The Evolution of Bitcoin Investments: Bitcoin Equities are the New Altcoins

Unpacking the Impact of Bitcoin-Related Equities on the Bitcoin Investment Landscape

In this analysis, we examine the evolving relationship between Bitcoin and the emergence of related equities as a new aspect of its adoption and growth trajectory. By comparing the performance of companies like Coinbase (COIN) and MicroStrategy (MSTR) with Bitcoin's market behavior, we identify this trend as a significant evolutionary step in Bitcoin's journey towards global adoption. This development highlights a shift in investment paradigms within the Bitcoin ecosystem, illustrating a maturation process that extends beyond its initial conception.

Coinbase COIN Catches Bitcoin

In a previous post, we highlighted that Coinbase (COIN) significantly outperformed Bitcoin in 2023, up 410% to bitcoin’s 150%. I specifically anticipated this result would swap in 2024, especially in the first quarter. Now, as we are coming up on the end of Q1, let's revisit COIN's trajectory to assess how it has fared against Bitcoin since that initial discussion.

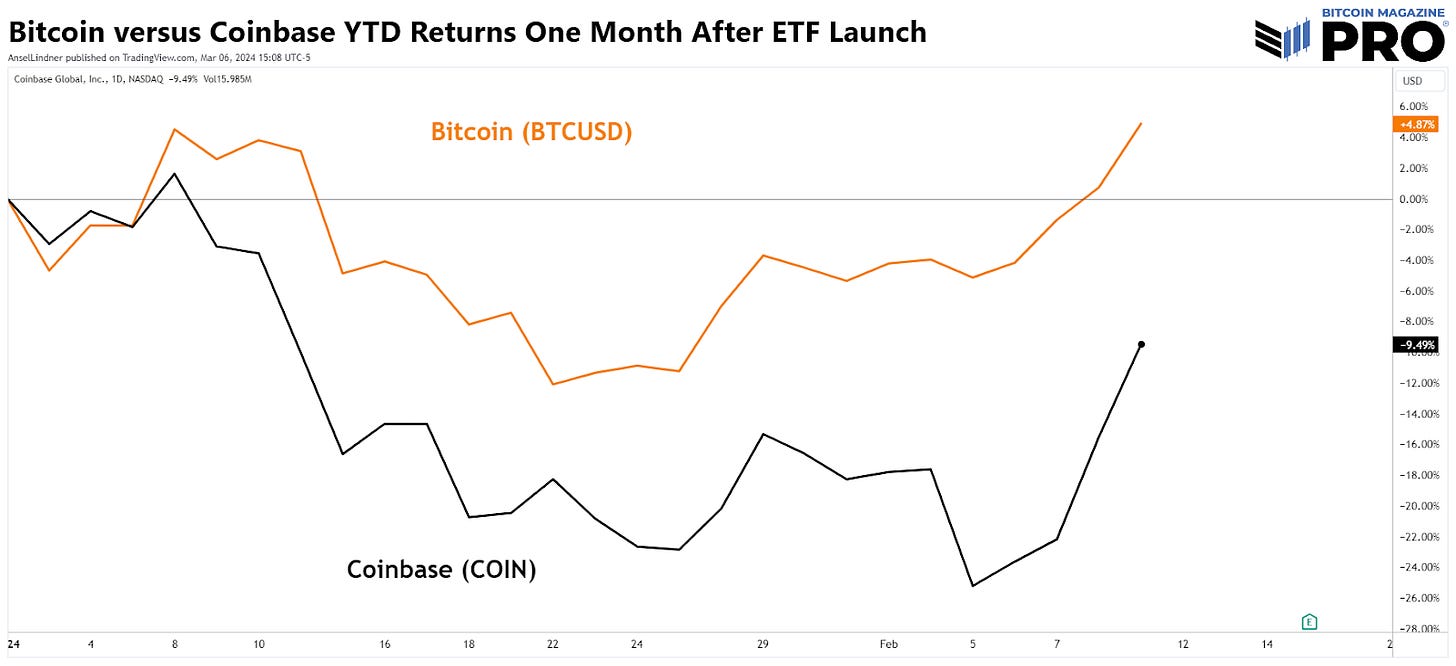

That forecast was accurate for the first month after the ETF launch, Bitcoin was up 4.87% YTD at that point, while Coinbase was down -9.49%.

However, since then, COIN has been on a massive run, catching and now surpassing the Bitcoin spot performance YTD, which is quite the task given bitcoin is itself up considerably.

Coinbase’s rally is not done, but it remains to be seen if it can continue to outperform Bitcoin. This week, COIN broke through major resistance (below), and has a clear path up to IPO price. The only resistance to speak of is the 61.8 retracement fibonacci and golden pocket, which covers the range of $240-250. IF it can break through that level, too, it might be off to the races. However, there are limits on COIN’s price that spot bitcoin does not have.

For example, we can compare Coinbase to some similar companies. COIN’s market cap is $57 billion compared to the Intercontinental Exchange (ICE), who owns the New York Stock Exchange (NYSE), their market cap is $79 billion. Coinbase today roughly holds $200 billion in assets under management (AUM). That is comparable to Silicon Valley Bank (SVB) that blew up last year, but nowhere near the likes of Bank of America (BAC) with AUM of $1.6 trillion and a $293 billion market cap. There is a possibility that COIN can reach illogical valuations, but it is unlikely. Therefore, reaching the IPO price is a good target, but it is unlikely to significantly over perform from there. That would mean the returns from current market price is slightly higher than 50% and anything more than that would be stretching into illogical territory. While bitcoin can still 3-4x in this bull market from here.

Needless to say, COIN looks strong, but it’s not the only one. MicroStrategy (MSTR), which we wrote about a couple weeks ago here, and CleanSpark (CLSK), a public bitcoin miner, are also doing very well. For the record, I expect bitcoin to end the year massively outperforming COIN and CLSK, but there is an exception for MSTR given it is like a slightly leveraged spot ETF. Bitcoin has consistent ETF inflows, averaging $214 million/day as of 5 March, the supply restriction of the halving only ~50 days away, and the flight to quality in the coming recession, it is hard to see how COIN can keep up with bitcoin.

Despite that, there is growing interest in owning these shares even by long-time, fully orange-pilled, bitcoiners. It is an interesting phenomenon, because people are looking at these stocks as substitutes to holding bitcoin in the bull market, and hoping they perform slightly better. People expect them to translate into higher returns or buying more bitcoin in the future. It is very reminiscent of altcoins.

Equity Alternatives or Altstocks

Altcoins have been a persistent fixture of the bitcoin space since 2011, like fleas on a cat. They tend to feed off the bitcoin pumps, rising dramatically in bull markets and falling sharply in bear markets. They evolved over the years, from pure altcoins like Litecoin, to Initial Coin Offerings (ICOs), to DeFi and NFTs most recently. In general, they are scams but they are also a natural outgrowth of rapid value creation in Bitcoin, similar to an inflationary boom. In any explosive market there is bound to be tag-alongs and scavengers.

Source: CoinMarketCap

This cycle we are witnessing a new evolution in alternatives; traditional equities. While they are legitimate businesses and regulated, they are increasingly being seen as alternatives to holding bitcoin. I’m not saying this is a bad thing, but it will affect our valuation math and understanding of bitcoin’s ultimate path to global dominance. When you hear targets of $10 trillion or $20 trillion market cap, is that bitcoin only, or bitcoin and altstocks? Again, very reminiscent of the ideas around total “crypto” market cap or the Bitcoin dominance index of yore.

On the below chart, you can see despite the nearly 50% rise in bitcoin this year, some altstocks have done even better, while others are not doing very well. Unlike altcoins, these alternatives should increase our ability to diversify in different stages of the bull and bear markets. For instance, miners did well in 2023 while the bitcoin price was in consolidation for most of the year and miners were positioning themselves for the coming bull market. However, in 2024, as competition is heating up and the bitcoin price is rallying, miner shares look less attractive than holding spot bitcoin. Notice CLSK was outperforming by a lot until 26 Feb when the bitcoin price broke out.

Between Bitcoin and COIN or CLSK, spot bitcoin is the more defensive trade. As a stock, these alternatives have idiosyncratic risk, are affected by broader stock market sentiment and recession concerns. Germany, Japan and China (per my analysis) are already in recession and we should not expect the US to remain unscathed. In other words, bitcoin-related stocks have different risks than owning bitcoin itself, that much is obvious I think.

Evolution Never Stops

It is important to place the rise of equity alternatives into the broad context of the monetization of Bitcoin into a world money. The 0-to-1 invention of Bitcoin started to create value that was accumulated by bitcoin itself, which incentivized copy cats which all carried unique properties and risks. They all derived their underlying value from Bitcoin. These alternatives ran their course and the pure altcoin era ended. The initial evolutionary explosion was met by a selection event when the energy these first mutants fed off of was redirected to ICOs. ICOs exploded in numbers until they, too, were cut off by Defi and NFTs.

This stage was not feeding off the monetary properties of bitcoin yet, only the technological accomplishment. That is why there was so much hype around “blockchain” and “tokenization”. Those are technological ideas, not monetary ideas.

The new evolution of alternatives are equities related to bitcoin. They will attract the vast majority of energy and investment surrounding bitcoin, along with the value that is leaked off of bitcoin’s price appreciation and spreading adoption. Where altcoins fed off the technological accomplishment of Bitcoin, this new genus of alternatives is feeding off the successful evolution of bitcoin itself into a store-of-value.

Saifedean Ammous and others have shown the monetization process will travel through phases, slowly achieving acceptance as a store of value, unit of account and medium of exchange. The stage he did not see, which explains altcoins to a large degree, is the initial technological acceptance stage. We are now officially entering the store of value stage and I personally think this is where most of the eventual value will accrue to bitcoin.

Once bitcoin is widely held in large pools of capital around the world, it can start to be seen more and more as a unit of account. Then years later, it will start to be used as a medium of exchange, likely as a derivative layer 2 currency version of the underlying consensus-layer money.

Conclusion

Bitcoin's evolution continues and is entering its next phase of evolution. Bitcoin-related equities are a step in this journey, representing a significant milestone as Bitcoin cements its place in the minds of people as a monetary good. These new investment vehicles, while drawing parallels with past altcoins, are uniquely integrated into the traditional financial system, offering investors novel ways to engage with Bitcoin's growth. This transition not only underscores Bitcoin's shift from a technological curiosity to a viable store of value but also signals its expanding influence in reshaping investment strategies and the future of finance.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you enjoyed this article, please consider liking and sharing it. This will enable us to reach and inform a larger audience.