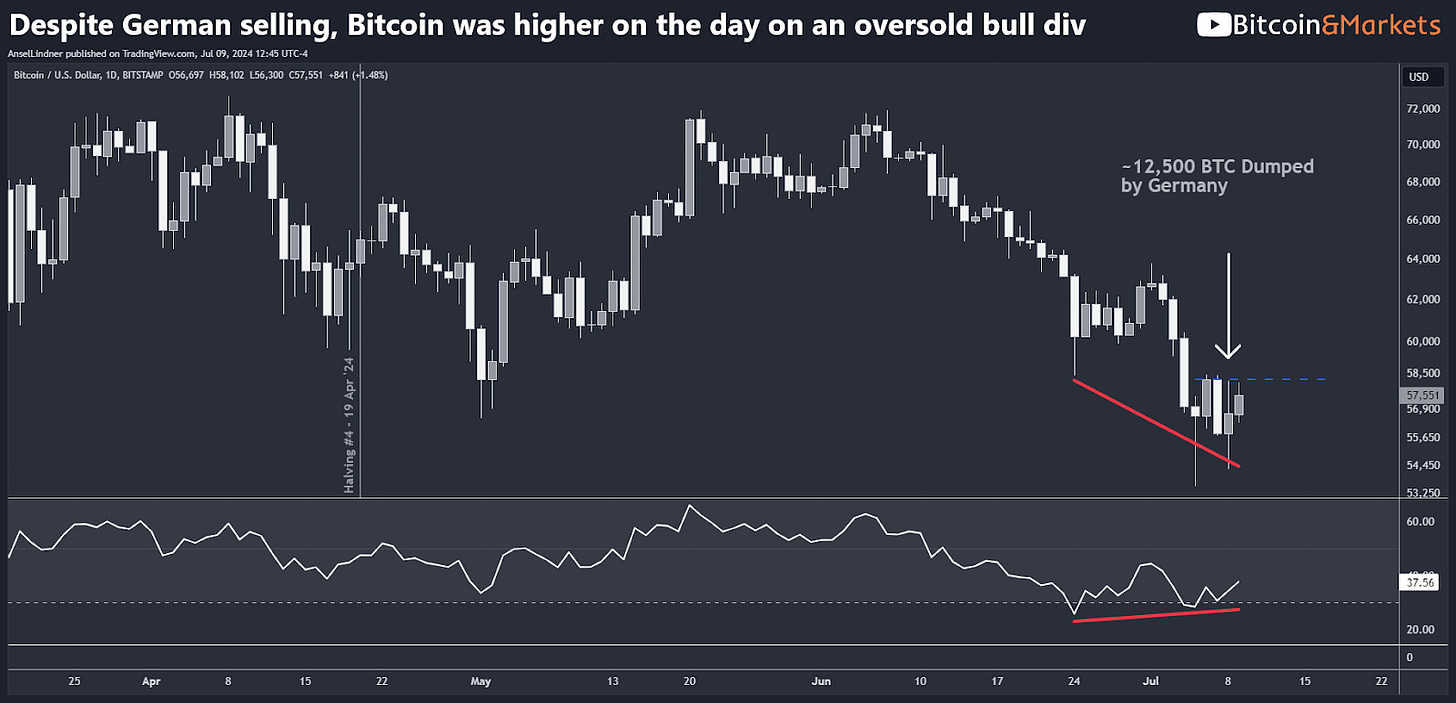

Several major bearish narratives have taken over the space, however, it is important to remember that in Bitcoin negative events tend to get overestimated, while positive developments tend to get underestimated. The German government has been offloading a large stash of Bitcoin they seized from Movie2K, a pirated film site, earlier this year. They started with 50,000 BTC and are now down to 23,000. Despite selling 12,500 BTC yesterday, Bitcoin's price ended higher on the day.

Source: Arkham

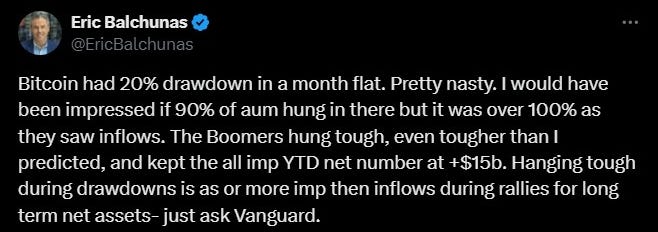

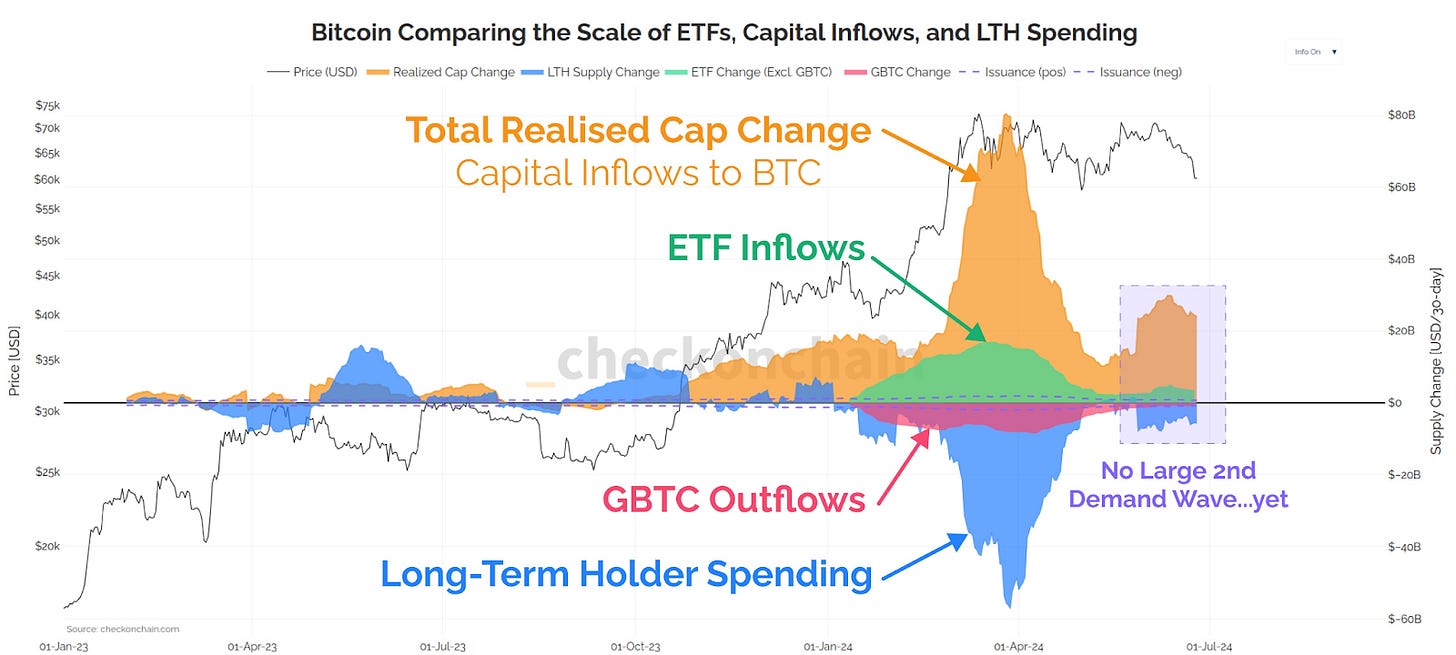

Bitcoin spot ETF flows have turned positive again, with $295 million in inflows yesterday and $143 million last Friday, signaling interest in accumulation at these levels. Bloomberg analyst Eric Balchunas also tweeted that he was impressed that the Bitcoin spot ETFs not only held onto 100% of their AUM during this recent 27% drawdown, but added to it.

Source: @EricBalchunas

The MtGox disbursements, long feared to cause a sell-off, are likely to be less impactful than expected. There is a bot on Twitter, @MtGoxBalanceBot, that provides hourly updates on the MtGox Trustee account. So far, they are reporting 2700 BTC have been sent to creditors who registered for accounts on designated Japanese exchanges.

It's important to note that ETF inflows are only 20% of total spot demand, with most trading volume coming from regular exchanges, showing a robust market demand.

Source: Checkmatey

In this context, Bitcoin still managed to be higher on the day yesterday, and is trying to continue today. The immediate “must break” level to continue this bounce is $58,250 (blue dash line).

Let’s examine several other price metrics from our By the Numbers tracker.

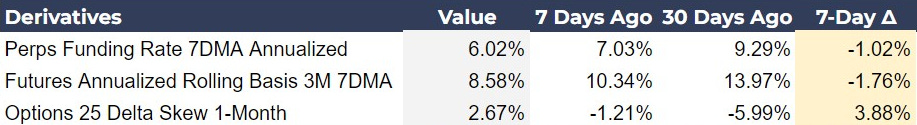

Derivatives Markets

Perps funding rates have come down significantly. At bottoms, we expect funding rates to briefly hit negative levels, but that is not required in this environment IMO. They have come down dramatically and have plenty of room to move in the bullish direction.

Source: LookIntoBitcoin

The Futures Annualized Rolling 3M Bases is notably down from 14% a month ago, to 8.5% today. The Basis trade is therefore less attractive at these levels which stops aggressive shorting of futures.

The Options 25 Delta Skew is also drastically changed from negative (pessimistic) to positive (optimistic). Traders are anticipating more volatility to the upside, but it is still relatively low all things considered.

Macro is Looking Recessionary

A huge piece to this Bitcoin cycle puzzle this time around is the overarching macro environment. Bitcoin is now a $1 trillion+ asset class, hopefully $5 trillion by the time this cycle is over, it is a new massive player on the macro scene, and will be affected by the global macro environment. It appears we are going into recession in the next 12 months, and what does that mean for Bitcoin? Will it perform as a risk-on stock or a risk-off safe haven asset like gold and Treasuries?

The change in Global M2 is starting to turn positive as central banks make their dovish pivot with several major central banks cutting rates at their last meetings. The 1.22% YoY number is still historically low. Just look at the 5-year CAGR of 5.55%. Looking at a chart of US M2, it is barely breaking positive, meaning there is very little M2 creation going on right now.

Source: FRED, M2 YoY change

M2 is not the best measure of money in the economy. Legend Lacy Hunt likes to use ODL (Other Deposits and Liabilities, Table 2. Line 36 of H.8). This measure removes currency (low volume percent of transactions) and money market funds (very illiquid). This gives us a more accurate measure of the money supply in the economy than M2. What does it show? It’s shrinking. This is a sign that the economy is actively in deflation and shrinking, which will lead to defaults and recession.

Source: FRED

ISM PMI was also disappointing this month, with Manufacturing scoring its 19th contraction in 20 months and accelerating to 48.5. It has been offset by a resilient Services PMI (not shown in table), which has maintained over 50 in 11 of the last 12 months. However, in June, Services PMI hit 48.8, the lowest since COVID and well below where recession typically sets in.

Source: Econ_Parker

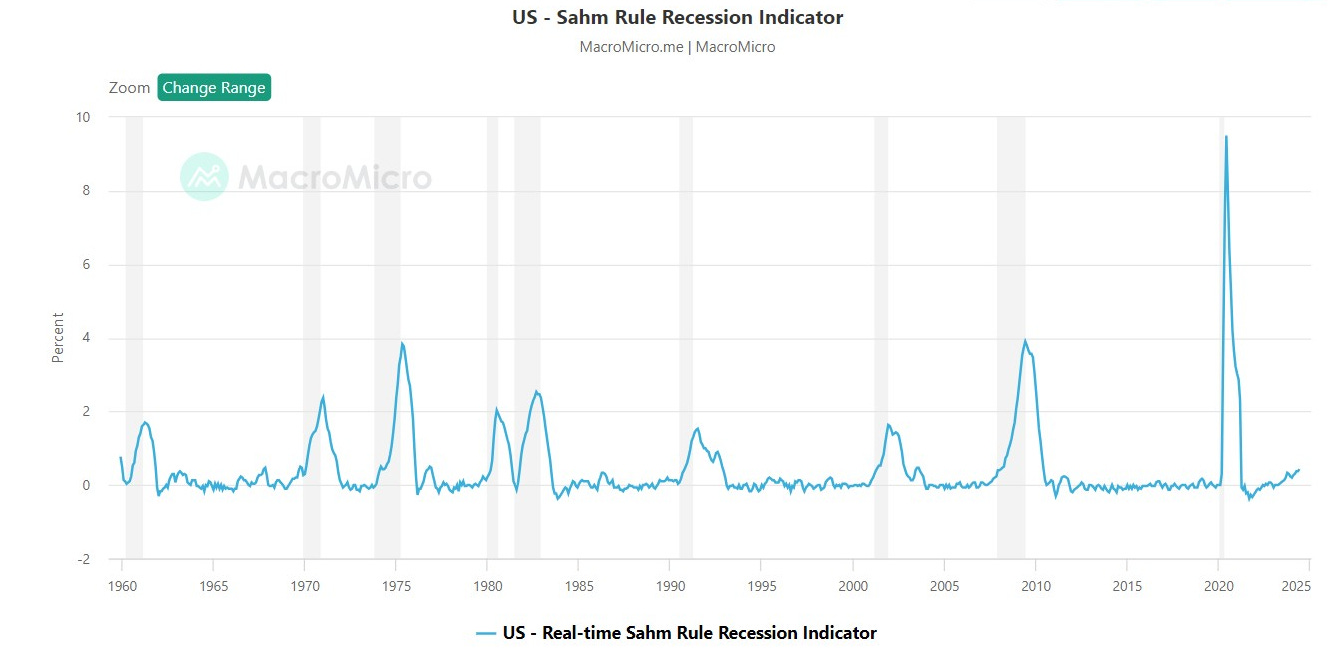

Additionally, jobs data out of the US is deteriorating. You might have heard people talking about the Sahm Rule this week because we are beginning to see a move higher in the unemployment rate, which is extremely important to declaring a recession. The unemployment rate in June was 4.1%.

Source: FRED

The Sahm Rule, named after Claudia Sahm, a macroeconomist at the Federal Reserve and the White House Council of Economic Advisers, says “recession is signaled when the three-month moving average of the U.S. unemployment rate is half a percentage point or more above the lowest three-month moving average unemployment rate over the previous 12 months.”

Source: MacroMicro

You can see above, when the indicator rises to hit the 0.5% mark, it reliably indicates the start of recession. It just hit 0.5%. This indicator is simple and quite reliable, however, the COVID shock to unemployment, might cause some deviations in this cycle. However, if accurate, it is signaling an imminent recession that will become stronger as the unemployment rate continues to tick upward.

Can Bitcoin Recover While Going Into Recession?

With all the above information in context, about the bearish Bitcoin sentiment, the dumping by Germany and recent 27% drawdown, the demand from the ETFs and spot buyers, and the likely coming recession, does this leave Bitcoin in a place to complete its bull market cycle through 2024 and into the first half of 2025?

Of course. Despite elevated supply, demand has been able to keep up at this price level, and all this new supply is ultimately temporary. Germany will not be able to keep this pace up for long because they simply don’t have much more Bitcoin. The MtGox creditor selling is likely vastly overestimated, which itself will lead to a correction once it becomes obvious only a small fraction of the recovered Bitcoin will hit the market. Additionally, the demand for Bitcoin going into a deflationary recession should increase as a counterparty risk-free safe haven.

My pre-recession prescription this year has been to be bullish on stocks, bonds and Bitcoin. While I’ve only been correct on 2:3, bonds have performed better than most analysts have predicted. Below is the Nasdaq compared to Bitcoin. I highlighted two important areas of divergence, 2019 and today, both were dominated by pre-recessionary pressures. If history repeats, it is likely that Bitcoin catches up to stocks and not stocks that catch down to Bitcoin.

Bitcoin Magazine Pro Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!

This is just the content I love.

I am surrounded by non-Bitcoiners. How about writing an article for them? I need something to share, especially with older family members who are not going to be influenced by me.

How do we know that the BTC that exited Germany’s wallets and into exchange deposit wallets so far has been sold to market?

Is it possible that they have more than the 23k BTC left?