2023 Year in Review and 2024 Forecast

Everything related to Bitcoin had a massive 2023, what can we expect as we navigate 2024?

Topics this week

Bitcoin 2023 Review

Bitcoin in 2024

Economic Outlook for 2024

Bitcoin Ends 2023 Strong

It’s been a long year, especially since Blackrock’s June 15 spot ETF filing. To the surprise of many Bitcoin black-pillers, instead of the establishment fighting Bitcoin, it has turned supporter. Larry Fink, Paul Tudor Jones, Mohamed El-Erian and other influential investors articulated an investment thesis that makes bitcoin palatable to institutional investors. Specifically, bitcoin is being painted as a safe haven asset on par with US Treasuries and gold.

2023 was the third year in the cycle, and a good one by historical standards. Years containing the halving have always seen extremely good performance.

Bitcoin stocks performed extremely well in 2023. The Valkyrie Bitcoin Miner ETF (WGMI) returned 330% compared to bitcoin’s 150%. Coinbase ($COIN) did even better, returning 410%. MicroStrategy ($MSTR) also did extremely well, not only returning 350% on the share price, but upping the bitcoin per share slightly as well.

Bitcoin related stocks did well, but are almost all heavily overbought. I expect bitcoin to outperform miners and Coinbase in 2024, especially in the first quarter, with some unique opportunities along the way.

Bitcoin Outlook for 2024

We know of a few major events coming in 2024 that could change bitcoin forever. January 10 is the final day for approval of a batch of spot ETFs. The SEC wants to approve them as a batch so as to not pick winners and losers. January 10 is the deadline for the rule change (19b-4 filings), however, the launch date will depend on the acceptance of the financial nuts and bolts of these products in their S-1 filings. A report dropped by Reuters on Friday after the deadline set by the SEC says, “People familiar with the filing process said issuers that met their end of the year filing revision deadlines may be able to launch by January 10.” This would be a huge step up in the timeline.

After an ETF launch we will approach the end of the first quarter. These end of quarter periods tend to be highly volatile. Silicon Valley Bank and Signature Bank both failed at the end of Q1 last year, and the COVID crash was at the end of Q1 in 2020. I expect some market fireworks in that period again as the Bank Term Loan Program runs out. Finally, the halving is estimated to be around April 17. Lots happening in the first few months of the year.

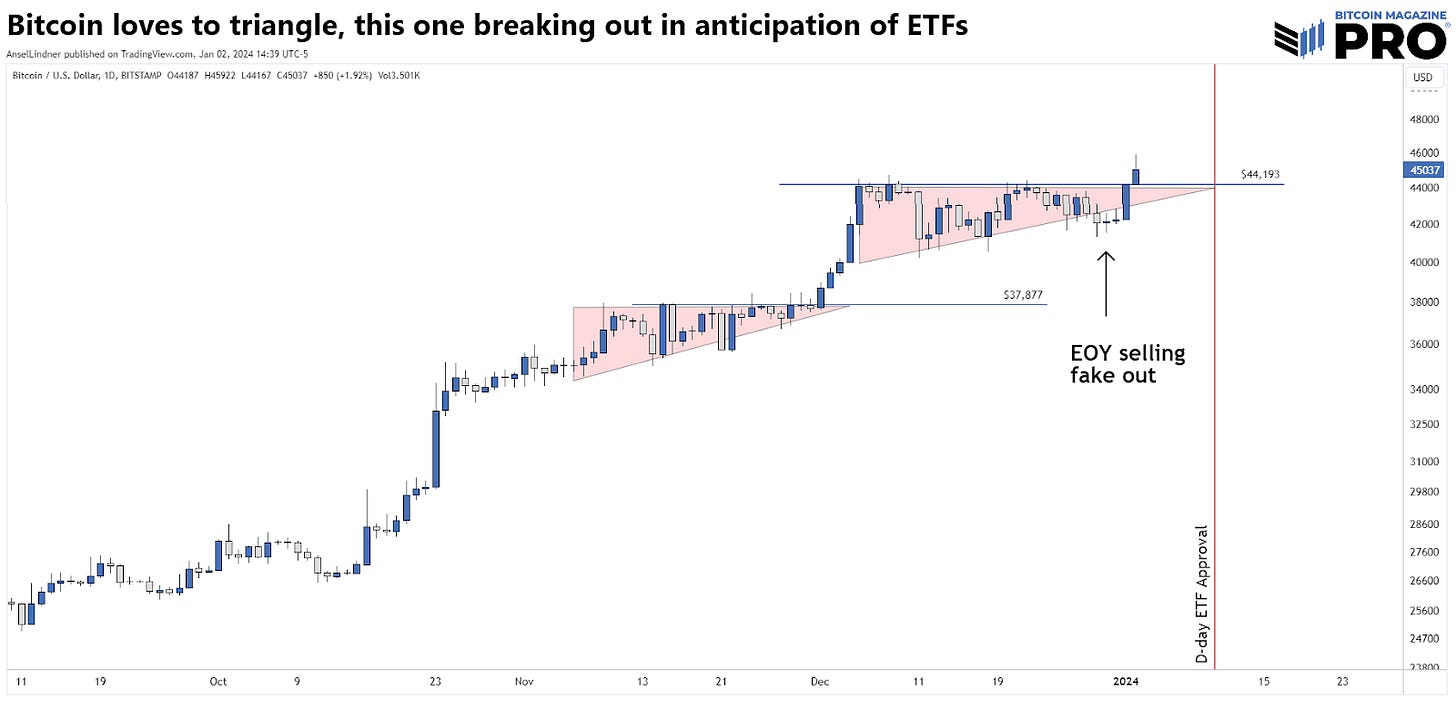

Price should react quite positively to all these events. Bitcoin’s price jumped during the banking crisis in 2022, and the ETF and halving are obviously fundamentally bullish. The first ever weekly golden cross coincides with the ETF approval deadline and a very strong bull flag. Price should start the year in spectacular fashion.

As you can see below, we are triangling into the ETF approval. I was expecting a break out in the first few days of the year. The ETFs have not been priced in simply because there are too many unknowns.

Targets we are watching:

Inscription debate

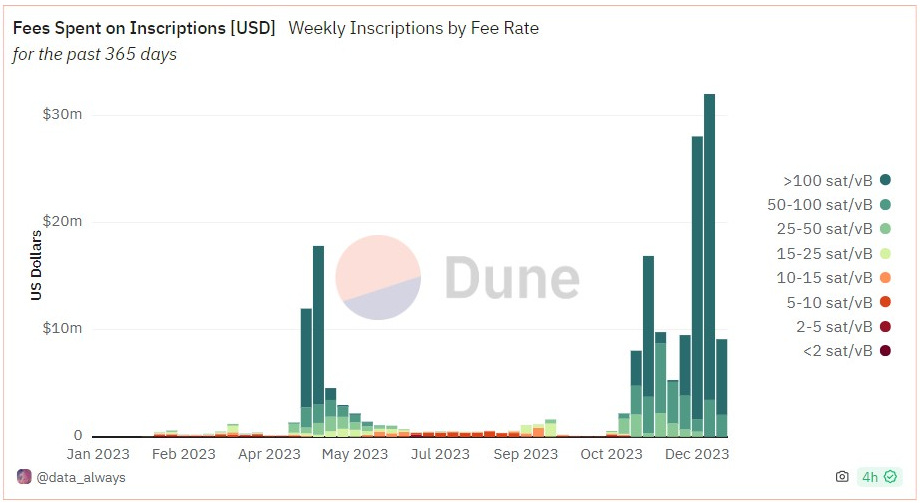

The other major narrative that formed in 2023 was the Ordinals and Inscriptions debate. Sides in the debate are crystallizing as fees remain very high. The pro-inscriptions side hopes to bring an NFT boom to Bitcoin itself, while the anti-inscriptions side calls it an attack on Bitcoin. Unlike the Scaling Conflict of 2016-2017, a majority of bitcoin owners don’t know or care about this debate yet. I expect things to get more heated in 2024.

Inscriptions have undoubtedly clogged the mempool, causing fees to skyrocket, but have not negatively affected price. I look at it from a game theoretical and economics perspective. Inscriptions boost miner revenue and reduce liquid supply of bitcoin by freezing low value UTXOs. Bitcoin is unlikely to soft-fork in order to stop inscriptions for three reasons. 1) The reason behind the soft-fork is arbitrary which weakens Bitcoin’s decentralized security model, threatening the foundational value proposition. 2) High fees are a positive force on bitcoin’s value, and everyone’s incentives are aligned around NgU. 3) High fees incentivize Layer 2 scaling we know is needed.

Economic Outlook for 2024

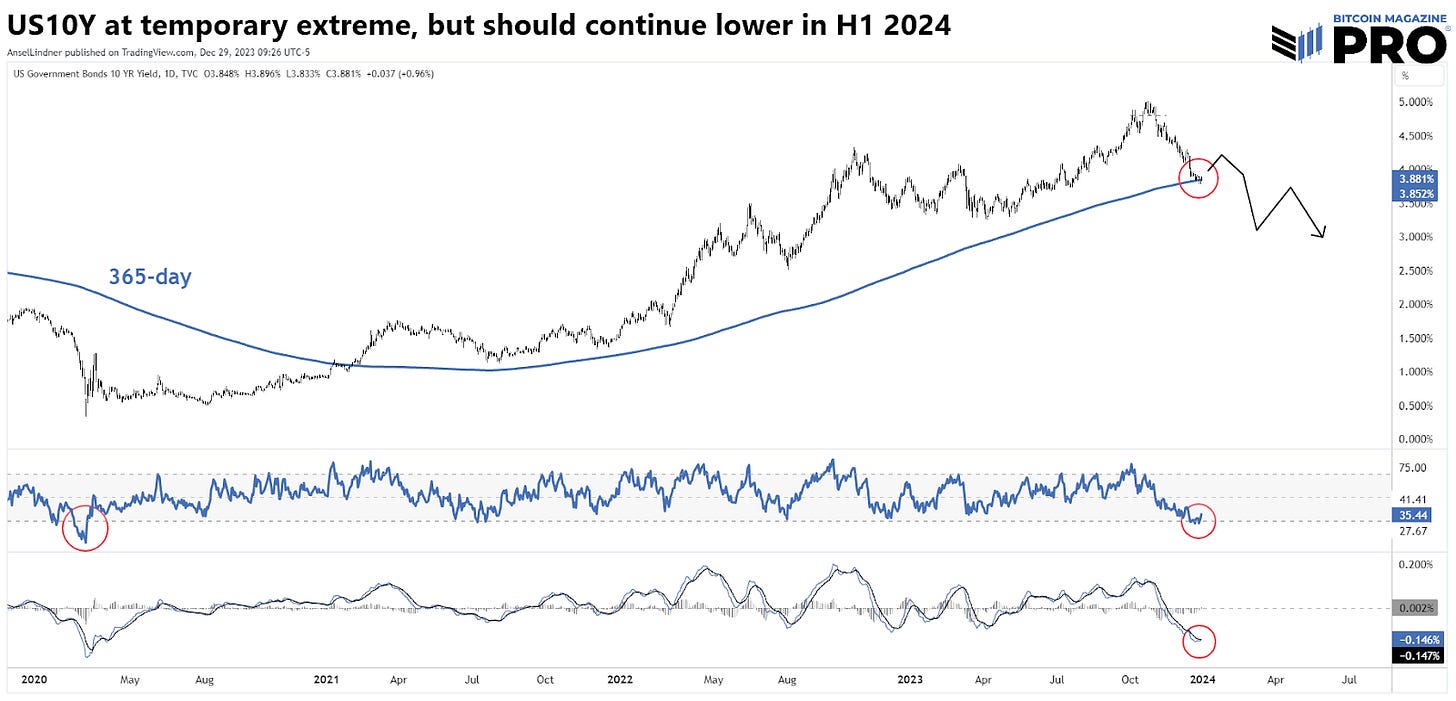

Many were surprised with the speed with which CPI and PCE came down in 2023. Despite this, the reacceleration narrative persists. There is almost zero chance CPI will reaccelerate to any significant degree in 2024, because commercial bank credit and M2 are falling. Falling Treasury yields also tell us demand for safe and liquid instruments is rising which is the opposite of a booming economy demanding credit expansion. I expect CPI to continue to come down faster than people expect throughout 2024.

The Federal Reserve will cut rates several times in 2024. I’m in the school of thought that says Fed rates are a mirror of the economy and don’t actually matter much. Lower Fed Funds is not a stimulus, it is a result of recessionary conditions.

Back in November, I walked my Bitcoin & Markets members through what to expect as we move into recession 2024. So far, things are progressing as we would expect.

Treasury yields will continue lower in 2024 and the Fed will follow with cuts.

Stocks have come a long way in the last two months and a cool off is in order. However, stocks should continue to rally as money is diverted from productive real world use into stocks. With potential recession starting in H2 2024, the rally is not likely to continue throughout the entire year.

I’ve been a huge advocate for weak oil, pushing back on doomer calls for peak oil. That will also continue in 2024. Currently, OPEC+ has 5.5 million bbl/day (mmbpd) of excess capacity that could be turned on relatively quickly, and the US continues to exceed production expectations. I expect oil to end 2024 lower, but trade most of the year between $60 and $80.

There is one wild card that could change the whole temperament of the coming recession: unlocking pent up demand in the housing market. Sales have been historically slow due to rises in mortgage rates. As mortgage rates come down rapidly, sales and refinancing will pick up. These new loans are money printing and are a stimulus to the economy. This could be enough to lift the US out of recession pretty quickly.

It’s not guaranteed we will get a recession in 2024, but highly probable, with it more likely to be a deep recession than a mild one. The recession will be global and hit each nation differently. The US will attract capital flight because it is the “cleanest dirty shirt”, making its recession less severe.

There is a chance the recession can be pushed out further into 2025. Whatever the case, the first half of 2024 will be a continuation of 2023. Money is getting defensive and moving into safe haven assets. This will force stocks higher, bond yields lower, and the dollar should remain range bound. This is not a rising liquidity environment despite what macro talking heads say. They were wrong in 2023 and they’re wrong on this. Money flows are tightening. Perfect for bitcoin as it becomes a household name as a safe haven.

If you liked this content please hit the like button and share!