How is the Bitcoin Network Preparing for the Halving?

Investor Insights on Miner Positioning and Strategies, Network Traffic, and Market Trends Heading into the Halving.

Introduction

A comprehensive analysis across various Bitcoin metrics reveals a market at an intriguing juncture. The stability in miner stocks, anticipation around the halving, and evolving ETF dynamics point towards a potentially tighter supply and heightened investor interest. Meanwhile, network traffic data, with declining fees and mempool size, alongside fluctuating inscriptions, point to a situation of subdued speculative activity and efficient network performance. Investors should remain vigilant, as these indicators collectively suggest a market ripe for shifts influenced by upcoming halving events, investor sentiment, and broader economic factors, all of which will shape Bitcoin's near-term trajectory.

Public Miners: Strategies Pre and Post-Halving

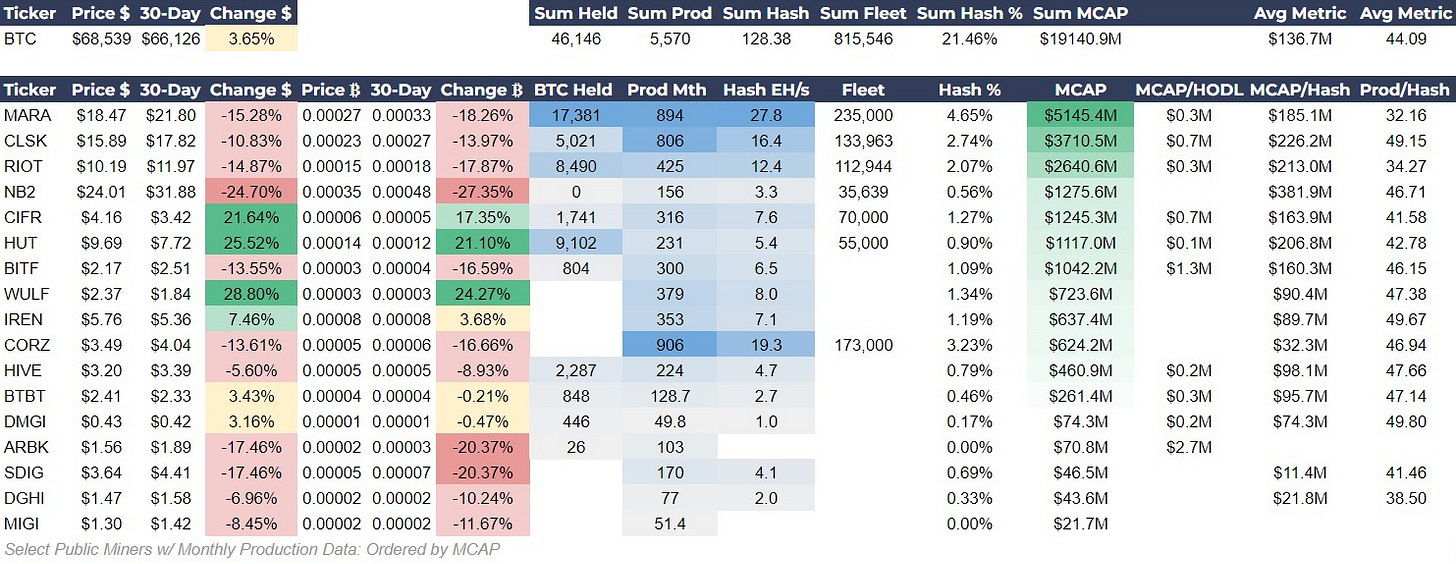

The relative stability in the USD versus BTC returns for the miners over the last 30 days implies that Bitcoin's price has been fairly constant, which it has been. On 4 March, price closed at $68,359 and the closing price on 4 April was $68,538.

Most miners’ share prices were negative over the last 30 days, with some interesting standouts. CleanSpark (CLSK) is no longer outperforming. That hat has been passed to HUT, Cipher (CIFR) and TeraWulf (WULF). They all posted strong gains over 20% vs USD and BTC. HUT, in particular, has an impressive hodl stack and should outperform others when the bitcoin price finally breaks out higher. Northern Data (NB2), on the other hand, on paper looks in a precarious position relative to competitors.

A closer look at the BTC held by each company, alongside their market capitalization, provides insights into how the market values the Bitcoin holdings of these miners. The MCAP/HODL ratio is particularly telling; a lower ratio might suggest that the market is undervaluing the Bitcoin reserves of the company.

Investor Insights

Watch low MCAP/HODL players in rallies: A lower MCAP/HODL suggests that the market is undervaluing the Bitcoin reserves of the company, and that during a rally those miners stand to gain much more value than miners with low bitcoin reserves.

The Bitcoin Halving Favors HODL, too: With the Bitcoin halving just 14 days away, miners with substantial Bitcoin holdings stand to disproportionately benefit. Post-halving, if Bitcoin's value rises due to decreased supply, these miners' reserves could significantly appreciate, opening up many strategic advantages and expansion opportunities.

Analyzing Short-Term Mining Activity into Halving

Analyzing the mining activity data reveals some nuanced trends in the Bitcoin mining landscape over the last 30 days. The Hash Rate 7DMA shows a slight decrease over the last week but is up 5.22% from 30 days ago, suggesting a recent plateau or minor decline following a period of growth. The Hash Price 7DMA has dipped slightly over both the 7-day and 30-day periods, indicating a possible tightening of profit margins for miners.

The recent divergence in revenue measured in BTC or USD has plateaued in the last week. The stability in the revenue figures is largely due to the consistent Bitcoin price over the past month. The rally at the end of February to 4 March is still noticeable in the 30-day USD revenue, but that will dissipate this week.

The drop in Transfer Volume to Exchanges and Miners' Wallet Balance confirms an increasing supply shortage and preparation by miners for the halving and the next leg of the rally after the current consolidation.

Investor Insights

Supply Shortages: Investors should monitor miners' selling behaviors and the halving's impact closely, as these factors will amplify the effects of increased demand from the ETFs and major buyers. Having and sourcing bitcoin post-halving will be much harder, inevitably forcing price higher.

Non-Linearity Around the Halving: Investors should prepare for potential non-linearity in miners' revenue numbers as the Bitcoin halving approaches. The halving will reduce block rewards, however, when the supply contraction leads to a price increase, the USD value of these reduced rewards will be offset or even enhanced. This sets the stage for a sell-the-rumor, buy-the-news climate around the halving. In the days following the halving when miners are still chugging away in profit, there could be a rotation toward mining stocks.

Bitcoin Network Traffic Analysis

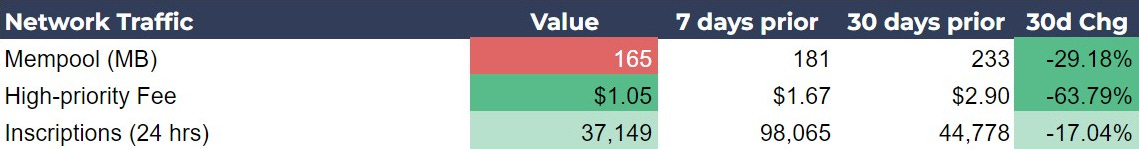

The Bitcoin network's traffic metrics show a discernible shift in activity over the last 30 days, suggesting nuanced market developments. The significant decline in the mempool size from 233MB to 165MB means more transactions are being approved currently than new transactions being made.

A shrinking mempool aligns with the decrease in transaction fees from $2.90 to $1.05. These historically low fees point towards the value proposition currently most preferred by the market is not transactional, but savings related. The average value in dollar terms of daily bitcoin transactions peaked at a monstrous $19 billion around 12 March, but is still very high at $10 billion/day. Larger transactions dominate despite the low fee environment.

Furthermore, the decrease in daily inscriptions after a brief surge last week suggests that the speculative interest in Bitcoin from retail investors, hasn't returned quite yet. Bitcoin has been relatively out of the headlines during this consolidation, and altcoins are not doing well.

Investor Insights

Monitoring Speculative Trends: The decline in inscriptions suggests a wane in speculative interest, which can be an early indicator of retail sentiment towards Bitcoin. This is not necessarily a bad thing, retail investors tend to be relatively late to the party. Retail will come in the second half the bull market, but we aren’t in that YOLO-type environment yet.

Fee Analysis for Market Health: Transaction fees remain historically low, indicating a current lack of urgency in network usage. We expect to see urgency and fee-insensitive transactions just prior to, and during, price volatility. With fees currently so low, volatility is less likely in the near-term.

Image of the Day

We’ve recently had some big news about Wall Street banks directly approaching miners to buy bitcoin held in reserves due to supply shortages on exchanges. Today, BlackRock has revised its Bitcoin ETF prospectus to include several new Authorized Participants, notably adding massive names like Citadel, Goldman Sachs, UBS, and Citigroup. The key takeaway is that major firms are now eager to engage with and are comfortable being publicly linked to Bitcoin. The floodgates have yet to fully open, and just in time for the halving.

Source: Eric Balchunas, Bloomberg

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

Missed out on this week's Bitcoin Magazine Pro insights? Here's your opportunity to catch up:

Don't miss these essential reads to stay ahead in the world of Bitcoin!

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

YOLO