Bitcoin Transaction Fees Plummet While Mining Stocks Soar

As the initial spike in bitcoin transaction fees subsides from May highs, publicly traded mining stocks continue to outperform after a brutal 2022.

Relevant Past Articles:

Brc-20 Brings Tokenomics To Bitcoin, Spiking Transaction Fees

State Of The Mining Industry: Public Miners Outperform Bitcoin

Mining Market Overview

After a short-lived transaction fee frenzy in Q2, mining revenue has normalized back to pre-ordinal levels, but public mining equities have continued to outperform. In February, we covered the introduction of ordinal inscriptions on Bitcoin and their lack of impact on the transaction fee market at the time, but that drastically changed starting in April with the advent of brc-20 tokens and the rush to create tokenomics on Bitcoin. Miners continued to see a large increase in revenue coming from fees throughout the months of April and May, but those numbers have dwindled, leaving mining stocks at local highs.

Block Space Demand & Fee Revenue

Despite the prevalence of ordinal transactions, which constituted over 50% of all bitcoin transactions on Tuesday, the fee revenue related to those types of transactions has significantly dropped since the height of the May frenzy. As of yesterday, non-ordinal based transactions contributed to 85% of the total fee revenue, which in absolute terms, is a small fraction of the numbers recorded during the peak in May.

It's essential to note that larger-sized transactions by weight in block space terms, such as inscriptions of pictures and videos on the blockchain, weren’t the predominant drivers of ordinal volume. Instead, brc-20 tokens — a simple token standard largely propelled by speculation — were driving the volume. The chart below illustrates the evolution of ordinal usage, with images initially leading the charge, followed by a second wave and peak frenzy driven by brc-20 usage and the indiscriminate demand for immediate block space.

The average weekly fee revenue to miners has drastically fallen from 338.45 BTC/day on May 12, to a meager 17.37 BTC/day yesterday. Meanwhile, the mempool has successfully cleared a substantial portion of the high-fee-paying backlog from two months ago.

We continue to believe that block-space demand for ordinals positively impacts miners and helps drive a high revenue fee market. However, it’s becoming clear that the temporary frenzy we observed two months ago was more of a short-lived phenomenon fueled by hype rather than substance.

The weekly average fee revenue, which once represented 25% of all miner revenue, has dwindled to just 1.75%, using the 7-day moving average. As it stands, miners still derive the majority of their revenue from the block subsidy, which is slated for a 50% reduction in approximately April 2024.

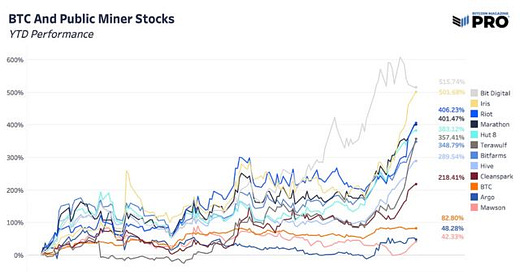

Impressively, despite the contraction in fee market revenue and the fall in hash price (miner revenue per terahash), public miner stocks have soared since the initial ordinals-driven fee spike, showing strong resilience even amidst consolidation in the bitcoin market, hinting at possible strong buy-side flows from institutional capital allocators.

The rest of this article is open to paying members only. Here’s what’s behind the paywall 🔏:

Public mining companies’ production updates. ⛏️

Analysis of mining equities’ outperformance. 📈

The “Bitcoin Yardstick” measure of over- and under-valuation in the bitcoin market. 📏

Mining Production Updates

With the latest round of monthly production updates, nearly all miners have new hashrate, holdings and operational data. Both hashrate and bitcoin holdings were up again in the month of June, while bitcoin production was down significantly relative to May. The sharp explosion in ordinals transaction fees has now receded, leaving May to be an outlier month for increased bitcoin production and higher miner revenues.

For the TLDR of the latest swath of updates, here are the highlights:

Riot is expecting self-mining hash rate capacity to be 20.1 EH/s by mid 2024 (currently 10.70).

Iris Energy is targeting expansion of hash rate from 5.6 to 9.1 EH/s by early 2024.

Marathon is closing in on 23 EH/s target and launched a new Abu Dhabi joint venture to bring an additional 7 EH/s online.

Terawulf actually increased their month-over-month bitcoin production, highlighting an average power cost of 3.5 cents per kilowatt hour.

Hut 8 is waiting on the merger completion between U.S. Data Mining Group to bring hashrate to 7.5 EH/s (currently 2.6).

To dive into each company further, we’ll provide the latest updates from the mining companies themselves on their production activities. These updates reflect the ongoing trends and activities in public mining, providing a snapshot of the various strategic, operational and financial developments in each company.

MARA

“The decreased production relative to last month was due to weather-related curtailment in Texas and a significant decrease in transaction fees, which fell to approximately 5.1% of the total bitcoin we earned in June compared to 11.8% in May. The emergence of Ordinals significantly increased transaction fees in May, and while network congestion eased in June, we view recent trends as a positive sign for the future of mining economics.”

“In June, we increased our operational hash rate 16% month-over-month to 17.7 exahashes, and we increased our installed hash rate 8% month-over-month to 21.8 exahashes. The final steps to achieving our 23 EH/s goal are in Ellendale, ND and Garden City, TX.

“In addition, we are also excited to announce that our new joint venture in Abu Dhabi began hashing earlier this week as the first containers in our Mina Zayed facility powered up. The speed of execution from ideation to production is a testament to Marathon’s significant technology expertise and our growing team of mining professionals. Our UAE partners at Zero Two have quickly brought our combined vision to reality, and we continue to expect the full 7.0 exahashes to be online before year end 2023.”

BTBT

“In June 2023, the Company produced 119.1 BTC, a 5% increase compared to the prior month. The increase in production was primarily driven by a higher average active hash rate and was partially offset by a decrease in transaction fees compared to the prior month.”

“As of June 30, 2023, Bit Digital had transferred 129 BTC to its strategic partner, Auros Global Limited, as collateral for yield optimization strategies connected to 430 BTC that Auros is conducting on behalf of Bit Digital. This allocation relates to the Company’s broader objective to enhance its overall treasury management solutions.”

DMGI

“In addition to the vast majority of DMG’s digital assets being self-custodied, DMG does have a small portion at Prime Trust, a qualified custodian, in the state of Nevada. Recently Prime Trust was issued a cease-and-desist order from the State of Nevada, Department of Business and Industry, Financial Institutions Division (FID) and then subsequently was petitioned to be placed into receivership. DMG currently holds approximately 49 bitcoin and 45 ether which it does not have access to while the FID investigates Prime Trust. The Company does not have a timeline for access to those assets while the Nevada regulator is undertaking its investigation. As of June 30, 2023, the Company held 509 bitcoin, and the inability to access its digital assets held at Prime Trust will have no effect on DMG’s business operations nor plans.”

HIVE

“We expect to provide updates on our growing hashrate capacity as we work towards our interim goal of 4 EH/s, and moreover, we are actively evaluating opportunities in the market for our year end goal of 6 EH/s.”

HUT8

“Hut 8 disclosed in an amendment to its Form S-4 Registration Statement filed in mid-June that it expects the installed self-mining capacity of Hut 8 Corp. to be 7.5 EH/s, assuming the completion of the proposed all-stock merger of equals between U.S. Data Mining Group, Inc. dba US Bitcoin Corp (“USBTC”) and Hut 8 (the “Transaction”). This includes the 1.8 EH/s installed self-mining capacity at the King Mountain, Texas site which is owned by a joint venture in which USBTC has a 50% membership interest alongside a leading energy partner.

“On June 26, Hut 8 announced that it entered a US$50 million credit facility with Coinbase Credit, Inc.”

IREN

“Targeting expansion from 5.6 EH/s to ~9.1 EH/s4 of potential data center capacity by early 2024”

“The reduction in monthly operating revenue and Bitcoin mined (vs. May) primarily reflects the reversion in network transaction fees and increase in difficulty-implied global hashrate during the period.”

RIOT

“June was a momentous month for Riot, as the results from our mining operations, power strategy and growth plans have all come together,” said Jason Les, CEO of Riot. “We announced an initial order of 33,280 MicroBT miners for our Corsicana Facility, which is expected to add 7.6 EH/s to our self-mining fleet and also provides optionality for future orders at the same terms. This long-term purchase agreement locks in our pricing for the next generation of miners and provides a path to executing on our ambitious growth plans.

“In June, Riot mined 460 Bitcoin while also significantly leveraging our power strategy. As temperatures in Texas reached near record levels during the month and power demand was high, we made dynamic decisions on our power usage based on market signals. Through our participation in various market programs within ERCOT, the Company generated $8.4 million in power sales and $1.6 million in demand response revenue, which when combined, represented the equivalent of an additional approximately 361 Bitcoin based on the average price of Bitcoin during the month.

“Our long-term, fixed-price, power contracts provide Riot the ability to curtail our Bitcoin mining operations and sell large blocks of power back into the grid during periods of peak demand, ensuring power is available to Texans while generating economic benefits to the Company. This power strategy is a key differentiator for Riot as it supports our low cost of production and is made possible by our vertically integrated structure and unmatched balance sheet strength.”

“Due to the ongoing impact of damage incurred to Building G during the severe winter storm in Texas in December 2022, Riot now anticipates achieving a total self-mining hash rate capacity of 12.5 EH/s at its Rockdale Facility in the second half of 2023.

“The Company has entered into a long-term purchase agreement with MicroBT, which includes an initial order of 7.6 EH/s of next-generation Bitcoin miners for its Corsicana Facility. Upon full deployment by mid-2024, Riot’s total self-mining hash rate capacity is expected to be 20.1 EH/s.”

WULF

“Despite the increase in network difficulty and decrease in transaction fees, and many of our peers facing downtime and/or curtailed operations due to geographic concentration in Texas, TeraWulf increased its monthly bitcoin production by 8% in June,” stated Kerri Langlais, Chief Strategy Officer of TeraWulf. “Last month, TeraWulf realized an average power cost of 3.5 cents per kilowatt hour and an average availability in excess of 98% across its facilities. The Company’s low energy costs and high availability despite the high summer temperatures are a testament to our team’s decades of energy infrastructure management experience,” added Langlais.

Public Mining Equities Performance

While 2022 was a challenging year for the mining industry, 2023 has seen a resurgence, partly due to passive allocation from institutions and a temporary rebound in hash price. This revitalization has propelled the total public mining market cap from $2.52 billion to $12.12 billion, with the proprietary Bitcoin Magazine Pro mining index surging from 76 to 358. The performance for miners has been remarkable, as bitcoin is impressively up 147% year-to-date and the miners’ basket has surged 353% — a trend persisting despite decreasing fee revenue, likely perpetuated by passive buy side flows from institutions like Vanguard and Fidelity.

Looking more closely at the valuation of public miners as a whole, we can calculate their worth using the Bitcoin Yardstick. Created by Capriole Investments, the Bitcoin Yardstick is a handy method to gauge bitcoin's worth. It’s akin to a P/E Ratio for stocks, but instead of earnings, it looks at the energy spent to keep the Bitcoin network secure, compared to its market cap.

To calculate, take the Bitcoin Market Cap, divide it by the hash rate, but adjust the hash rate with a 2-year rolling Z-Score (standard deviations from the mean).

The creator points out three significant markers:

Yardstick less than -1σ (standard deviation) = below the average valuation.

Yardstick greater than +2σ above mean valuation.

Yardstick more than +3σ above the mean

These markers provide valuable insights into bitcoin's potential over- or under-valuation.

As of now, the mining market has navigated past the -1σ below-average zone. This transition often signals the beginning of miner outperformance against bitcoin, typically continuing in spurts (albeit with heightened volatility) until bitcoin ventures into significantly overextended territory, breaching the +2σ and +3σ zones.

Considering the noticeable fall in fee revenue from the highs, what could account for the significant miner outperformance?

As we've previously noted, the brief history of publicly traded mining corporations suggests that outperformance often trails hash rate and bitcoin price capitulation, as was the case in the second half of 2022. Furthermore, a renewed interest in publicly traded bitcoin-exposure products seems evident, spurred by the latest round of spot Bitcoin ETF applications, notably led by BlackRock. This trend is clearly reflected in entities like GBTC, MicroStrategy and mining stocks, which are notably much smaller and less liquid than the other vehicles.

A recent talking point in the crypto space is the institutional giant Vanguard’s increased exposure to both Marathon Digital Holdings and Riot Platforms. While this move has been somewhat misinterpreted by some, given that Vanguard passively allocates for its clients through exchange-traded products housing large baskets of public companies, the indiscriminate buying into this small market with a relatively illiquid float has proven highly beneficial for the publicly traded miners. This is a welcome turnaround for these companies, some of whom were prime targets for short sellers during a challenging 2022.

Final Note

In conclusion, it’s worth remembering that miners can exhibit significantly greater volatility than bitcoin itself. Public miners as vehicles for investment remain a supercharged bitcoin play for bull markets, while offering you the opposite result in bear markets. In the interim, the ongoing rise in hash rate, coupled with lower fees and a stagnant bitcoin price, does not offer the revenue boosts to miners like they experienced in May, although many are combating and even outpacing the rise in hash rate by deploying more machines.

In regards to the security budget and miner revenue from fees, we maintain our confidence in the long-term sustainability of the Bitcoin fee market. With a profit-driven market mechanism, the ongoing block space demand for bitcoin transactions, and the new additions like image/video/document preservation through ordinals and speculative transactions involving brc-20 tokens, we remain entirely assured that the market will reach a long-term equilibrium as the block subsidy gradually diminishes with each subsequent halving epoch.

All in all, the current environment remains much more favorable compared to Q4 of 2022 or Q1 of 2023. We anticipate that miners, due to their inherent volatility and low float, will continue to outperform bitcoin during periods of bitcoin appreciation, as bitcoin slowly but surely marches upwards, before giving up many if not all of those gains and then some to the downside during bitcoin bust cycles.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!