Market Speculators: Last Call For The Merge

Bitcoin closed down 9.6% yesterday with more downside today. The current drawdown is still in line with prior cycles and follows risk assets. The perpetual funding rate APR for ETH hits over 300%.

Relevant Pieces:

7/20/22 Caution: Bear Market Rallies

8/17/22 The Ethereum Merge: Risks, Flaws and The Pitfalls Of Centralization

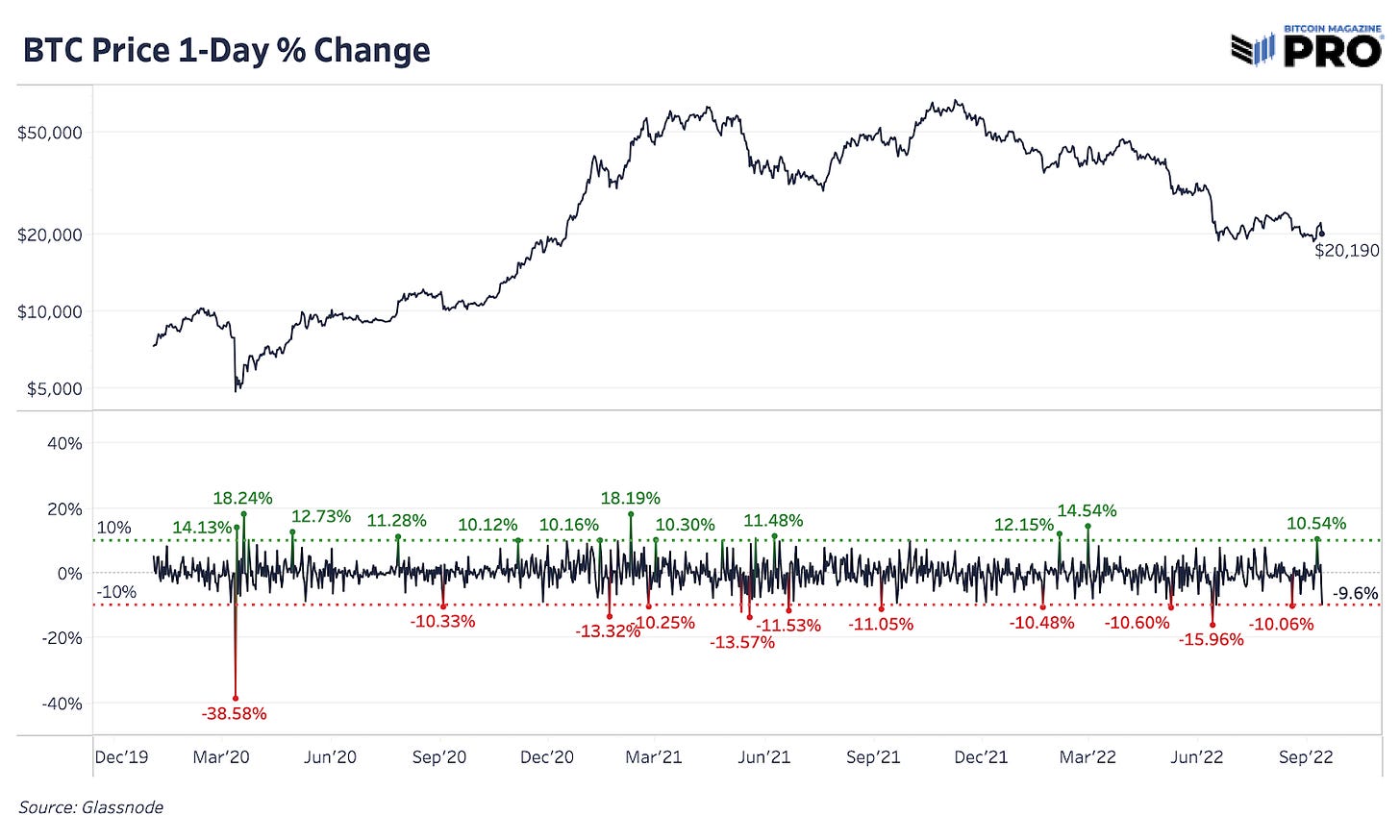

Bitcoin Closes Down 9.6%

Yesterday’s bitcoin move, based on closing prices, came in at a 9.6% 1-day decline. That’s nothing new for this bear market trend which has seen eight other days just like it since the peak in November 2021. The majority of these carnage days come with some sort of relief rally the day after.

Based on the current intraday bitcoin price of $19,735 at the time of writing, we will need to see a heavy bounce and support from buyers here to maintain that trend. Today’s fall and subsequent leverage wipeout follow direct suit with what’s happening with equities. S&P 500 Index has yet to reclaim a key support area of 3980 and was slightly green on the day.

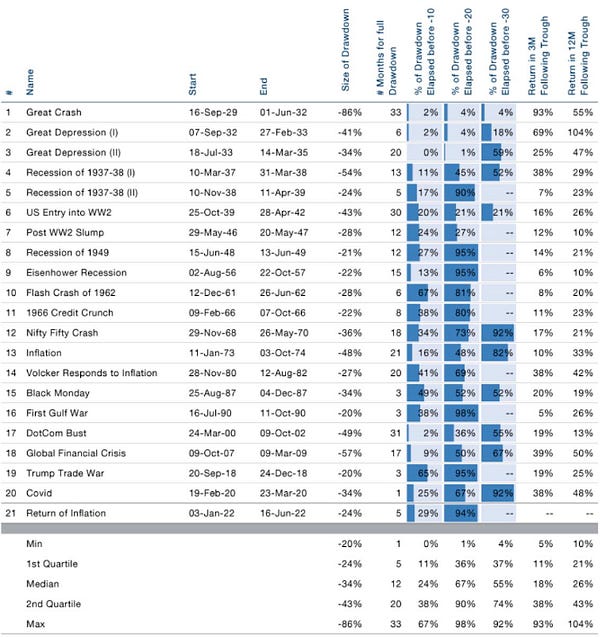

As we highlighted previously in our analysis, “Caution: Bear Market Rallies,” the duration of these rallies and of the bear market overall are consistent with historical examples. In terms of percentage drawdown, previous bitcoin cycles are not proving to be different analogues. As a reminder to readers, the additional selling today comes with the S&P 500 Index only down 18% from all-time highs. The median drawdown for major financial corrections is 34% lasting 12 months. It’s increasingly more difficult to evaluate current conditions apart from this lens as we watch this play out further.

Funding And The Merge

Next, we wanted to highlight that the Merge is set to happen later tonight (early tomorrow morning after midnight). The market is still rife with speculation and various arbitrage plays for this event. It’s looking more and more like “sell the news” and the volatility for the week isn’t over yet.

Our issue on the Merge, “The Ethereum Merge: Risks, Flaws and The Pitfalls Of Centralization,” covers the technical aspects of the Ethereum hard fork change to its consensus algorithm. One of the most interesting dynamics has been the rise of negative perpetual funding in the ETH market.

The neutral rate for this market is 10% APR but today we’ve seen rates go as high as 366% across exchanges. That means ETH shorters are paying longs that much in interest to take on their position. We’ve never seen this play out in derivatives markets for any asset and it’s likely because of the sheer amount of hedging arbitrageurs and speculators are taking on. A strategy to buy spot ether and short the perpetual market would yield market participants any new hard fork ETHPOW coins that come out of the Merge.

But it comes at a hefty cost, every eight hours those shorting have to pay 0.33% of their position. Likely, shorters are willing to pay these costs with expectations that they can profit from the additional forked coins later on. We will find out soon if the majority of these positions actually want to hold and own their spot ether in these conditions post-Merge as positions start to unwind.

Source: Laevitas

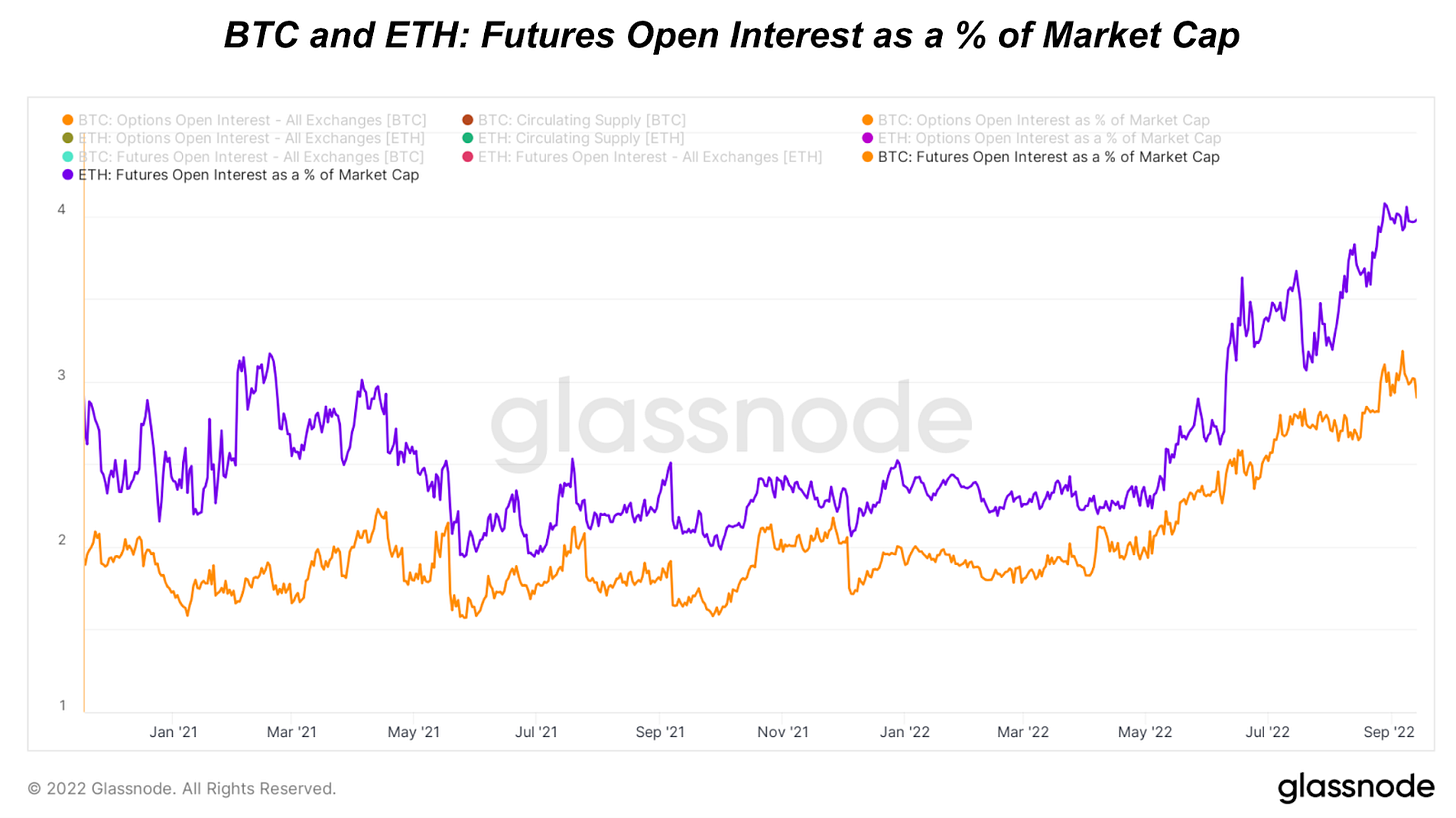

Some back-of-the-napkin math can roughly estimate the market’s expectation for the proof-of-work Ethereum chain to be approximately 0.75% of the market cap of Ethereum today (given the blended average funding rate of -0.25% that short positions pay to longs every eight hours). The deeply negative funding rate and the vast size of the Ethereum futures market shows the sheer demand to get the forked PoW ETH.

As a percentage of total market cap, the futures market for ETH is much larger than that of BTC, which can partially be attributed to speculation around today’s planned hard fork, otherwise known as “the Merge.”

In regards to bitcoin’s derivative market dynamics, earlier in the year the perpetual futures funding rate getting over a neutral rate (longs paying shorts for bullish bias of 10% APR) would be a signal of the market getting overheated. Now we’re at a point where funding hasn’t been able to reach or sustain a neutral funding rate since late July. Funding looked over extended along with the options market showing call options as pricier to put options, a signal that’s been valuable many times now in this downtrend.

In Case You Missed It: “The Ethereum Merge: Risks, Flaws and The Pitfalls Of Centralization”

In tomorrow’s issue we will cover the aftermath of the Ethereum hard fork event, dissect the unwind in derivative market positioning, and discuss potential short-term liquidity effects that could reverberate across the market given positive and negative outcomes of the Merge.

Lastly, we’ll finish today’s piece off with some satirical commentary for subscribers.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section.

Word on the street is internet coin going to win the war in Ukraine after merge.

Delta skew work interesting. Does that data go back to early ‘20 (think that’s when Derebit started BTC options trading)? If so, does it look like it was a compelling signal for intermediate moves throughout ‘20 and early ‘21 too? I’m assuming it would’ve been flashing consistently during the big move higher in late ‘20 and into ‘21.