Hash Price Surge and Mining Efficiency: Key Drivers in This Week's Bitcoin Mining Sector

Analyzing the surge in hash price, its impact on public miners' profitability, operational efficiency's role in stock valuation, and speculative insights from network traffic.

Introduction

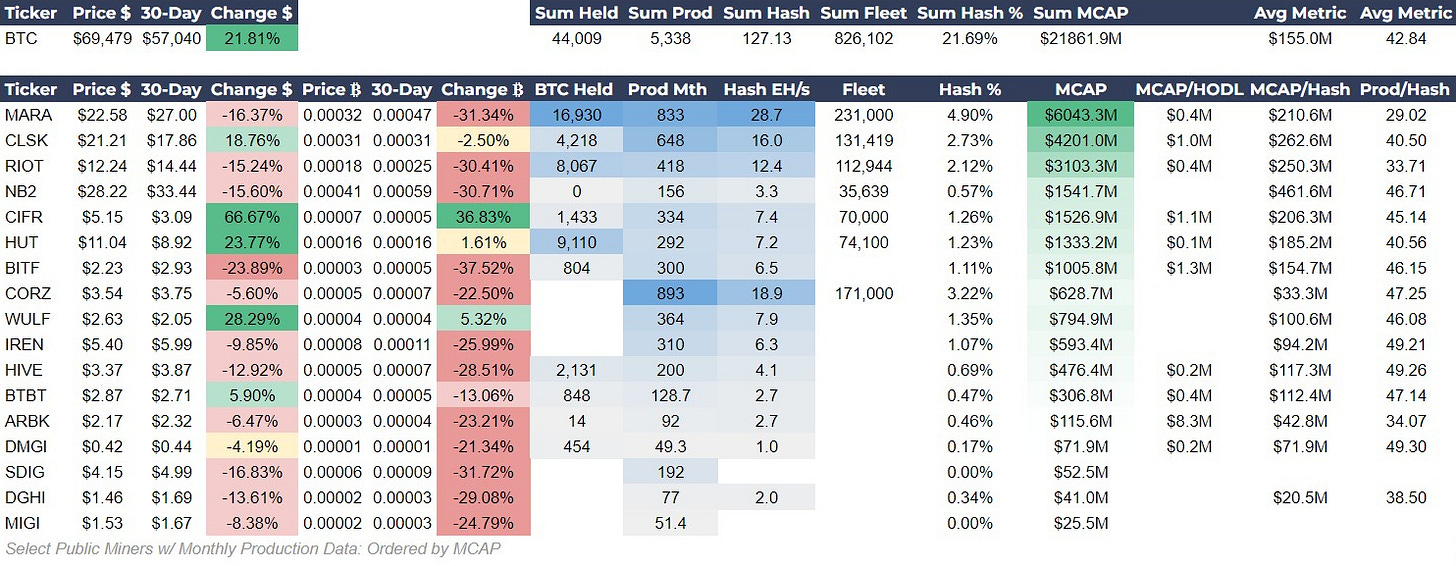

Happy Good Friday. We are back with another update of our Mining Tracker. This week we discuss that operational efficiency, rather than Bitcoin reserves, may offer a stronger signal of a miner's stock performance. Despite varying stock performance among miners, the sector benefits from an overall increase in hash price, indicating rising profitability.

Network data suggests a stable and adapting Bitcoin infrastructure, with low fees and increasing inscriptions hinting at heightened speculative interest. Investors should consider efficiency metrics and network trends in their strategies, particularly as the Bitcoin market shows signs of consolidation, potentially poised for its next movement in the ongoing bull market.

Let’s dive in.

Public Miners Mixed in Price Consolidation

Over the last 30 days, CleanSpark (CLSK) has made a fantastic run, which might be waning. Cipher (CIFR) has grabbed the top spot as best performing miner over that time, with HUT8 (HUT) and TeraWulf (WULF) also doing very well.

Upon examining the correlation between stock performance and key productivity metrics, we observed that there is no discernible correlation between the market capitalization relative to Bitcoin reserves (MCAP/HODL) and the stock performance in USD or Bitcoin terms. This suggests that the market does not directly link a company's Bitcoin reserves with its stock price performance, potentially due to varying strategies around Bitcoin holdings and the influence of external market factors.

However, a slight positive correlation was identified between the production to hash rate ratio (Prod/Hash) and stock performance, suggesting that companies with higher operational efficiency tend to have marginally better stock performance. This correlation, albeit modest, underscores the importance of operational efficiency in the mining industry.

Investor Insights

Strategic Reserve Analysis: Investors should not discount the strategic implications of Bitcoin reserves on company valuations based on short-term data. In conditions where Bitcoin’s price is rapidly appreciating, a positive correlation is likely to appear. Companies with significant Bitcoin holdings could present latent value not immediately reflected in stock prices in a general Bitcoin bull market.

Operational Efficiency as a Differentiator: In a sector where operational efficiency margins can be thin, the slight positive correlation between Prod/Hash and stock performance highlights the importance of efficiency as a competitive edge. This is potentially a better indicator than BTC Held of management competence and a more resilient business model.

Mining Activity

The analysis of the recent Bitcoin mining activity data reveals several key aspects of the network's current state and its implications for the market. The hash rate, a critical indicator of network security and mining activity, shows slight fluctuations with a minor overall increase, signifying stable mining engagement. Meanwhile, a notable rise in hash price by over 20% in the last 30 days indicates a significant boost in miners' profitability, reflecting the impact of Bitcoin's price appreciation on mining economics. Despite the hash rate's stability, the network's difficulty adjusted upwards, suggesting a competitive and robust mining environment.

In terms of revenue, there's a mixed picture: Bitcoin revenue for miners slightly decreased, yet when converted to USD, there was a substantial increase, underscoring the influence of Bitcoin's price movements on mining revenue. The data on fees and transfer volumes present a nuanced view, with a decline in Bitcoin fees revenue and a reduction in Bitcoin volumes transferred to exchanges, possibly indicating a lesser inclination to sell among miners.

These observations collectively paint a picture of a healthy, competitive, and adapting Bitcoin network, influenced by and influencing the broader Bitcoin market dynamics.

Investor Insights

Monitoring Hash Price: The significant increase in hash price is a positive signal for the mining industry's profitability, which could attract more investment into mining infrastructure. During a period of Hash Price gains, it is logical that the most efficient miners would benefit, as seen in the public miner results above. However, during periods of Hash Price declines, miners with higher bitcoin reserves will likely have the advantage. Therefore, Marathon (MARA), Riot (RIOT) and HUT should outperform as Hash Price becomes more competitive.

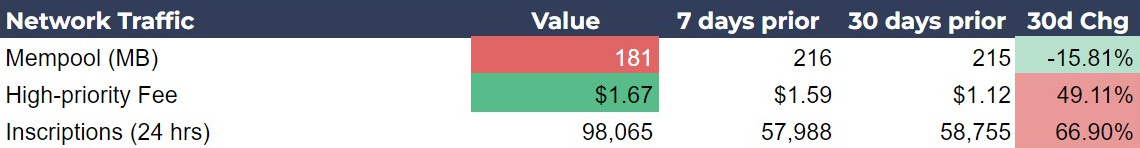

Network Traffic and Speculative Return

Overall, in the last 30 days we’ve experienced a gently shrinking Mempool, relatively flat and cheap fees, and until this week, subdued inscription rates. Network traffic stats are very stable at this time.

Investor Insights

Speculative Return: The Bitcoin price has been consolidating near $70k since 4 March. It might be time for the next leg up in this bull market. Previously, we’ve written about interpreting the number of daily inscriptions as a measure of speculative interest in bitcoin. With an increase in the number of inscriptions, the market might be signaling a rise in speculative interest.

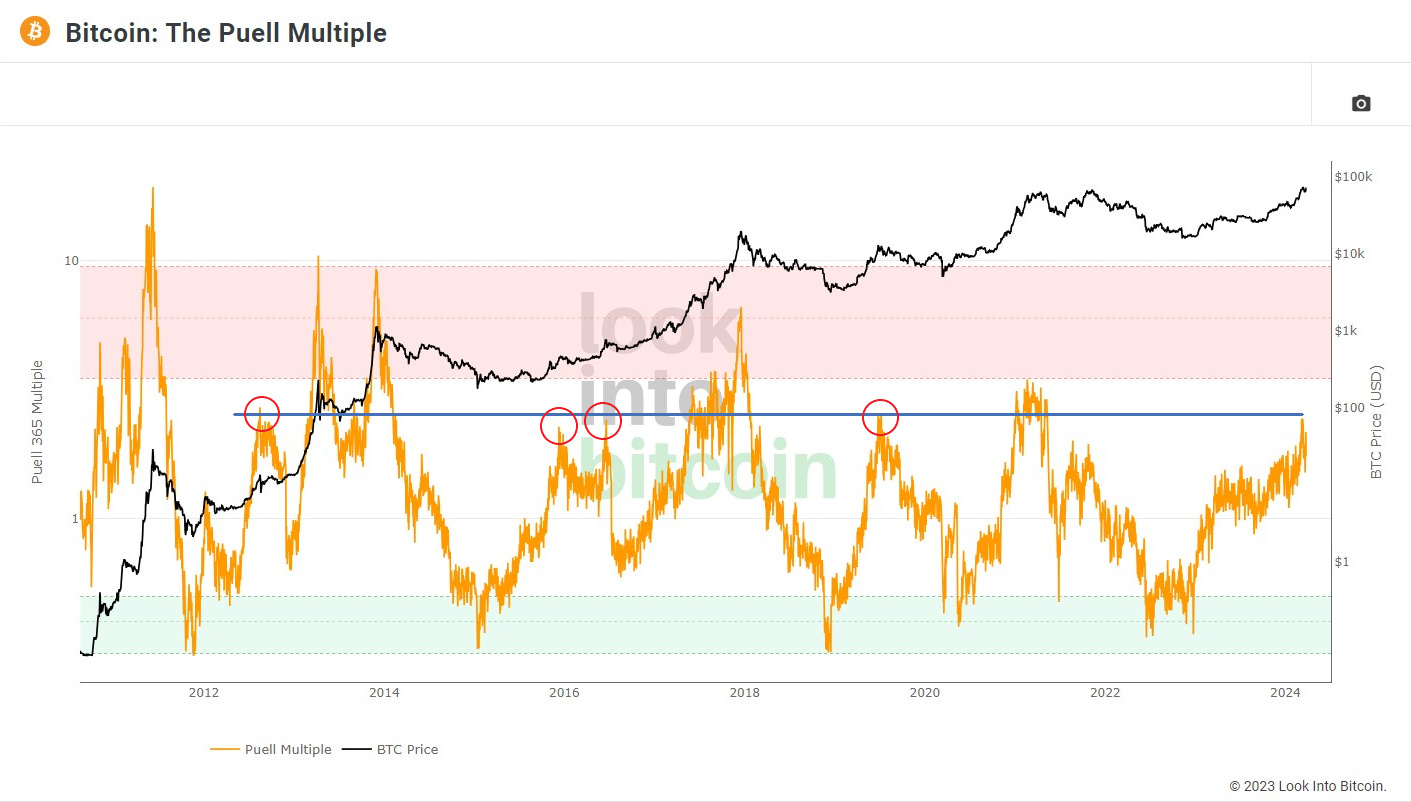

Chart of the Day

The Puell Multiple is calculated by dividing the daily issuance value of bitcoins by the 365 DMA of daily issuance value. It is a good metric by which to evaluate the phase of the cycle bitcoin is in. As you can see below, the recent high mark corresponds to the previous cycle’s mid-cycle tops. The chart also illustrates that we are not at an ultimate cycle top. This chart also graphically represents that miners are generally in a profitable place. This part of the cycle then should tend to be bullish for their stock price.

Source: LookIntoBitcoin

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

Missed out on this week's Bitcoin Magazine Pro insights? Here's your opportunity to catch up:

Don't miss these essential reads to stay ahead in the world of Bitcoin!

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!