Part 2: The Contagion Continues - Major Crypto Lender Genesis Is Next On The Chopping Block

Genesis needs $1 billion liquidity injection by Monday, won't come from parent company DCG. Gemini sees major bitcoin outflows. Silvergate on the ropes as investors fear potential bank run.

Relevant Past Articles:

The Exchange War: Binance Smells Blood As FTX/Alameda Rumors Mount

The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

Part 2 of “The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block” published Thursday, November 17 for paid subscribers.

Part 2

Source: Genesis Quarterly Report

We know from on-chain activity that Genesis had tons of interactions with Alameda, Gemini and BlockFi through their OTC trading desk; FTT was also a top token received and sent in that activity. Without Genesis sharing more details, we don’t know the extent of the exposure and capital needed to make customers whole. Yet, the fact that the parent company DCG hasn’t already stepped in to provide another liquidity injection is a warning sign on where this might end up. Just today, news surfaced that Genesis is seeking a $1 billion credit facility immediately. Not good.

In the worst-case scenario, the lack of funding supplied by DCG could spark questions around accessible liquid assets. DCG and Grayscale have dissolved trusts before and that option is not off the table.

It’s an unlikely path but certainly one to highlight since Grayscale is the largest holder of bitcoin via the Grayscale Bitcoin Trust, holding nearly 633,600 bitcoin. Easily, this could be a regulatory issue or another limitation (that we don’t know about) where DCG cannot supply the capital to Genesis.

Source: Coinglass.com

Circle, the issuer of the stablecoin USDC, also has ties to Genesis. Yet, they highlight that their Circle Yield product only accounts for $2.6 million in collateralized loans outstanding which, if true, is fairly insignificant.

The asset mix of Genesis’s loan book varied heavily over the last year. In the peak of the market during the Luna crash, Genesis saw a substantial rise in the ethereum loan share of their book at the height of many speculative plays in the market. Since then the asset mix has become heavily dominated by bitcoin and USD as heightened speculation was washed out. The overall active loan book fell over 77% in less than a year.

Source: Genesis Quarterly Report

We will likely hear more about the state of Genesis in the coming days since they want/need the capital injection by Monday. This would be a massive hit to a laundry list of institutions in the industry if withdrawals remain suspended and funds tied up. Genesis reflects the exact reason why the overall contagion of the FTX and

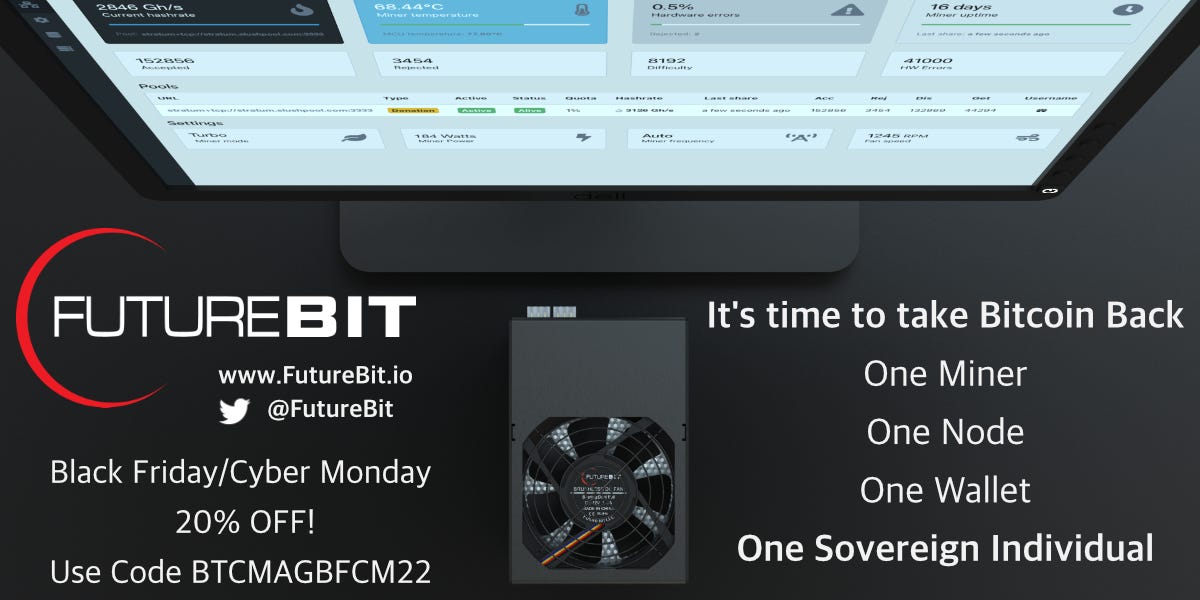

FutureBit Black Friday 20% Off Sale

Only the People have the Power to Control Bitcoin...We created the tool, the rest is up to you.

While supplies last, code “BTCMAGBFCM22” is valid until 2/28/22

Alameda Research collapse has yet to play out. Defaults and insolvencies come in waves, not all at once. It takes weeks and months to see where the biggest holes are and who is having liquidity, counterparty and/or insolvency troubles.

On top of that, nearly every major player and market maker has pulled their cash from exchanges to shore up their own balance sheets and decrease counterparty risk. Liquidity in the market is thin and the time is ripe for volatility to ensue. Although the market has seemed to find a temporary bottom amid all of the negative news headlines over the last week, the unknown downside risk still far outweighs the upside potential in the short term. If you’re an active market participant, tread with caution until we better understand the full extent of the damage and blood out there yet to unfold.

Other Infrastructure To Watch

Who else is at the center of many institutions in the market? Silvergate Bank is one of those. Since the beginning of November, their stock is down nearly 56%. Silvergate Bank is at the nexus of banking services for the entire industry, servicing 1,677 digital asset customers with $9.8 billion in digital asset deposits. FTX accounted for less than 10% of deposits and the CEO has tried to reassure markets that their current loan book has faced zero losses or liquidations so far. Leveraged loans are collateralized with bitcoin that can be liquidated as necessary. Yet, the ongoing risk is a complete bank run on Silvergate deposits. Although the CEO’s comments sound reassuring, the stock performance over the last two weeks tell a much different story.

Even if a bank run scenario is unlikely, Silvergate deposits are likely to take a hit and we’ve yet to see second-order effects take shape from that happening. Signature Bank is the other main banking provider for the industry and they highlighted that FTX and its related companies only make up less than 0.1% of total deposits across $23.5 billion. Not as bad as Silvergate, but their stock has still taken a beating this month, down 20% so far.

This concludes Part 2 of “The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block” published Thursday, November 17 for paid subscribers.

Try a 30-day free trial of the Bitcoin Magazine PRO paid tier to receive all of our articles in full as they go live.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like if you enjoyed this article. As well, sharing goes a long way toward helping us reach a wider audience!