Pro Market Keys Of The Week: Stock Market Concentration, SEC Sues Binance

Crypto markets tank with news of the SEC suing Binance. Wall Street braces for a massive liquidity drain and equities are more concentrated than ever. Is this the start of a new bitcoin bull market?

What We’re Watching

Binance And Changpeng Zhao Sued By The SEC

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Binance, one of the world's largest cryptocurrency exchanges, and its founder Changpeng “CZ” Zhao. The lawsuit alleges multiple violations of U.S. securities laws. Here are the key points:

The SEC accuses Binance and its affiliated companies of misleading customers and misdirecting funds to a separate investment fund owned by CZ.

The lawsuit alleges that Binance and its affiliate BAM Trading operated as an unregistered securities exchange, broker-dealer and clearing agency. They are also accused of selling unregistered securities, including BNB and BUSD.

If the lawsuit is successful, it could potentially bar Binance and CZ from conducting business in the U.S.

SEC Chair Gary Gensler accused Binance of engaging in an "extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law."

The SEC alleges that Binance unlawfully operated in the U.S. as part of an elaborate scheme to evade U.S. federal securities laws. It claims that Binance falsely stated that BAM Trading operated the Binance.US platform independently and that U.S. customers could not use the Binance.com platform.

The SEC also alleges that Binance.US lied about its market manipulation prevention measures and allowed wash trading by an undisclosed "market making" trading firm, Sigma Chain, which is also owned by CZ.

This lawsuit follows a similar one filed by the Commodity Futures Trading Commission in March.

CZ has stated on Twitter that they will issue a response once they have reviewed the complaint.

We will send out a deeper analysis on Binance’s treasury and transparency in the coming week.

In case you missed it, Dylan LeClair was joined by Caitlin Long, Ram Ahluwalia and Mark Connors for a panel about “The Fed Vs. The Financial System” at Bitcoin 2023.

Wall Street Braces For $1 Trillion Treasury Issuance

Following President Joe Biden's signature on legislation to suspend the federal debt ceiling, the U.S. Treasury is readying a flood of new bonds that could impact the market significantly. With the Treasury coffers running critically low and the debt ceiling officially lifted until 2025, this financial activity could amount to over $1 trillion in new securities.

Having covered the debt ceiling in recent articles , we now wait and see how the expected resolution plays out in the market. The massive issuance of new bonds is expected to drain liquidity from the banking sector, potentially resulting in tightened economic conditions as bank reserves decline and short-term funding rates increase. Strategists, including those at JPMorgan Chase and Citigroup, have warned that this could knock almost 5% off the combined performance of stocks and bonds this year, due to impact on market liquidity and supply/demand dynamics in global fixed income markets, with demand for U.S. Treasuries crowding out less creditworthy investment vehicles. Afterall, despite the hysterics around the debt ceiling, what entities on the planet are more likely to repay creditors than one who can indirectly rely on a money printer for funding?

Analysts from Bank of America equate the expected impact of Treasury bill issuance to that of a quarter-point interest-rate hike by the Fed.

Saudi Arabia Introduces Oil Cuts Amid Market Uncertainty

OPEC+ (Organization of Petroleum Exporting Countries) and allied countries convened in Vienna for a critical meeting on June 2 and 3, facing the uncomfortable backdrop of uncertain demand and volatile oil prices. Notably, the group disallowed members of traditional media organizations from attending, casting a veil of secrecy over the weekend meetings.

The uncertainty was dispelled when Saudi Arabia pledged an extra cut of 1 million barrels per day in July, bringing its production to a several-year low. The move was reminiscent of a recent gambit against short sellers that came after oil prices had dropped by 11% in May, and due to prices struggling to recover amid concerns about the Chinese economy.

These developments can be seen as a strategic play by OPEC+ against against Western interests, particularly against the political push by G7 nations in the context of the fight against inflation. Central Bank hawkishness has been instrumental in curbing the oil prices that sparked the inflationary surge in 2021, and the recent actions by OPEC+ can be interpreted as a countermove in an attempt to regain control over the global oil market.

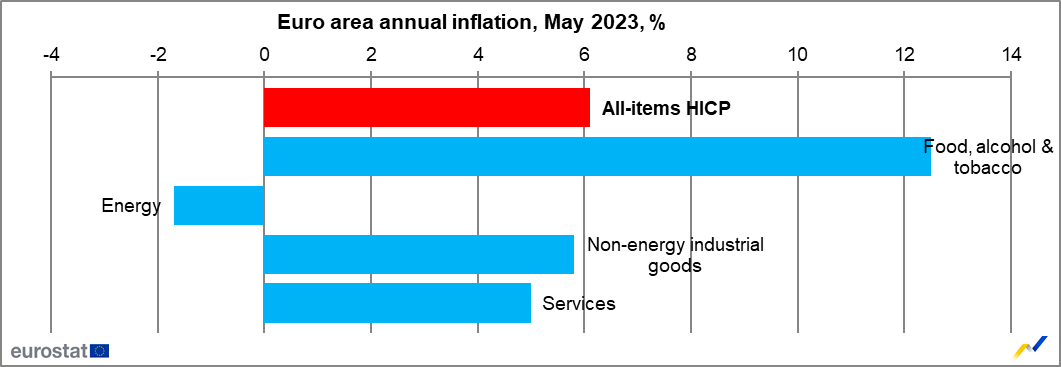

At the height of inflationary fears in 2022, energy prices — from crude oil to natural gas and coal — surged due to an overheating economy and geopolitical worries, serving as the leading contributor to inflationary pressures. Now, a little over a year after Russia’s invasion into Ukraine, the energy component of Western inflation gauges is deeply negative year-over-year, with the deflationary change in annual readings contributing to the recent disinflationary trend in inflation readings since the 2022 peak.

Recent graphics from the St. Louis Fed shows this dynamic more clearly, with core components now leading the inflationary charge, instead of energy components — a notable shift from 2022.

Data from Eurostat, the statistical office of the European Union, tells a similar story. With energy negatively contributing to year-over-year inflation numbers, stickier components are carrying the inflation momentum amid the lull in energy prices.

Historic Concentration In Equities Markets

Concentration risk in equity markets is at its highest level ever, with the top five companies representing a 25% share of the aggregate S&P 500 market capitalization, while just three names represent 19.7% of the total market cap in the index. Such a historic concentration among the biggest names has never been witnessed in the history of the data. There is no doubt about the sheer dominance and monopoly of the tech companies currently carrying markets, but there are questions about the relative value of the future earnings for these companies.

With such dominant performance by mega-tech to start the year, market breadth is at levels seen at or near market bubble peaks, with the difference in performance between the top five performers compared to the index itself at extremely elevated levels.

Forward Volatility Expectations For Stocks At 2021 Lows

Equity markets are grinding upward. Wall Street’s favorite risk gauge, VIX — the S&P 500 1-month implied volatility index — has fallen to new lows, touching levels equivalent to the lowest points it reached during the peak everything bubble frenzy of 2021.

While still higher than much of the 2010s, it is yet to be seen if market volatility can remain at such muted levels while the Fed continues on with its tightening regime and is no longer supporting the market with regular quantitative easing liquidity injections.

Market Prospects Amidst Rising Interest Rates

Famed financial analyst, Jim Grant, is declaring the onset of a long cycle of rising rates, guided by his theory of interest rates exhibiting generational-length phases rather than cycles.

Grant started “Interest Rate Observer” in 1983, and he holds tremendous respect and recognition in financial circles. He’s known for criticizing both the hubris of central bankers and the many mistakes made by “Mr. Market.”

In a recent “Odd Lots podcast,” Grant observed, “Interest rates fell for the last quarter of the 19th century, rose for the first 20 years of the 20th, fell from 1920 to ‘46, rose from ‘46 to ‘81, fell from ‘81 to, call it 2021.” His view is primarily based on pattern recognition, underscored by the unprecedented bearishness witnessed in the bond market during 2020 and 2021, when an enormous number of debt securities were priced to yield less than nothing. Grant added, “But there were $18 trillion, I think, at the peak … the most extraordinary expression of unqualified bullishness on an asset class.”

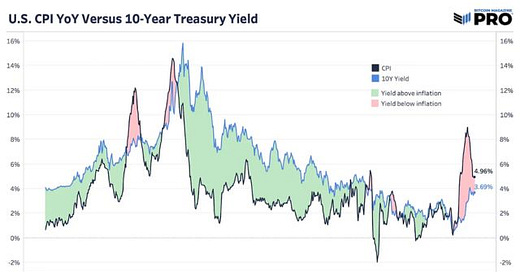

In our view, the proliferation of negative yielding debt was one of the largest catalysts for the surge in the bitcoin price during the monetary madness of 2020 and 2021. Despite negative yielding debt all but ceasing to exist in nominal terms, our view is that long-dated fixed income investments still represent an unattractive bet, given the inflationary conditions currently present and likely to persist into the future. Short-dated securities may offer a different risk profile, given near-term disinflationary trends with rates above 5.0% on the short-end of the Treasury curve, long duration government debt securities are likely to be the instrument used by governments globally to soft default on historic debt burdens, through a steady dose of inflation throughout the 2020s.

Back to the podcast, Grant highlighted that despite increasing rates, certain sectors have shown resilience, such as homebuilders who are capitalizing on the low-supply market scenario as homeowners with low-interest mortgages are choosing not to move. Grant explained, “Interest rates have gone from nothing to five plus on the short end of the yield curve. And wouldn't you suppose that the home builders would have taken a big but instead ... the homebuilders made new highs recently ... Because rates have kind of put interest rate handcuffs on people who are in possession of one of these sweet mortgages.”

While the current state of interest rates and the market in general has become increasingly complex, Grant's analysis paints a broader picture, urging investors to adapt and recognize the opportunity in this potentially higher-rate environment.

Bitcoin Price Action: New Bull Market Or Bear Market Rally?

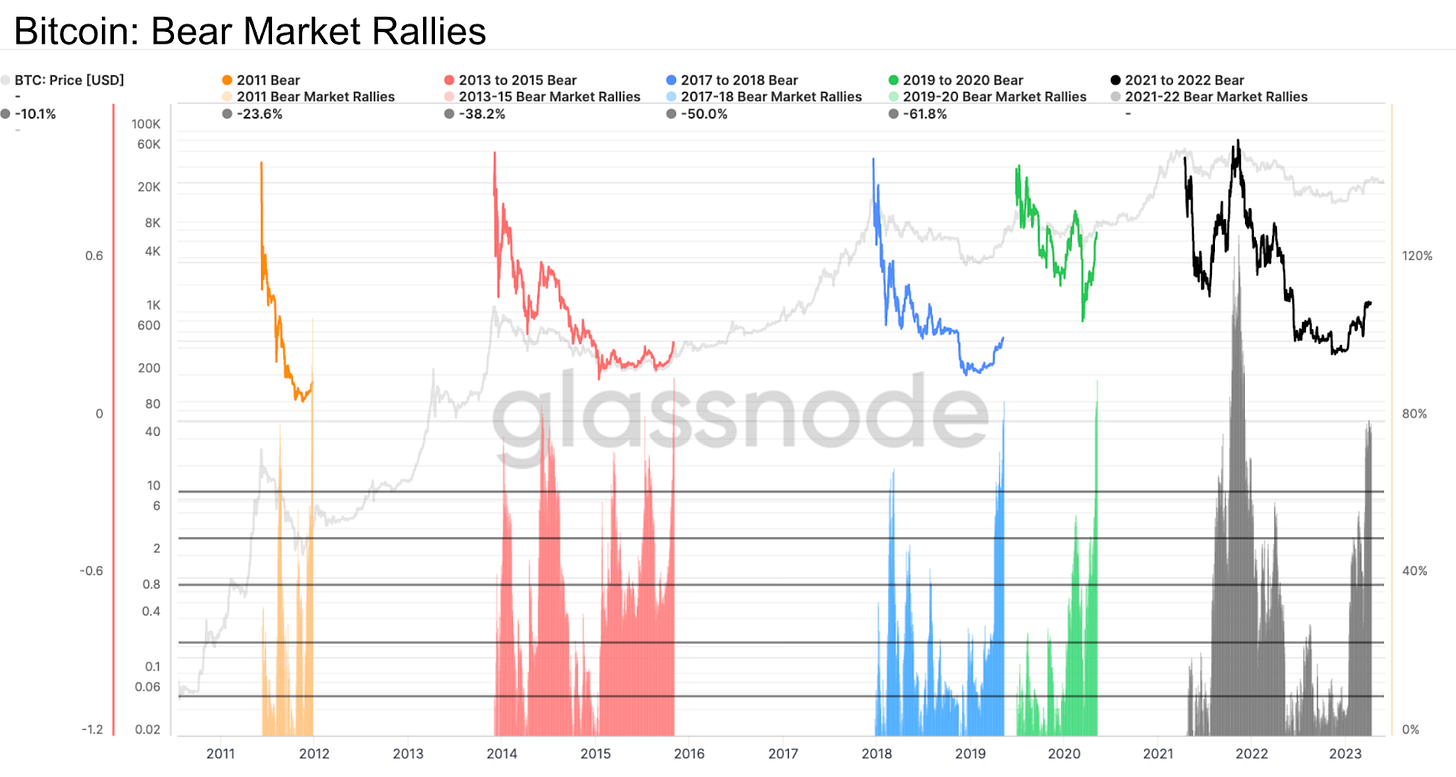

The technical definition of a bull market and a bear market in bitcoin are a bit different than legacy markets due to the immense volatility ( +/- 20% serves as the typical threshold for Wall Street). Still, we can take a closer look at previous bull and bear market cycles to get a frame for what is in the realm of possibilities for bitcoin going forward.

While a bear market rally would presume bitcoin eventually goes back to its $15,500 lows from 2022, we think this outcome — even amid the potential possibility of a macroeconomic firestorm — is unlikely due to the amount of forced selling that was absorbed during the 2022 crypto winter.

A look toward history shows that bitcoin’s rally off the lows would put it in the upper echelon of historic “bear market rallies,” and instead looks much more like what the start of a new bull market overlaid against previous market cycles.

Conversely, if we look at previous bull market corrections in bitcoin, we can see that pullbacks of 50% are regular occurrences. While a 50% pullback from current market levels would put the price below those 2022 lows, the point we want to emphasize is: As bitcoin climbs the figurative wall of worry, its ascent will be anything but a smooth ride.

Final Note

Understand what you hold, and how much of it you are comfortable with considering upside and downside scenarios, considering the possibility of extreme volatility in both directions to arise once again in the future.

While we forecast a choppy second half of 2023, we want to reiterate that bitcoin’s market volatility is the price you pay for supreme risk-adjusted returns, if bitcoin is to continue upon its monetization path as the world’s dominant digital asset.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!