We Aren't Bullish Enough: Monumental Shift in Bitcoin’s Fundamentals

We are witnessing a massive realignment of fundamentals, where they formerly fought us, now they join us.

For years, bitcoiners have been fighting a seemingly uphill battle with the powers that be. Resistance varied from country to country: discriminatory regulations, billionaire investors spreading FUD, arrests, and outright bans on mining and trading. However, the power dynamic has now shifted.

The shift started in 2023, with Blackrock's application for a spot ETF—a company often associated with corruption and elite conspiracies. While Bitcoin’s incentives eventually work on everyone, it was mildly surprising and seemingly out of the blue that Blackrock wanted to promote Bitcoin. We don’t have to like our new promoters, but Bitcoin has new friends in high places, and this week we glimpse the massive scale of this shift.

After several weeks of calm and a contained Bitcoin price, the last few days have brought far-reaching changes to Bitcoin’s fundamentals. From ETF inflows to significant institutional endorsements, the bullish momentum is unmistakable. In this post, we delve into recent events reshaping Bitcoin's landscape and why the bullish sentiment might still be underappreciated.

Bitcoin surged over 7% yesterday, breaking through and closing above the 50-day moving average that we’ve been monitoring, creating a higher high to follow the higher low, cementing the bottom on May 1. This rally was the result of a confluence of events, sparked by April’s CPI data coming in under forecasts for the first time in months. However, the narrative is much broader and more bullish than just a single economic data point.

Institutional Involvement: 13F Filings Reveal Major Positions

One of the most significant shifts in fundamentals was revealed by the recent wave of 13F filings from major institutions and funds reporting Bitcoin ETF positions just before the May 15th deadline. These filings detail substantial allocations into Bitcoin ETFs by major institutional investors. The significance of these filings cannot be overstated. The list of participants is lengthy: UBS, Bank of Montreal, Scotia Bank, Toronto Dominion Bank (TD Bank), US Bancorp (a Rothschild firm), BlackRock, Millennium Management, Bracebridge Capital, Hightower Advisors (the #2 RIA firm in the US), Cambridge Investment Research, Sequoia Financial Advisors, Integrated Advisors, Brown Advisory, Pine Ridge Advisers, Boothbay Fund Management, and even the State of Wisconsin.

Hedge fund Millennium Management, with over $64 billion in AUM, disclosed holding approximately $2 billion (>3% AUM) across several Bitcoin ETFs. Other notable allocations include Bracebridge Capital holding $434 million, and the State of Wisconsin Investment Board (the state’s pension fund and 9th largest in the country) revealed a $163 million stake in the Bitcoin ETFs. Wisconsin was the biggest surprise in the filings, as a government pension fund allocating 0.5% of their portfolio to Bitcoin. Other pension funds, endowments, and sovereign wealth funds will likely follow, especially considering earlier this month Blackrock announced talks with these types of investors.

According to Matt Hougan, CIO at Bitwise, this list is just the beginning, with many professional investors expected to increase their holdings significantly over the next six to twelve months. Hougan noted that the pattern of due diligence typically leads to broader platform-wide allocations, dramatically increasing Bitcoin’s potential institutional investor base. Hougan suggested the number of 13Fs with Bitcoin could rise to 700+ firms by the next filing deadline. Hougan highlighted the Bitcoin ETFs far surpassed the early performance of the gold ETF in 2004.

ETF Inflows and the Veblen Good Effect

All those 13F filings were for Q1 flows into the ETFs, how do they affect current flows? We might already be seeing the beginnings of this second wave of ETF buyers. After flows had been negative for 10 of the last 13 days, each day this week has been a positive flow day.

Bitcoin exhibits a unique relationship with price that differentiates it from typical goods. In the case of most goods, demand decreases as the price rises. However, Bitcoin behaves like a Veblen good, where demand actually increases as the price rises. This phenomenon is crucial in understanding the potential impact of the recent 13F filings revealing large, well-respected firms allocating to Bitcoin.

The investors and amounts disclosed in the 13Fs are likely to spark inflows, which will tip the price higher and begin an upward spiral for Bitcoin. As major companies publicly reveal their substantial Bitcoin holdings, other large investors reevaluate their positions. Seeing respected institutions allocate to Bitcoin can lean the internal due diligence processes of other firms in favor of making similar investments. This causes the price of Bitcoin to rise, which in turn convinces yet more allocators to buy Bitcoin, thus creating a self-reinforcing cycle.

This powerful feedback loop is a price/inflow spiral that can lead to significant price movements for Bitcoin. As we move into the second half of Q2, this dynamic is likely to play a crucial role in shaping Bitcoin’s market trajectory, driven by these institutional endorsements and the inherent Veblen good characteristics of Bitcoin.

Government Support for Bitcoin and Stablecoins

The regulatory landscape for Bitcoin is shifting dramatically. A total political realignment is happening as we speak in favor of Bitcoin!

In Staff Accounting Bulletin #121 (SAB 121), in very strange guidance, the SEC banned banks from custodying bitcoin. Congress took it up and passed a measure in the House and Senate to rescind this guidance. Biden has threatened to veto it, but vetoing a bipartisan bill in an election year would be contentious. If signed, it could open the flood gates for pent up demand from banks to offer Bitcoin services.

In a similar story of the government surprisingly protecting people’s rights, Oklahoma has passed a law protecting the right to own, transact, and personally hold Bitcoin. The vote was a surprising 76 to 2. This could be followed soon by other States such as Montana, Idaho, Wyoming, Texas, Tennessee and Florida. Such laws safeguard Bitcoin holders from government overreach into their privacy and personal finances.

Additionally, on the legislative front, Paul Ryan, a prominent establishment Republican and former Speaker of the House, suggested in an interview that stablecoin legitimization could happen within the year. He explained the benefits of stablecoins holding dollar denominated assets like government bonds, and further entrenching the dollar in the global digital economy.

Stablecoin legitimization is good for Bitcoin. Ryan distinguished stablecoins and crypto, something that could be expanded to Bitcoin since the SEC considers it the only commodity in the space. Tether is also fully committed to increasing their bitcoin reserves. If they can expand their circulating supply and revenue, they will have more money to stack bitcoin reserves.

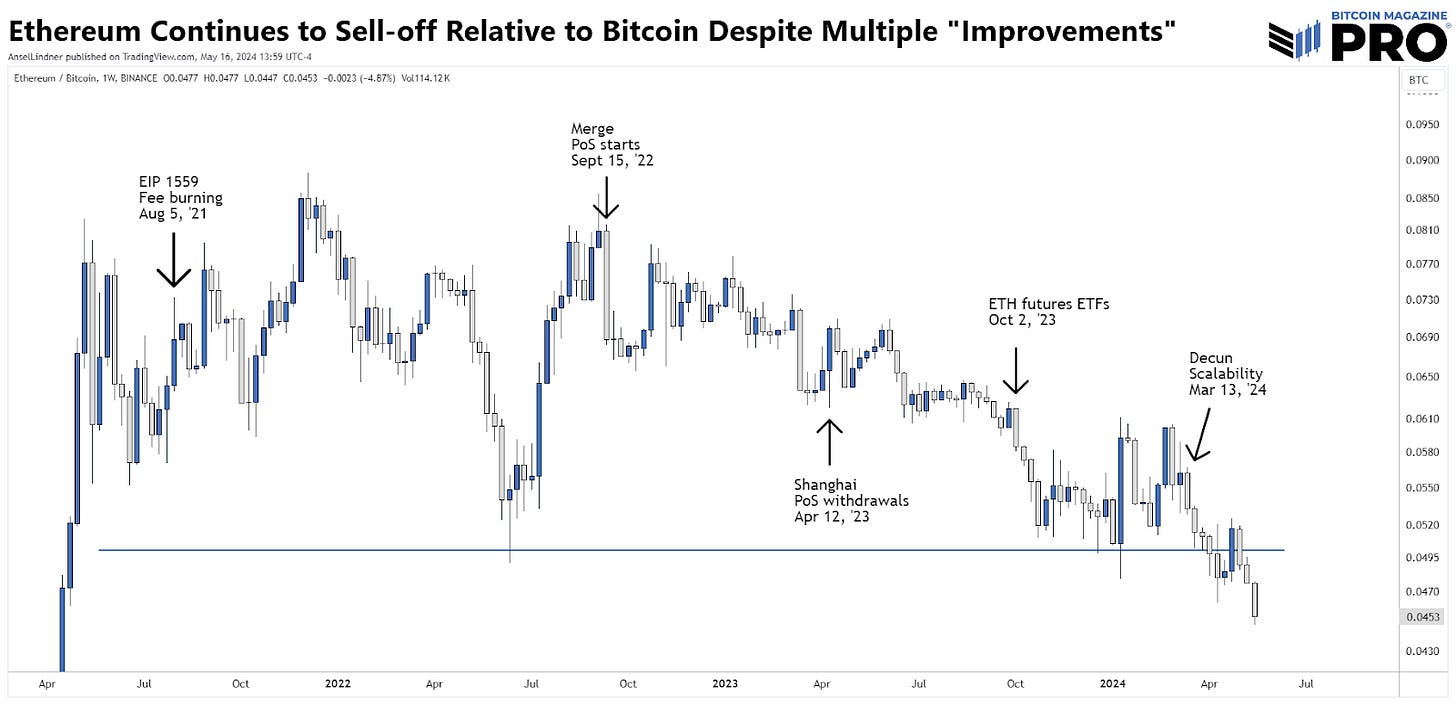

Ethereum Bleed

The last major fundamental shift I’d like to discuss today is the slow decline of Ethereum. The token’s troubles have been widely discussed on Twitter over the past couple of weeks. In a recent filing, the SEC alluded to the fact that the Ethereum ETFs applied under the wrong rule. They applied for a commodity-backed ETF, implying they should have applied as a security-backed ETF.

Source: SEC

Such a reclassification would create substantial uncertainty for Ethereum, exacerbating its downward spiral. It could lead to a capital flight from ETH to BTC, as Bitcoin’s clear regulatory status as a commodity is the best alternative. Investors fleeing Ethereum are likely to seek refuge in Bitcoin, driving up demand and further fueling the positive feedback loop discussed earlier. The migration of billions of dollars in capital from Ethereum to Bitcoin will not only bolster Bitcoin's price but also will unequivocally cement its status as the only viable digital asset.

Conclusion

The past week has been transformative for Bitcoin fundamentals. We are no longer fighting an uphill battle. Major capital allocators are flocking to bitcoin, official disclosures are spurring demand, governments are passing supportive laws, and a longtime rival is declining. We are not bullish enough. As institutional interest grows and regulatory treatment improves, Bitcoin's position as a key asset in the global financial system is becoming increasingly solidified.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!