FOMC Eve: Markets Prepare For Fed Decision

September FOMC meeting is tomorrow and the Federal Reserve is expected to raise rates by 75 basis points with a rate peak in March '23 at 4.7%. The 30-year and 3-month Treasury inversion grows closer.

Relevant Articles:

9/1/2022 Inflationary Bear Market Spells Trouble For Investors

9/16/2022 Five Key Charts To Watch Right Now

Another 75 Basis Points Inbound

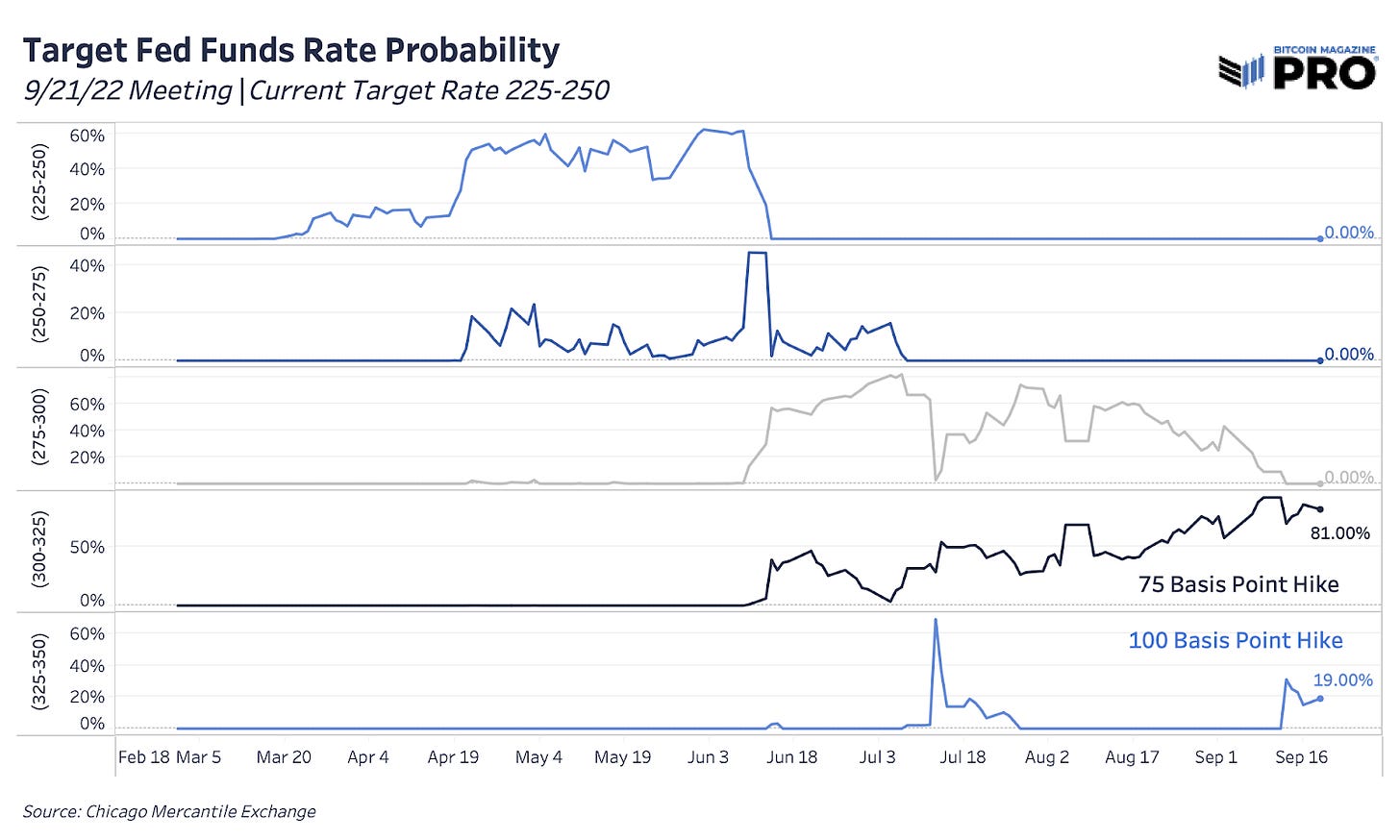

Consumer Price Index (CPI) releases and Federal Reserve Open Committee (FOMC) meetings have been the events to really move markets this year, especially for risk assets and bitcoin. Tomorrow brings the latest FOMC September meeting decision with the Fed expected to raise the target rate by another 75 basis points. Apart from tomorrow’s meeting, there will be two more meetings this year — in November and December.

For the majority of the year, the regime shift in the market has been about rising inflation, rising interest rates to combat that inflation and the subsequent impact on equities to adjust for a higher cost of capital. Market consensus expected disinflation to be here quicker and the Fed to be more limited in their ability to hike rates further. That hasn’t been the case and rate hikes around the world are continuing into a likely earnings recession unfolding for the U.S. toward the end of this year — a perfect storm.

The 2-year Treasury yield, at just under 4%, is a signal that the market is essentially allowing room for the Fed funds rate to go up another 145 basis points before turning over. Currently the market is pricing in a 50% chance that the Fed hikes 200 basis points to a 425-450 range by the end of the year (over the next three meetings). The highest odds, priced by the market, are that the Fed hikes 75 basis points tomorrow, 75 basis points again in November and then slows to 50 basis points in December.

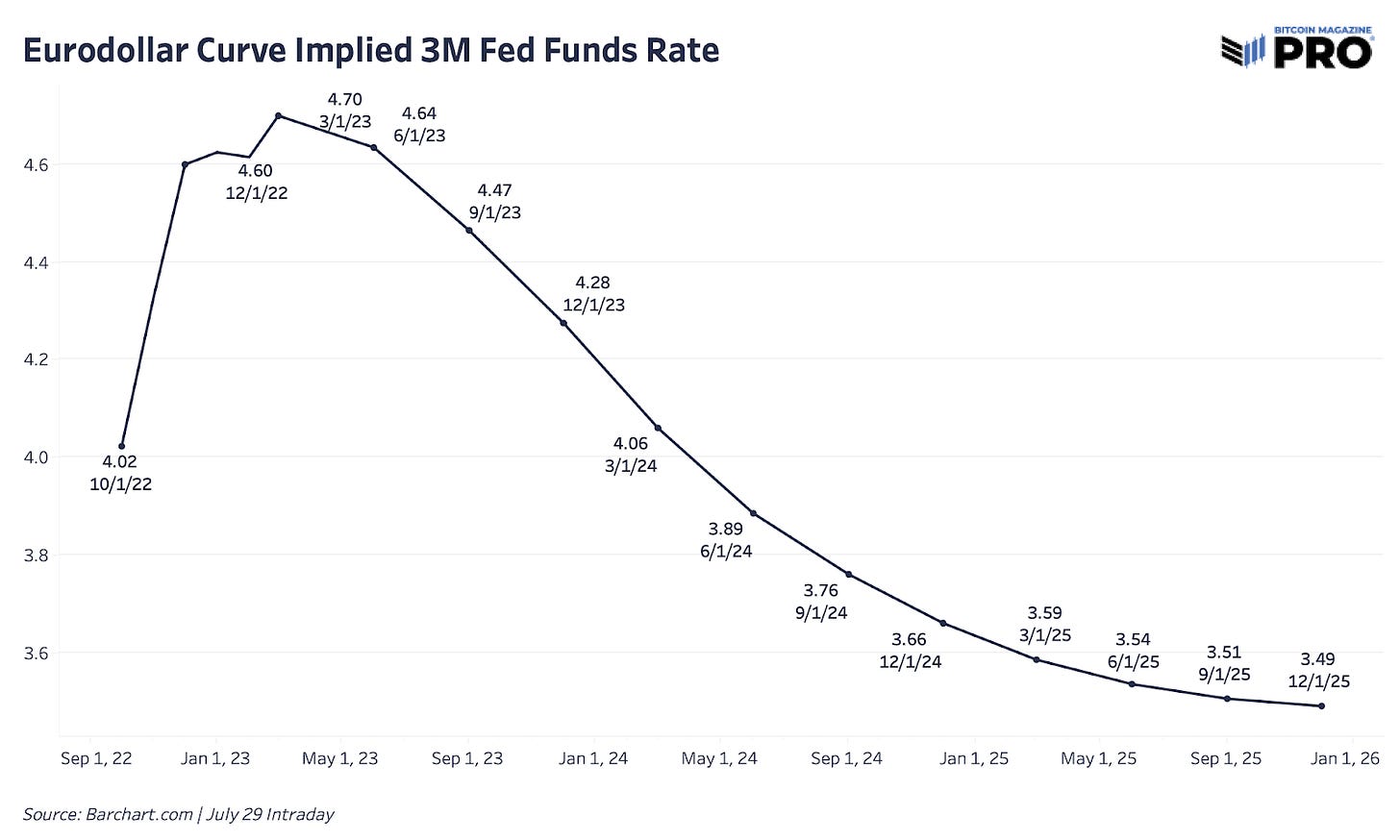

The eurodollar curve shows the same picture and we can see now that the market really does “believe” the Fed after not buying the rhetoric and implying massive cuts in early 2023. The market currently projects that the Fed will stop their rate hiking by March 2023 and reach a 4.7% implied federal funds rate.

It’s rare to see the federal funds rate higher than the 2-year Treasury but it has happened four separate times since 1989. At this point, it seems that the Fed would welcome a scenario where their aggressive rate hikes lead to a major deflationary shift. Yet, it’s a double-edged sword since deflationary busts wreak havoc just like persistent inflation can. We’re in a unique position and Stanley Druckenmiller’s observation says it best,

“Once inflation gets above 5% it has never come down unless fed funds have gotten above the CPI. Frankly I don't think we'll get there because of the extent of the asset bubble and the damage that would be done.”

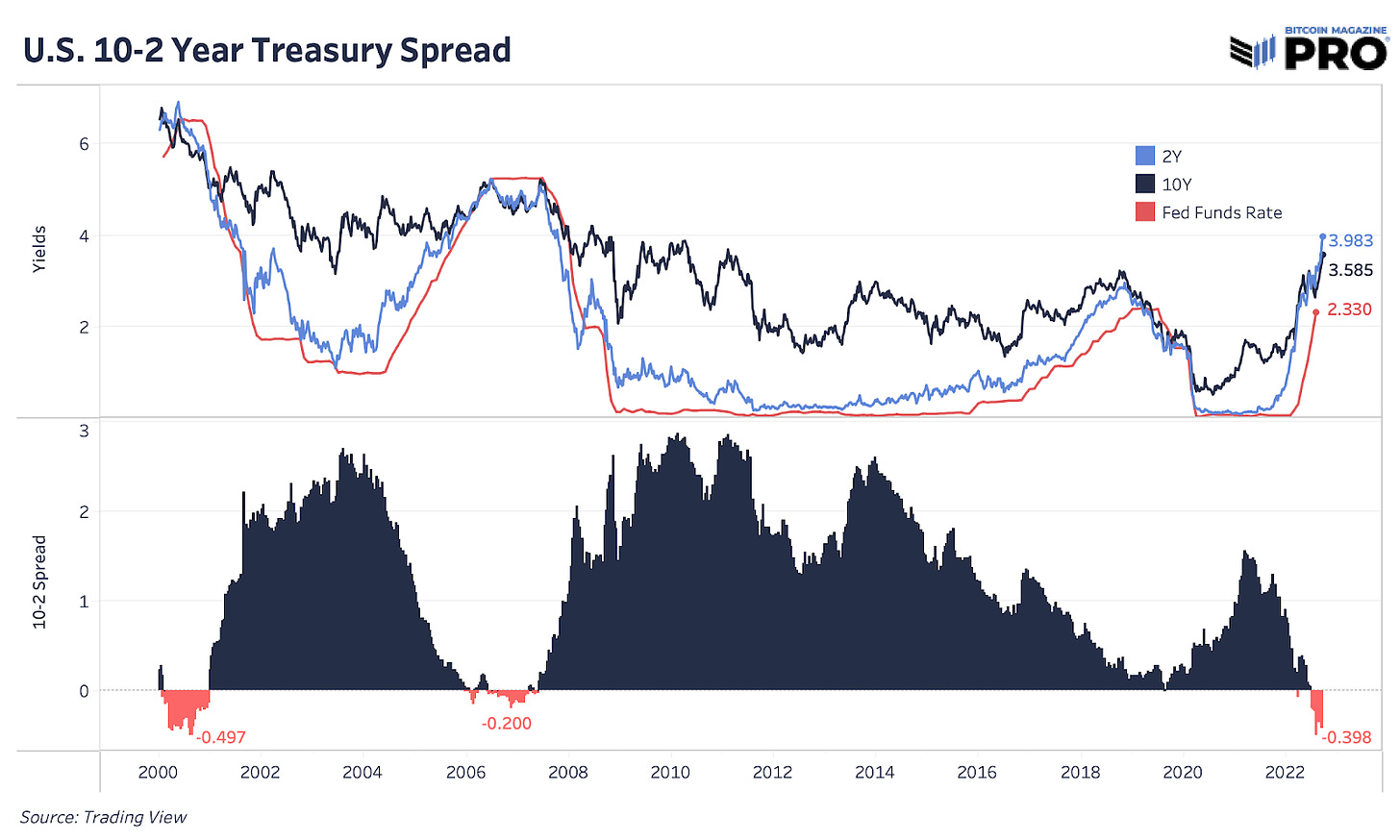

The Treasury yield curve is extremely flat and in many instances inverted, showing just how unusual the current market regime is. As interest rates likely extend beyond 4% before the end of the year, the short end of the curve will likely continue to extend above long-end rates.

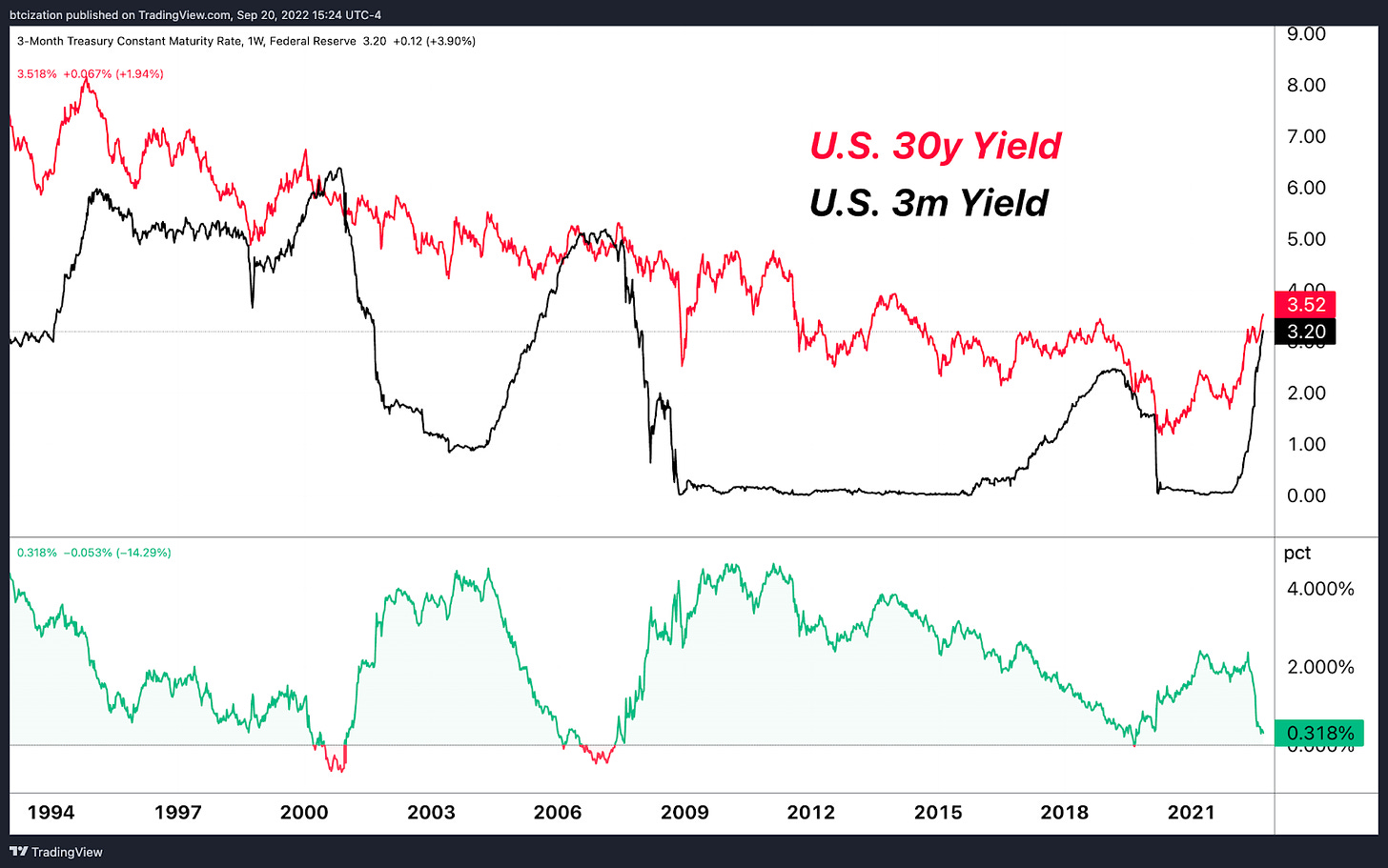

Similar to the 10y-2y yield spread, the 30y-3m yield spread, another historically reliable recession indicator, is looking increasingly likely to invert.

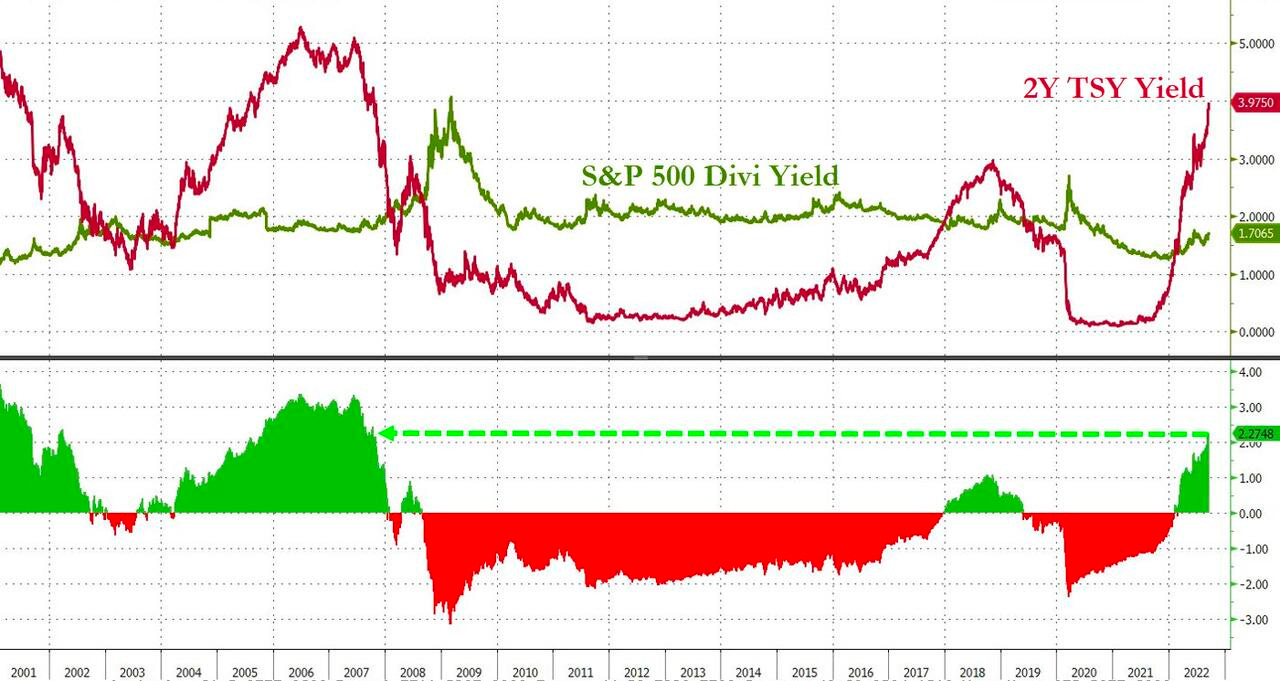

The implications of drastically higher short rates cannot be understated. Firstly, it not only chokes off the private sector, given that debt needs to be rolled over at significantly higher borrowing costs, but secondly, the higher short rates go the less attractive equities look relative to fixed-income instruments.

Shown below is the 2-year Treasury yield and the S&P 500 dividend yield. While earnings yield (the inverse of the P/E ratio) could also be an applicable comparison, the comparison is a valid one for investors looking to park their capital in assets that will generate flow. The higher short rates go, the more equities must fall to be equally attractive in earnings terms.

Source: ZeroHedge

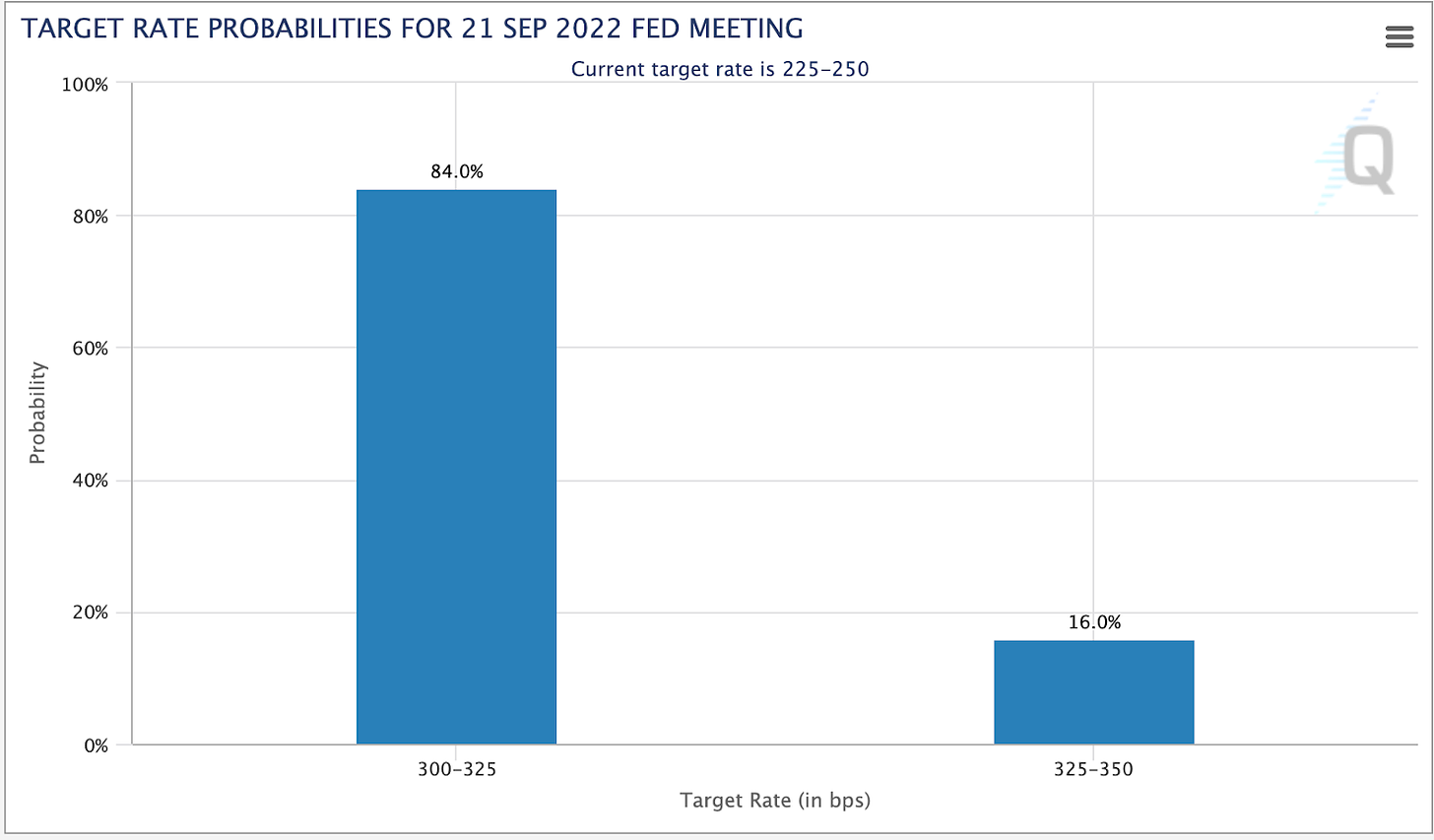

Tomorrow’s FOMC meeting will bring another rate hike, which as previously stated is expected to be 75 bps. Given the 84% probability of a 75-bps hike, in the event of a 100-bps rate hike, it’s likely that we will see a viscous repositioning downwards across global risk assets.

Source: CMEGroup

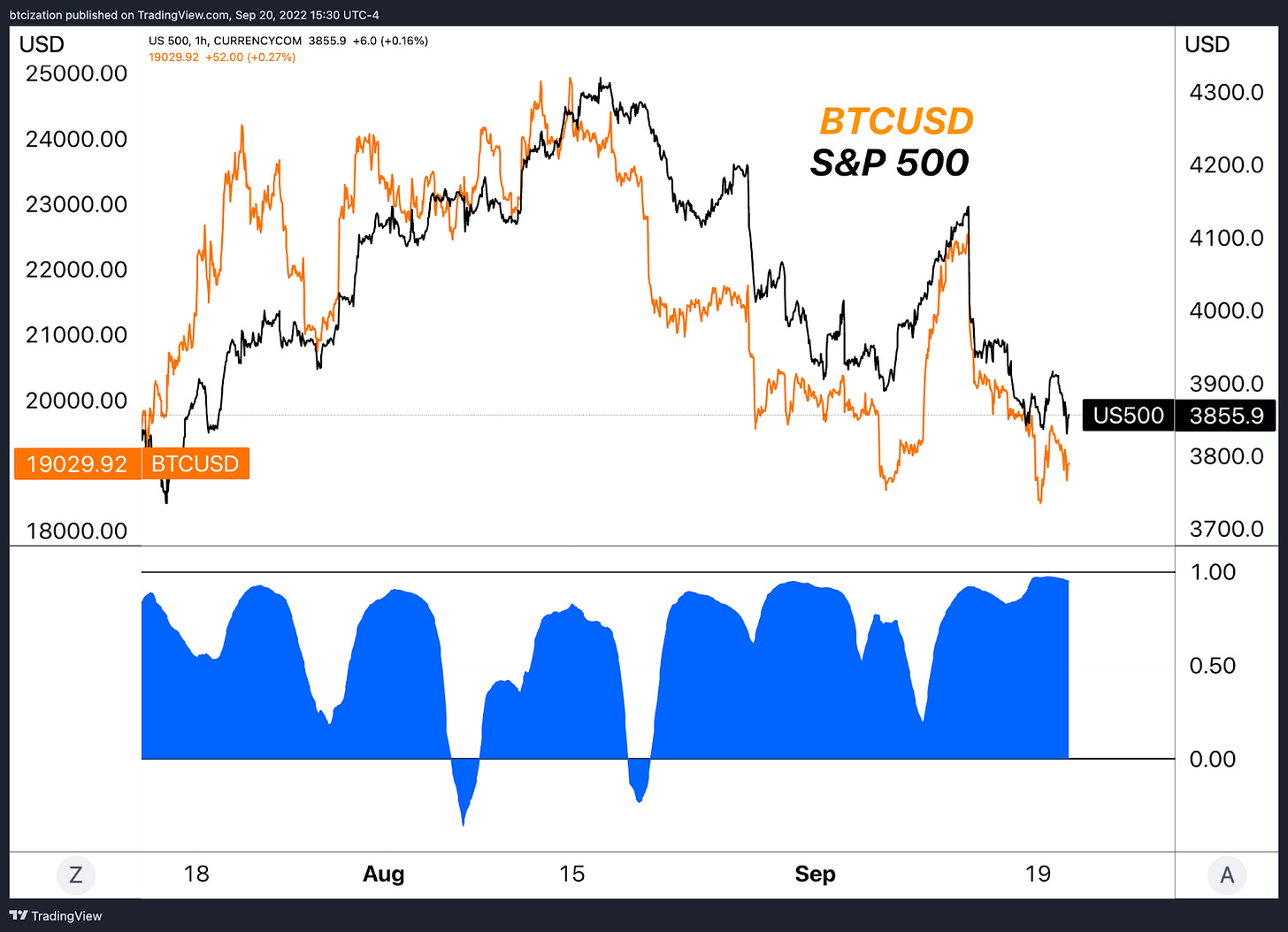

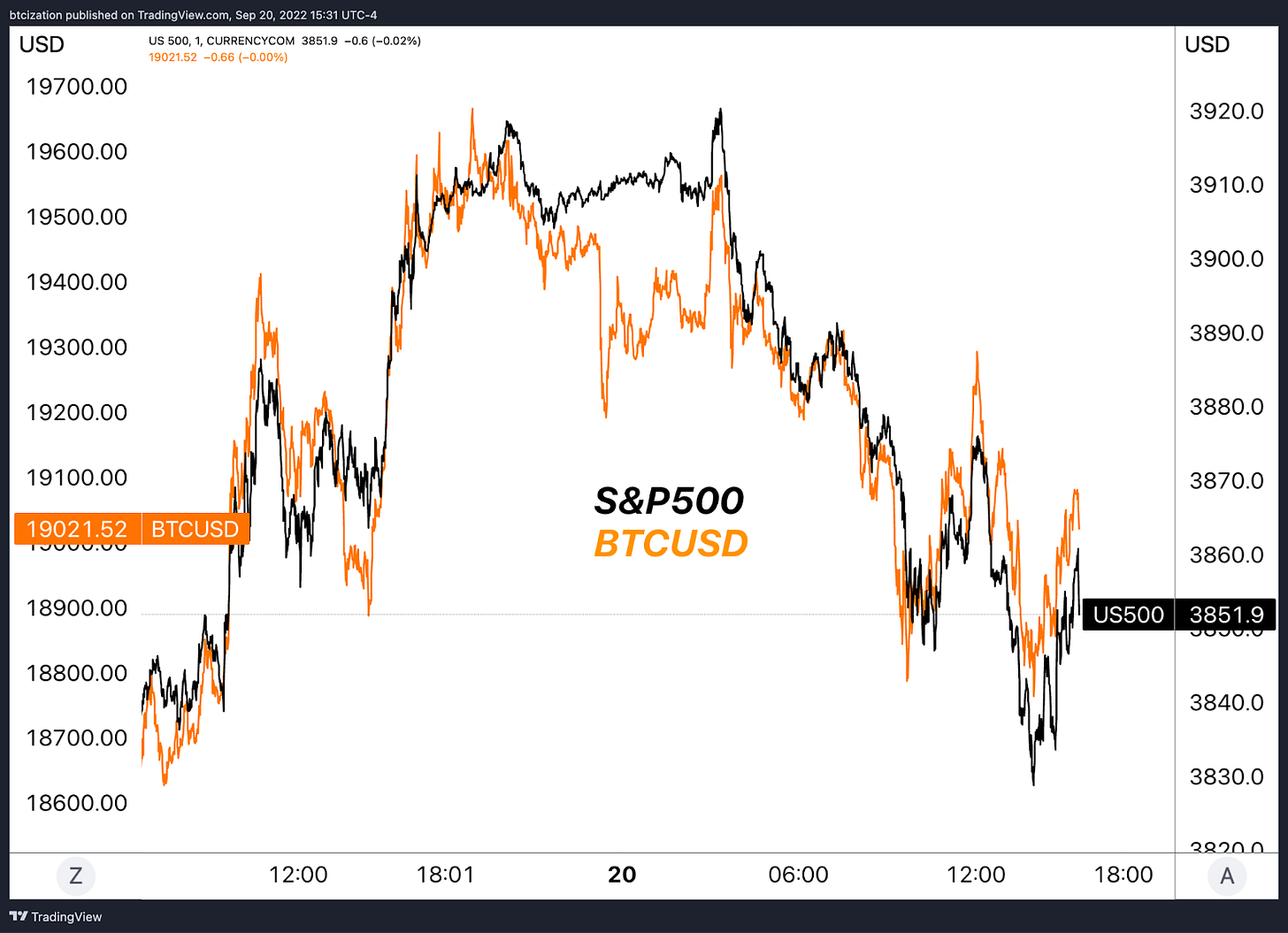

Given that bitcoin and equities have traded nearly 1:1 in recent weeks, expect once again for equities markets to dictate the next direction for the much less liquid bitcoin market.

Putin’s Unknown Address

Lastly, it was announced this morning that Russian President Vladimir Putin would be delivering a speech addressing the nation at 1:00 p.m. EST. Ultimately, the address was reportedly postponed until tomorrow. While it is unknown exactly what the address will cover, certain political analysts believe it is potentially the most important address from Putin since the proclamation of military operations in Ukraine. This event, given its unknown nature, has large implications for global capital markets given the geopolitical uncertainties brought about by war.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section.