The Central Bank Tipping Point and the Rise of Bitcoin

Central Banks Shift to Fight Recession, Surging Bitcoin ETF Inflows, and the Everything Hedge in a Revolutionary Period

Introduction

In today's post, the May jobs report shocked markets with an unexpected surge in payrolls, while simultaneously revealing massive losses in employed people. Central banks are starting to admit weakness, with the Bank of Canada and the European Central Bank cutting interest rates to combat looming recession fears. Amid this turbulence, Bitcoin ETF inflows are surging and institutional interest skyrocketing. Let's explore how these events intertwine and what they mean for the future of Bitcoin as a safe haven asset.

Want more like this? Check out BitcoinandMarkets.com.

The End of Credit and the Rise of Bitcoin

To catch you up on my successful macro thesis, here's a brief background before diving into current events. For the past five decades, the world has ridden an expansive credit bubble, spurred by unanchored elasticity since 1971. This era fueled globalization, improved living standards, and population growth. However, it’s clear this grand credit-based experiment is nearing its end. As the economy buckles under debt and diminishing returns, trust in traditional financial structures erodes. Enter Bitcoin—a decentralized, trustless form of money with which to rebuild a functioning system.

With diminishing returns on credit, more economic activity is focused on maintaining the fragile global credit system. The first significant crack appeared during the Global Financial Crisis (GFC), and now we see an inevitable second wave of economic contagion. The current deflationary bust is unavoidable, prompting central banks to cut rates—a significant milestone toward the coming recession.

May Jobs Report Shocker

The May payrolls report revealed an impossible addition of 272,000 jobs, significantly exceeding the highest Wall Street estimate of 258,000. March and April numbers, however, were revised down a total of 15,000 jobs. If the establishment survey, also known as the Non-farms payrolls survey, is indeed correct, it means the economy is robust and adding jobs at a substantial rate. Markets typically put more stake in the establishment survey even though the unemployment rate is dictated by the other major jobs-related survey, the household survey.

This second survey by the Bureau of Labor and Statistics (BLS) measures the number of employed people, instead of the number of jobs. The household survey showed the exact opposite, reporting a decline of 408,000 working Americans, and hence a rise in the unemployment rate from 3.9% to 4.0%. The labor force participation rate also dropped from 62.7% to 62.5%. This month’s data has resulted in the biggest gap on record between the two surveys. Something isn’t right here.

Source: FRED

The way in which the establishment survey counts the birth/death adjustment (i.e. business creations vs failures) automatically added 231,000 jobs to the establishment survey. These jobs weren’t counted but simply plugged in by a formula.

Source: Zerohedge

When added together, the labor force participation rate and the household survey, the number of employed people in the US dropped 625,000 to 133.3 million, while the establishment survey showed the exact opposite, a 272,000 increase in payrolls.

Markets tend to prefer the Non-farms payrolls, but the discrepancy is so large, most analysts can’t help but notice it. I suspect that the initial effect of the payroll gains will quickly turn into concern about the participation rate and overall employment. Central banks are starting to realize this and rate cuts are already here.

Bank of Canada and European Central Bank are Canaries in the Coal Mine

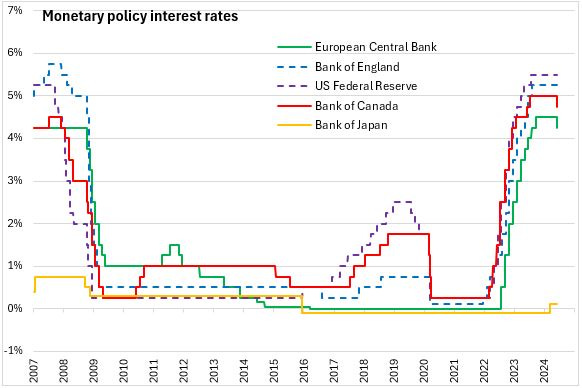

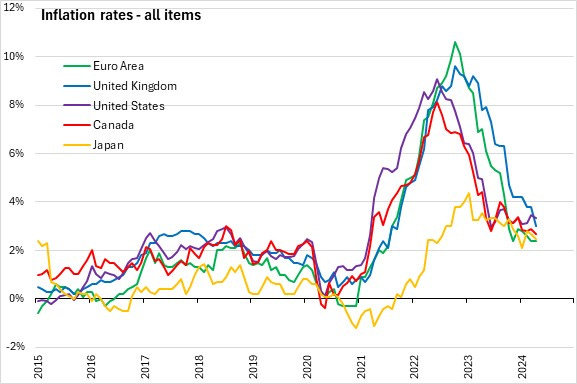

The Bank of Canada (BoC) became the first G7 nation to cut interest rates this week, reducing its key policy rate from 5% to 4.75%. This was followed the next day by the European Central Bank (ECB) cutting its key interest rate from 4% to 3.75%, despite ongoing inflationary pressures in the euro zone. These cuts are a huge signal of a coordinated shift in monetary policy. To switch to fighting a slowdown from fighting inflation is a serious juggling act.

Source: Nova Scotia Bank

Both central banks claimed that their inflation rates would continue to fall, but are notably abandoning inflation as their primary concern, switching instead to the slowdown in their economies.

Source: Nova Scotia Bank

Switzerland, Argentina, Brazil, and Mexico are among the important banks cutting rates in 2024. While some East and South East Asian countries like Japan and Indonesia are actually raising rates to protect their currencies. It is safe to say that BoC and ECB are working in close coordination still, as large globalist banks, and you can expect the Bank of England to follow suit this month with their own cut. Overall, we are beginning a period of less global central bank coordination.

The elephant in the room, however, is the Federal Reserve. Will Chairman Powell follow along with a cut next week?

Source: AP Photo/Manuel Balce Ceneta

Personally, I think Chairman Powell has shown significant restraint when it comes to coordinating monetary policy. He has disavowed CBDCs and unequivocally rejected using central bank operations for climate policy. If the Fed cuts rates next week, it will be due to internal considerations, like the weakening labor market, not in an attempt to show solidarity by harmonizing global monetary policy.

We aren’t the only ones noticing these changes of course. The paradoxical thing about central bank policy these days is that it portrays the opposite of what is intended. For instance, hiking sends the signal to the market that the economy is so good the central bank has to try and cool it off. And vice versa, when they are forced to cut, it is because the economy is much worse than maybe most investors think it is. In this environment, pristine collateral (government bonds) and safe haven assets like bitcoin will see increasing demand.

ETF Flows are Exploding higher

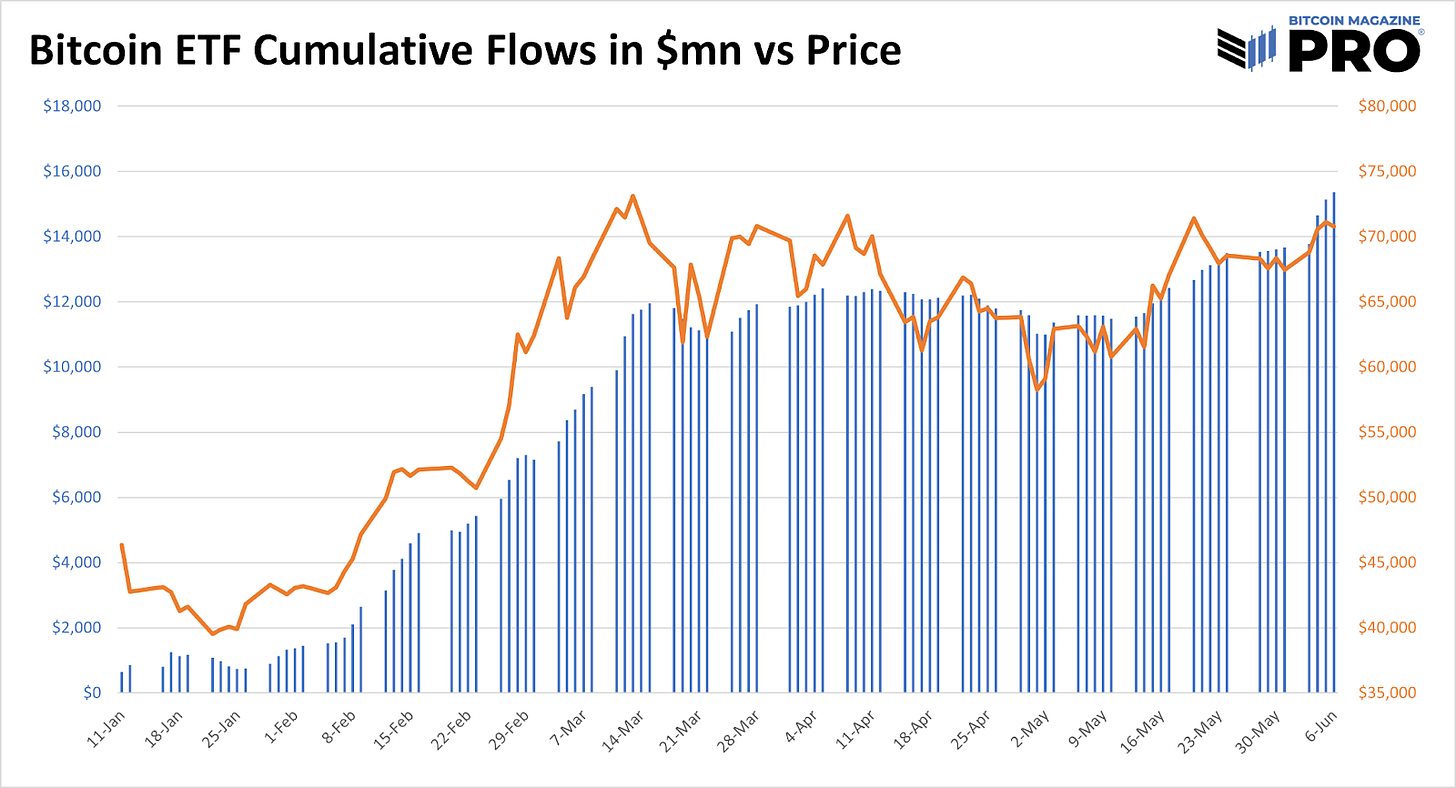

We see this growing demand from institutional and well-connected entities in the Bitcoin ETF flows, specifically in the current 18-day streak of positive inflows. This follows a period of 25 days where 18 days saw net outflows where the market was digesting the unprecedented performance of the Bitcoin ETF launch. Those outflows abruptly ended with the Q1 13F filings that showed some big-name players were getting involved. Since then we haven’t had another negative day.

To grasp the true importance of these inflows, we need to think of them in context of the global economic situation we discussed above. If the global economy is deteriorating to the point where central banks are starting to cut rates, investors know it is time to get defensive.

Now, if the flows were $10M/day or very small, we would not be able to draw many conclusions from that. However, since the average inflow over this 18-day streak is $215M/day, and this week have averaged $424M/day, we can confidently conclude that Bitcoin is being seen directly as a good investment in this defensive time.

Bitcoin is the perfect asset in this environment, because it is not only the business cycle heading toward a recession, but also about the overall viability of the financial system as a whole. Global debt is immense and not getting any better. Global trust, that has enabled globalization and the mountain of debt, is being eroded with every escalation in the Ukraine and Israeli conflicts. The fragility of the global credit system itself is being exposed. Amid such uncertainty, Bitcoin emerges as a compelling hedge in all directions. Investors are taking notice.

Conclusion

In conclusion, the surge in ETF inflows highlights the increasing confidence in Bitcoin as a financial safe haven. This trend, set against the backdrop of global economic uncertainty and central banks' monetary easing, reinforces the narrative that Bitcoin is not just a speculative asset but a critical component of a diversified and resilient investment portfolio. As we move forward, these inflows are likely to continue, further bolstering Bitcoin's position in the global financial system and driving its long-term growth potential.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!