The Fed Looks Silly And Bitcoin Takes A Breather

This week was full of CPI and PPI numbers, as well as the FOMC. Our pre-recession set-up is firing on all cylinders.

If you got value from this post, please like and share. Thank you!

Topics this week:

Macro discussion

Bitcoin price update

CPI and FOMC debrief

Yields Dive, Stocks Rip: Market Doesn’t Believe the Fed

Stocks are hitting ATHs, right in-line with our pre-recession calls. The 18-months prior to recession, stocks and bonds rally. Bitcoin has not been through a major recession — the COVID recession was abnormal and brief — , but I agree with the likes of Paul Tudor Jones, who calls bitcoin a safe haven asset. This was lent additional evidence in March’s banking crisis when bitcoin rallied 40%.

As a reminder, a summary of the pre-recession trade is as follows: We are in a credit-based system, and as we approach recession and more people feel the pain, money will flow out of economic activity like starting a new business or expanding an existing business and instead head toward safe haven assets. Credit creation slows and money becomes tight. Blue chip stocks are safer than starting a new business, so stocks rally on the way into recession. Bond yields will fall as demand rises, oil and commodities should also fall due to softening demand, and bitcoin should rise as the ultimate safe haven asset. Note: no consideration should be given to Fed policy or M2. They are noise.

Unlike nearly every other macro analyst, I think the stock market rally was obvious for the above reasons. I’ve been talking about it since last year, at least since September 27, on this newsletter during the down slope at the end of Q3.

Treasury yields falling tells us money is getting tighter and more defensive.

Oil and other commodities are falling as demand weakens into recession. Here we see the Goldman Sachs Commodity Index falling below previous support to fresh 2-year lows. If you are a big believer in the consensus inflation narrative right now, these three charts together should shake you awake from your dream. A deflationary recession could hit as early as Q2 next year, but my forecast is still for an official start in Q3.

Bitcoin Price Update

Let’s do it! Let’s get into bitcoin and see where this bull market is headed!

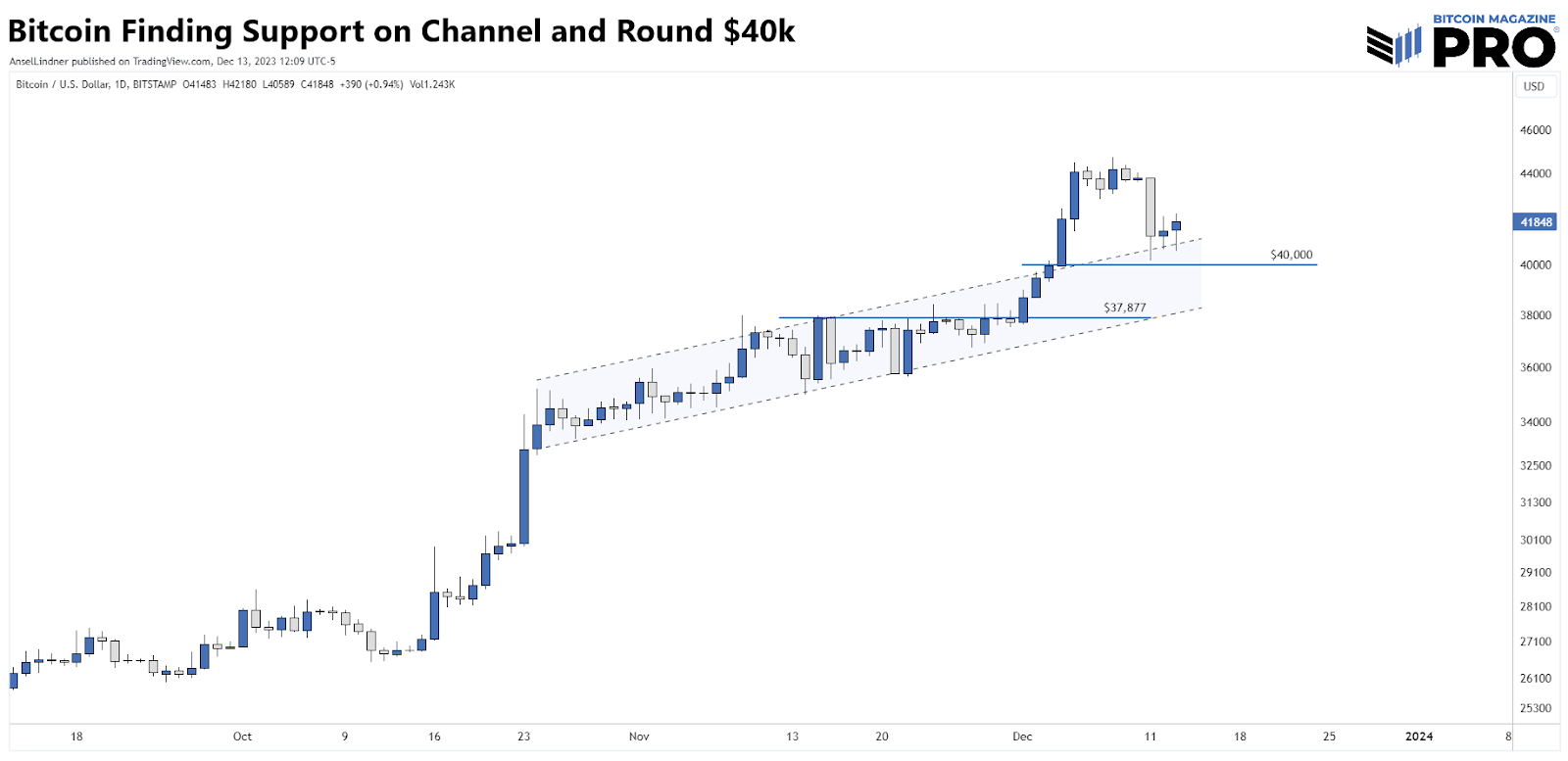

Bitcoin decided to take a break at $44,000. My target remains the same of $48k, but since this brief consolidation is happening, we could blow right through to $50k or higher.

On the daily chart, bitcoin is finding support on the top of the previous channel. On my Bitcoin & Markets member Proton last Friday, I said $40k was a logical support level if we had a pull back. The price did not get extremely overheated on a daily perspective, resulting in the pull back not having much force — only 10% so far. If we would have gotten to $50k, the pull back would have been bigger, but again, $40k would have marked the 20% pull back area then: A good target in that case.

This slight correction matches the fundamentals as shown on our Dashboard posts. I pay close attention to the rate of change of the on-chain metrics. Two weeks ago, they started to slow, signaling a temporary pause in momentum. This is reflected in price by this brief, healthy dip.

From above, the movement in stocks and bonds mean the pre-recession trade is far from over. Bitcoin is in a macro bullish environment with extremely bullish fundamental events on the horizon — the ETF and halving. The deadline for the spot ETFs is only 28 days away, January 10, and has not been priced in.

Path from November CPI to December FOMC

I have an out-of-consensus view of inflation. We are in an overarching deflationary environment where the high rate of price increases is not sustainable. We have seen outright contractions in commercial bank credit (first time since Great Financial Crisis) and M2 (first time in at least 40 years). The deflationary wave that is about to hit us is going to be massive.

That’s the context in which I view CPI. We should expect CPI to continue to fall through the coming recession. This won’t fall in a straight line, but we should not bite-off on any reacceleration meme. That said, I understand the criticisms of CPI in general. It’s not perfect, but it is in-the-ballpark correct. Let’s not throw the baby out with the bath water.

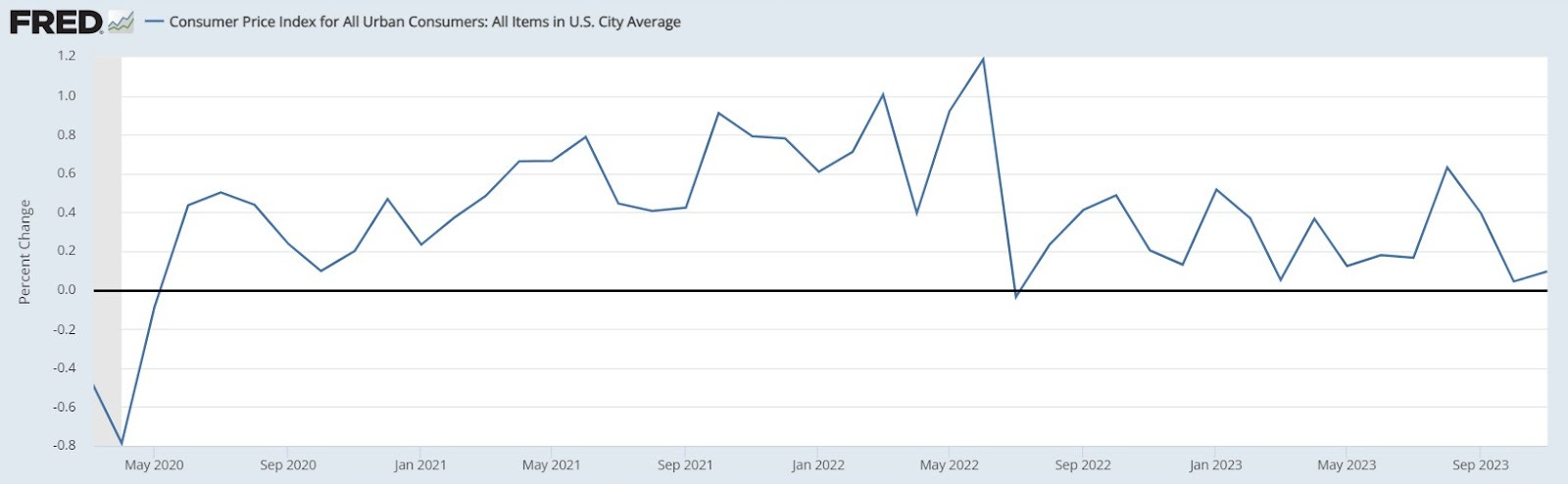

After last month’s shock 0% print, I thought this month was going to be the same. The November headline number disappointed me a little, coming in at 0.1% MoM. That’s still under the 2% target when annualized. And if you annualize the last 3 months, you get 2.1%.

Source: FRED

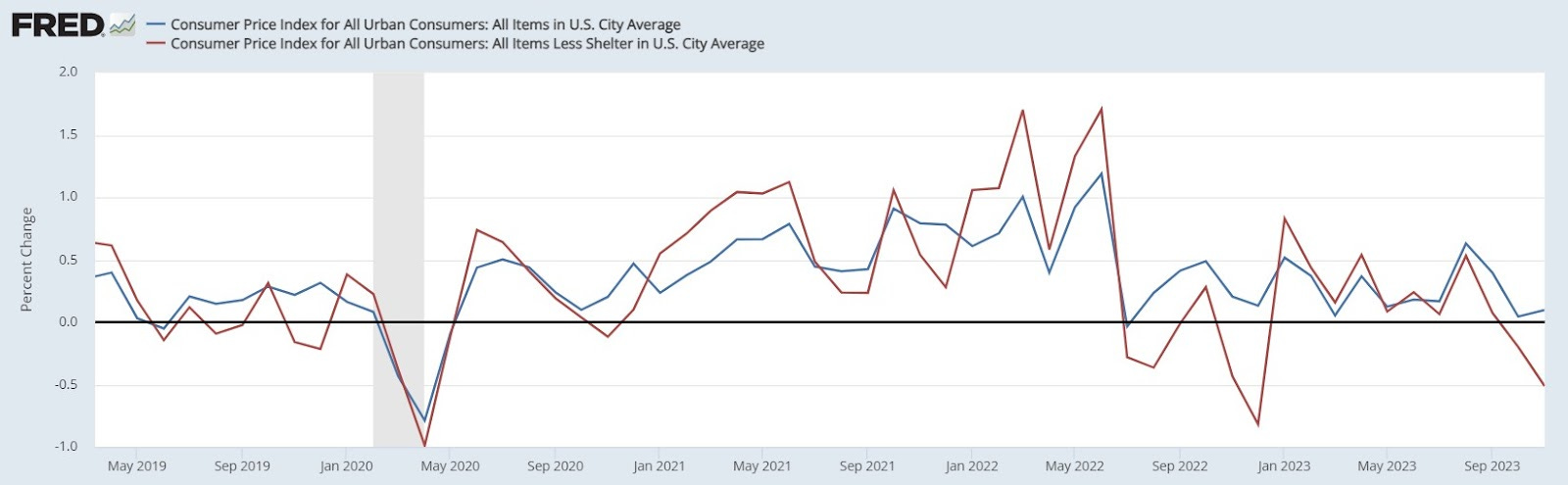

There was a shocker in this month’s CPI numbers though. If you take out the controversial Shelter component, it was -0.5% MoM! Shelter is controversial for a good reason: There is no agreement globally on how to count it. Even within the US, the two government price indices, CPI and PCE, measure shelter differently, using different weights and survey methods. It will not be the case that shelter prices can reaccelerate and pull CPI back up. Shelter is a lagging component of a year or more. It will follow the rest of the CPI that is down at -0.5%

Source: FRED

CPI is confirming my overall thesis: The economy is slowing rapidly as money creators and large pools of capital are getting defensive. Where does this leave the Fed?

Chairman Powell is well aware of what I’ve covered above. He knows a significant recession is coming. On top of that, market pricing told us they would hold rates steady at this meeting. The only question for Powell to answer is how will he package the message of a coming pivot?

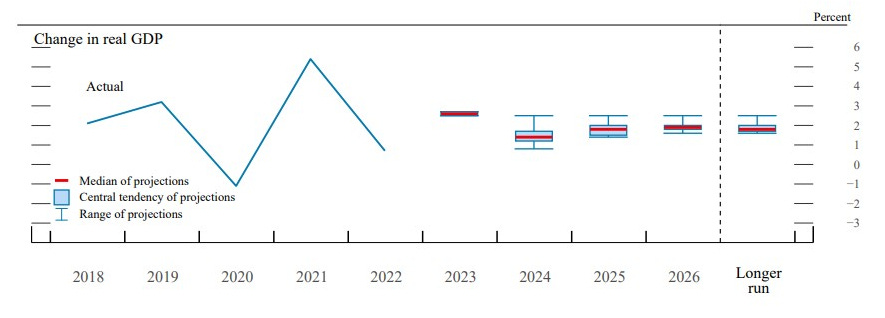

The thing that stood out to me from the policy statement was the first line implying the Fed is acknowledging a recession, even though their Summary of Economic Projections (SEP) doesn’t show them expecting a recession next year.

Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter.

Notice below in their SEP projections, GDP, unemployment, and PCE inflation all smoothly glide into normal. No hint of recession in those projections, but their language in the statement is starting to lean in that direction. It is my forecast that PCE and CPI will overshoot far below their 2% target, meaning GDP will as well.

Source: Federal Reserve SEP

I am writing just after the FOMC press conference and the markets seem to have picked up on that recession acknowledgement as well, because the pre-recession trade is booming. Stocks up over 1% on the day, the 10Y yield is down 4% to 4.00%, and bitcoin is higher up 3% to $42,700.

If you got value from this post, please like and share. Thank you!