Part 2: Not Binancial Advice

Binance's bitcoin balance sees its largest one-day outflow ever. BUSD stablecoin experiences large redemptions and the price legitimacy for the exchange-native BNB token is called into question.

Relevant Past Articles:

The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block

The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

Celsius Bankruptcy Details $1.2 Billion Hole In Balance Sheet

Part 2 of “Not Binancial Advice” published Tuesday, December 13, for paid subscribers.

Part 2

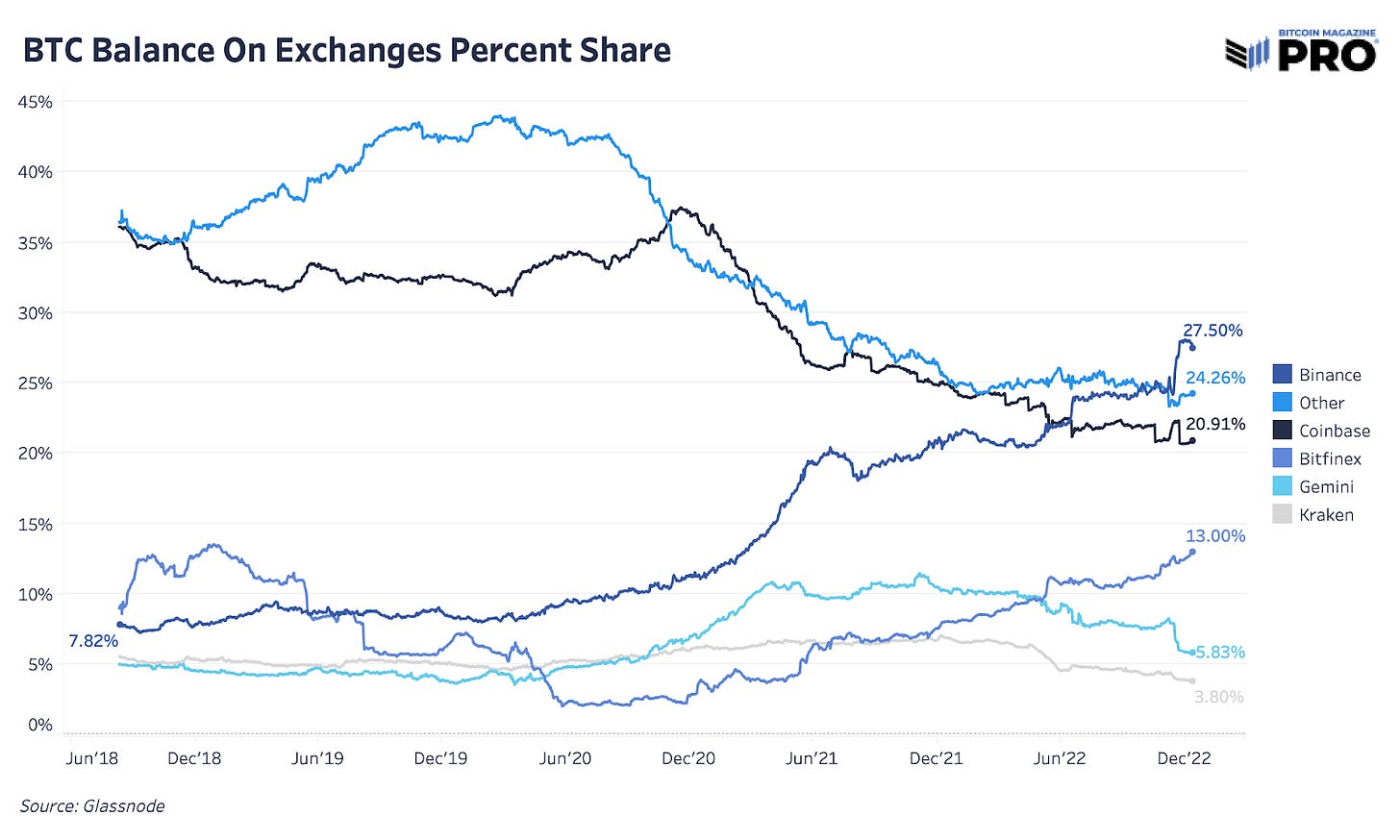

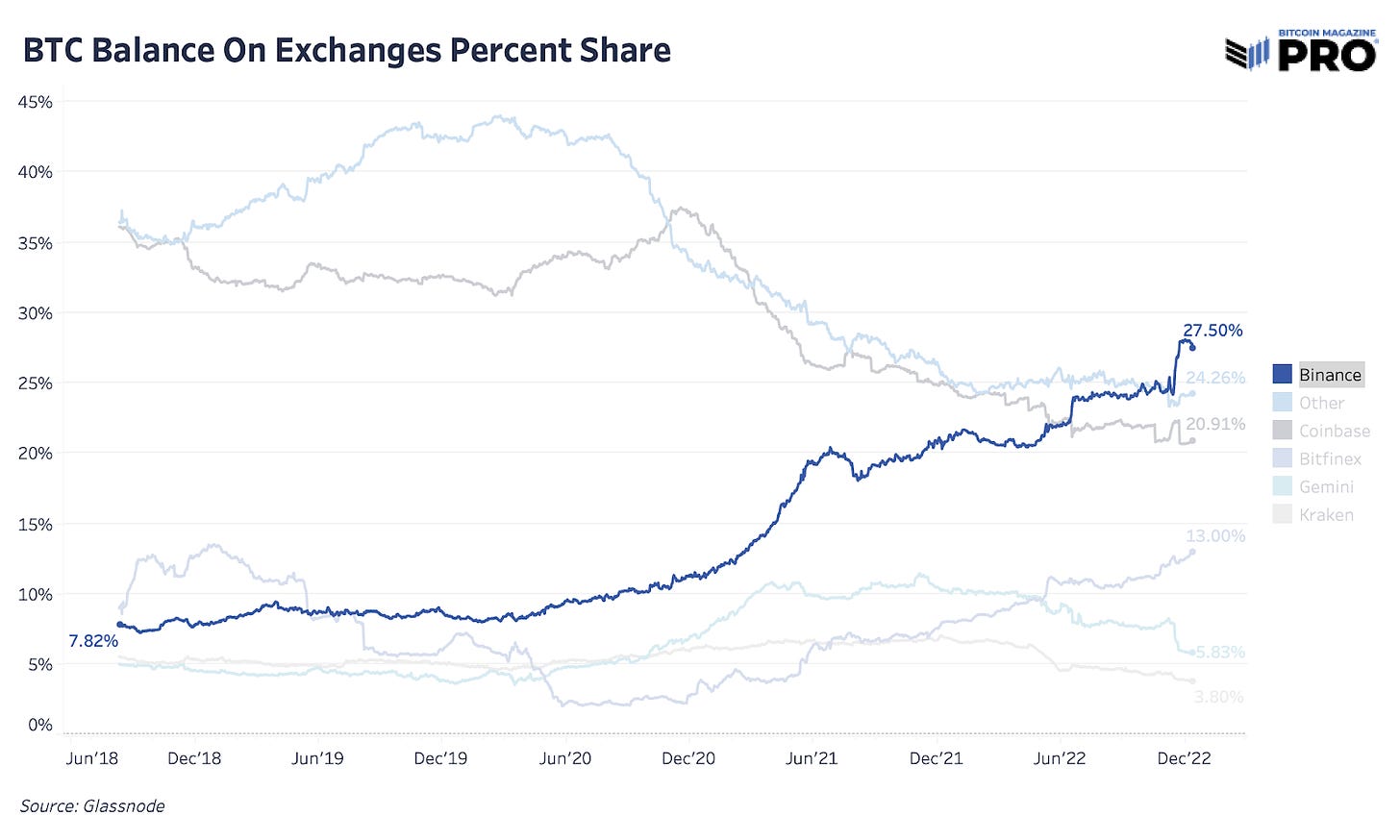

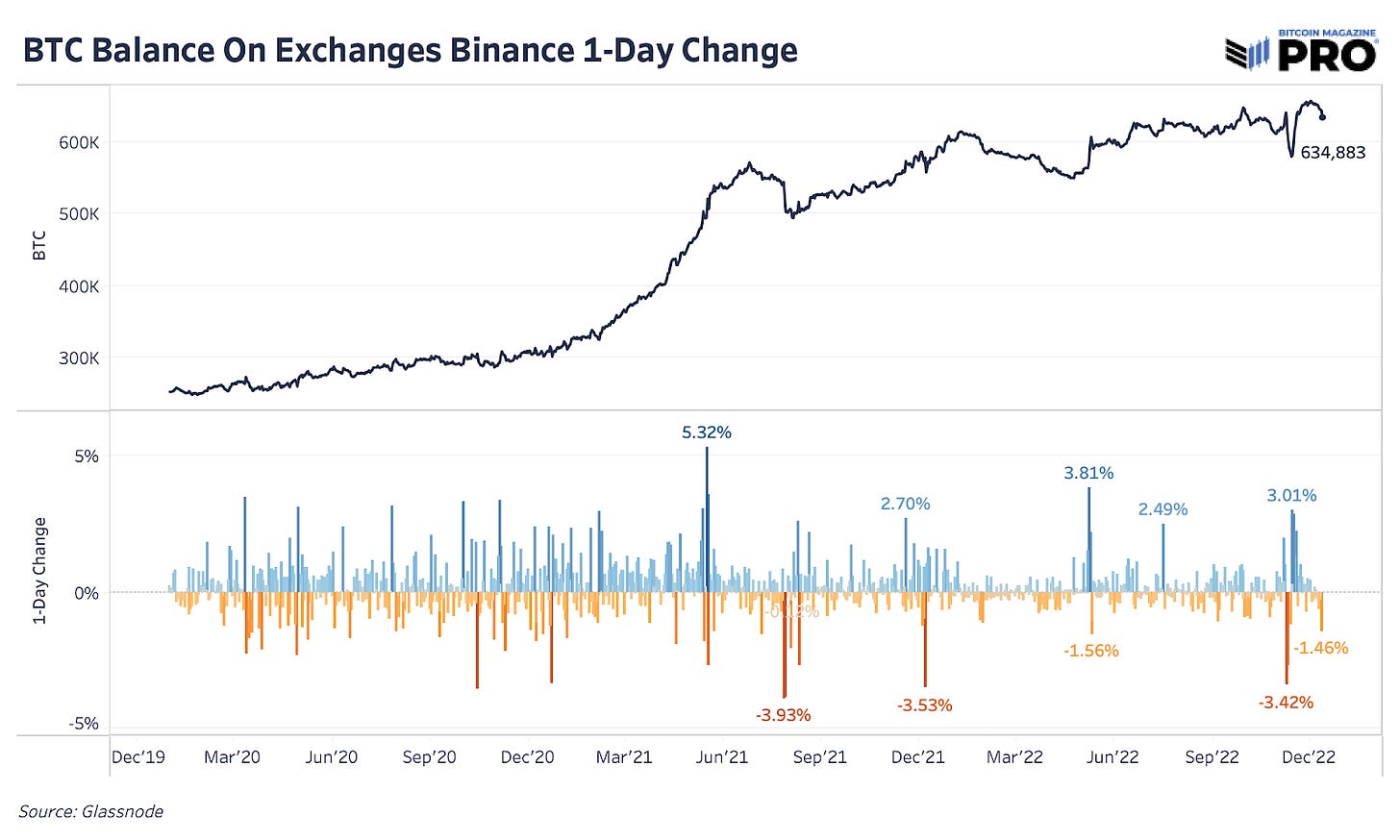

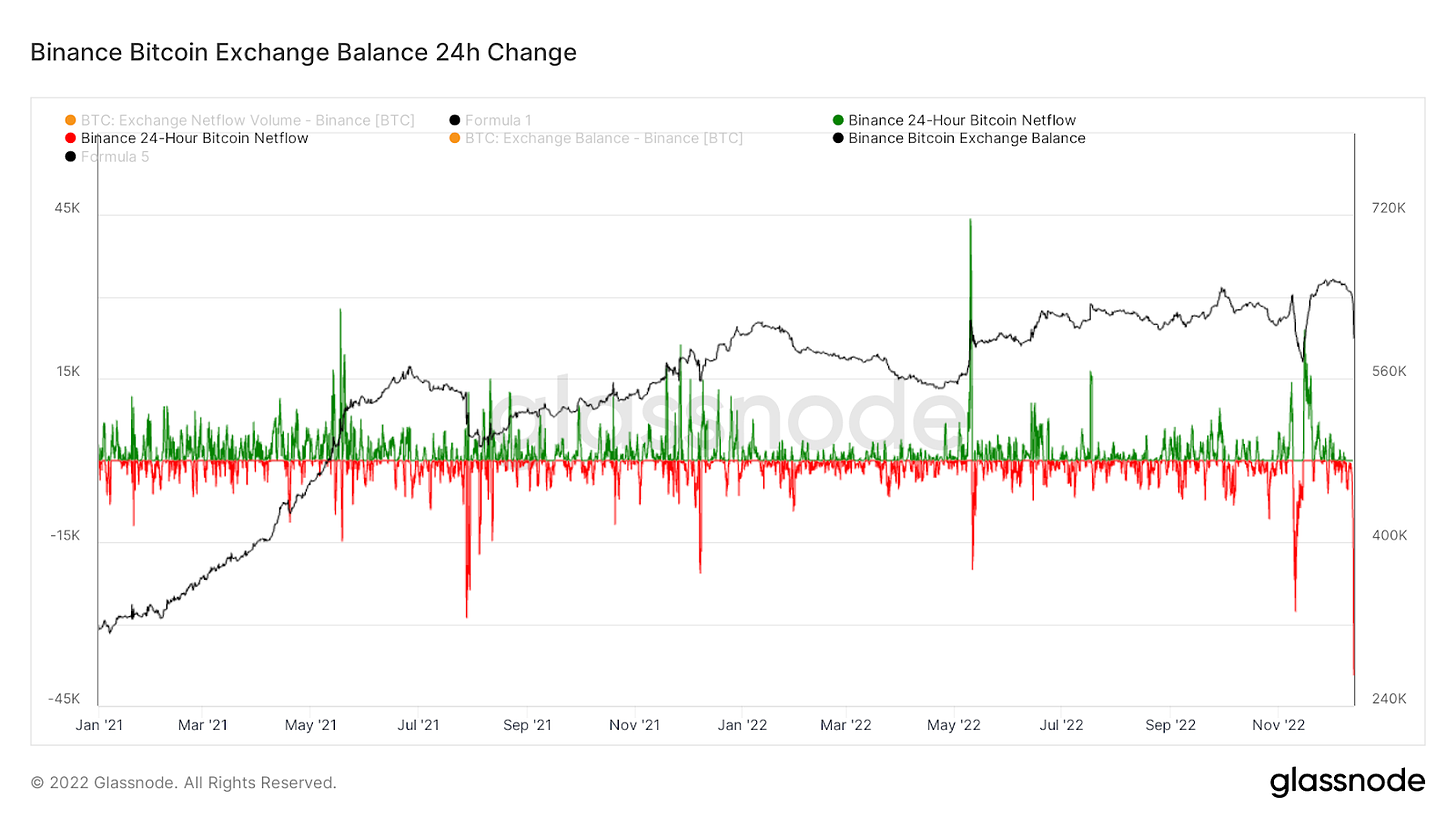

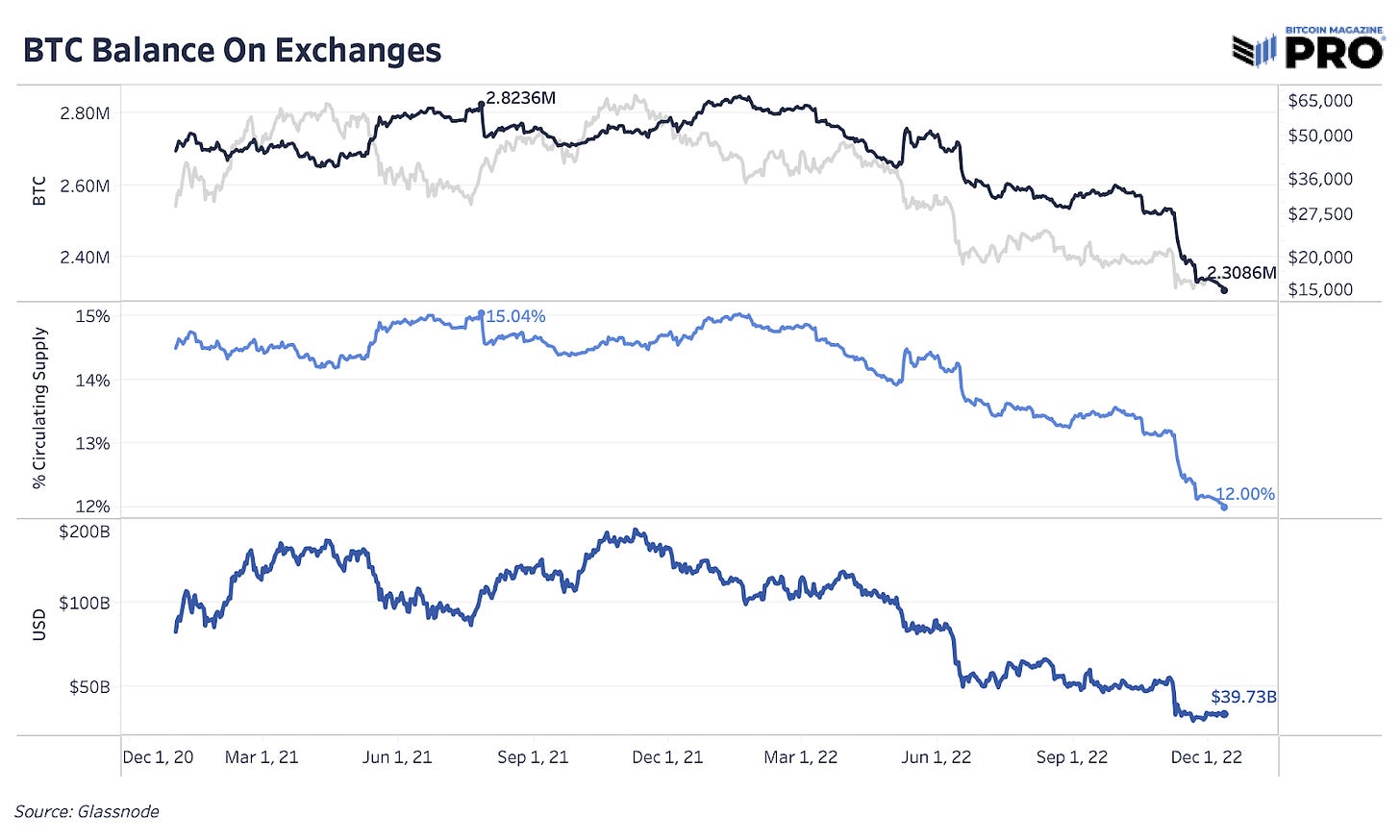

According to Glassnode, the total bitcoin exchange balance on Binance is down around 6-7% over the last day, after reaching a peak on December 1. Although balances remain above 500,000 bitcoin and Binance has shown a rising trend of bitcoin balances on the platform this year, this is a significant move for outflows in just 24 hours. The largest one-day change in bitcoin outflows was just shy of 4% back in July. As a general comparison, the trend of bitcoin exchange balances was a much different story for FTX, whose balance had been falling heavily since June.

Note that in some of the charts below, exchange balances are using daily data from Glassnode instead of 10-minute or 1-hour intervals where we can see more of the latest bitcoin exchange outflows. The numbers above reference the latest 1-hour interval data. Exchange balance data, especially intraday, can change and data is typically more reliable on a longer time horizon, especially given that we have little insight into Glassnode’s classification and data science techniques that are used to label different wallets and addresses. Yet, however you cut the data, Binance outflows over the last 24 hours are a bit alarming and raise questions: Is this a one-off event and just business as usual or is this the start of something more?

In absolute terms, the last 24 hours have brought about the largest ever flight away from Binance for both bitcoin and stablecoins — an extremely notable move.

In particular, in the case of BUSD, Binance’s native stablecoin that has its reserves custodied by U.S. financial firm Paxos, there has been a notable amount of redemptions as of late. Large holders of BUSD have been withdrawing from Binance and sending it to Paxos, redeeming the stablecoins for dollars. This shows up as BUSD being “burned” at the Paxos Treasury.

Readers can track the on-chain addresses provided by Binance for free here.

The main cause for concern is not whether Binance has any bitcoin/crypto or not. We can transparently see that the firm controls tens of billions worth of crypto assets. What isn’t exactly clear, similar to FTX, is whether the firm has commingled users funds or whether the firm has any outstanding liabilities against user assets.

Binance CEO Changpeng Zhao (CZ) has said that the firm has no liabilities with any other firms, but as recent months have shown, words don’t mean all that much. While we are not claiming that CZ is lying to the public about the state of Binance finances, we have no way to prove otherwise.

CZ’s response as to whether the company was going to audit liabilities against user assets was, “Yes, but liabilities are harder. We don't owe any loans to anyone. You can ask around.”

Unfortunately, “ask around” isn’t a satisfactory enough answer for an ecosystem supposedly built around the ethos of don’t trust, verify.

While there is no doubt that Binance is an industry giant in the crypto derivatives industry, how do we know the firm isn’t doing similar things as past actors in regards to trading against clients using user funds and/or proprietary data. Things like the former Chief Legal Officer of Coinbase departing Binance U.S. last summer after just three months as the CEO leaves one with many questions.

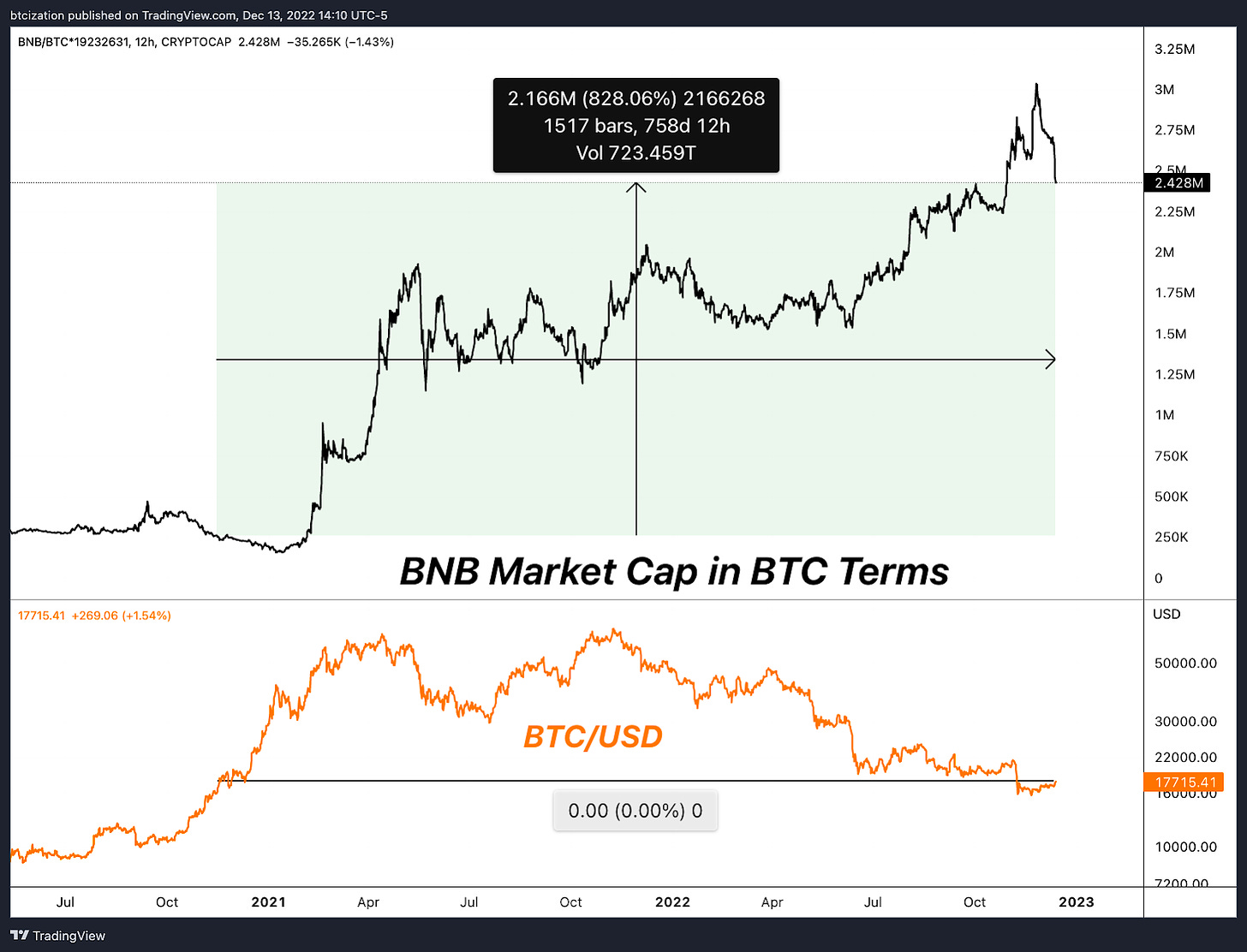

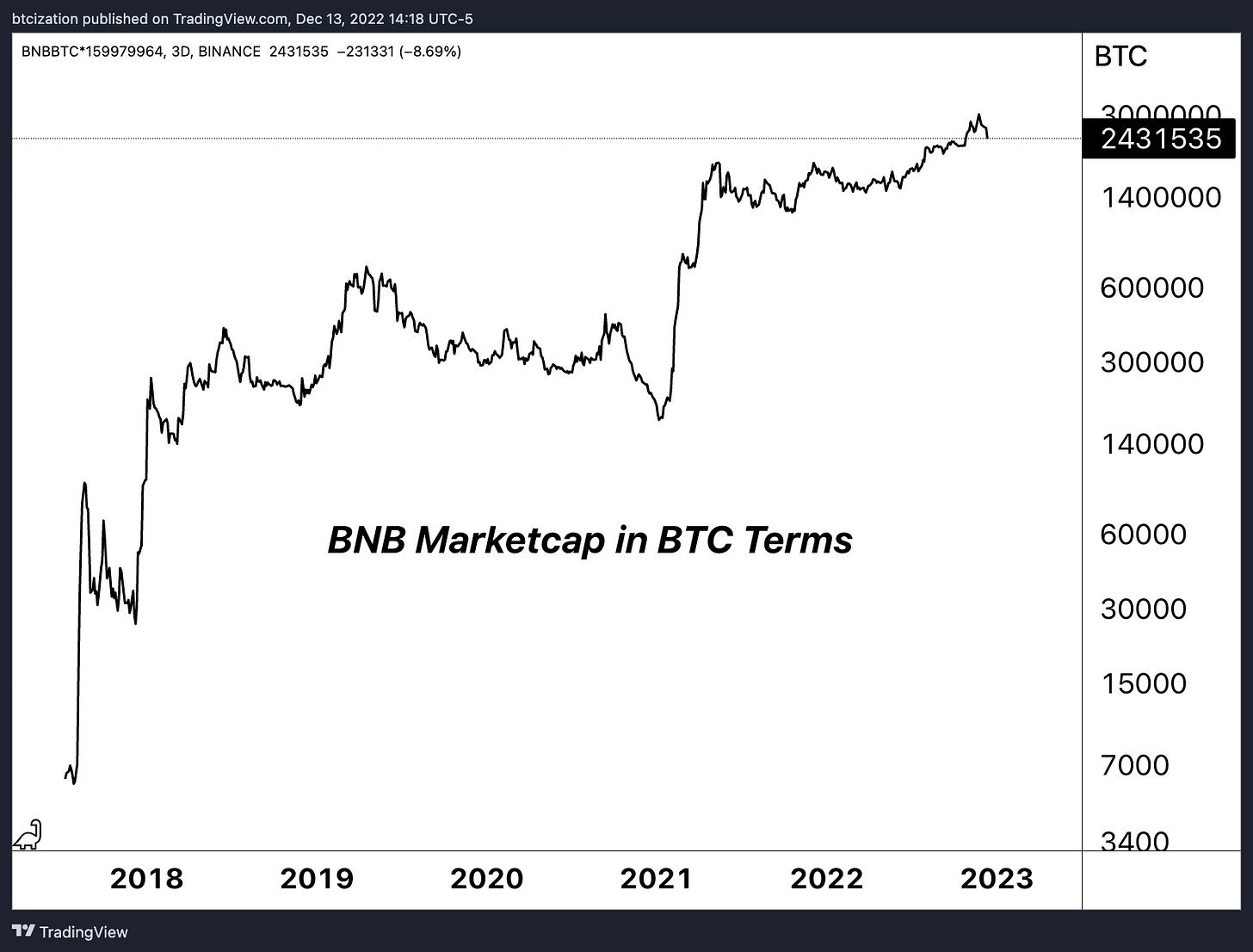

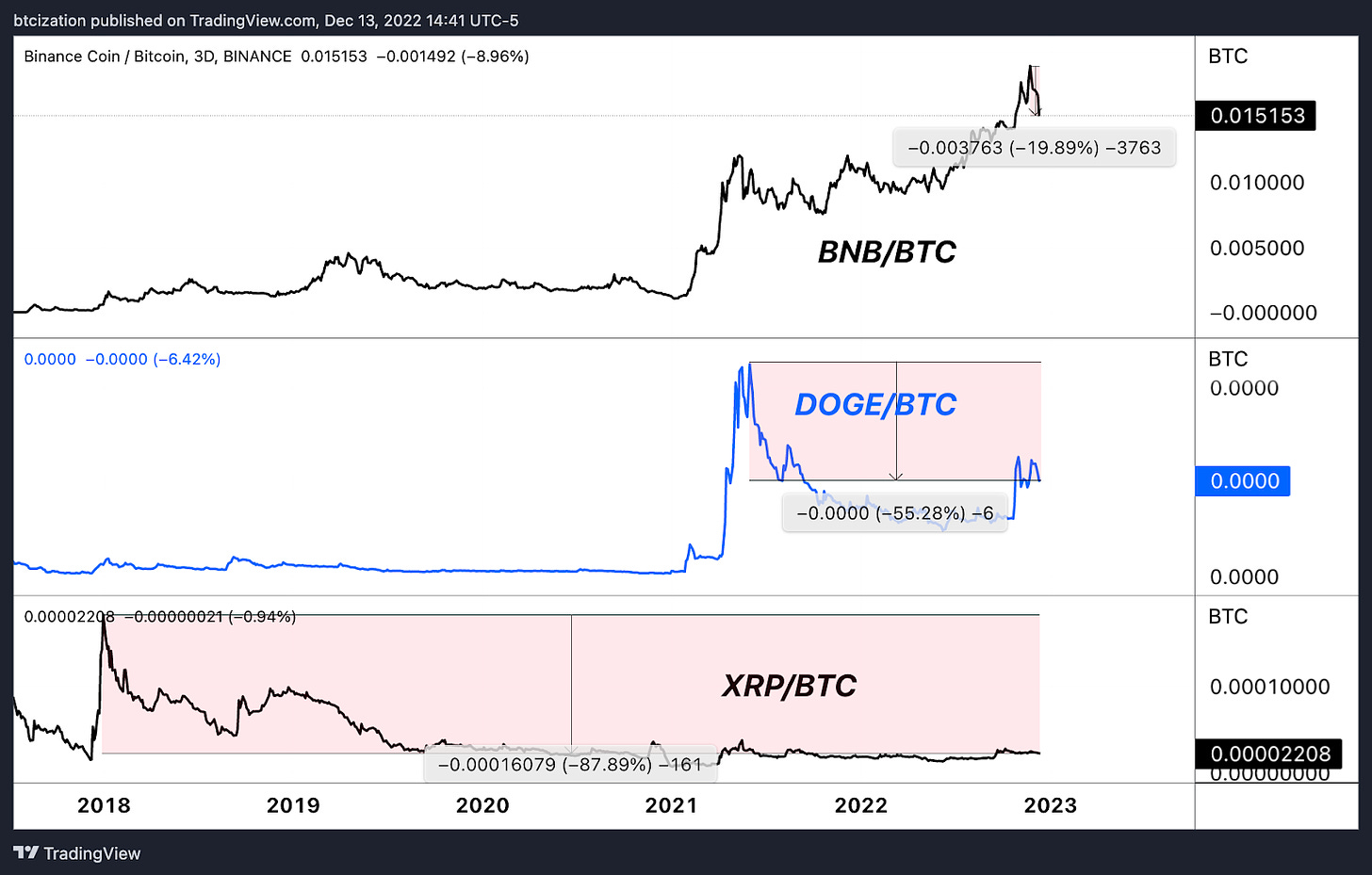

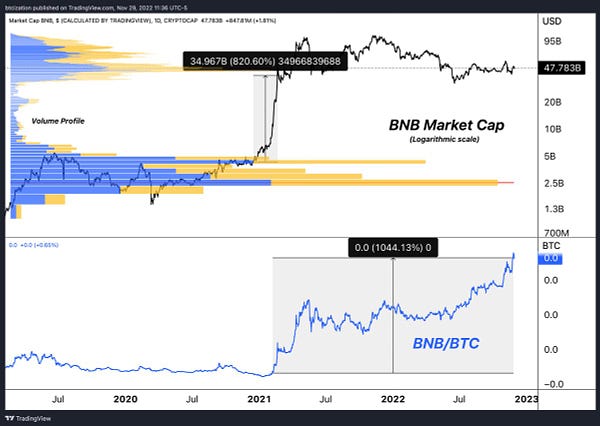

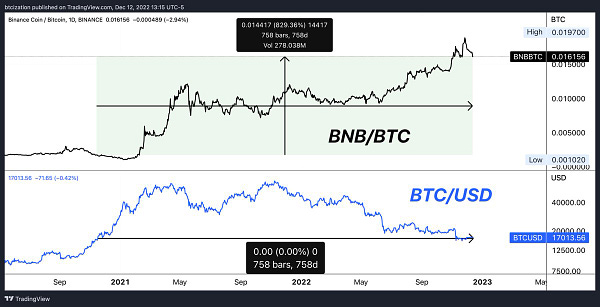

To add to our skepticism, the price of the Binance exchange token BNB is near all-time highs in bitcoin terms, appreciating an astounding 828% against bitcoin in the last 785 calendar days.

Is BNB, a more centralized cousin to Ethereum, really worth approximately 14% of all bitcoin that will ever exist? BNB is not equity in the Binance company. BNB is a crypto token spun up from nothing in 2017.

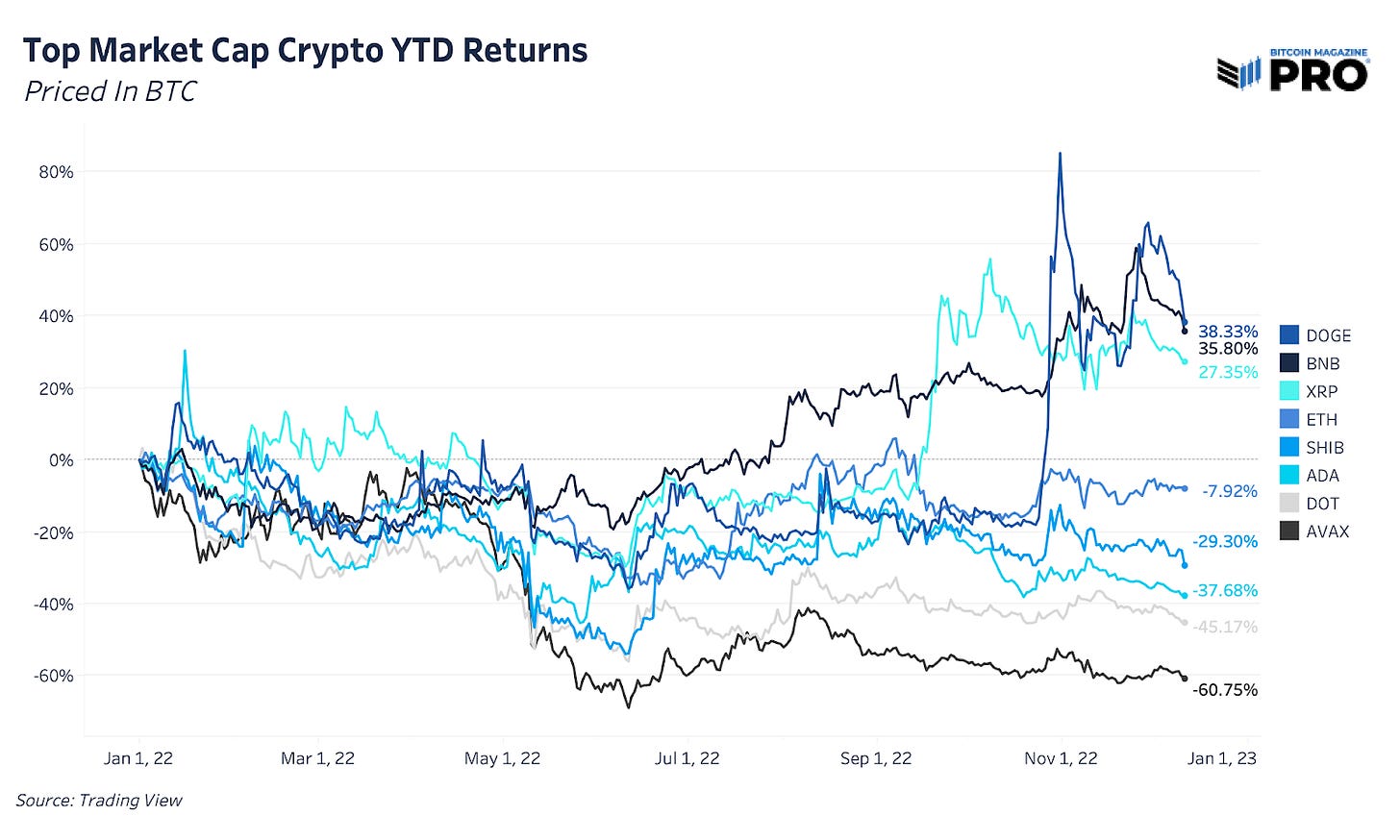

BNB is one of the few cryptocurrencies that is up year-to-date in bitcoin terms, with the others being illiquid alts well below their BTC-denominated all-time highs.

The only other two cryptocurrencies that outperformed bitcoin during 2022 have been the “meme” DOGE, which is 55% below its all time high in bitcoin terms, and quasi-security XRP, which has been delisted by major exchanges and is 87% below its all-time highs in bitcoin terms.

Why is the outperformance so notable? Why are we hammering this point so hard? Because financial markets aren’t magical machines tied to a fantasy-land reality. Financial markets — while appearing to be disconnected from reality at times — always come crashing down to reality, exposing those that were possibly perceived as giants once before.

For the most part, the crypto industry is an attempt at modern alchemy, and exchange tokens minted from nothing with centrally engineered “tokenomics” are no different.

In fact, they are part of the problem.

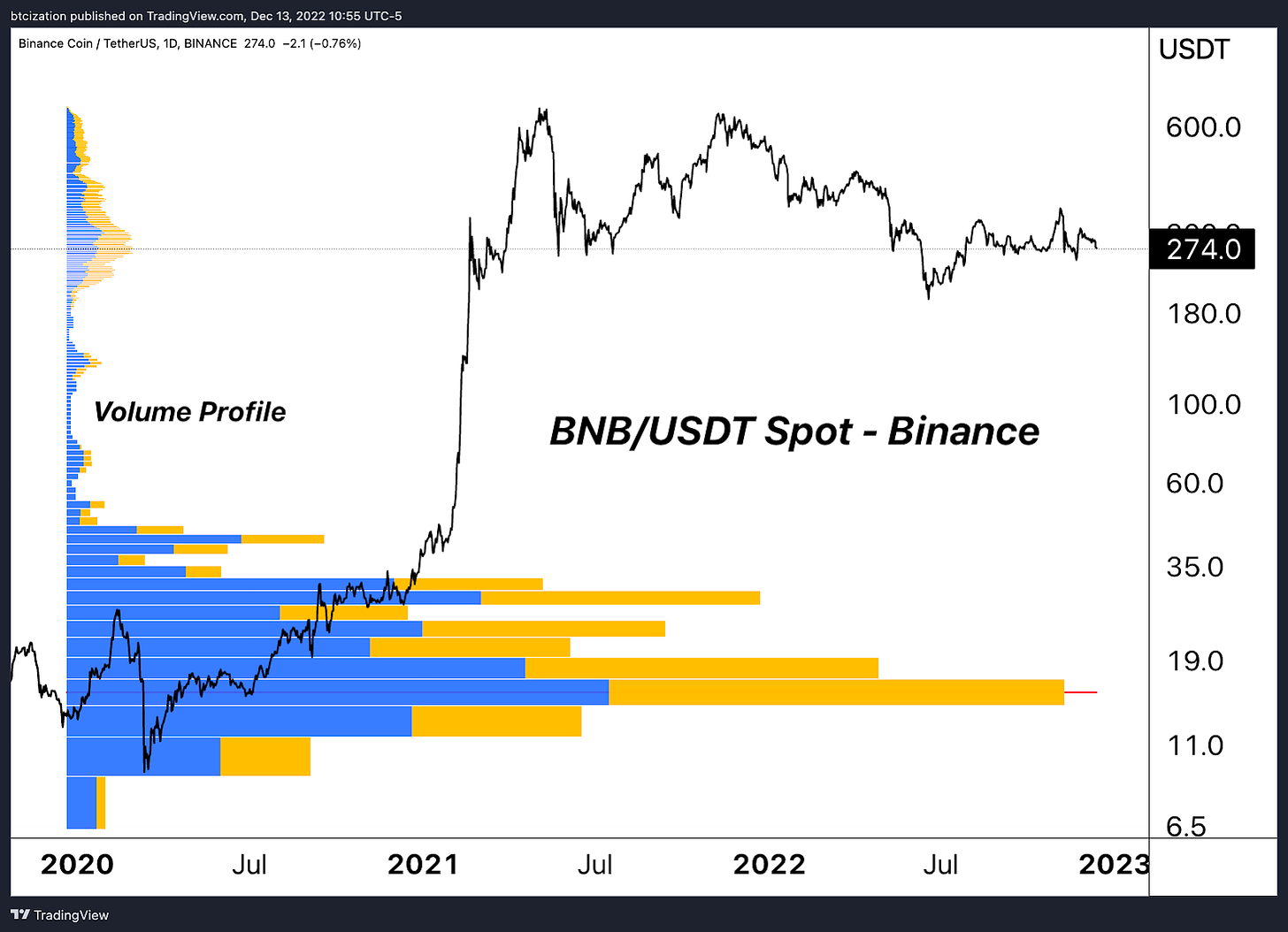

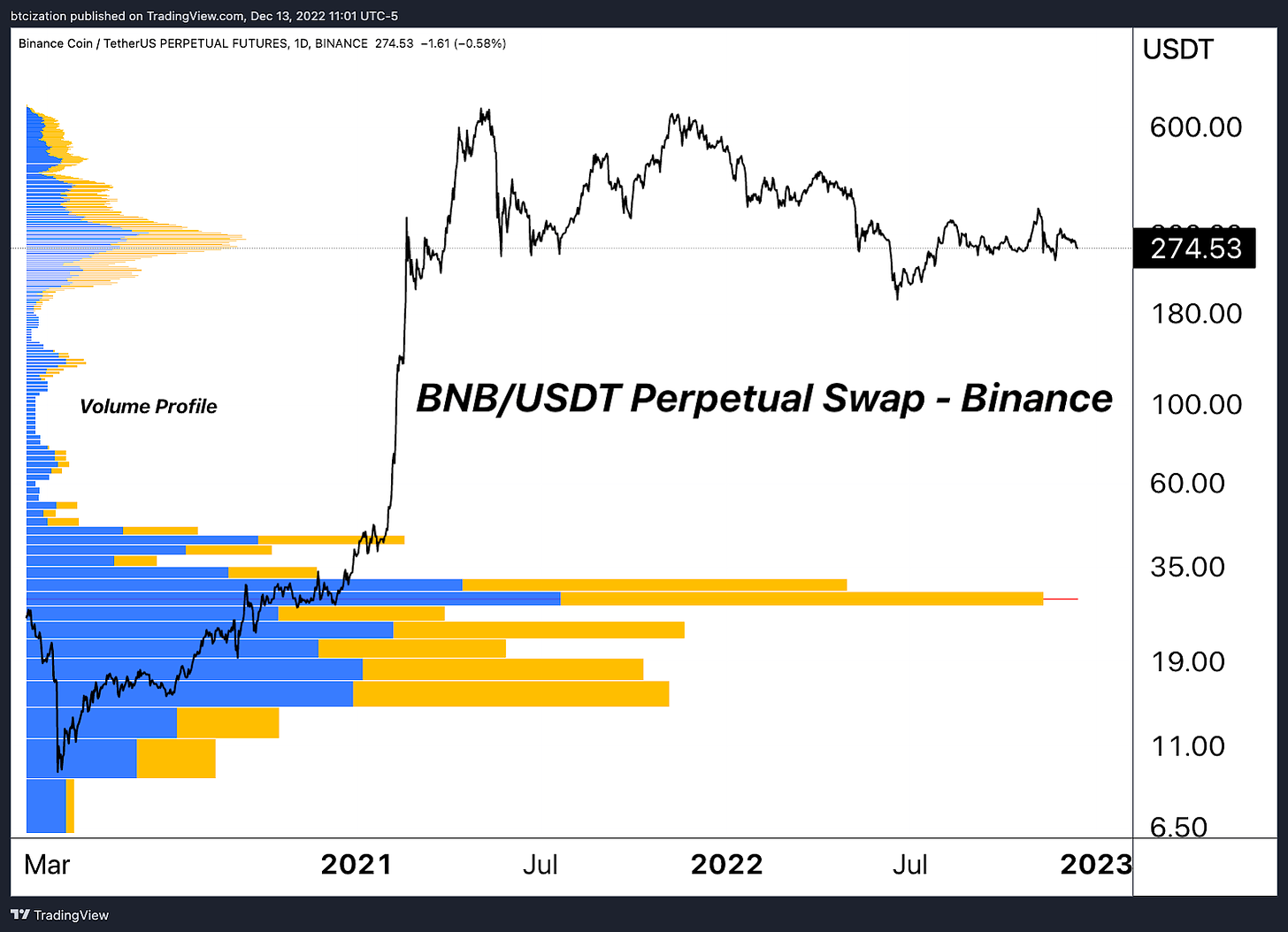

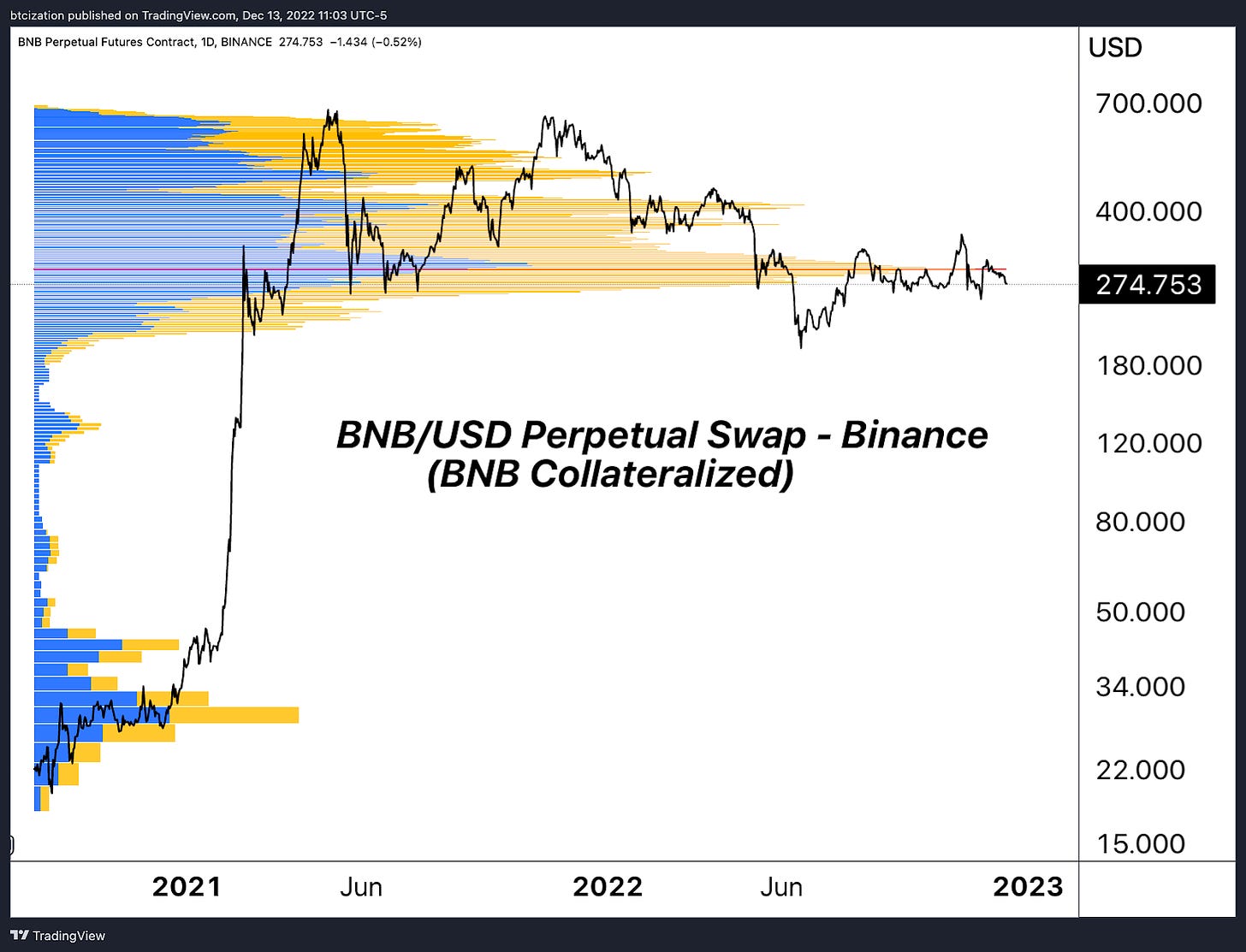

It could be possible that BNB was pushed up with the internal help of Binance or its unofficial affiliates during the bull run. Just look at the volume profile of where coins changed hands on its native exchange. While it would be a leap of faith to say this took place directly using customer funds à la FTX, the revenue of the company has been used to buy back the token, similar to a stock buyback.

While it remains to be seen whether the firm is levered against its own token in any sort of way, it would certainly be no surprise to us if the company supported the ascent of the token/chain, similarly to many other exchanges with token that outperformed bitcoin during the bull run. BNB is a “blockchain” that can be arbitrarily halted by the Binance team. It is not even attempting to be a decentralized application set.

That’s fine, but we remain extremely skeptical that its relative valuation against bitcoin — what we believe to be humanity’s best bet as decentralized digital cash — is tethered to reality.

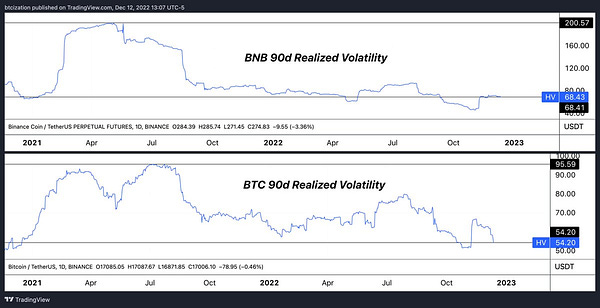

How does something that traded with double the realized volatility of bitcoin during the bull market now have the same implied volatility in the bear market after it has appreciated by over an order of magnitude with a strong relative outperformance throughout 2022?

The entire “industry” is cross-collateralized, and all of the altcoins are merely riding on the beta of bitcoin with far less liquidity, thus having greater volatility and potential (fleeting) upside.

We think this attempt at modern alchemy is destined to fail, at worst. At best, the asset likely drastically underperforms global neutral money through its adoption phase. Said differently, the worst-case, paranoid-style take would be that the exchange rate of BNB is tied to the solvency status of Binance the exchange. We don’t think that there is an overly strong probability of this outcome per say, but it is certainly non-zero.

The coming weeks will be full of headlines around the state of global crypto regulation in a post-FTX world. In a 48-hour period, Reuters published news stating that the U.S. Justice Dept is split over charging Binance, Binance withdrawals for bitcoin and aggregate stablecoin pairs have hit all-time highs and the BNB exchange token has fallen 10% relative to bitcoin.

Out of an abundance of caution, we will continue to urge readers operating on any centralized exchange — of which Binance is most definitely included — to look into self custody solutions. There have been far too many instances of incompetence and/or misconduct from exchanges.

It’s not that we don’t trust CZ or Binance, the fact is we don’t trust anyone.

The whole point of bitcoin is we now have an asset that is truly the liability of no one. Verify the ownership of an open distributed network with cryptography; don’t trust permissioned IOUs. With the mix of regulatory concerns about the global crypto derivatives industry, a questionable exchange token with unbelievable relative performance over the last two years and a shaky proof-of-reserves attestation — that was incorrectly claimed to be an audit and had industry CEOs raising eyebrows — we find the need to urge our readers to evaluate their counterparty risk.

We will update readers as the situation developers.

This concludes Part 2 of “Not Binancial Advice” published Tuesday, December 13, for paid subscribers.

Try a 30-day free trial of the Bitcoin Magazine PRO paid tier to receive all of our articles in full as they go live.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!