Friday Roundup: Inflation Remains Key Focus, Rate Hike Inbound

Slowing GDP and persistent inflationary pressures have prompted debates on the appropriate policy response. The market expects more rate hikes late into 2023. Jerome Powell gets pranked.

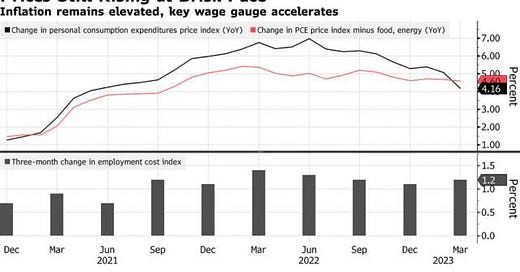

The trend of slowing GDP and persistent inflationary pressures in the U.S. and eurozone have prompted debates on the appropriate policy response among economists and central bank officials. Both the Federal Reserve and the European Central Bank continue to face the challenge of addressing these inflationary pressures, while attempting to navigate an environment of decelerating growth. This week in the United States, personal consumption expenditure (PCE) and quarterly GDP data came in, presenting a stagflationary cocktail to market participants. GDP read at an annualized 1.1% in the first quarter of 2023, far less than the median forecast of 1.9%. Concurrently, the core PCE price index — the Fed’s preferred inflation gauge excluding food and energy — accelerated to 4.9% as it was driven by a tight labor market through the first quarter of the year.

With unemployment at a mere 3.5%, rising labor costs strengthen the case for another interest rate hike at the Fed’s upcoming meeting on May 3. Our base case remains that the Fed’s tightening regime will continue until it manages to break the back of inflation and/or the real economy, with the overwhelmingly likely case that both options are one in the same.

With the stall in first quarter GDP and annualized inflation still running far above the Fed’s 2% target, the stagflationary scenario continues to get priced into the market. Economists are forecasting second quarter GDP to come in at a very underwhelming 0.2%, while the Fed’s data-driven GDPNow estimate for real GDP in the second quarter stands at a more optimistic 1.7%.

What does the market predict for the upcoming Fed meeting? Let’s take a look…

Another 25 basis point hike in policy rate at the Fed’s next meeting is the expected outcome by the market. The market currently gives this outcome a probability of 85.1% and a 14.9% probability of no hike, while looking to 2024 for Fed policy to loosen once again.

Source: CME FOMC Tracker

Expected policy rates for January 2024 and January 2025 have risen since the immediate knee jerk reaction to the banking collapses that occurred in March, but the market still expects 144 basis points of easing in policy rates during the 2024 calendar year.

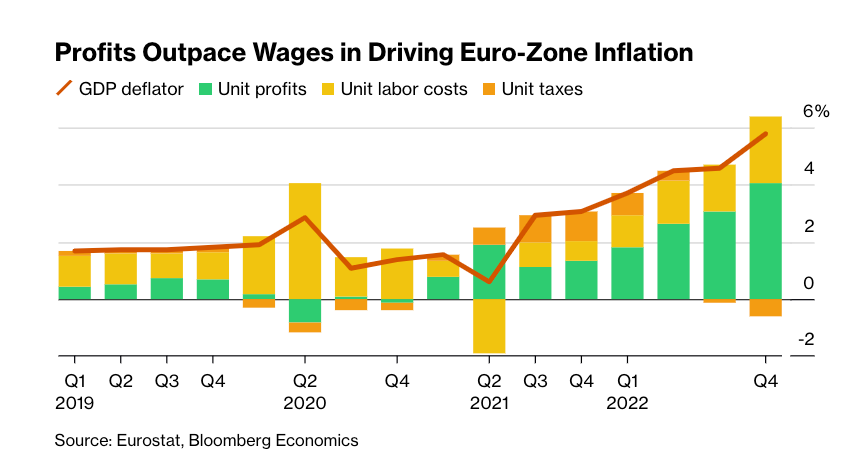

Across the pond, eurozone officials have begun to champion the term “greedflation” when discussing upwards price pressures. They describe the phenomenon as corporate profits and widening margins driving up wages and prices in a self-perpetuating spiral. ECB President Christine Lagarde warned of this dynamic recently and reiterated that it threatened to complicate the central bank's efforts to bring inflation back to the 2% target level. Shown below is a graphic depicting the current “greedflation” in the eurozone.

Final Note

An interesting twist to this week’s macroeconomic developments was the announcement that Jerome Powell was tricked into having a call with two Russian pranksters who posed as Ukrainian President Volodymyr Zelenskyy. During the call, Powell answered questions on the topics of inflation and the Russian central bank. Given the supposed independent status of the Federal Reserve from every sovereign nation — including the United States government and especially Ukraine — it isn’t exactly clear what purpose the call would have served if it was in fact real, but it did capture some candid moments of Powell expressing his views for the coming quarters:

“We would tell you that a recession is almost as likely as very slow growth.”

While nothing was disclosed in the call that threatens national security or foreign policy interests, such an occurrence begs the question: In a world where technology is advancing at a more rapid pace than ever before, what sense does it make to have an economic system where the most vital input, the price of money, be set by humans — who are obviously prone to basic error and miscalculation?

As highlighted in our latest piece, “One Year Until The Bitcoin Halving: Analyzing Holder Dynamics,” we expect the dichotomy between the two systems to become increasingly clear to everyday individuals and sophisticated investment institutions alike.

A monetary bearer asset with a predetermined algorithmic monetary policy, which dynamically adjusts to the level of computational power attempting to acquire said asset, is far and away a superior compared to a system set and controlled by the whims of unelected policy makers.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!