Pro Market Keys Of The Week: Stablecoin Summary

Stablecoin drama dominates the crypto-native news cycle. PayPal launches a stablecoin at the same time as Tether’s USDT sees massive redemptions and Circle’s USDC continues to decline.

What We’re Watching

PayPal Backed Stablecoin Launching

PayPal is introducing a new stablecoin, PayPal USD (PYUSD), backed by U.S. dollar deposits and issued by Paxos Trust Co., marking a significant move for mainstream financial companies into the crypto space. This move comes amidst heightened regulatory scrutiny and the variable stability of other stablecoins. The stablecoin, which will have a similar structure to the BUSD stablecoin Paxos released initially with Binance before being shut down, will release monthly reports on the assets backing PYUSD to maintain transparency. The news is indicative of a highly competitive landscape for stablecoin issuers, which looks to be heating up as of late.

USDT Briefly Deviates From $1

Over the past weekend, the Tether-issued stablecoin, USDT, encountered downward pressures, dropping below its $1 peg and the 0.10% “redemption band”. Tether has a 10 basis points redemption fee, meaning institutions don’t typically redeem for dollars unless the stablecoin drops below the redemption band. Recent speculations have centered around the contrasting market caps of stablecoins USDT and USDC. While USDC's market cap has been on a decline, USDT's has remained resilient. Given the rise in interest rates from near-zero to over 5%, it's logical to anticipate pressures on stablecoin market caps. Yet, the distinct trajectories of USDC and USDT are intriguing.

Prominent figures like Binance CEO Changpeng Zhao (CZ) have recently expressed reservations about Tether. CZ has highlighted the risks associated with regulated stablecoins, especially potential regulatory clampdowns. CZ described Tether's operations as a "black box" and touched upon Binance's difficulties with fiat integration due to ongoing legal matters. Binance's recent focus on alternatives like TrueUSD and First Digital USD indicate its pursuit of a variety of stablecoin partners to diversify its fiat rail access.

Following these remarks and the recent USDT price action, Tether CTO Paolo Ardoino commented on Twitter, emphasizing the unique dynamics surrounding USDT and its competitors.

This follows many analysts speculating on a potential trend trend: Selling of Tether often leads to conversions into USDC, which then appears to be redeemed.

Recent CVD (cumulative volume delta) data, a measure that reflects the net difference between buying and selling volume, which highlights market pressure directions shows net selling pressure on USDT pairs.

USDC Decline Continues

Amid USDT's price movements, speculation grew around the idea that platforms might be converting other assets into USDC for redemption if they can't redeem large amounts of USDT. If these theories are accurate, USDC could become the primary route to convert crypto dollars to fiat. Notably, Ardoino announced a $325 million redemption in USDT, the largest since FTX's collapse, while denying suggestions of denial of redemption services.

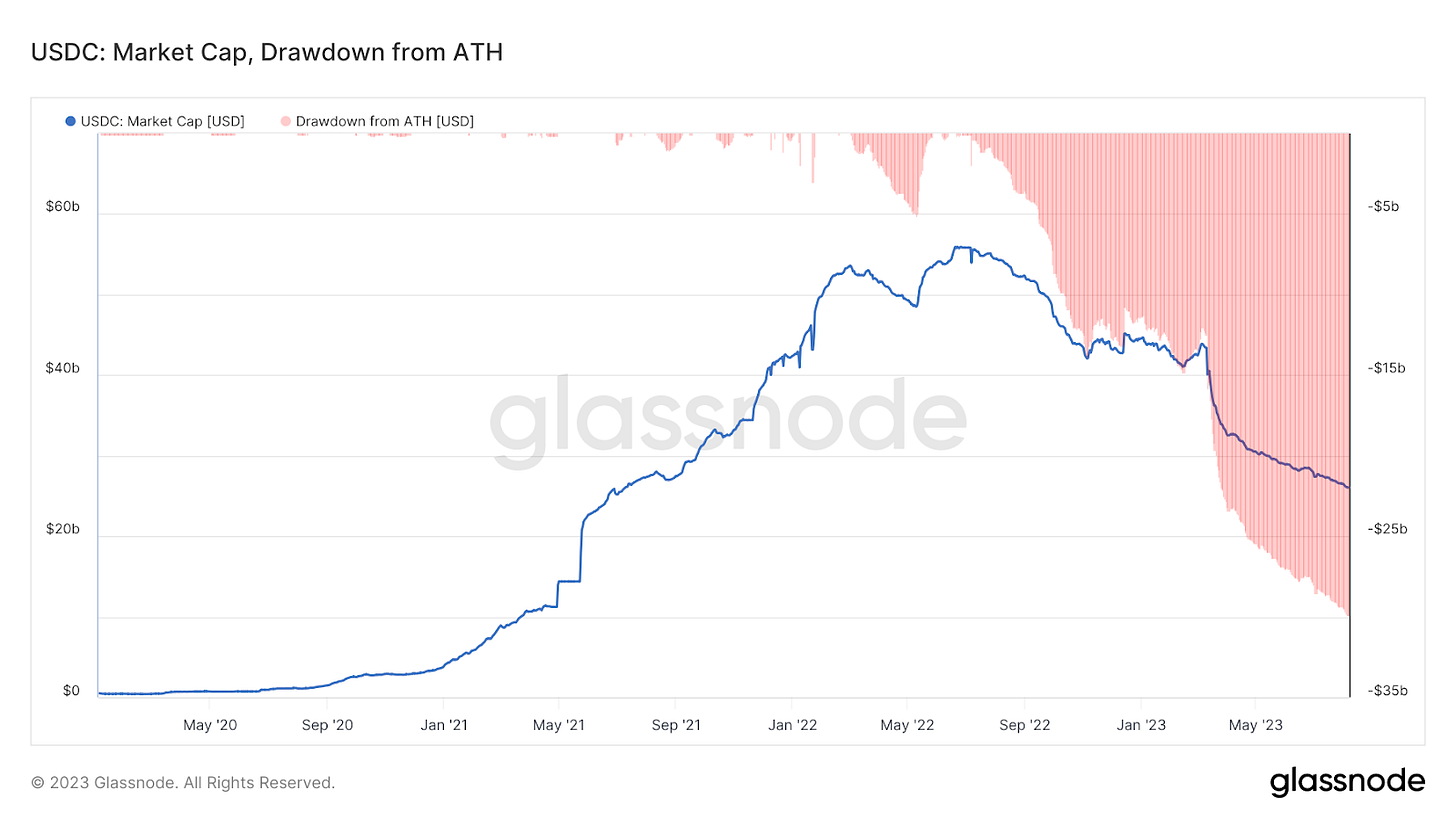

USDC supply has been in near constant decline since rates began to rise in 2022, and the process accelerated following the collapse of Silicon Valley Bank and the temporary de-peg of USDC, with circulating supply of the Circle-issued stablecoin now nearly $30 billion from its peak.

In regards to what this could mean for the bitcoin market,e are a few things to consider:

Stablecoin supply declining is indicative of dollar capital leaving the crypto landscape to seek higher yields available on cash equivalents in the traditional financial sector (with short-term rates over 5%). This is an understandable development.

In regards to the dichotomy between USDC and USDT, one factor likely playing a part is the recent hostility by U.S. regulators pushing investors and crypto-native capital offshores.

Something to watch closely is how long it will take USDT to reclaim above its redemption band, as the longer such an event persists that larger decrease in USDT supply likely occurs. Historically bitcoin volatility spikes have happened in tandem with instances of USDT trading below $1. While correlation is not causation, a potential material decline in the USDT market cap would lead to tightening crypto liquidity, and could be a potential factor to disrupt the historically low realized and implied volatility regime currently underway in the bitcoin market.

Shown below are instances of Tether trading below its 0.10% redemption band, USDT market cap, along with 1-month bitcoin implied volatility.

Bitcoin's Volatility Landscape

This year has been characterized by a notable reduction in bitcoin's realized volatility, with the 1-year window echoing December 2016 levels. This decline is reminiscent of several historical periods:

Transition from the 2015 bear market into a period of reaccumulation in 2016.

The bottom of the bear market in 2018, followed by a 2019 recovery.

The stabilization post-COVID-19 in 2020.

The aftermath of FTX's failure in 2022.

Adding to this narrative, bitcoin options' implied volatility has plummeted to unprecedented lows. Contrasting the 60%-100% range seen in 2021-2022, the current landscape showcases values between 24% and 52%.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!