Bitcoin Miners Show Signs of Recovery During Bitcoin Slump

Despite a rumored bear market, US mining firms show multiple signs of recovery throughout June. Buying pressure on depressed Bitcoin prices counteracts previous selling pressure.

Although Bitcoin’s price has remained in limbo throughout the beginning of July, a few positive signs for miner profitability suggest that this industry is on the rebound.

It’s no secret that the world’s leading decentralized currency has seen a few stumbles as the summer has gone on. A variety of factors have created this situation, but a leading contributor to the quasi-bear market has certainly been the behavior of Bitcoin miners. Pushed to the brink by months of stagnating prices and the post-halving mining ecosystem, the industry as a whole saw a wave of liquidations crest in June. Bitcoin reserves held by mining firms hit a 14-year low during this period of increased selling, and this in turn helped contribute to a selling pressure on Bitcoin as a whole. Others have joined in on the fire sale, such as exchanges and the German government, and this succession of blows has helped turn stagnation into a real downward turn.

Still, although the situation has been far from ideal, every price action in the world of Bitcoin creates winners and losers. The various essential components of the digital asset ecosystem can rise and fall for reasons totally independent of each other, and suffering business ventures may rebound during bear markets as easily as others fail in prosperous times. As it turns out, there are several trends that suggest a growing momentum in the world of Bitcoin mining, and a recovery in this field may help rebuild long-term profitability.

First of all, a report from JPMorgan, released on July 8th, indicated that the mining sector had actually outperformed much of the extended crypto industry throughout the month of June. While Bitcoin’s price lagged and the ETFs saw weeks-long streaks of outflows to the tune of $660 million+ dollars, the US mining industry saw its stock valuation jump as high as 20% in the same month. JPMorgan credits this stock valuation to some of the alternate revenue streams that various mining companies have accrued, particularly singling out AI. Hut 8 made headlines when it secured a $150 million equipment-sharing deal with an AI company, ginning up a frenzy of speculative investments from the broader market. In a particularly heartening detail, several attempts by AI companies to carry out outright takeovers were thwarted by mining firms like Core Scientific. In other words, the industry has a clear preference for treating these lucrative deals as supplemental income and not as an opportunity to pivot away from Bitcoin altogether.

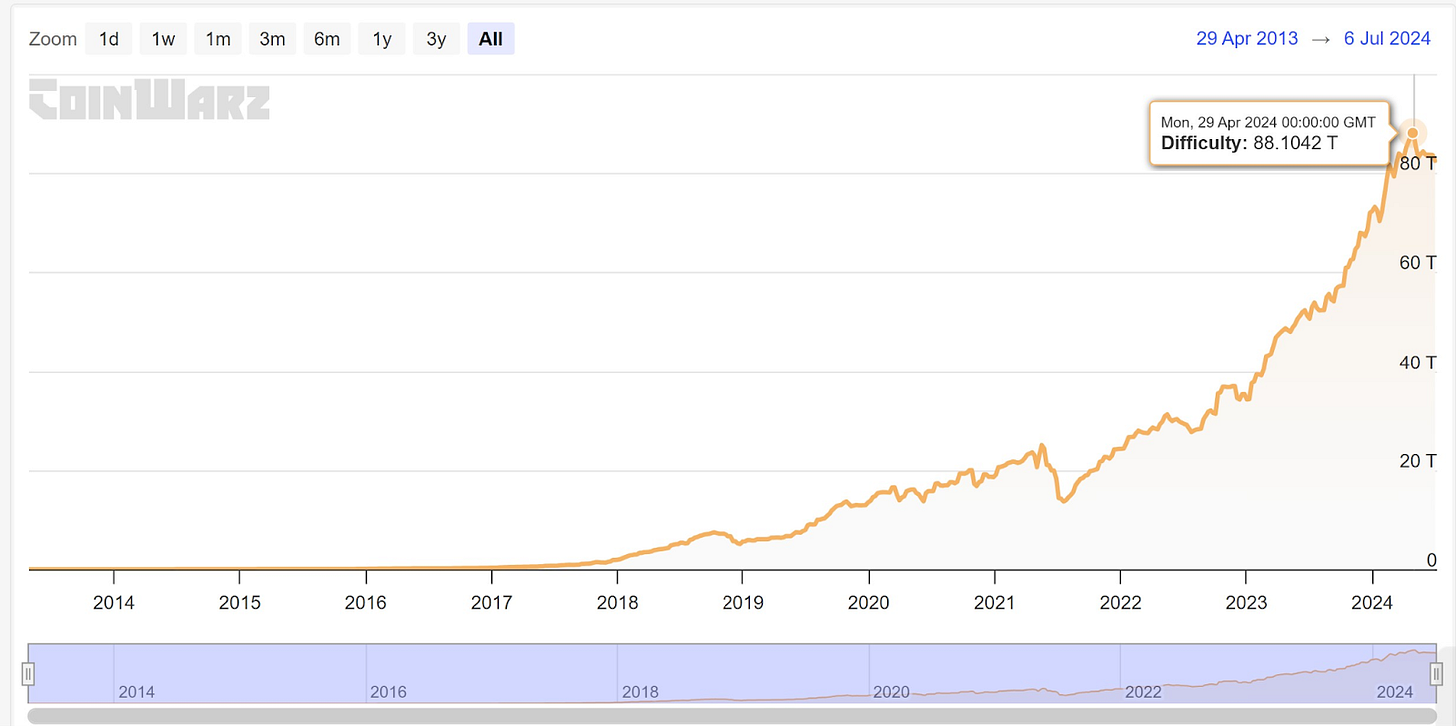

However, JPMorgan’s assessment of the miners’ apparent recovery in June is not the only conclusion drawn by outside observers. On the same day, a different analysis carried out by Jefferies Group, an investment banker, described similar success for different reasons. Their report was less tied to the stock valuation, pushed up by the possibility of AI deals, and more to the underlying profitability of these firms. Jonathan Peterson, one of this report’s authors, claimed that “June was a month of modest recovery from the immediate impacts of the halving that were most pronounced in May." Specifically, increased capitulations in the worldwide mining sector have reduced the hash rate, allowing surviving high-capital miners to have bigger pieces of the pie. US miners in particular, therefore, have been able to weather the storm, taking up an additional 1.7% of the global hash rate at a time when mining difficulty is the lowest since the halving.

In other words, the halving is a global event, but the entire globe has not been impacted equally. It was well known beforehand that only the most prepared mining companies would be able to thrive in the post-halving environment—the companies most able to pursue alternate revenue streams, swallow months of depressed income, upgrade their physical infrastructure, and more. Apparently, the American Bitcoin mining industry has been better equipped than others to endure these doldrums. These companies have managed to secure a larger share of the total market and can now enjoy a situation where mining is cheaper and easier. It took breakneck selloffs and novel business ventures to reach this point, but the seas have calmed by several metrics.

This good news for miners has been accompanied by a series of other small positive signs from the wider markets. For example, digital asset funds in aggregate have experienced inflows for the first time in weeks, to the tune of $441 million. According to data from CoinShares, $398 million of these inflows have belonged squarely to Bitcoin, or over 90%. CoinShares cites Bitcoin’s recent price weakness as the impetus for these massive buys, a reverse of the selling pressure kicked off by the miners themselves. With Bitcoin struggling for an extended period, huge numbers of small investors have seized the chance to buy cheap Bitcoin, creating a sense of buying pressure. It’s unclear how long this particular trend will continue, but it’s certainly a welcome one. Prominent bulls like Metaplanet have only added to the furor with their own major purchases.

Still, it’s not as if everything is looking completely rosy for the US Bitcoin mining industry. A controversial takeover attempt involving some of the space’s largest players has cast a shadow of unease, one that’s prompted other leading firms to indirectly comment on the state of the industry. Additionally, as usual, prominent mainstream media coverage has painted another harsh outlook on the industry, timed to correlate with new business expansions. Nevertheless, these concerns are certainly dwarfed by the economic fundamentals here. It’s unclear how long Bitcoin will take to recover if people keep buying it at heightened rates, but the mining industry seems well on its way already. Strong foundations in this vital sphere will surely lead to stability elsewhere.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!