PRO Market Keys Of The Week: Corporate Greedflation & Binance Woes

Investors attribute corporate greed as a major cause of inflation rates. Hedge funds continue to short Treasuries. Commercial real estate may be the next domino to fall in an economy-wide contraction.

What We’re Watching

Upcoming Economic Calendar:

June 13, 2023

U.S. Consumer Price Index

FOMC begins two-day meeting

June 14, 2023

Eurozone Industrial Production

U.S. Producers Purchasing index

FOMC Rate Decision

IEA Oil Market Report released

June 15, 2023

People's Bank of China Central Bank Meeting to decide on One-Year Policy Loan Rate

China Property Prices, Retail Sales, Industrial Production

ECB Rate Decision

U.S. Initial Jobless Claims, Retail Sales, Empire Manufacturing, Business Inventories, Industrial Production

June 16, 2023

Eurozone CPI

Bank of Japan Rate Decision

U.S. University of Michigan Consumer Sentiment

Hedge Funds Shorting Short-Duration Treasuries

Hedge funds have continued their record-breaking trend of selling short-dated U.S. Treasuries. According to data compiled by the Commodity Futures Trading Commission, leveraged investors have increased their net-short two-year Treasury positions for an 11th consecutive week up until June 6, 2023. This trend indicates that hedge funds believe the Federal Reserve's fight against inflation is far from over and that there might be more interest rate hikes on the horizon. Investors often view the two-year treasury as a blended average of the next two years of Fed Funds Rate, so the direction of the two-year Treasury can serve as a gauge for where rate expectations are headed.

With economic data coming in better than expected for much of the year and equity indices at year-to-date highs, these funds are betting that interest rates will remain at a higher level for longer than previously anticipated, further reinforcing the monetary tightening dynamic and giving lag effects from the high rates more time to filter through the economic system.

Corporate Profit And Inflation

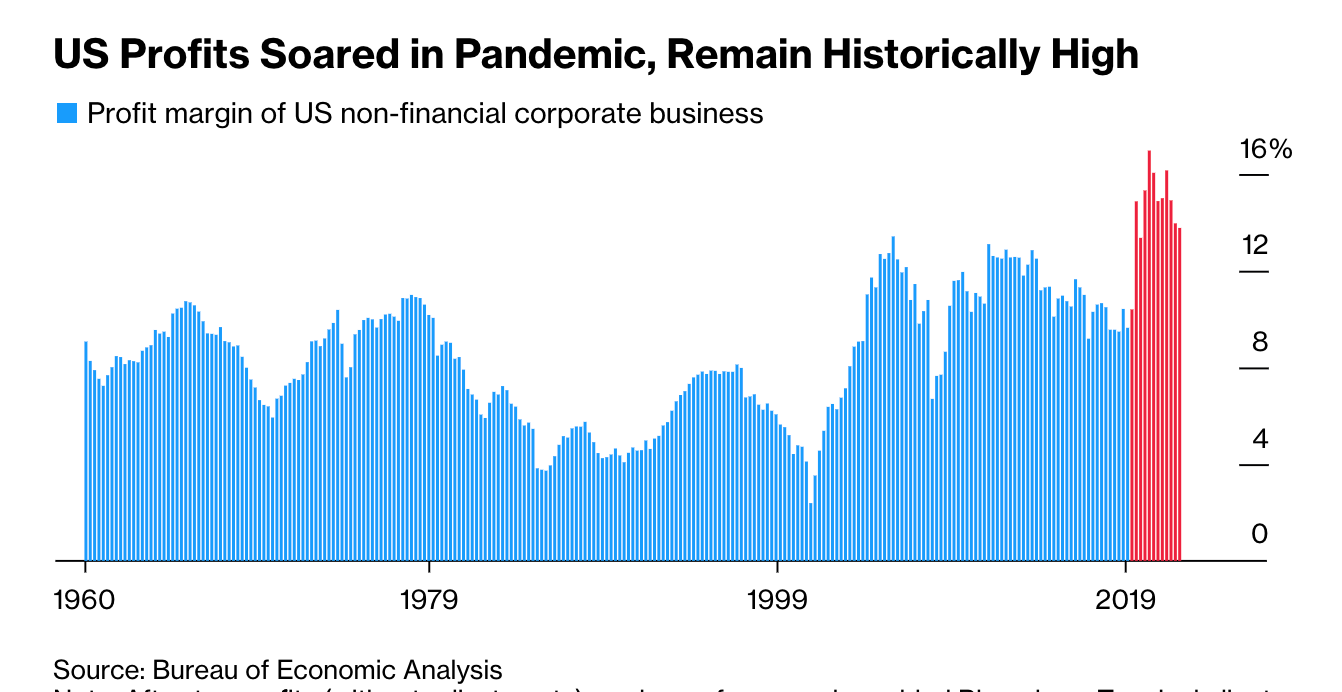

A Bloomberg poll conducted among professional and retail investors suggests that the inflation surge is significantly driven by soaring corporate profits. About 90% of respondents believe that companies across Europe and America have been increasing their prices beyond their own costs since the start of the pandemic in 2020.

This belief has led to what some are referring to as “greedflation,” a phenomenon where companies exploit their monopolistic positions to raise prices and enhance profits. Amid the inflation turmoil, about 80% of the poll participants support the use of tight monetary policy to curtail profit-led inflation. The age-old debate about the “cause” of inflation is one that economists and investors alike have debated since the formation of capital markets — it is unlikely to be settled now. However, the point is that despite the soaring costs in recent years, corporate margins are still wide, which has allowed firms to insulate themselves from the rising costs, while squeezing the consumer in the process.

However, a majority of the respondents expect these high-profit margins (which reached a 70-year peak during the pandemic) to eventually decline to pre-pandemic levels. Despite the high corporate margins, only a slim majority (53%) of poll respondents believe this price reduction will occur.

The current situation brings forward essential questions about the implications of the widening profit margins on inflation and how best to address the situation.

More Regional Bank Pressure On The Horizon?

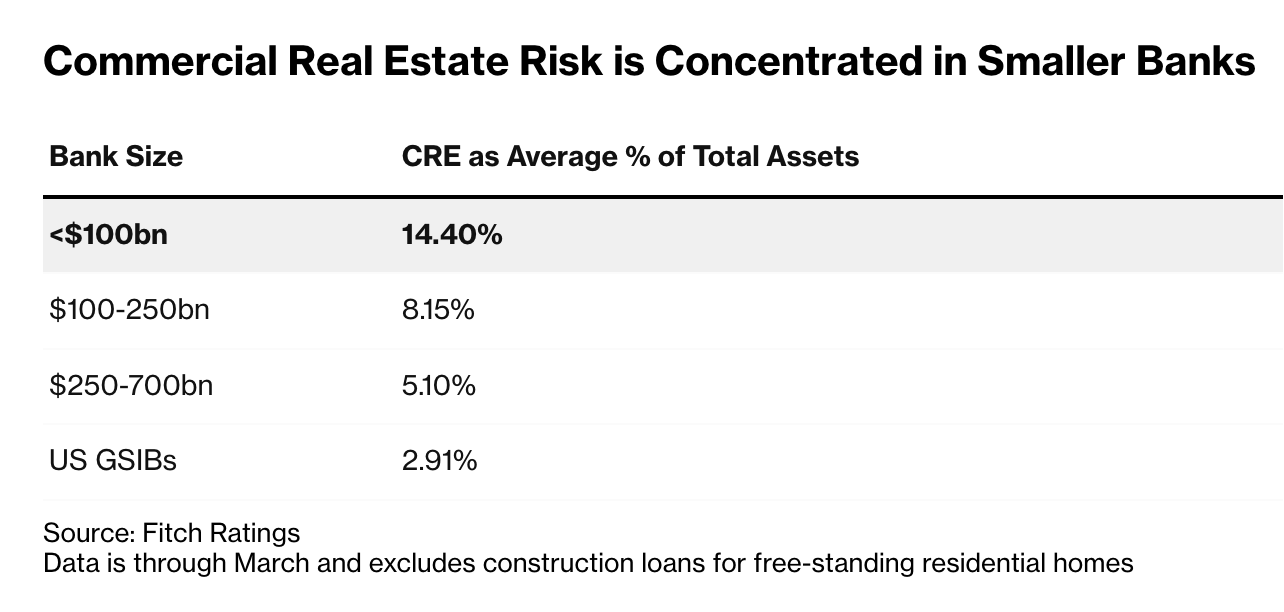

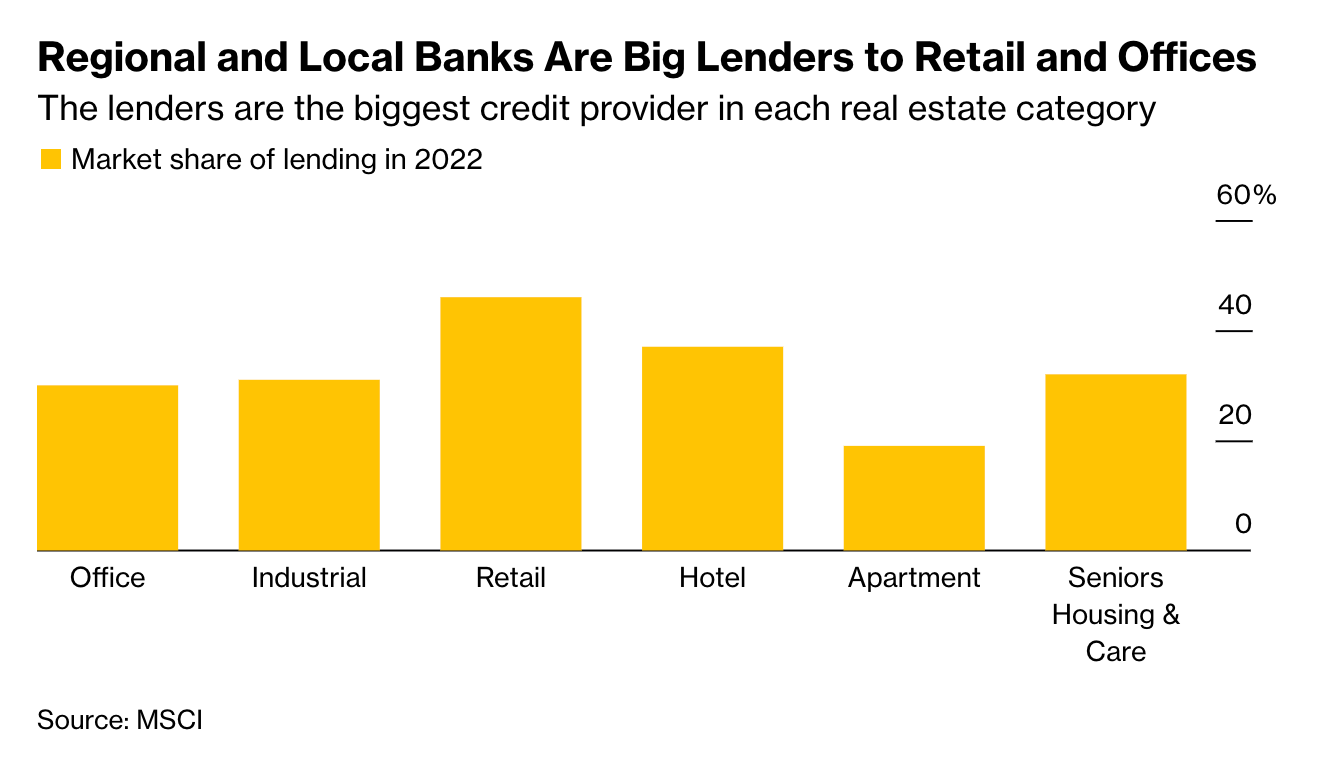

We now turn our attention to the increasing challenges that regional banks are facing in the United States, as emphasized by Soros Fund Management's CEO Dawn Fitzpatrick. She cautions that a contraction in credit is inevitable, with potential bank failures lurking beneath the surface. The commercial real estate sector is projected to amplify these challenges, given the significant role regional banks have played in this industry in recent years.

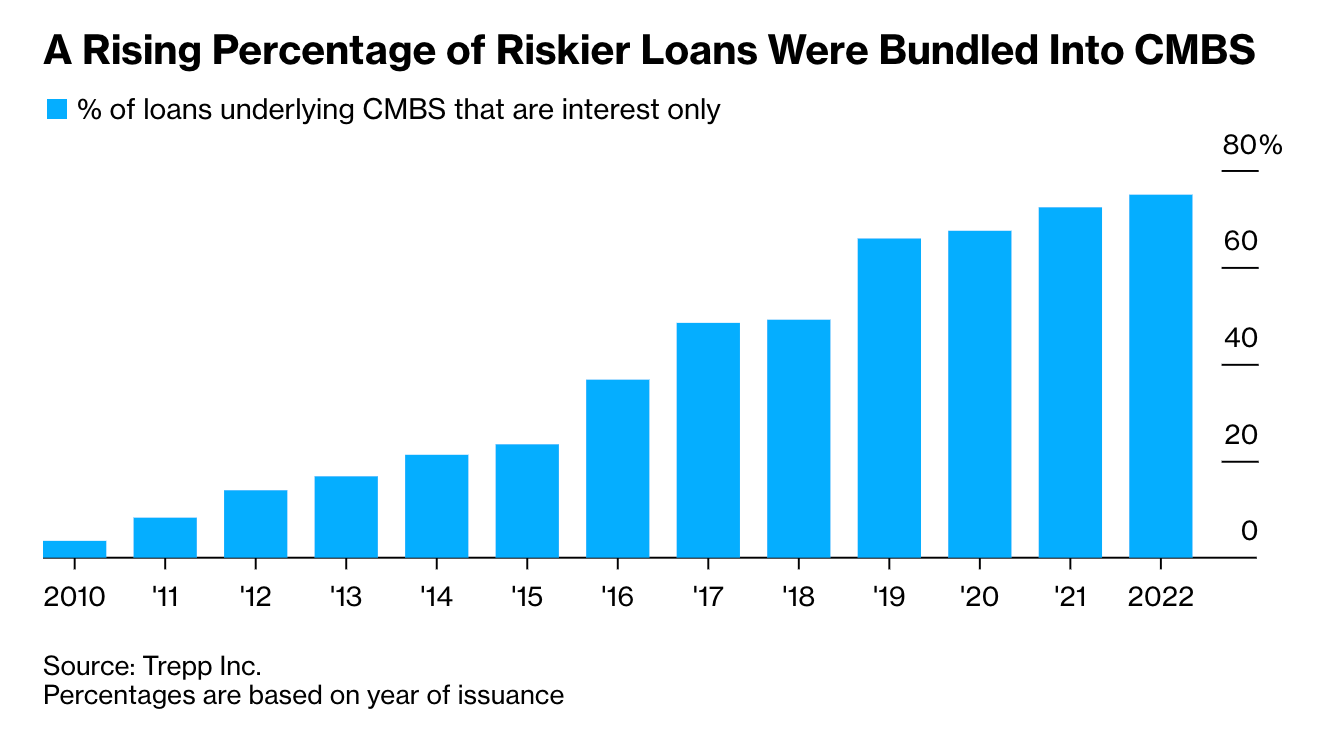

The value of office space has plummeted due to the proliferation of remote working. The situation is further exacerbated by looming debt repayments, with almost $1.5 trillion in commercial property debt due before 2025. As interest rates rise, many properties are losing value. To put this into perspective, 700 U.S. banks now exceed the Federal Deposit Insurance Corp.’s 2006 guidelines on commercial real estate loan concentration, a figure that was less than half only two years ago, as per Apollo Global Management Chief Economist Torsten Slok.

A spate of regional bank failures could constrict credit access for property developers and landlords, particularly those with smaller or lower-quality portfolios. The ripple effects could destabilize the market of commercial mortgage-backed securities and put regional banks under an intensified lens of scrutiny.

Nigeria SEC Declares Binance Illegal

In a significant regulatory move, Nigeria’s Securities and Exchange Commission (SEC) has declared Binance Holdings Ltd.’s operations illegal in the country. This comes just days after the U.S. SEC initiated lawsuits against the firm.

One unit of the renowned cryptocurrency platform in Africa’s largest economy, Binance Nigeria Limited, lacks registration and regulation by the SEC, leading to the characterization of its operations as “illegal.” This clampdown occurs amid a high volume of digital token transactions by Nigerians, despite the country’s prohibition on banks processing cryptocurrency transactions. This development follows the Nigerian SEC's earlier deliberations on allowing tokenized coin offerings on licensed digital exchanges that are backed by assets, excluding crypto. The SEC has issued a stern warning to Nigerian investors about the extreme risks associated with investment in crypto assets and ordered Binance to cease solicitation of investments from Nigerians, hinting at potential further regulatory action against the platform and similar exchanges operating in the country.

BNB Continues Descent as Binance Fears Mount

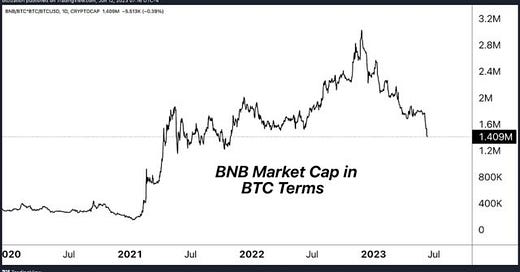

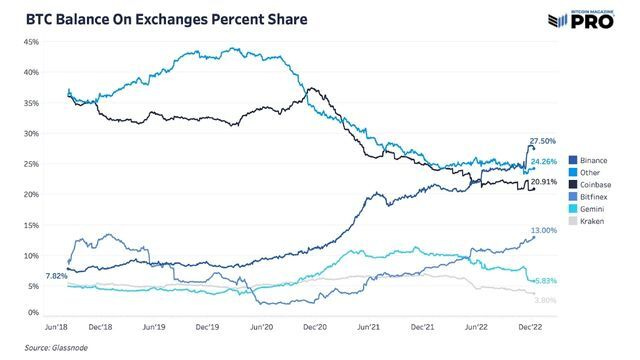

As global regulatory worries mount for the world’s largest crypto-derivatives marketplace Binance, their BNB exchange token continues to face downward pressure against the native crypto benchmark: bitcoin.

In our controversial December issue “Not Binancial Advice,” we highlighted the seemingly dislocated valuation of BNB relative to BTC. Since that article, the market capitalization of BNB has fallen from approximately 2,400,000 BTC to around 1,400,000 BTC today. We expect this long-term trend to continue.

In our view, the highly centralized exchange token — which is majority owned by Binance and primarily traded on its platform — remains extremely overvalued against bitcoin, which could lead to potential second and third order spill-over effects.

Later this week, we will publish a primer on our primary causes of concern for the world’s largest crypto exchange. We’ve held some evidence of the current allegations against Binance in our editorial vaults for concerns of it being overly speculative, but with official charges being filed, we will publish the findings in an upcoming article.

“To add to our skepticism, the price of the Binance exchange token BNB is near all-time highs in bitcoin terms, appreciating an astounding 828% against bitcoin in the last 785 calendar days.

“Is BNB, a more centralized cousin to Ethereum, really worth approximately 14% of all bitcoin that will ever exist? BNB is not equity in the Binance company. BNB is a crypto token spun up from nothing in 2017.

“Why is the outperformance so notable? Why are we hammering this point so hard? Because financial markets aren’t magical machines tied to a fantasy-land reality. Financial markets — while appearing to be disconnected from reality at times — always come crashing down to reality, exposing those that were possibly perceived as giants once before.

“For the most part, the crypto industry is an attempt at modern alchemy, and exchange tokens minted from nothing with centrally engineered “tokenomics” are no different. In fact, they are part of the problem.” — Not Binancial Advice

Not Binancial Advice

Relevant Past Articles: The Everything Bubble: Markets At A Crossroads Collapsing Crypto Yield Offerings Signal ‘Extreme Duress’ The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

this is great research. The leverage in CMBS is truly frightening. Is another BIG SHORT in CRE on the horizon sooner than we think?