Voyager Announces Large Exposure To 3AC

Voyager lent 52% of loan book to Three Arrows Capital and sees its stock fall 48.75% today.

Voyager’s Loan Book Exposure

Early on June 22, 2022, Voyager Digital, a crypto company which enabled users to deposit on their platform for yield, announced it took large losses from loans extended to Three Arrows Capital.

“Voyager concurrently announced that its operating subsidiary, Voyager Digital, LLC, may issue a notice of default to Three Arrows Capital ("3AC") for failure to repay its loan. Voyager's exposure to 3AC consists of 15,250 BTC and $350 million USDC. The Company made an initial request for a repayment of $25 million USDC by June 24, 2022, and subsequently requested repayment of the entire balance of USDC and BTC by June 27, 2022. Neither of these amounts has been repaid, and failure by 3AC to repay either requested amount by these specified dates will constitute an event of default. Voyager intends to pursue recovery from 3AC and is in discussions with the Company's advisors regarding the legal remedies available. The Company is unable to assess at this point the amount it will be able to recover from 3AC.” — PR Newswire

This announcement follows some of our suspicions last week around Voyager and their lending counterparties.

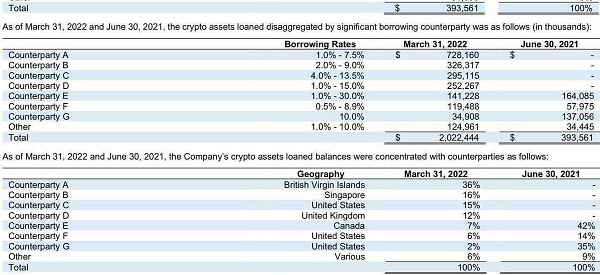

Source: Voyager Investor Relations

Even more interesting than Counterparty B from Singapore borrowing $326 million (presumably 3AC), is the fact that if you combine the exposures of Counterparty A and B, you reach a figure of $1.05 billion. When accounting for when the document was released at the end of the first quarter, bitcoin was trading at approximately $45,000.

Now, looking back at the Voyager press release today on the exposure to 3AC, consisting of 15,250 BTC and $350 million USDC, when marking the bitcoin to its value at the end of Q1, you get an approximate value of $1.04 billion or almost exactly the amount loaned to Counterparty A and B combined. Entry-level detective work brings you to find that 3AC, formerly based in Singapore, relocated to the British Virgin Islands last year before relocating again to Dubai this spring.

So not only was a publicly traded company lending customer deposits to a hedge fund, the lending accounted for over 52% of its loan book and the lending took place in a completely unsecured fashion, exposing its depositors to massive amounts of risk obscured by the allure of crypto native “yield.”

Shares of Voyager stock (VOYG) are down 48.75% today, at the time of writing, with the company down 97.5% off its all-time highs.

Last week, we focused almost exclusively on the contagion sweeping the crypto industry, and we feel that the main takeaway be reiterated once again. To quote the conclusion of our Friday newsletter,

“Take possession of your own bitcoin, and eliminate counterparty risk where possible. The only thing worse than becoming a forced seller due to your own leverage, is becoming one due to risks of a counterparty you entrusted.”

Unsecured Leverage

The last month in the crypto industry should serve as a lesson for experienced and new participants alike. “Yield,” often generated with layers of unsecured leverage on bearer assets is a ticking time bomb. One of the largest reasons that the effects of the “contagion” have been so strong has been due to this unsecured leverage.

Collateralized borrowing is one thing: You post over collateralized bitcoin in order to borrow dollars, and if the exchange rate of BTC/USD falls the borrower needs to either:

Post more collateral

Pay down the dollar-denominated debt

Liquidate the bitcoin to pay down the debt

Unsecured lending, and the systemic risks it unveils throughout an industry, is the very thing that bitcoin was created to stop.

“The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” — Satoshi Nakamoto

For the sake of the industry and the bitcoin exchange rate, one can hope that we’ve heard the last of second and third order effects of the contagion.

Thank you for reading Bitcoin Magazine PRO®! Please leave a like or comment if you enjoyed this article. Feel free to share our profile, although this post is only for our paid subscribers.

Good analysis and observations of the situation. We'll see where this lands.

Avoiding debt altogether is a superior financial strategy. I'm glad you guys are covering these events, and I'm even more glad some "companies" have decided to show us exactly what not to do.