Unstoppable Bullish Fundamentals: Bitcoin Will Soon Follow

Discover how bullish fundamentals, surging ETF inflows, and bipartisan political backing are setting the stage for Bitcoin's next massive price surge.

Introduction

While the bitcoin price is still caught in its multi-month range, things are only getting more bullish in the fundamentals. In today’s post we’ll walk through the emerging Bitcoin voter demographic and how it is being courted by both sides of the political divide. Then we will move into ETF inflows resuming following the 13F filing deadline of 15 May. Finally, we get to some exciting bitcoin charts.

If you want more posts like this, consider following me on my personal website bitcoinandmarkets.com.

The First Bitcoin Election

Former President Trump stunned bitcoiners with his comments at the Libertarian National Convention last week when he said:

“The future of bitcoin will be Made-In-The-USA. I will support your right to self-custody. I will keep Elizabeth Warren and her goons away from your bitcoin. I will never allow the creation of a CBDC.”

Source: Bitcoin Magazine, view video here

Trump estimates that 16% of Americans own bitcoin. This is close to a recent Grayscale poll that revealed 17% of US adults own bitcoin and that inflation is the biggest bipartisan concern.

Source: Grayscale

Biden is also in the middle of a huge flip-flop on the issue. His campaign has been reaching out to industry players seeking to understand the community better and get advice on policy. This is on top of the recent bipartisan success of overruling the SEC’s guidance block banks from being a bitcoin custodian in SAB 121, and the House passing FIT21 a bill that would add clarity to bitcoin regulation and agency responsibilities.

The Bitcoin demographic is obviously becoming a heavily sought-after and easily targeted cohort of nearly 30 million voters. They cross the political spectrum with many traditionally liberal voters liking it because it can help the common man beat inflation and conservative voters who like the fiscal restraint of sound money.

Inflows Return to the ETFs

The Bitcoin spot ETFs have experienced 12 consecutive days of inflows totaling over $2 billion. This followed a period of 10 out of 13 days with net outflows. This positive streak started on 13 May right as the Q1 13Fs were rolling in. 13Fs show what large entities with over $100 million AUM own and are required to be filed quarterly. May 15th was the deadline for Q1 reports and they started trickling in, in the days prior.

I wrote about the possibility of 13F causing a spike in inflows here on May 16.

The investors and amounts disclosed in the 13Fs are likely to spark inflows, which will tip the price higher and begin an upward spiral for Bitcoin. As major companies publicly reveal their substantial Bitcoin holdings, other large investors reevaluate their positions. Seeing respected institutions allocate to Bitcoin can lean the internal due diligence processes of other firms in favor of making similar investments. This causes the price of Bitcoin to rise, which in turn convinces yet more allocators to buy Bitcoin, thus creating a self-reinforcing cycle.

We’ve only started to see the price response to the new positive inflows and the complete 180 from politicians has not even started to register. Let’s get into the charts and take a look at how price could develop in the short, medium and long term.

Bitcoin Price Warming Up

Simple Moving Averages

Let’s start by taking a look at some simple moving averages, then we’ll get to the exciting possibilities. Price is currently testing support at the 20-day MA. This level has acted as a strong support in the past, and we expect it to hold and start the next leg higher. However, if that does not hold, the 50-day MA is not far below and serves as an additional support level. Notice the similarity to the last rally starting in February, where a similar pattern was observed and led to significant price appreciation.

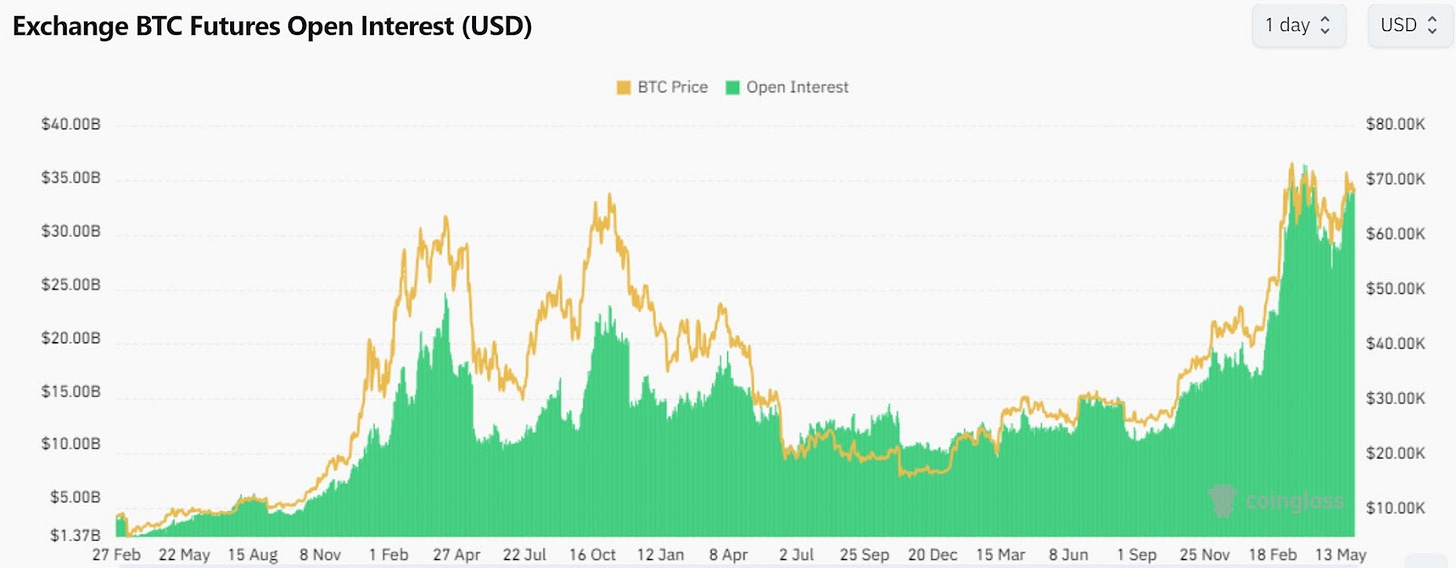

Futures Open Interest

Bitcoin recently broke $34 billion in futures open interest, with Chicago Mercantile Exchange (CME) taking the top spot ahead of new bitcoin exchanges. This shows a significant maturation of the market with established and highly-respected traditional exchanges becoming the default market platforms for trading bitcoin. The return to highs in open interest also speaks to renewed bullishness in market sentiment and the sustainability of recent price movement.

Source: Coinglass

Consolidation and Potential Breakout

The chart below shows Bitcoin's price consolidating within a defined range and forming a possible breakout pattern. The ETF inflows starting on May 13 have provided a significant boost, creating a positive streak that is likely to drive the price out of this consolidation zone. This pattern suggests that a breakout is imminent, and we could see a substantial move upwards in the near term.

Performance During Election Season

Historically, Bitcoin has shown strong performance during US presidential election seasons. The quarterly chart highlights the three quarters leading up to the US presidential election (Q2-Q4) in each election year, where Bitcoin consistently has significant gains. This historical trend, combined with the current political environment where both parties are courting the Bitcoin voter demographic, suggests a favorable period ahead.

Parabolic Pattern

If Bitcoin breaks out higher from here its massive parabolic move is intact. This weekly chart shows the long-term uptrend and suggests that the coming weeks are likely to be highly volatile and positive for Bitcoin. The parabolic trajectory indicates that we could see explosive price movements as the market continues to recognize Bitcoin's strong fundamentals.

Quarterly Chart Showing Explosive Potential

The quarterly chart below illustrates that each time Bitcoin sets a new quarterly high close, the following 6-9 months have historically seen explosive upside movements. This pattern is repeating itself currently, indicating that we could be on the verge of another significant rally. The breakout to a new quarterly high close suggests strong bullish momentum and a high likelihood of continued price appreciation.

Conclusion

The stage is set for an explosive Bitcoin rally! Bullish fundamentals, ETF inflows, and political attention are converging for a massive price surge. Technical charts indicate imminent breakouts, and historical patterns show Bitcoin thrives during election seasons. Investors should be ecstatic about the current setup. The fundamentals are rock solid, the market sentiment is bullish, and the technicals are flashing breakout.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

Yes Sir! Great analysis.

Thank you for your work!

LFG