Pt 2: Preparing For Tomorrow’s CPI Reading - Market Braces For Volatility, Bitcoin Open Interest Surges

Markets await the highly anticipated September CPI data release due Thursday. Consensus leans towards month-over-month growth and a CPI surprise higher could take yields higher and risk assets lower.

Relevant Past Articles:

Part 2: Preparing For Tomorrow’s CPI Reading - Market Braces For Volatility, Bitcoin Open Interest Surges

Part 2 of Wednesday’s article. Published 10/12/22 for paid subscribers.

At the time of writing, the latest CME probability market data shows nearly a 90% chance of a 75 basis point rate hike in November — and a much less certain picture of what happens in the December meeting. The highest probability as of now is another 50 basis point rate hike to come. The range of probabilities and uncertainty is consistent with what we’re seeing in the 2-year Treasury yield. All of that can change rather quickly, especially with the volatility in yields we’ve seen over the last month.

Where CPI lands relative to consensus is anyone’s guess, but the markets look to be waiting for their next direction until that data comes out. The main medium-term concern, beyond tomorrow’s data, is still that Core CPI will stay at a 5-6% annual growth rate for many months. As it lags heavily, rent inflation is a major component that will likely further increase before turning over. Medical care services is also a component that rose significantly in August and continues to do so as it’s more affected by stickier labor costs that are also rising. Despite oil’s rise over the past two weeks, energy may be less of a short-term factor in the September data as commodities continue to turn over. But the latest oil prices could easily come surging back amid OPEC production cuts and winter shortage demand approaching.

These examples are just a few CPI components but they reiterate the point on what the Fed wants to see come down: the housing market to cool off via higher mortgage rates (to drive lower home and rent prices) and labor costs to stop rising via higher unemployment. Outside of the Fed, we’ve seen the heavy depletion of the Strategic Petroleum Reserve in an attempt to temporarily curb oil prices globally but that tool will soon come to its end at the current rate of drawdown. Every tool is on the table to take inflation lower, whatever the costs and second-order effects.

Here are two external pieces of research we will highlight if you want to dig into CPI components more:

This thread from Bob Elliott (former Bridgewater) on CPI components and Core CPI projections.

The CPI projection model from Prometheus Research that forecasts an inflation surprise to the upside driven by housing inflation contributions.

What Does It Mean For Bitcoin?

In yesterday’s piece, we emphasized the lack of historical volatility in the bitcoin price right now. This won’t last and the market is wound up for a fairly volatile move one way or the other. The CPI print could easily be that catalyst. If we’re to see a move to the upside, our framework is still that the move will be a temporary rally to blow out leveraged shorts, take liquidity and likely reverse back to the downside. A large CPI surprise could send the market on a trajectory to test a lot of liquidity and stop losses just below $18,000. That’s the surprise CPI bear case. Again, look to the equities market direction to determine the short-term trend.

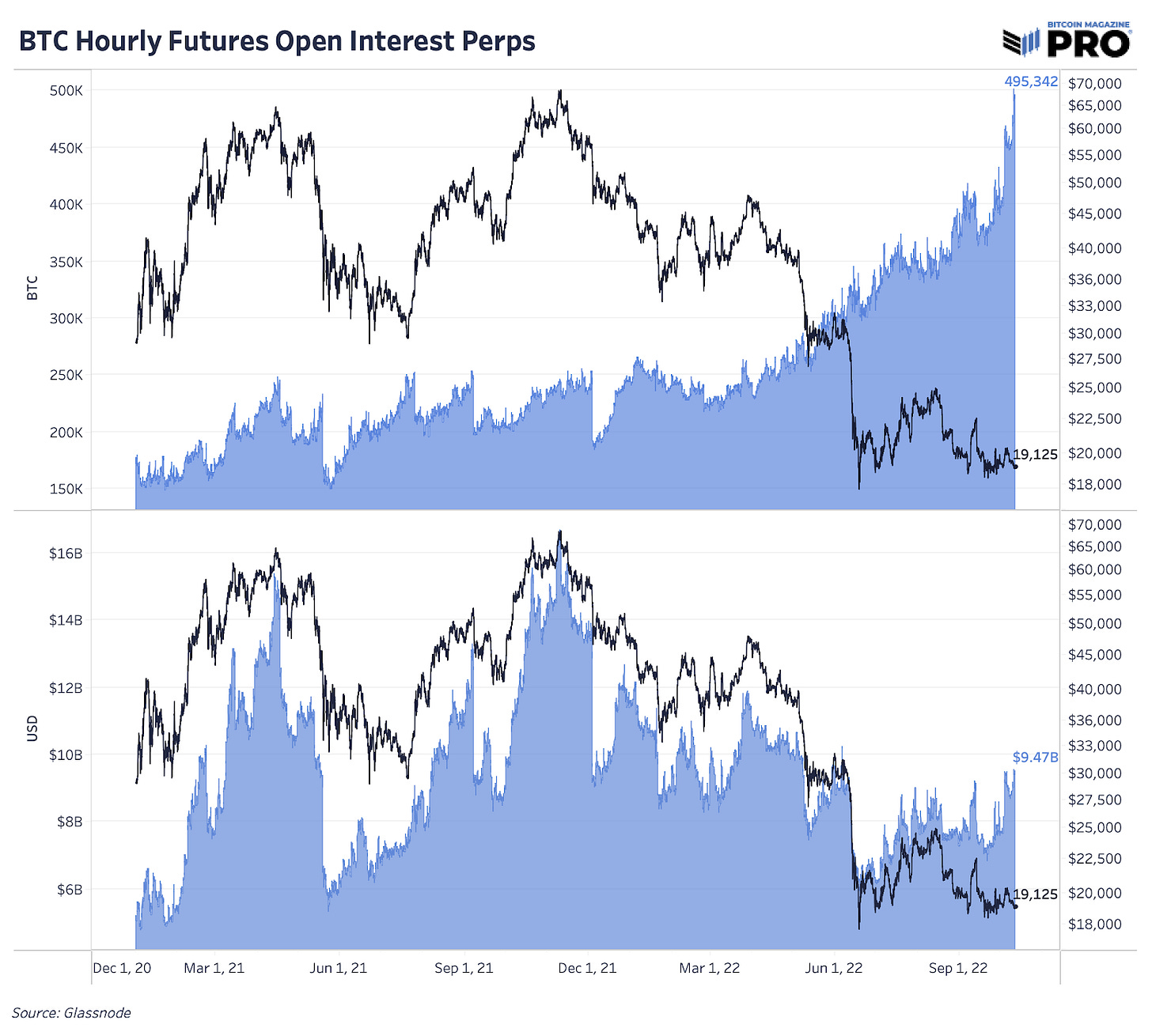

There’s been a significant rise in derivatives market open interest (denominated in BTC), via the perpetual futures market since the start of October. It’s likely both a mix of heightened speculation and hedging happening right now, but either way we can expect a lot of these positions to unwind fairly soon which is why bitcoin’s realized volatility won’t stay quiet for long.

As for the broader relationship between higher CPI prints and bitcoin’s relationship, in our previous inflation piece we highlighted the differences between a monetary debasement hedge and an inflation hedge:

“In our view, bitcoin acts as the hedge against perpetual monetary debasement and has never performed well as a classic CPI ‘inflation hedge,’ especially in a bear market. However, demand for bitcoin as an inflation hedge is a different argument in countries that are experiencing higher inflation relative to bitcoin’s recent depreciation. In this scenario, stablecoins and increased access to U.S. dollars will also thrive.

Higher inflation in today’s market environment is worse news for any risk asset. It not only works to destroy consumer sentiment and erode purchasing power but also brings forth a wave of monetary tightening actions that drain market liquidity.

It’s the response and actions post these events that make the case for owning bitcoin.”

Inflation is proving to be sticky and structural while whatever is left of the Fed’s credibility is on the line. If they cannot vanquish inflation (after being completely wrong on its trajectory), then all of modern monetary policy has failed and they know that. Inflation is by far still enemy No. 1 and the highest of political concerns. Even a month of downward pressure in headline CPI, 8% is miles away from getting back to a 2% target. That’s ultimately why we think things get worse before they get better. The Fed would likely welcome a deflationary bust, a further collapse in assets and a deep global recession to take this problem off their hands. Or else, we will live in a world with structural inflation and higher central bank inflation targets over the next decade.

With that said, the game is now patience. As monetary policies continue to prove ineffective and/or completely destructive, bitcoin will still be here. Many will realize it never “died” and it will have a place in the world beyond a high beta correlation.

This concludes “Preparing For Tomorrow’s CPI Reading: Market Braces For Volatility, Bitcoin Open Interest Surges”, published for our paid tier subscribers Wednesday 10/12/22. You can access the original article by clicking the button below.

Try a 30-day free trial of the Bitcoin Magazine PRO paid tier to receive all of our articles in full as they go live.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like if you enjoyed this article. As well, sharing goes a long way toward helping us reach a wider audience!