Russia Recovers, Yellen Anticipates Dollar Trouble: Bitcoin, Sanctions, and Debt

As Bitcoin regains value, Treasury Secretary Janet Yellen raises the alarm about a possible debt crisis. Bitcoin may not only exacerbate the dollar’s problems, but also show a path away from it.

US Treasury Secretary Janet Yellen has raised the alarm about potential dangers to the dollar, most especially Bitcoin’s ability to circumvent the global reserve currency with its own borderless model.

Bitcoin has been on the mend for the past few days, after a drawn-out period of high selling pressures and sagging valuation. Despite an early drop Tuesday morning that was quickly erased, the price of Bitcoin has grown more than $6k from where it was Friday afternoon. Although it will take more than a few days of growth to ward off all the bearish sentiments festering in the community, these gains are welcome news, among several other signs of a long-term recovery. With Bitcoin doing better, in fact, it’s raising old fears that it may be a wrecking ball for the financial orthodoxy.

Bitcoin’s relationship with the giants of traditional finance has been complicated, especially since the ETF approval in January. For those taking a short view on Bitcoin, the news cycles of this year all point towards Bitcoin’s mainstream adoption. It has the SEC’s stamp of approval, billion-dollar investment banks are investing more than ever, and the pro-Bitcoin political movement is gaining more and more steam. And yet, it’s easy to forget that this acceptance sits in tension with the fact that Bitcoin was created in direct response to the banking crisis. Its roots, in short, are infused with the dream of a decentralized financial system. One of the most classic use cases for Bitcoin is its use in circumventing sanctions or other trade restrictions, and these facts have not been ignored by everyone.

Janet Yellen, the US Secretary of the Treasury, described some of these tensions in her testimony before the House Financial Services Committee on July 9th. Essentially, she warned the Committee that the dollar’s viability is intimately linked with its status as the global reserve currency, and efforts to circumvent it could trigger a debt crisis to the tune of $34 trillion. Specifically, she testified that “we have very powerful sanctions that are available because of the important role of the dollar in international transactions. The more we have used sanctions, the more countries look for ways to engage in financial transactions that don't involve the dollar." And in her eyes, Bitcoin is a perfectly viable option to circumvent the dollar.

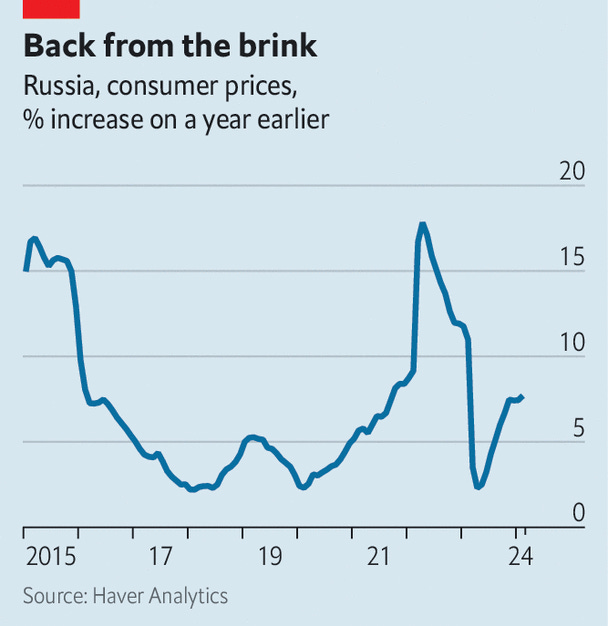

Yellen has been making similar comments in interviews since May, claiming that Bitcoin’s price may rise to $1 million as the US debt crisis wobbles. She did not make these claims as an optimistic vision but rather a pessimistic one, implying that Bitcoin’s success would come at the detriment of US economic policy. Yellen made this connection more explicit with her testimony to the Committee, saying, “The Russian Central Bank has urged the use of crypto to evade Western sanctions. A stablecoin offers no particular advantage in that it’s stable, you can’t make money by holding it, and it usually doesn’t pay interest—ccertainly not the interest you get on money market funds. Its sole advantage is evading our sanctions." Russia’s economy suffered serious blows in the immediate aftermath of their bungled Ukraine invasion of 2022 and the resultant sanctions, but it has recovered significantly. The IMF claimed in April that it’s set to grow faster than any of its Western competitors.

Russia’s recovery and growth since the war is an extremely complicated situation where the digital asset space has only played a tangential role so far, but the Central Bank’s crypto endorsements show that this role is only growing. Additionally, the influential Russian Union of Industrialists and Entrepreneurs took these recommendations a step further, advocating for a national Bitcoin fund to facilitate foreign trade. In other words, Russia is a thorn in the side for the US sanction ecosystem as it is, and forces are growing in the country to directly embrace Bitcoin as a tool in this fight. This even comes at a time when Iran has proposed linking the economies of itself, Russia, China, and others to form a counterweight to US economic policies. Ineffective sanctions mean less US leverage, and less US leverage could spell a fatal crisis for the dollar as we know it. Bitcoin’s role in this dynamic may grow significantly from here.

Yellen seems to be fairly early in identifying Bitcoin as a potential significant danger to US economic policy, especially considering that Bitcoin is seeing such new acceptance in the highest spheres of the American economy. For example, BlackRock is currently the world’s largest asset manager with over $10 trillion in AUM, and its CEO, Larry Fink, addressed some of these concerns head-on. “My opinion five years ago was wrong,” he claimed in a CNBC interview. “I believe Bitcoin is a legitimate financial instrument." This change of heart from such an influential figure is certainly positive, but he went on to touch on its interactions with debt crises worldwide: “[Bitcoin] is an instrument that you invest in when you’re more frightened. It is an instrument when you believe that countries are debasing their currency on excess deficits. There’s a real need for everyone to look at it as one alternative," he claimed. Some of Japan’s largest conglomerates already see Bitcoin as an escape from that country’s debt crisis. Why would the US be any different?

In short, these pressures feed into each other. The US debt pile holds some $34 trillion, and this situation is reasonably stable because of the dollar’s international influence. If that influence wanes, and Bitcoin could very well facilitate that, then the debt pile gets wobbly. And yet, if American businesses anticipate disaster from a debt crisis, they could always pull out and use Bitcoin as a more stable reserve, just like Japanese companies have! Entirely unrelated actors could use Bitcoin in ways that benefit each other, either causing a dollar calamity or outlasting it. In this context, it’s certainly understandable that Germany has dumped its billions in Bitcoin reserves with alarming speed. As the EU’s economic powerhouse and an integral part of the Western financial system, Germany might want nothing to do with Bitcoin’s dangerous possibilities.

Janet Yellen’s testimony, although possibly premature, does reflect an ever-present tension in the global Bitcoin space. The ETF has been approved, and all the US's biggest firms have invested billions in it. However, no matter how much Bitcoin is accepted, it can never be owned. Around the world, Bitcoin can be turned to radically different ends thanks to its decentralized nature, and these ends will not necessarily benefit the entire financial establishment. In summary, Bitcoin’s future is a live wire, and it would be extremely premature to claim that new waves of investment have housebroken it. Bitcoin can still take people worldwide in directions that they’d never imagined, and yet, Bitcoin can provide a cushion for the scariest scenarios. No matter what happens, it’s plain to see that a bet on Bitcoin can pay off in unexpected ways.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!