What Derivatives Positioning Can Tell Us About The Bitcoin Market

An overview of the perpetual futures and options market for bitcoin and ethereum in the context of previous market cycles.

For those who missed Friday’s announcement, we have some exciting changes coming to Bitcoin Magazine PRO!

It is our goal to provide you with the best possible insights to navigate the market and to do that, we believe it is important to have skin in the game.

With this in mind, we are happy to announce the addition of Dr. Jeff Ross who will be managing the new Bitcoin Magazine PRO Fund beginning in early September!

Dr. Jeff has extensive experience managing capital through his firm Vailshire Capital Management and is a highly-respected voice in the Bitcoin space. He will be making long/short calls, actively managing risk, and giving you actionable trade ideas, all while updating you on the performance of the Bitcoin Magazine PRO Fund.

Paid subscribers will receive these updates, in-depth market commentary from our research team, and will continue to receive early access to our monthly market research reports as they are released.

We will continue to release details as the launch approaches, thank you for supporting Bitcoin Magazine PRO!

Options and Derivatives Update

One dynamic and chart we’ve covered extensively before is bitcoin’s perpetual futures market funding rate compared to price. In the previous 2021 bull run, the perpetual (perps) futures market played a key role in moving short-term prices to both the upside and downside with excessive leverage. It’s worth reviewing the state of the derivatives market and the system’s current leverage as bitcoin price has broken down from its latest rally, following U.S. equities on a potential path towards new lows.

Since the top in November 2021, the perpetual futures market has been consistently biased towards the downside (neutral funding rate is 0.10%). Simply put, more of the market participants were and still are biased short over the last eight months. Even during the latest bear market rally move, that hasn’t changed. We didn’t see the funding rate go above neutral territory showing a clear sign that long speculators and risk appetite have not returned to the market.

With the successful launch of a bitcoin futures ETF in U.S. markets last fall, along with a general unwind in speculative activity across the bitcoin/cryptocurrency market, perp funding rates have been teetering from a neutral to short bias with much less explosive moves in funding rates. Although derivatives market dynamics have changed, it’s still worth watching for an actionable signal from the perps market where the shorting bias gets heavily offside as it's shown to do throughout history marking significant bottoms. It’s worth noting that in previous bear market cycles (where new incoming spot demand was diminished by willing sellers) funding could stay negative for long periods of time, due to lack of demand to speculate/leverage the asset from the bulls.

Another way to visualize the funding rate is to look at an annualized value with the current negative funding rates yielding an estimated 3.32% for taking a long against the majority of shorts. Since the breakdown in November 2021, the market has yet to get back over the annualized neutral funding rate.

Price has moved with the trend of declining futures market open interest in USD since the market top. That’s easier to see in the second and third charts below which just shows the perps futures market share of all futures open interest. The perps market accounts for the lion’s share of open interest of over 75% and has grown substantially from approximately 65% at the start of 2021.

With the amount of leverage available in the perps market, it makes sense why perps market activity has such a large impact on price. Using a rough calculation of the total perps market volume from Glassnode of $26.5 billion per day (7-day moving average) versus Messari’s real spot volume (7-day moving average adjusting for inflated exchange volumes) of $5.7 billion, the perps market trades nearly five times the volume to spot markets. On top of that, daily spot volume is down nearly 40% from last year, a statistic to help understand just how much liquidity has left the market.

Given the volume of the bitcoin derivative contracts relative to spot markets, one may arrive at the conclusion that derivatives can be used to suppress bitcoin. We actually disagree, given the dynamically priced interest rate associated with bitcoin futures products, we believe that on a long enough time frame the effect of derivatives is net neutral on price. While bitcoin likely exploded much higher than it otherwise would have due to the reflexive effects of leverage, those positions eventually were forced to close, thus an equal negative reaction was absorbed by the market.

Markets outside of bitcoin can give us a better idea of excess leverage and speculation build-up in the larger ecosystem. What we’ve seen during Ethereum’s 130%-plus rise from candle wick lows in just under two months is a substantial rise in stablecoin open interest. Nearly all market participants wanted to get long the Merge, cover shorts and take bets. Now, we’re seeing an unwind of some of that euphoria as the Merge narrative faces an equities market selling off again.

Although not as significant, you could see some of the leverage and speculation building across many alternative cryptocurrencies as “alt season” calls and euphoria started to take over again. Bear market rallies have to be convincing to many to lure in as much liquidity as possible (wrecking both shorts and longs on its path) and that’s exactly how the rally has played out so far.

Estimated leverage ratios, the ratio of futures open interest to exchange balances, across both bitcoin and ETH have soared over the last two months as rally and Merge narrative speculations have taken off. However, the bull/bearish bias observed across both futures and options markets is less speculatively bullish than much of 2021.

Crypto Market Options

In our August 12 issue titled “Rising Speculation - Evaluating The Explosion In Derivatives Interest,” we covered some of the option market dynamics for both bitcoin and ether, specifically referring to the amount of speculative activity in derivatives taking place in anticipation of the Ethereum Merge.

Read also: “The Ethereum Merge: Risks, Flaws and The Pitfalls Of Centralization”

“In particular, there is a large amount of bullish speculation around ETH for the September expiration (which should occur after the Merge). Shown below are the options open interest by strike price in both ETH and USD terms.

“With the largest strike prices for call options above $4,000 ETH (more than 100% above the current market price), there are three separate strike prices above $100 million in notional open interest. Bitcoin on the other hand, has no strikes with notional call option value above $100 million, despite Ethereum being just 50.8% of its market cap.

“This, if nothing else, shows the large amount of short-term speculative interest in Ethereum. This can also be seen in regards to the two assets’ futures open interest as a percent of market cap, which has seen Ethereum leading since the start of the data set.” - “Rising Speculation - Evaluating The Explosion In Derivatives Interest”

Today we will reintroduce a concept to our readers to quantify the speculative bias of the options market called 25-Delta skew. 25-Delta refers to options

“If a 25-Delta put skew is indicated as being +25.0%, that means the volatility on that strike is 25% higher than the volatility on the ATM (at the money) strike. Likewise for the call. A 25-Delta call skew of -20.0% is 20% lower than the ATM (at the money) volatility.” - Market Chameleon

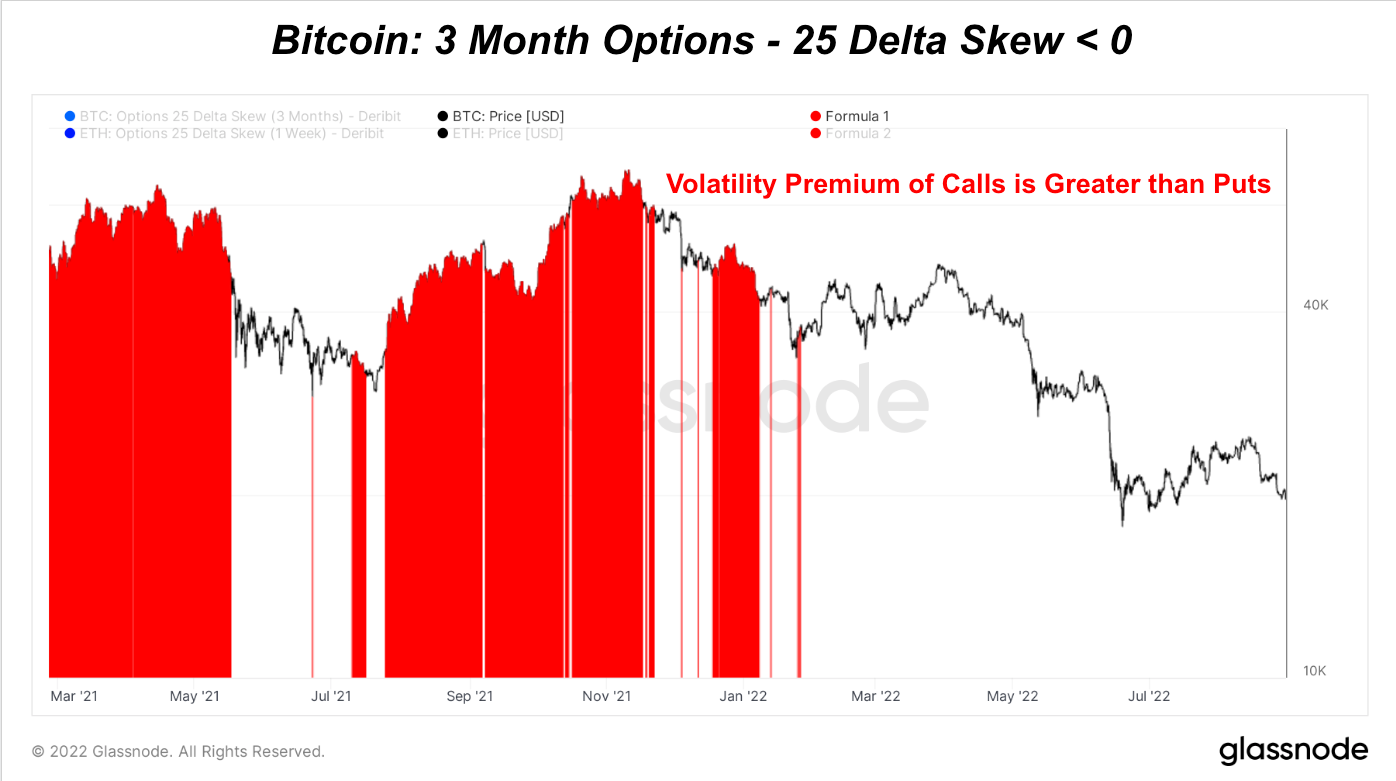

When combined, we can see whether calls or puts are “pricier” in a particular moment. When negative, the volatility premium for calls is higher than puts, while markets often show us that volatility is the greatest in moments of downside panic.

Thus, when calls begin to garner a speculative premium, especially across short and long time frames, that can potentially serve as the signal that things have gotten overheated to the upside. As bitcoin reached for 25k, delta skew went negative for 1-week options for the first time in the local uptrend, signaling that speculative long activity had once again returned in the market.

Source: August 11t Tweet

Let’s take a look at the delta skew for bitcoin and ether across various timeframes.

As the market has once again fallen to the $20,000 level as equities have cratered, put premium in the options skew has returned:

Shown below is the same chart, with only periods where calls demanded a volatility premium (negative delta skew):

Similarly, the same data for 1-month options is shown below:

Downside protection in the form of puts has stayed trading at a premium relative to calls for 1-month bitcoin options since late March.

Similarly, 25 Delta Skew on both three-month and six-month option contracts have remained positive (puts pricier than calls), showing the strong demand for downside protection from institutional investors at the current juncture.

Interestingly, options in the Ethereum market were much more aggressive to the bull side during the recent summer relief rally.

The delta skew for ETH options across timeframes (1 week, 1 month, 3 months, and 6 months) all flipped negative (calls pricier than puts) during the relief rally for brief periods of time.

We expect there to be strong demand for protection in the crypto derivatives market, in both the form of futures short positions as well as puts for the foreseeable future, so long as the macro environment continues to deteriorate.

We also suspect there will be a significant mispricing to the short side over the next six months, with both delta skews and perpetual futures funding rates going extremely positive (puts premium over calls) and negative (shorts pay longs to hold positions) respectively.

The effect of this late hedging and shorting in the market will fuel the move from the ultimate bottom, but at this time, the market is still waiting for global equities and bonds to make its next large move.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section.

This article was packed tighter than Vitalik's pants.

Great article. Still trying to wrap my head around all this derivative info. Lots to process. Glad I subscribed.