Part 2: This Time Isn’t Different - Miners Are Biggest Risk Facing Bitcoin Market In Repeat of 2018 Cycle

The Bitcoin mining industry faces intense pressure as hash price reaches new lows and the difficulty adjustment continues rising. We compare today’s mining situation to parallels from 2018.

Part 2 of “This Time Isn’t Different: Miners Are Biggest Risk Facing Bitcoin Market In Repeat of 2018 Cycle” published Tuesday 10/25 for paid subscribers. Click below to view the original post.

Relevant Past Articles:

While there was already a “capitulation” per se earlier this summer during the initial cryptocurrency market deleveraging in June, hash rate has since gone vertical, with new fleets of the newest Bitmain Antminer S19 XP, an industry-leading miner, just now being deployed en masse by the largest miners.

Shown below are two of our favorite indicators for the state of the bitcoin mining market, hash ribbons and difficulty ribbons. Both indicators build on similar concepts: using basic moving averages of hash rate and difficulty to visualize when the hash rate trend is turning over (i.e., miners are capitulating).

Given the current state of hash rate and difficulty, we believe that the pressure is indeed building, but the figurative burst has yet to occur.

The Mechanics Of A Race To The Bottom

As new fleets of the industry’s most efficient miners get deployed, a twofold impact on industry participants is being realized:

The delivery and deployment of the new S19 XP ASICs (and other cutting edge mining technology) are occurring now, but it is key to remember that these machines were purchased for the most part in back order during the 2021 bull market cycle. As such, these machines were much more valuable than their current prices today, meaning the capital expenditures on these machines were immense. This means that even at marginal profitability (depending on energy prices for the operator), these machines must operate full speed ahead and continue hashing.

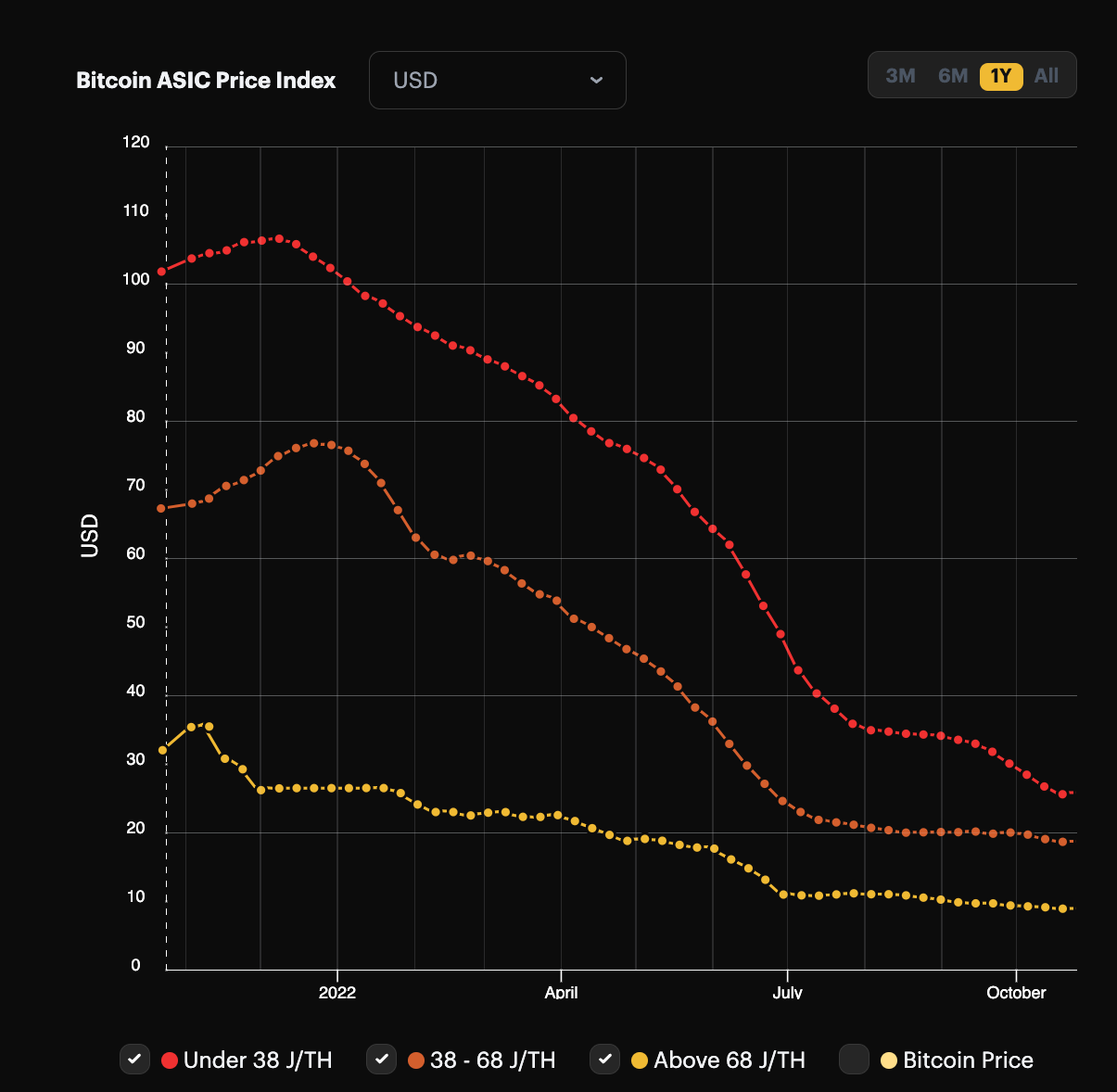

Show below is the the value of ASICs quoted in both USD (1) and BTC (2) respectively.

Source: Luxor Hash Rate Index

Source: Luxor Hash Rate Index

The second impact is that less efficient machines, or operations that did not materially increase their share of the hash rate, are now facing record low revenue figures, in both bitcoin and in dollar terms. For a sector that leveraged up to buy and hold both bitcoin and ASICs en masse in 2021, this is not ideal. Estimates show there are approximately 78,000 BTC in miner wallets directly, with a little less than half of that in the hands of publicly traded and reported miner operations.

Subscribed

In the current state of the market, new price lows are not guaranteed but they are a significant probability that many should be prepared for. As highlighted above, there’s a lot of dry bitcoin powder from miners that can be sold and distributed at any time into a fairly illiquid market (relative to the previous bull market period). That’s what we know from public bitcoin miners. Glassnode estimates approximately 78,000 bitcoin in miner wallets worth nearly $1.5 billion at a $19,200 bitcoin price.

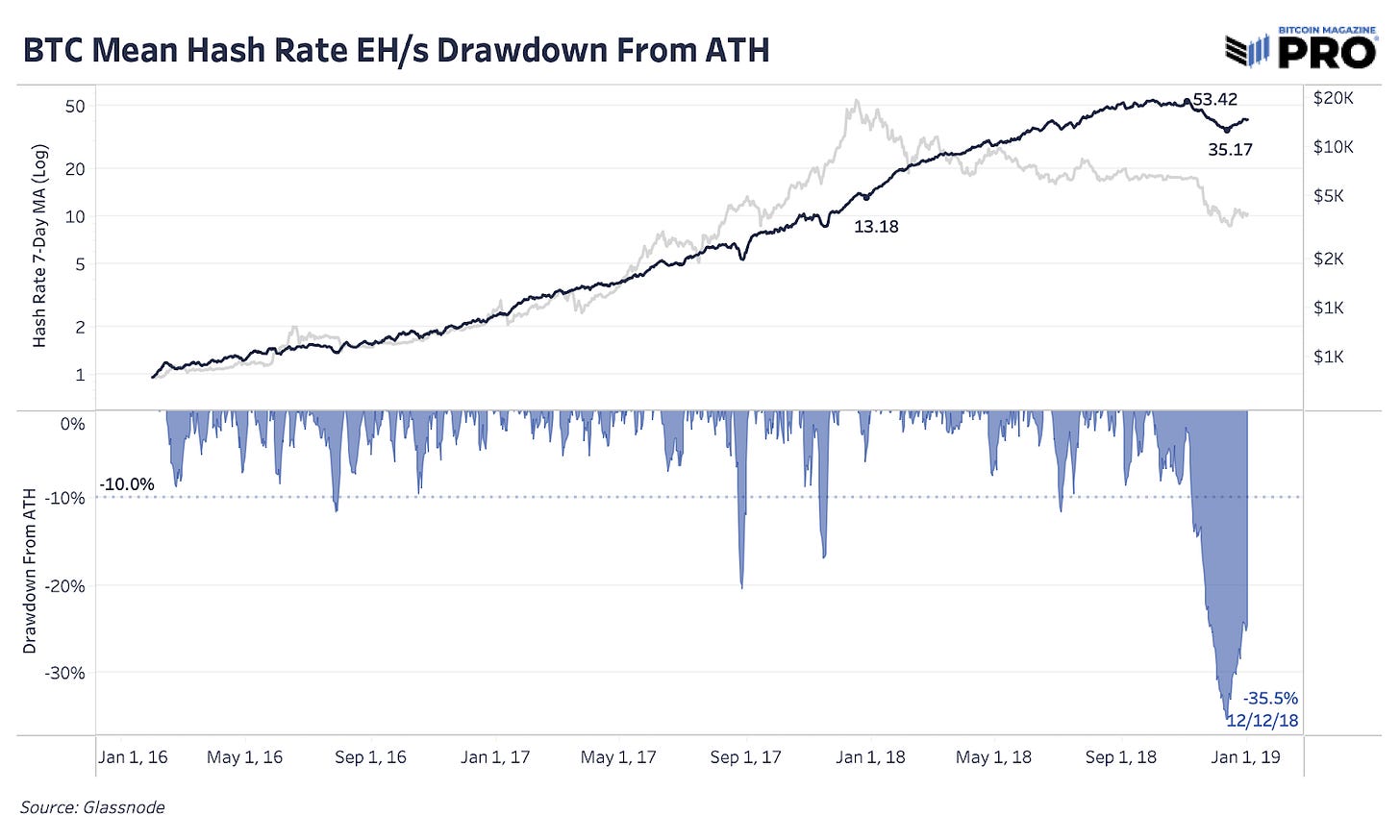

We could easily see a scenario where further bitcoin price and miner industry revenue pressures force more of that held bitcoin back into the market along with a significant drawdown in hash rate. Below charts show the comparison of hash rate, price trajectory and percentage drawdown from 2018 and present day.

If there is a case for the last leg lower, this is it, and our data-driven approach has us leaning towards this having a decent likelihood of playing out. In the chart below, observe what happened to the bitcoin market the last time there was a price stagnation following a drawdown of this caliber as hash rate soared to daily new highs (hint: the dotted line).

While history doesn't repeat, it often rhymes, and our data-driven approach has our team on increasing alert about the pressure this mining industry and subsequently the bitcoin market will face over the short term.

While we are in no way saying this occurs with certainty, the higher that hash rate goes while bitcoin the asset itself trades with increasingly muted levels of volatility -71% from its previous all-time high (around when some of the largest CapEx investments made into mining infrastructure took place), then it is increasingly probable a final miner-induced capitulation event will occur. This is not a prediction, but rather an observation based on the data currently in front of us. Our team wouldn't be surprised in the slightest if the following played out (2018/19 fractal used below), and you shouldn't either.

We should reiterate further that everything is probabilistic in nature, but the likelihood of harsh market outcomes in the short term probabilistically increases in the market conditions seen in recent months (i.e., rising hash rate, consolidating price -70% from all-time highs).

Structurally, this is no issue. There is no existential crisis that leaves Bitcoin vulnerable to network failure or a permanent bust. Rather, this is a completely healthy and capitalistic process which purges the weak from the strong, and ensures that only the most entrepreneurial and efficient operations will remain dominant players for long.

Try a 30-day free trial of the Bitcoin Magazine PRO paid tier to receive all of our articles in full as they go live.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like if you enioyed this article. As well, sharing goes a long way toward helping us reach a wider audience!