PRO Market Keys Of The Week: Bitcoin Capital Inflows Are Back

Bitcoin weekly inflows for investment products were the highest since July 2022. Public miner hash rate expands while miners outperform bitcoin. We highlight Binance’s new favorite stablecoin: TUSD.

Relevant Past Articles:

Pro Market Keys Of The Week: BlackRock Files For A Bitcoin ETF

BlackRock, Paper Bitcoin, Scissors: How A Spot ETF Will Impact The Market

Binance Revisited: Warning Signs At The World's Largest Bitcoin Exchange

What We’re Watching

Bitcoin Weekly Inflows

From CoinShares’ research, digital asset investment products saw $199 million of inflows last week, the highest amount since July 2022. Bitcoin is the main driver of inflows with $187.6 million. This came after eight weeks of consistent outflows across bitcoin investment products, which we’ve highlighted in our Market Dashboard summaries for paid subscribers. Last week, there was a clear trend of institutional investors piling into bitcoin exposure to capitalize on both the BlackRock ETF news as well as the many other new U.S. ETF applications filed with the SEC.

More Hash Rate?

Over this month, Bitcoin hash rate has come down from 393 EH/s all-time highs using a 7-day moving average. A significant rise in overall hash rate has come from public miners making progress on their previous hash rate expansion plans. Just today, Riot Platforms announced another major deal and expansion plan to add another 7.6 EH/s by 2024. Even amidst the bear market, the global race for hash rate isn’t slowing down. The chart below shows the aggregate reported figures and estimates for hash rate growth over the last year for some of the top public miners.

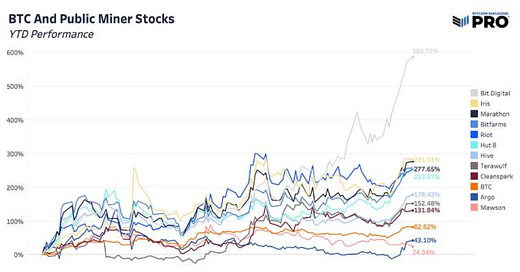

Miners Outperform Bitcoin YTD

It’s not just the hash rate growth but also the growth of hash price that has lifted public miner businesses and their equity so far in 2023. Public miners' year-to-date returns have been magnitudes higher than bitcoin returning over 200% on average versus bitcoin’s 82%. Typically, public miners in aggregate have outperformed bitcoin in bullish momentum periods while underperforming in bearish periods. Bitcoin public miners come with a higher volatility profile as well. The stellar returns have also come during a period where public miners were some of the most shorted stocks on the market during a time when market liquidity is thin.

UPCOMING SPACES! Join Bitcoin Magazine PRO on Thursday, June 29 at 9:00 a.m. EST, to discuss the Bitcoin Alpha Competition with a prize of $1 million!!!

TrueUSD (TUSD) Supply

Though originally created in 2018, the TUSD stablecoin is reemerging on the scene now that Binance has offered zero-fee trading promotions, seeming to usher it in as a replacement for BUSD, whose issuance was halted in February. TUSD has been the only stablecoin with a rising supply over the last month. Since the start of the year, TUSD supply has gone from $800 million to over $3 billion. Significant swings in supply increases have coincided with both major bitcoin rallies this year. There’s other ways to see how TUSD seems to be making a larger impact on bitcoin price moves as of late. TUSD is becoming an important stablecoin to track as supply now makes up over 2% market share.

The Macro View

After the Federal Reserve pause in rate hikes in June, the probability of another rate hike for July is now at 75%. The labor market and stickier inflation has yet to turn over in a meaningful way for the hiking rate cycle to end. This brings back the “higher for longer” view where inflation is still too high, unemployment is too low, economic growth has been fine, stocks are doing fine and the Fed has stated they want to hike more. A key element to see how this may change is to look at how wage growth impacts services inflation over the next month. We’re headed into the second half of 2023 where the probability for a recession is becoming much higher based on the 3-month and 10-year treasury inversion curve.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!