July CPI: What To Watch For?

July CPI comes out tomorrow. Core CPI is expected to accelerate. When inflation beats expectations, bitcoin typically sees more downside.

Structural Wage And Rent Inflation

Tomorrow, we’re back again for another round of the U.S. Consumer Price Index (CPI) data with headline CPI expected to come in at 8.7% (down from 9.1%) and Core CPI expected to come in at 6.1% (up from 5.9%).

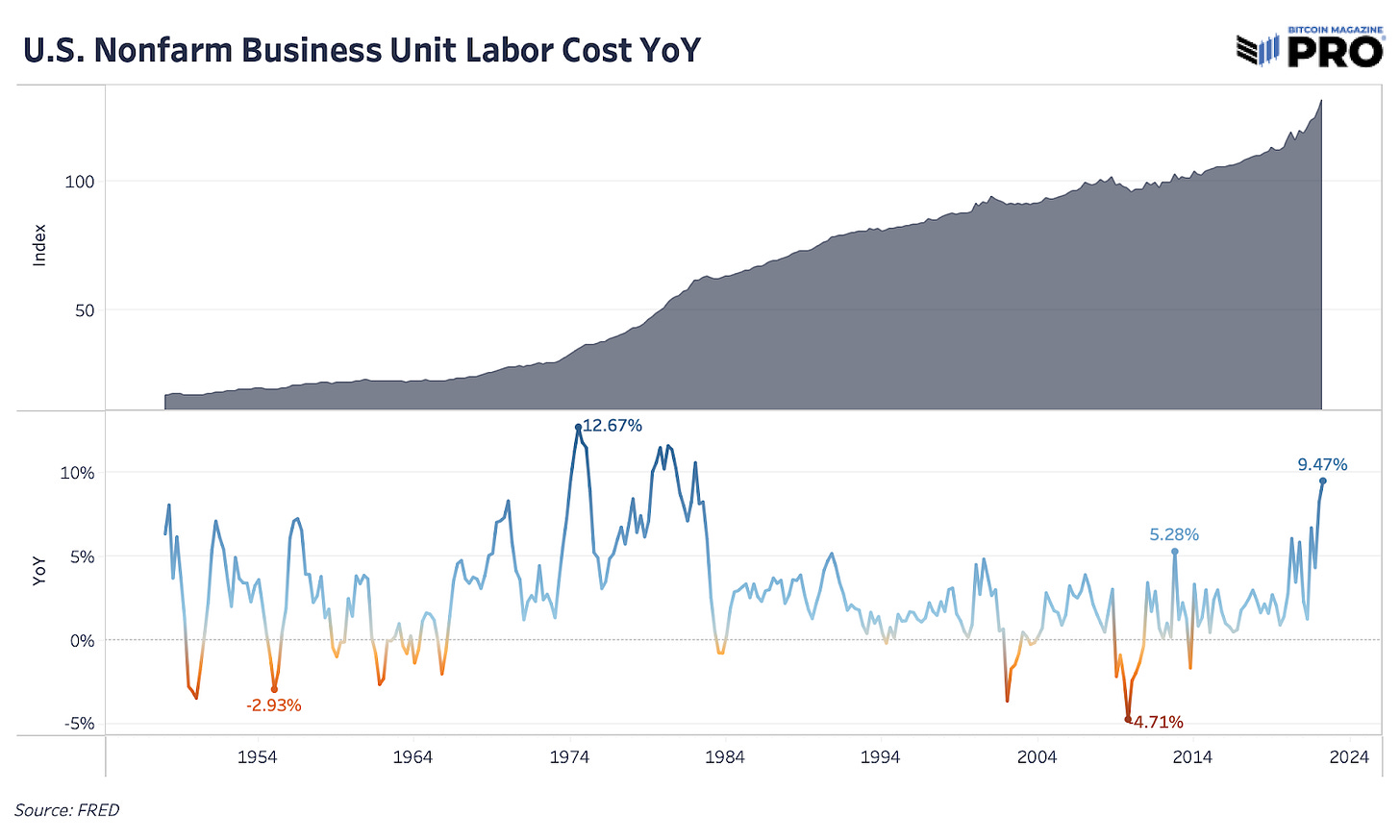

With Core CPI expected to continue accelerating, one of the biggest concerns for inflation is the consistent rise in wages seen over the last few months. Data for unit labor cost came out today for Q2 (a backward-looking metric) showing the largest annual increase since the 1980s. Although we may see headline CPI start to come down, the potential for a wage-inflation spiral driving an accelerating Core CPI is much more of a concern.

The Atlanta Fed’s wage tracker shows the same trend with median wage growth rising to 6.7% in the latest June data. All of this growth is in nominal terms and real earnings growth is still negative. If the Federal Reserve is serious about their hammer toolkit to bring inflation back down (or at least attempt to), then the rising wage data across the board will further push them into their aggressive tightening stance.

Wage growth is sticky and structural; it lasts for much longer than shocks to energy prices. Unemployment needs to rise and labor demand must cool off to help support any potential future of a 2% inflation rate target.

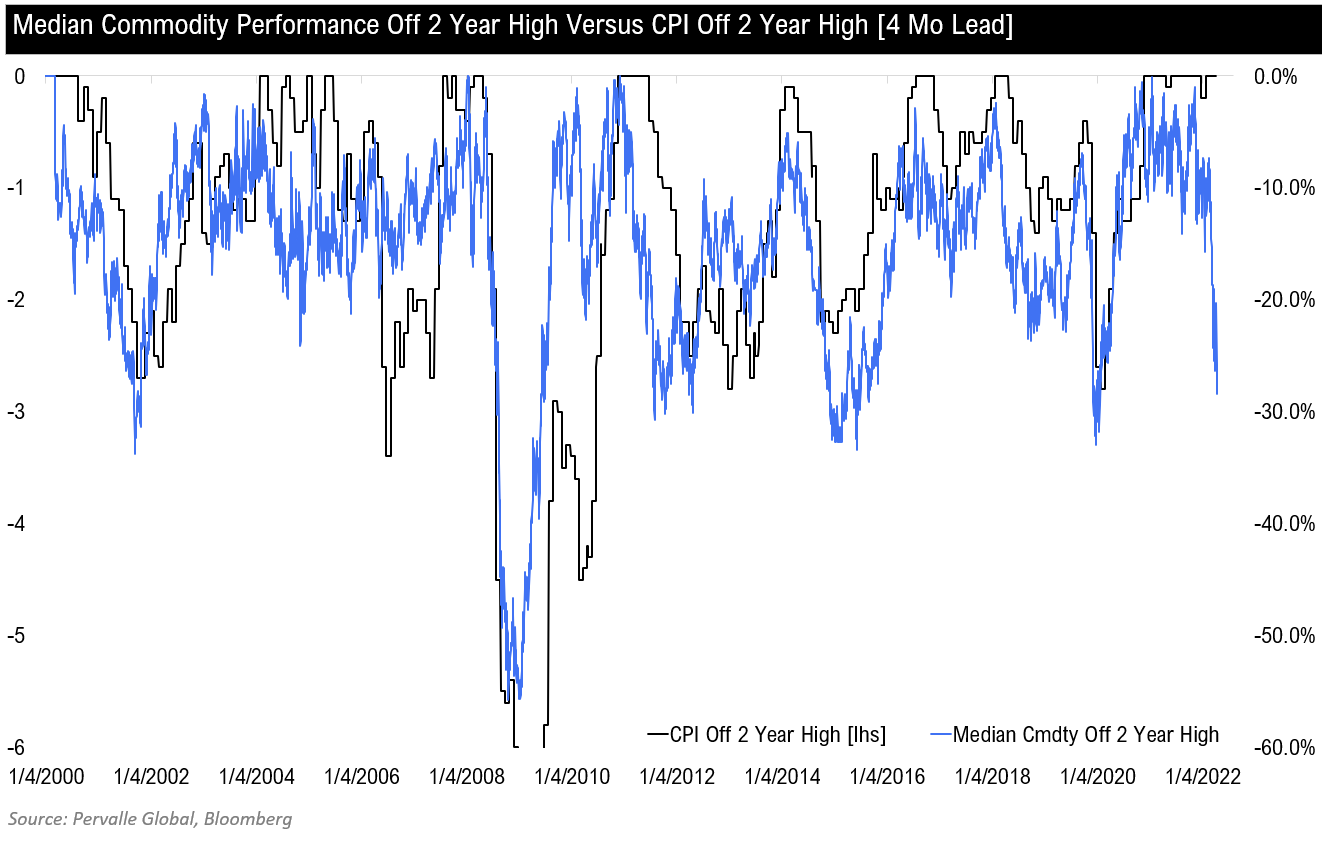

However, other parts of CPI inflation do look to be reaching their limits as commodities have had a sharp turnover from new highs. Taking a chart from Teddy Vallee, founder of Pervalle Global, commodity drawdowns lead CPI cooling off by about four months since 2000.

As for other CPI components like rent and shelter inflation, the owners’ equivalent rent (OER) portion of the CPI notoriously underestimates more robust external data sources. Apartment List’s National Rent Report as one example shows some minor cooling (month-over-month) in their rent index for July. Yet, rent went up in 87 of the 100 biggest cities so we’re not likely to see rent substantially come down just yet. Shelter makes up over 30% of the CPI with owners’ equivalent rent (subcategory) making up nearly 24%.

Typically, this OER inflation lags and can persist for months despite changing economic conditions. All this said, even if some components of CPI are primed to turn over, structurally higher inflation doesn’t look like it’s going away anytime soon.

What Does CPI Mean For Bitcoin?

CPI announcements have resulted in some of the most volatile trading days for the S&P 500 Index and bitcoin, as investors’ expectations change about inflation duration, market rates and future Fed policy speculation. Largely since November 2021, most CPI releases that come in higher than consensus expectations have led to more downside moves for all risk assets.

That’s consistently been the case except for the latest June data release, which came during an explosive bear market rally that looks to be largely driven by short covering and open interest. With the bear market rally looking closer to its conclusion, we could still see more “bad news is good news” swings in the market but that’s looking less likely.

The current global economic environment is one where capital markets formulated over the previous four decades have never experienced this level of inflationary prices, but given global debt burdens, increasingly higher yields will rapidly lead to a deflationary bust.

The global monetary order built after Bretton Woods, and specifically after the Nixon shock, has never been in a more fragile position. To kill inflation, central banks need to kill demand and asset prices.

Until the rate of inflation begins to abate, monetary conditions will continue to tighten, and risk assets will continue to struggle to find a bid. Regardless of the initial reaction by markets following tomorrow’s estimated 8.7% year-on-year headline print, the only politically viable option is for central banks to continue to tighten the belt on an already decelerating global economy.